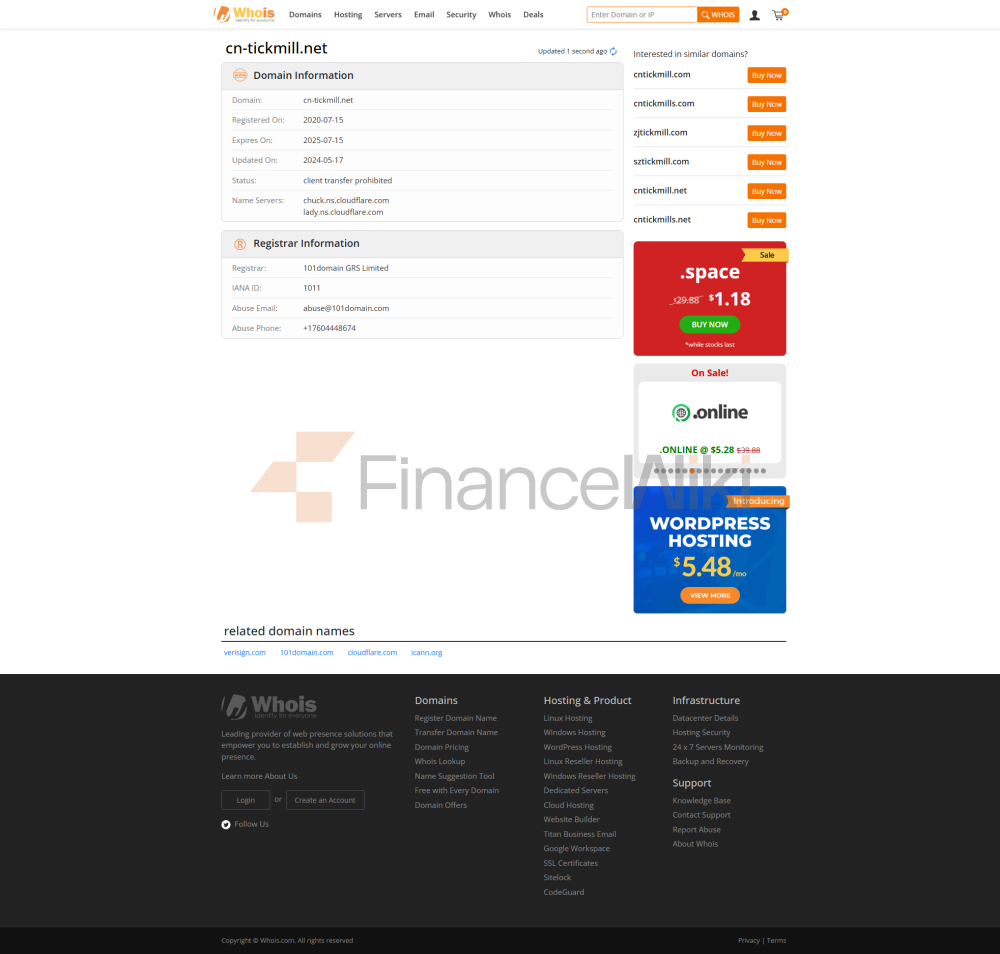

Company Profile

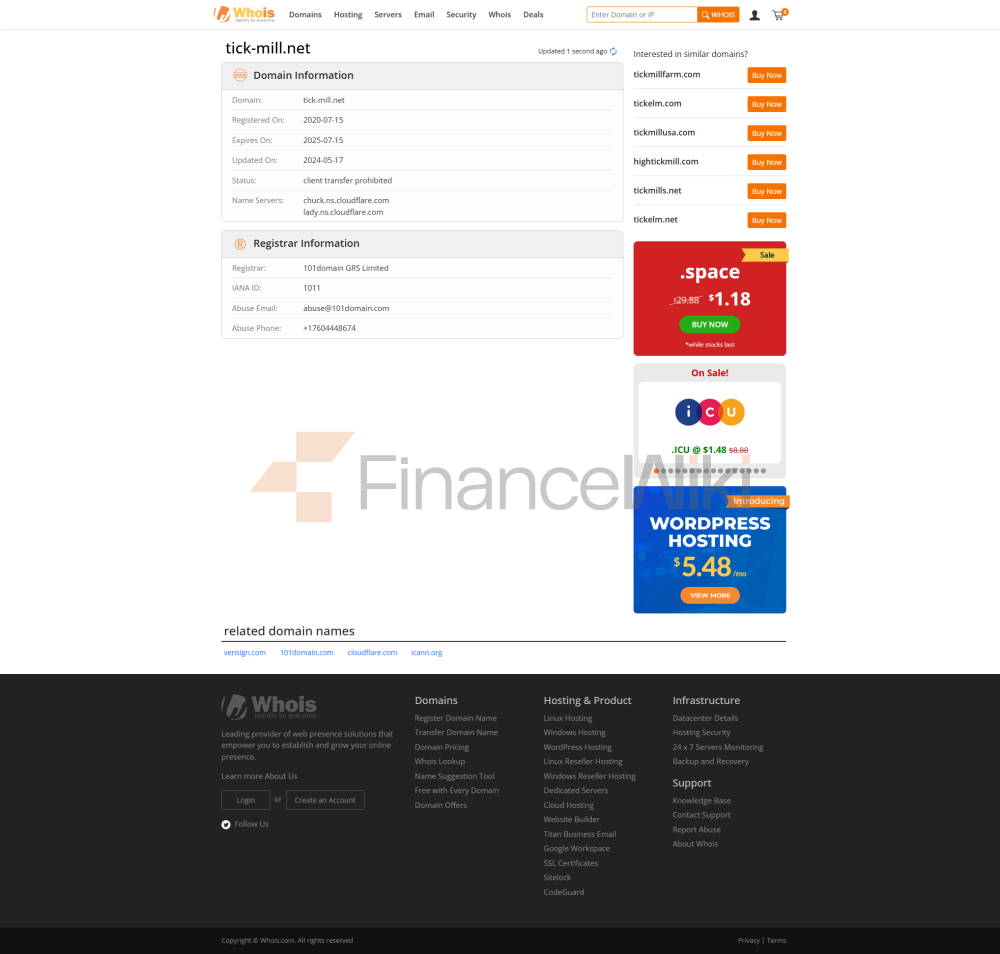

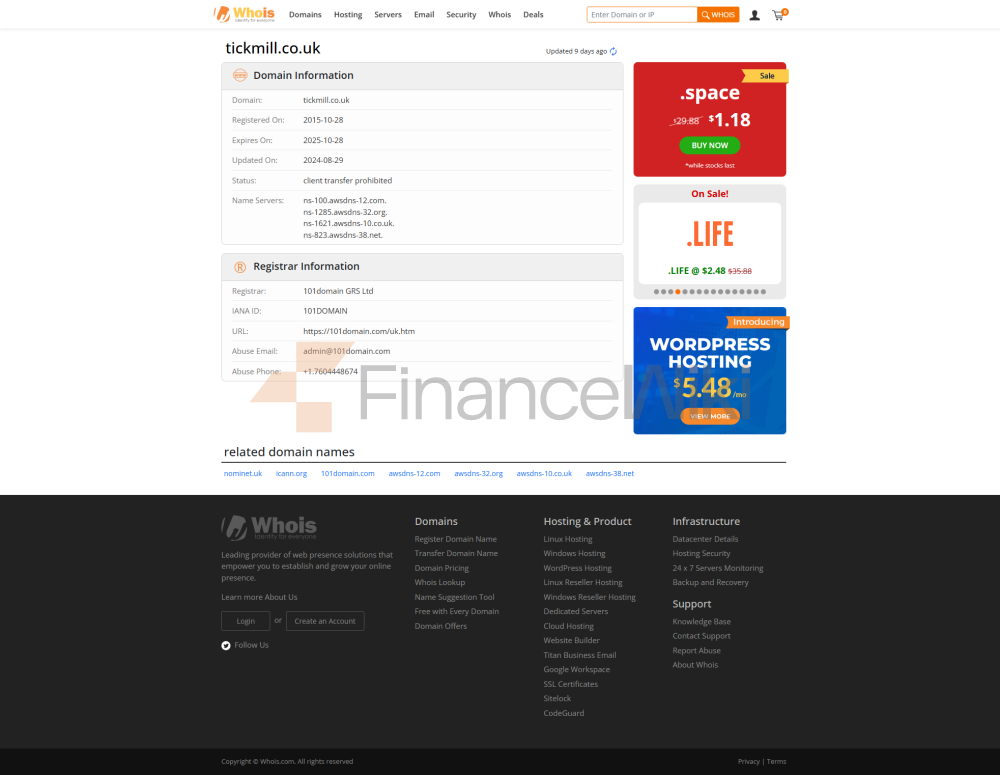

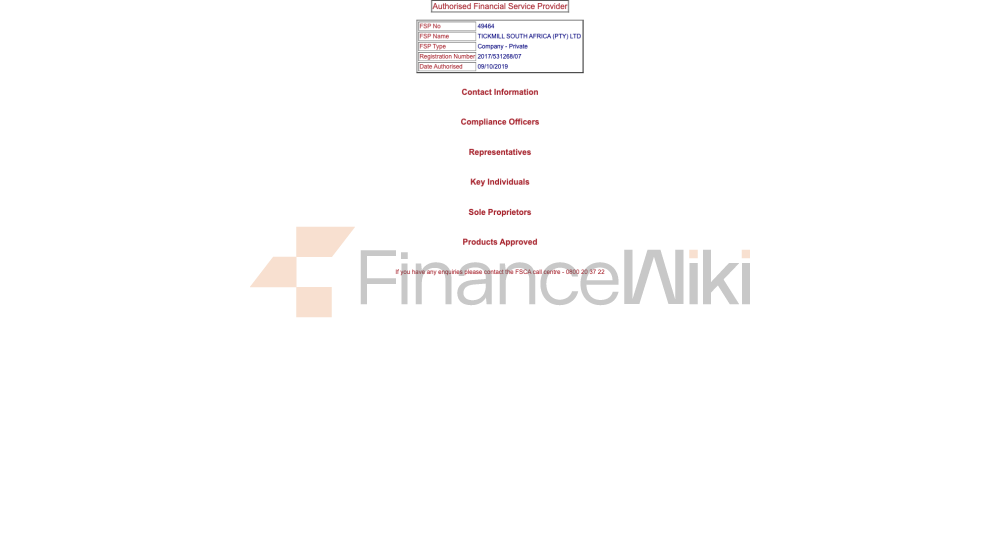

Full Name Of Company : Tickmill Established : 2014 Headquarters Location : London, UK Registered Capital : Undisclosed Regulatory License : Tickmill Holds Financial Regulatory Licenses In Several Countries, Including The Seychelles Financial Services Authority (Regulatory Number: SD008), The UK Financial Marekt Conduct Authority (Regulatory Number: 717270), The Cyprus Securities And Exchange Commission (Regulatory Number: 278/15), The Lebanese Financial Services Authority (Regulatory Number: MB/18/0028) And The South African Financial Sector Conduct Authority (Regulatory Number: FSP49464). Compliance Statement : Tickmill Strictly Complies With The Financial Regulatory Requirements Of The Relevant Countries And Is Committed To Providing Customers With A Safe And Transparent Trading Environment.

Regulatory Information

Tickmill Is Regulated By Financial Regulators In Many Countries Around The World, Ensuring That Its Operations Meet The High Standards Of The International Financial Industry. The Following Is The Main Regulatory Information Of Tickmill:

- Seychelles Financial Services Authority (FSA) : Regulation No. SD008, Which Oversees The Operational Activities Of Tickmill In Seychelles.

- UK Financial Marekt Conduct Authority (FCA) : Regulation No. 717270, Which Ensures Tickmill's Compliance In The UK Market.

- Cyprus Securities And Exchange Commission (CySEC) : Regulation No. 278/15, Which Oversees Tickmill's Operations In Cyprus.

- Lebanon Financial Services Authority (LBMA) : Regulation No. MB/18/0028, Which Is Responsible For Tickmill's Operations In Lebanon.

- The South African Financial Sector Conduct Authority (FSCA) : Supervisory Number FSP49464, Which Oversees Tickmill's Compliance In South Africa.

Trading Products

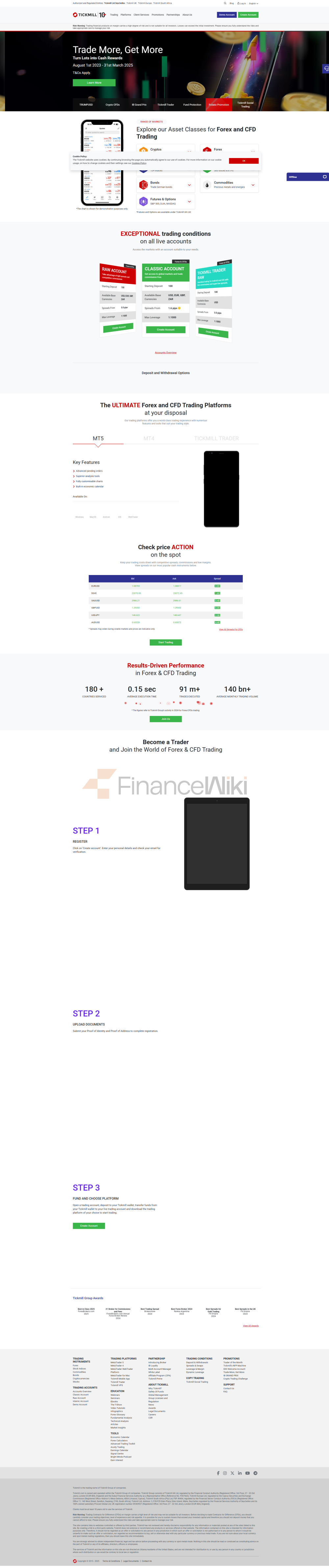

Tickmill Offers Clients Trading Services For A Variety Of Financial Products, Including:

- Forex : Offers Over 60 Currency Pairs, Such As USD/EUR, GBP/USD, Etc.

- Stock Indices : Supports The Trading Of Major Global Stock Indices, Such As The Dow Jones, NASDAQ, Etc.

- Oil : Offers Crude Oil Futures Trading, Including WTI Crude Oil And Brent Crude Oil.

- Precious Metals : Trading Precious Metals Such As Gold And Silver.

- Bonds : Offers Trading Services For Major Global Bonds, Such As US Treasuries.

Trading Software

Tickmill Offers Traders A Variety Of Trading Platforms, Including:

- MT4 Platform : MetaTrader 4 Is A Widely Used Trading Platform That Supports A Variety Of Trading Strategies, Providing Real-time Market Data And Charting Tools.

- MT5 Platform : MetaTrader 5 Is An Upgraded Version Of MT4 That Offers More Powerful Analytical Tools And More Comprehensive Market Data.

- MT4 WebTrader : Web-based Trading Platform That Allows Traders To Trade Instantly On Any Device.

Deposit And Withdrawal Methods

Tickmill Offers A Variety Of Deposit And Withdrawal Methods To Meet The Fund Management Needs Of Different Customers:

- Telegraphic Transfer (Bank Transfer) : Supports Deposits And Withdrawals In USD, EUR And GBP With A Minimum Deposit Amount Of $100 .

- VISA/MasterCard : Supports Credit Card Deposits And Withdrawals With A Minimum Deposit Of $100 . Skrill : Supports Deposits And Withdrawals In Multiple Currencies With No Processing Fees.

- NETELLER : Supports Deposits And Withdrawals In USD, EUR And GBP.

- STICPAY : Supports Deposits And Withdrawals In USD And EUR.

- UnionPay : Supports RMB Deposits And Withdrawals With A Minimum Deposit Of 700 RMB (approx. $100) .

Customer Support

Tickmill Provides Comprehensive Customer Support Services, Including:

- Multi-language Support : Supports Languages Such As Simplified Chinese, English, Italian, Polish, And Malay.

- Live Chat : Provides Instant Online Consultation To Help Customers Solve Trading Problems.

- Telephone Support : Provides A Global Customer Support Hotline, Customers Can Contact Tickmill's Customer Service Team By Phone.

- Email Support : Customers Can Contact Tickmill's Customer Service Team By Email (support@tickmill.com).

Core Business And Services

Tickmill's Core Business Includes:

- Forex Trading : Provides Low Spreads And High Liquidity Foreign Exchange Market Trading.

- Commodity Trading : Includes Trading Services For Commodities Such As Precious Metals, Crude Oil And Coffee.

- Stock Index Trading : Supports Trading Of Major Global Stock Indices, Such As The Dow Jones Index, Nasdaq Index, Etc.

- Bond Trading : Provides Trading Services For Major Global Bonds, Such As US Treasuries.

Technical Infrastructure

Tickmill's Technical Infrastructure Is Designed To Provide Clients With An Efficient And Stable Trading Experience. Its Main Technical Features Include:

- Low Latency Trading Platform : Ensures Traders Get Real-time Market Data While Trading. Multi-platform Support : Supports Multiple Trading Platforms Such As MT4, MT5, Etc.

- Security Measures : SSL Encryption Technology Is Used To Ensure The Security Of Customer Transaction Data.

Compliance And Risk Control System

Tickmill Strictly Complies With The Financial Regulatory Requirements Of Relevant Countries And Has Established A Comprehensive Risk Control System, Including:

- Fund Isolation : Customer Funds Are Completely Isolated From Company Funds To Ensure The Safety Of Customer Funds.

- Risk Management System : Adopts An AIoT Risk Control System To Identify And Control Trading Risks Through Real-time Data Analytics And Monitoring.

- Compliance Statement : Tickmill Commits Not To Engage In Any Non-compliant Financial Activities And Is Regularly Audited By Regulators.

Market Positioning And Competitive Advantage

Tickmill's Market Positioning Is To Provide High-quality Financial Services To Global Investors. Its Competitive Advantages Include:

- Multi-product Support : Provide A Wealth Of Financial Products To Meet The Needs Of Different Investors.

- Low Spread Trading : Provide Customers With More Competitive Trading Conditions Through Low Spread Strategies.

- Global Regulation : Has Financial Regulatory Licenses In Multiple Countries To Ensure Compliance Of Operations.

Customer Support And Empowerment

Tickmill Is Committed To Providing Clients With Comprehensive Support And Empowering Services, Including:

- Educational Resources : Provides Educational Resources Such As Trading Strategies, Market Analysis And Novice Guides To Help Clients Improve Their Trading Skills.

- Account Management : Provide A Variety Of Account Types To Meet The Trading Needs Of Customers With Different Capital Sizes.

- Customer Training : Regularly Conduct Online And Offline Trading Training To Help Customers Master The Latest Trading Skills.

Social Responsibility And ESG

Tickmill Actively Fulfills Social Responsibility And Pays Attention To Sustainable Development (ESG) Issues. Specifically Including:

- Environmental Protection : Support Clean Energy And Sustainable Development Projects.

- Social Responsibility : Provide Help To Socially Disadvantaged Groups Through Public Welfare Activities.

- Corporate Governance : Establish A Sound Corporate Governance Structure To Ensure The Transparency And Fairness Of Company Operations.

Strategic Cooperation Ecology

Tickmill Has Established Strategic Partnerships With A Number Of Financial Institution Groups And Technology Companies To Jointly Promote Innovation And Development In The Financial Industry.

- Technology Partners : Collaborate With Leading Global Fintech Companies To Develop More Efficient Trading Systems And Risk Management Systems.

- Financial Institution Group Collaboration : Collaborate With Several International Banks And Securities Firms To Improve The Safety Of Clients' Funds And Trading Efficiency.

Financial Health

Tickmill's Financial Health, Strong Capital Base And Stable Profitability. Its Financial Health Is Reflected In The Following Aspects:

- Capital Adequacy Ratio : Tickmill's Capital Adequacy Ratio Is Higher Than The Industry Average, Ensuring Its Stability In The Market Turmoil.

- Profitability : Through A Diversified Business Layout And Efficient Operating Strategies, Tickmill Has Achieved Sustained Profitability.

- Risk Management : Through Strict Risk Control Measures, Ensure The Company's Stable Operation In The Market Volatility.

Future Roadmap

Tickmill's Future Roadmap Includes The Following Aspects:

- Product Innovation : Continue To Develop More Financial Products To Meet The Diverse Needs Of Customers.

- Technology Innovation : Invest More Resources To Develop More Efficient Trading Platforms And Risk Management Systems.

- Market Expansion : Further Expand The Global Market And Serve Customers In More Countries And Regions.

- Social Responsibility : Continue To Fulfill Social Responsibility And Promote Sustainable Development And Environmental Protection Projects.

Tickmill Has Become A Trusted Financial Broker For Global Investors Through Its Professional Services, Advanced Technology And Strict Risk Control.

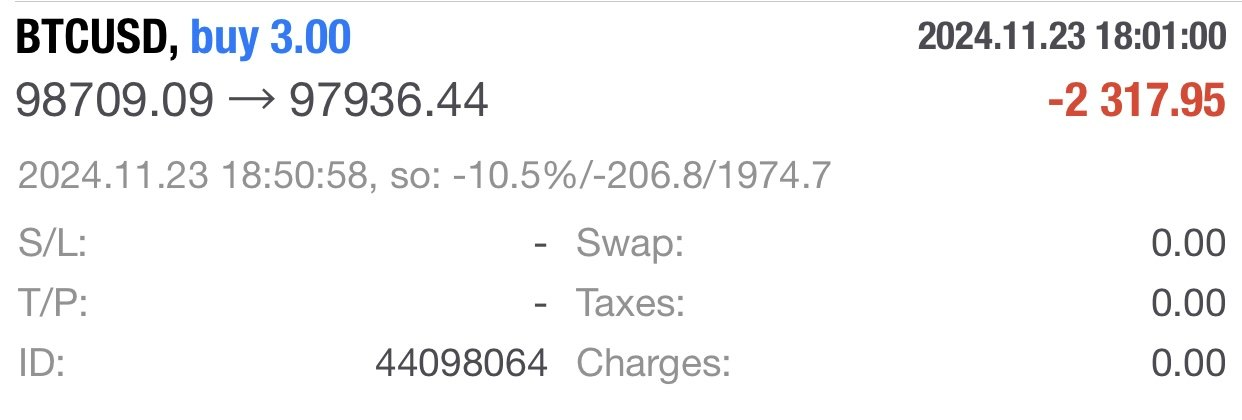

Serious Slippage

Serious Slippage