Corporate Profile

ATC Brokers Is A Foreign Exchange Trading Broker Registered In The United Kingdom. It Was Established In 2005 And Is Headquartered In London. It Is A Regulated Financial Institution Group That Provides Trading Services For Financial Products Such As Foreign Exchange, Precious Metals, Commodity Contracts For Difference (CFDs) To Retail And Institutional Clients Around The World. The Company Adopts A Pure Intermediary Model, Does Not Gamble With Customers, And Passes Transactions Directly To Liquidity Providers Through A Straight-through Processing (STP) Model, Ensuring Transparency And Immediacy Of Transactions. The Core Competitiveness Of ATC Brokers Lies In Its Rich Trading Products, Efficient Trading Platform And Strict Risk Management System.

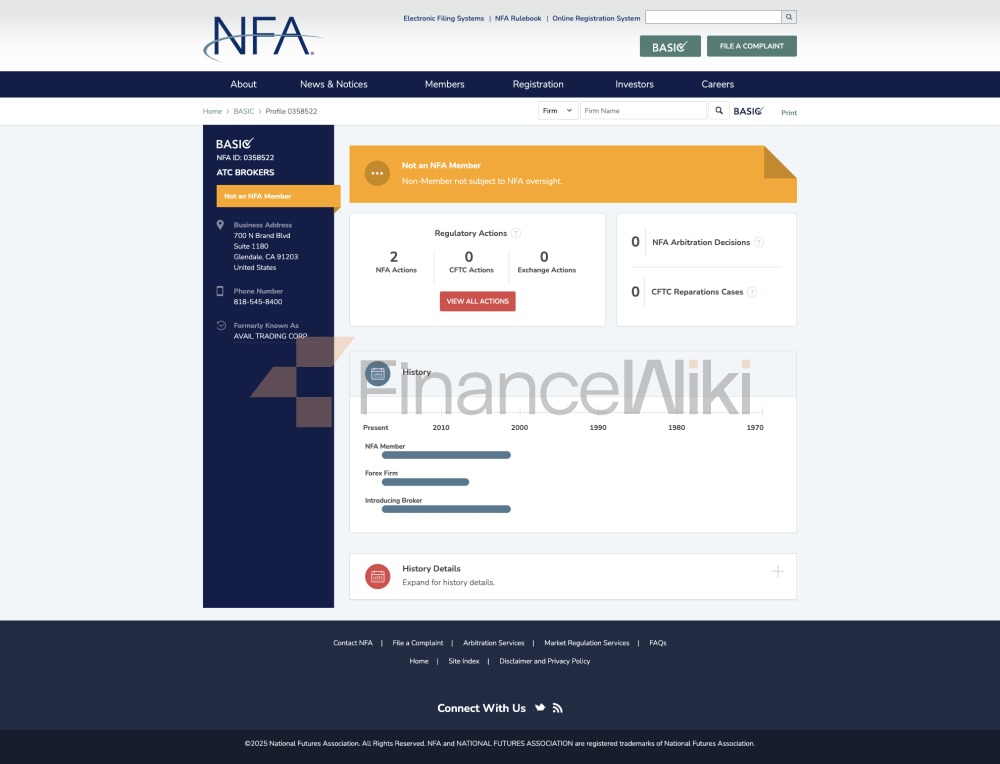

Regulatory Information

ATC Brokers Is Regulated By The UK Financial Marekt Conduct Authority (FCA) And The Cayman Islands Monetary Authority (CIMA) And Is A Legal And Compliant Forex Broker. The License Number Of FCA Is 591361 And The License Number Of CIMA Is 1448274 . According To Regulatory Requirements, The Company Must Comply With Relevant Laws And Regulations To Ensure The Safety Of Customers' Funds And Transaction Transparency. ATC Brokers' Compliance Statement Emphasizes That It Will Not Participate In Any Market Manipulation And Always Put The Interests Of Customers First.

Trading Products

ATC Brokers Offers A Wide Range Of Financial Products Covering Forex, Precious Metals, Commodities And Indices, Etc. The Following Are Its Main Trading Products:

- Forex: Major Currency Pairs Include EUR/USD, GBP/USD, Etc., Providing 1:30 Leverage.

- Precious Metals: Includes Gold (XAU/USD) And Silver (XAG/USD) CFDs, Providing 1:20 Leverage.

- Commodities: Such As Crude Oil And Natural Gas, Providing 1:10 Leverage.

- Indices: Including The S & P 500 And Dow Jones, Among Others.

Trading Software

ATC Brokers Uses MetaTrader 4 (MT4) As Its Primary Trading Platform, Providing Traders With A Friendly And Intuitive Interface And Efficient Execution Speed. MT4 Supports Multi-end Point Access, Including Desktops, Tablets And Mobile Phones. The Following Are The Main Features Of MT4:

- Minimum Number Of Trading Lots: 0.01 Lot For Forex And Precious Metals, 0.10 Lot For Commodities.

- Execution Mode: Market Maker And ECN Modes Are Provided To Meet The Needs Of Different Traders.

- Plugin Support: Users Can Customize The Plugin To Enhance The Trading Experience.

Deposit And Withdrawal Methods

ATC Brokers Offers A Variety Of Deposit And Withdrawal Methods, Including:

- Deposit Methods: Telegraphic Transfer, Visa And MasterCard Credit Cards, Skrill E-wallet, UnionPay.

- Withdrawal Methods: Telegraphic Transfer, Visa And MasterCard Credit Cards, Skrill E-wallet.

The Minimum Deposit Limit Is 5000 USD Or The Equivalent In EUR/GBP . Withdrawal Fees Are As Follows:

- Telegraphic Transfer: Free Of Charge.

- Debit Card: 2.9% Fee.

- International Telegraphic Transfer: £25/€30/$40 Fee. Skrill Withdrawal: 1.0% Fee.

- Faster Payment (UK Residents Only): £10 Processing Fee.

Customer Support

ATC Brokers Provides Multi-channel Customer Support Services, Including:

- Telephone Support: 24/5 (Monday To Friday) English Client Server At + 44 20 3318 1399 .

- Email Support: 24/7 Support Via Support@atcbrokers.com .

- Online Chat: Embedded Live Online Chat Function In The Platform, Which Is Convenient For Customers To Quickly Consult.

Core Business And Services

The Core Business Of ATC Brokers Includes:

- Forex Trading: Provides 24-hour Trading Services, Covering Major And Minor Currency Pairs Worldwide.

- Precious Metals Trading: Offers CFD Trading Of Gold And Silver, Suitable For Medium And Long-term Investments.

- Commodity Trading: Commodity Trading Represented By Crude Oil And Natural Gas, Suitable For Hedging Against Inflation Risks.

- Risk Management Tools: Offers Tools Such As Stop Loss, Take Profit, Limit Orders, Etc., To Help Traders Control Risks.

Technical Infrastructure

ATC Brokers' Technical Infrastructure Is Based On Industry-leading Platforms And Servers, Ensuring The Stability And Efficiency Of Trading. Its Main Technical Advantages Include:

- Low Latency Trade Execution: Connection To Global Liquidity Providers Via Optical Network To Ensure Fast Trade Execution.

- High Availability: Redundant Servers And Load Balancing Technology Are Used To Ensure The Stability Of The Platform Under High Trading Volume.

Compliance And Risk Control System

ATC Brokers Operates In Strict Accordance With The Regulatory Requirements Of FCA And CIMA, Taking The Following Measures To Ensure Compliance And Risk Control:

- Funds Segregation: Client Funds Are Kept In Separate Bank Accounts, Segregated From The Company's Working Funds To Ensure The Safety Of Client Funds.

- Risk Management System: Real-time Monitoring Of Client Account Risks Through Dynamic Margin And Leverage Adjustments.

- Compliance Statement: The Company Regularly Submits Financial Reports To Regulators To Ensure Transparency And Compliance.

Market Positioning And Competitive Advantage

ATC Brokers Has The Following Advantages In The Forex Brokerage Industry:

- Transparent Trading Mode: Adopts The STP Straight-through Mode To Ensure No Delays In Trading.

- Rich Trading Products: Offers More Than 100 Trading Instruments To Meet The Needs Of Different Traders.

- Efficient Trading Platform: The Stability And Ease Of Use Of MT4 Are Favored By A Large Number Of Traders.

Customer Support And Empowerment

ATC Brokers Offers A Variety Of Customer Empowerment Services, Including:

- Demo Account: Offers A Free Demo Trading Account To Help Beginners Become Familiar With The Trading Process.

- Educational Resources: Offers Trading Tutorials, Market Analysis, And Economic Calendars To Help Clients Improve Their Trading Skills.

Social Responsibility And ESG

ATC Brokers Actively Fulfills Corporate Social Responsibility, Including Supporting Community Development And Environmental Protection. The Company Gives Back To Society And Promotes Sustainable Development Through Donations And Volunteer Services.

Strategic Cooperation Ecology

ATC Brokers Has Established Strategic Partnerships With Many Well-known Financial Institution Groups And Technology Companies To Jointly Promote Technological Innovation And Market Expansion. Its Key Partners Include:

- Liquidity Providers: Partnering With Top Global Banks And Financial Institution Groups To Ensure Market Depth And Liquidity.

- Technology Providers: Partnering With Platform Providers Such As MetaQuotes To Optimize The Trading Experience.

Financial Health

ATC Brokers Has A Solid Financial Position With A Company Capital Adequacy Ratio Of 15% As Of The Third Quarter Of 2023, Higher Than The Industry Average. The Company Regularly Submits Financial Reports To Regulators To Ensure Transparency And Compliance.

Future Roadmap

The Future Development Direction Of ATC Brokers Includes:

- Technological Innovation: Continuously Optimize The Trading Platform And Trading Algorithms To Improve The User Experience.

- Market Expansion: Increase The Promotion In The Asian And Middle Eastern Markets To Attract New Customers.

- Rich Products: Launch More Financial Products, Such As Cryptocurrencies And Agricultural Futures.

Through The Above Analysis, ATC Brokers Has Demonstrated Its Professionalism And Competitiveness In The Foreign Exchange Brokerage Industry. When Selecting A Broker, Investors Should Consider Factors Such As A Company's Regulatory Qualifications, Trading Products, Customer Support, And Financial Health.