📌 Basic information

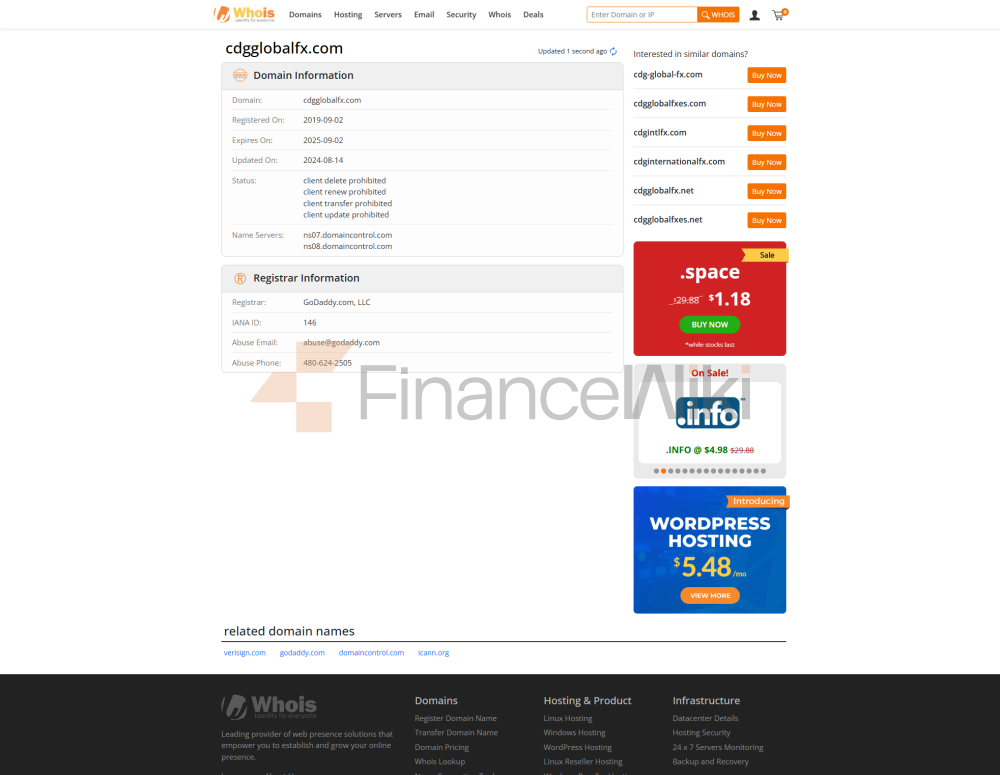

The full name of the company is CDG Global

Country of registration: Saint Vincent & the Grenadines (SVG).

Founded: According to public information, it was founded around 2003.

Company nature: foreign exchange and CFD brokerage company, using NDD (No Dealing Desk) straight-through execution mode.

🔗 Ownership and shareholding structure

No details of the shareholding structure or entrepreneur information were found in the public information. Some platforms mention that they are operated by "CDG Global (Labuan) Limited", but the actual controller and equity distribution are unknown.

📋 Enterprise classification and market positioning

Business Classification: Forex Brokers, CFD Providers; Provide multi-category trading including currency pairs, precious metals, stock indices, commodities, cryptocurrencies and more brokersview.com+2globegain.com+2m.brokersview.com+2forexpeacearmy.com+1forex.wikibit.com+1.

Market positioning: medium to high leverage, low threshold (minimum 50 USD deposit), multi-platform support (MT4/MT5). Target clients include small and medium-sized investors, quantitative traders, and active traders who need fast execution.

💼 range of services and products

trading products: forex (45+ currency pairs), precious metals, energies, commodities, stock indices and some cryptocurrencies such as BTC, ETH, LTC, etc.

Trading Accounts: Includes Standard Accounts, ECN Gold/Platinum/Diamond Accounts, and Swap-free Islamic Accounts.

Leverage: Up to 1:1000 (for some accounts) and up to 1:500 for Islamic.

Platform: Support MetaTrader 4, MetaTrader 5 (Windows, iOS, Android, Web).

Execution mode: 100% STP/ECN liquidity pass-through, no back-office trading operations, fast and transparent execution.

🏦 Deposit and withdrawal methods and customer support

Deposit methods: Bank Wire Transfer (SWIFT), Visa/MasterCard, Alipay, Bitcoin, FasaPay, Help2Pay, Neteller, Skrill, Ngan Luong, PayTrust88, ThunderXPay, Zotapay, and other multi-channels.

Withdrawal method: basically the same as the deposit channel, covering bank cards, e-commerce platform wallets and cryptocurrency channels.

Customer support: Multilingual support (including Chinese, Vietnamese, Indonesian, Spanish, Thai, Portuguese, etc.) via email, web form, Facebook, Twitter, Linkedln, Instagram. The platform advertises a 24/5 response.

⚙️ Core business and technical foundation

core business: provide foreign exchange and CFD trading, and achieve transparent quotation execution through straight-through docking with multiple banks/LPs (liquidity providers). Support EA, hedging, scalping and other strategies, and provide MAM/PAMM/copy trading functions forexpeacearmy.com.

Technical basis: real-time market processing capacity of 2,000+ price changes per second, and the best transaction execution in 1 millisecond; MT4/MT5 technology is stable and mobile-optimized.

📊 Market Competitive Advantage & Positioning

Benefits include:

Diversified trading products + high leverage + multi-account selection + fast technical execution + Multi-payment channels

Deficiencies/Risks:

Weak regulatory intensity (SVG + Labuan), historical regulatory warnings, withdrawal complaints, and long-term positions are not recommended for novices.

📈 Customer Support & Empowerment

Provide real-time online customer service and multilingual communication; The platform promotes resources such as trading information and training. In the community feedback, some users said that "the support team responds quickly and professionally", but there are also complaints pointing out that the customer service does not reply, and it is difficult to withdraw money.

In addition, participation in offline events in Taiwan may assist brand awareness.

🌱 Social Responsibility & ESG There

is currently no public ESG report or social responsibility program; The official website does not disclose information such as social welfare and environmental protection, which may not constitute its main ESG focus.

🤝 Strategic Partnership Ecology

The material mentions working with multiple bank-level liquidity providers (Tier-2 LPs), and EU subsidiaries working with PoPs. Details of the cooperation with major financial institutions were not disclosed.

💰 Financial health

No public financial statements or audited disclosures. There is a lack of operating data, and the outside world is unclear about its revenue and profitability. Its survival can be judged only by its years of operation (2003–2025) and its degree of activity.

🔮 Future Roadmap

Neither the official website nor the third-party platform disclosed clear future plans, including license expansion, technology iteration, product upgrades, or market expansion plans. If so, it should be officially disclosed by the company's official website.

e.g., platform technical evaluation) for in-depth analysis or request original source documentation, please let me know and I can dig further into the data.