Corporate Profile

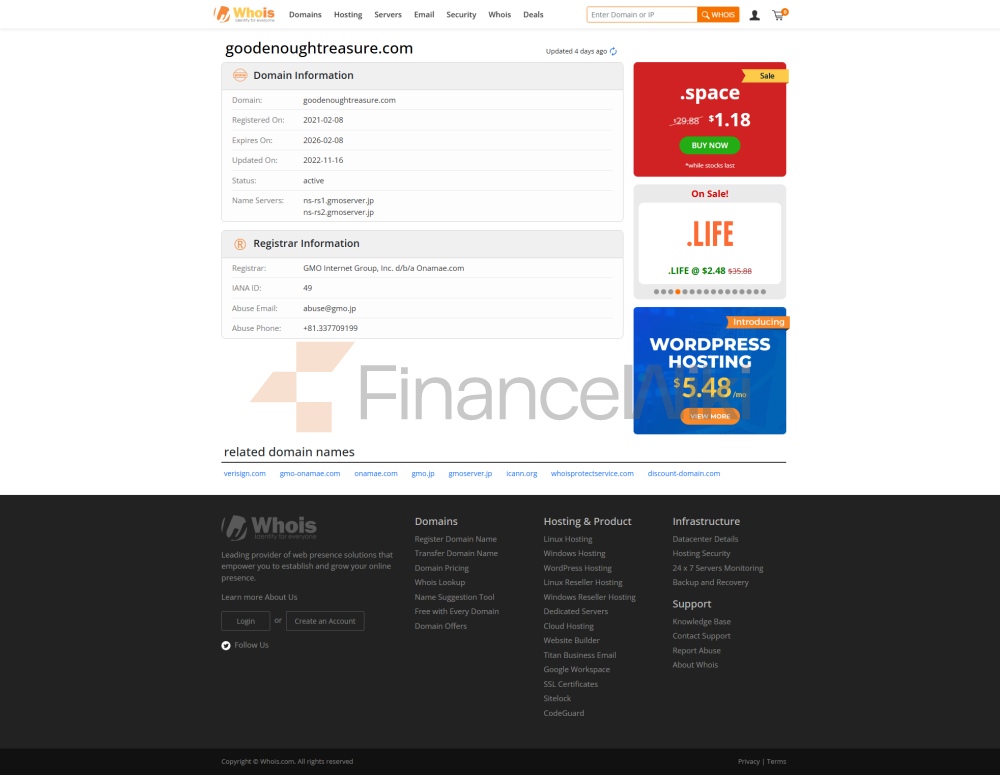

GOOD ENOUGH FX (referred To As "GE FX") Is A Forex Broker Based In Road Town, Tortola City, British Virgin Islands. The Company Focuses On Providing A Diverse Range Of Financial Marekt Tools And Services To Retail Traders Worldwide. As An Unregulated Broker, GE FX Has Certain Differentiating Advantages In Market Tools, Trading Technology And Client Server.

As Of 2024, GE FX's Core Services Include Forex Trading, Contracts For Difference (CFDs) And Cryptocurrency Currency Pairs. The Company Offers Clients A Convenient Trading Experience Through Its Trading Platform, MT4, And Supports Multiple Deposit And Withdrawal Methods. In Addition, GE FX Also Offers Demo Accounts To Help Novice Traders Become Familiar With Their Trading Environment.

Regulatory Information

Compliance Statement: GOOD ENOUGH FX Is Not Currently Regulated By Any Internationally Recognized Financial Regulator. This Information Has Been Publicly Disclosed By The Company And Confirmed By An Independent Investigation.

- Registered Country: British Virgin Islands

- Regulatory Authority: None (Unregulated)

- Compliance Risk: Because It Is Not Regulated, Customers Should Fully Understand The Potential Market And Capital Risks When Selecting GE FX.

Trading Products

GE FX Offers Traders A Wide Range Of Market Tools, Including:

- Forex Trading: Offers Multiple Currency Pairs Such As EUR/USD (EUR/USD), GBP/USD (GBP/USD), Etc.

- Contracts For Difference (CFDs): Covers Asset Classes Such As Stocks, Commodities, And Indices.

- Cryptocurrency Pairs: Offers Trading In Mainstream Cryptocurrencies Such As Bitcoin/USD (BTC/USD), Ethereum/USD (ETH/USD).

- Forex Exchange: Provides Real-time Market Data And Quotes.

Key Data:

- Number Of Instruments Supported: More Than 50

- Maximum Leverage: 1:200

Trading Software

GE FX Uses The Popular MT4 (MetaTrader 4) Trading Platform, Which Supports A Wide Range Of Devices, Including PC, Tablet, And Mobile. MT4 Is Known For Its Powerful Charting Capabilities, Technical Indicators, And Automated Trading Capabilities.

Key Data:

- Supported Operating Systems: Windows, MacOS, Linux, IOS, Android

- Trading Tools: Technical Analysis Tools, Strategy Testers, Economic Calendars, Etc.

Deposit And Withdrawal Methods

GE FX Supports A Variety Of Deposit And Withdrawal Methods For Global Customers. Here Are Some Common Methods:

- Bank Transfer: Supports A Variety Of International Bank Transfer Methods, Depending On The Country Where The Customer Is Located.

- Cryptocurrency: Supports Deposits And Withdrawals Via Bitcoin (BTC) And Other Major Cryptocurrencies.

- Electronic Wallet: Customers In Some Countries May Be Able To Make Deposits And Withdrawals Via Electronic Wallets.

Key Data:

- Deposit Handling Fee: Free

- Withdrawal Handling Fee: 5% Fixed Fee

Customer Support

GE FX Mainly Provides Support To Customers Through Website Inquiries And Frequently Asked Questions (FAQs). Customers Can Submit Questions Through Their Official Website, And The Company Will Respond Via Email Or Other Means.

Key Data:

- Supported Languages: English (other Languages Not Yet Confirmed) Response Time: Unannounced

Core Business And Services

GE FX's Core Business Focuses On The Following Areas:

- Retail Forex Trading: Provides Access To The Foreign Exchange Market For Individual Traders.

- CFD Trading: Provides Clients With CFD Trading Of Stocks, Commodities And Indices.

- Cryptocurrency Trading: Provides Trading Services For Mainstream Cryptocurrencies, Meeting Clients' Needs For Emerging Asset Classes.

Technical Infrastructure

GE FX's Technical Infrastructure Is Based On The MT4 Platform, Which Is Known For Its Stability, Reliability And Wide Range Of Features. MT4 Supports A Variety Of Technical Analysis Tools And Automated Trading Strategies, Capable Of Meeting The Needs Of Traders Of Different Levels.

Key Data:

- Trading Platform Version: MT4

- Main Features: Technical Analysis Tools, Automated Trading, Economic Calendar, Etc.

Compliance And Risk Control System

Although GE FX Is Not Directly Regulated By Any Regulatory Authority, The Company Still Needs To Establish An Internal Risk Control System To Protect Client Funds And Trading Safety. Its Risk Control System Mainly Includes The Following:

- Security Of Funds: Protection Of Client Funds Through Encryption Technology And Security Protocols.

- Trading Risk Control: Provides Stop Loss And Take Profit Functions To Help Clients Manage Trading Risks.

- Market Risk Management: Reduces The Impact Of Market Volatility On Clients Through Real-time Market Monitoring And Built-in Risk Rules.

Key Data:

- Available Devices: PC, Mobile Applicable Objects: Anyone

Market Positioning And Competitive Advantage

GE FX Is Primarily Positioned In The Market As A Broker That Offers A Wide Range Of Financial Instruments. Its Competitive Advantages Include:

- Diversified Products: Offers A Wide Range Of Trading Instruments Such As Forex, CFD, And Cryptocurrencies.

- Free Deposit: For Deposit Traders, GE FX Does Not Charge Any Handling Fees.

- Demo Trading Account: Free Demo Trading Environment For New Traders To Help Them Become Familiar With The Trading Process.

Customer Support And Empowerment

GE FX Provides Technical Support And Trading Education Resources To Its Clients Through Its Official Website And Trading Platform. Clients Can Visit Its Website For The Latest Market Analysis, Trading Strategies And Educational Content.

Social Responsibility And ESG

At Present, There Is No Public Information About GE FX In Terms Of Social Responsibility And ESG. Details Cannot Be Provided In This Section For The Time Being.

Strategic Cooperation Ecology

GE FX Has Not Made Public Information About Its Strategic Cooperation Ecology. There Is No Data Support For This Section.

Financial Health

There Is No Relevant Information About GE FX Financial Health. There Is No Data Support For This Section.

Future Roadmap

The Future Development Strategy Of GE FX Has Not Been Made Public. There Is No Data Support For This Section Yet.

Conclusion

GOOD ENOUGH FX Is A Broker That Offers A Wide Range Of Financial Instruments. Although It Is Not Regulated, Its Wealth Of Trading Tools And Technological Innovations Have Earned It A Certain Position In The Market. Clients Should Fully Understand Its Compliance Risks When Choosing This Company And Choose The Appropriate Trading Scheme According To Their Needs.