FintXpert Is A Global Financial Trading Platform Established In 2021 , Focusing On Providing Traders With Multi-asset Leveraged Trading Services, Covering Foreign Exchange, Stocks, Commodities, Indices And Cryptocurrencies. The Platform Claims To Attract Professional And Retail Investors With High Capital Support (up To $1 Million ) And Flexible Trading Conditions , And Currently Serves 150 + Countries .

Core Features And Services

- Forex (Forex) : Major, Minor And Emerging Market Currency Pairs.

- Stocks And Indices : Contracts For Difference (CFDs) On Global Listed Company Stocks And Mainstream Stock Indices.

- Commodities : Gold, Crude Oil, Silver And Other Commodities.

- Cryptocurrency : Support 200 + Highly Liquid Digital Assets , Including Bitcoin, Ethereum, Etc.

- High Capital Allocation : Through The "profit Splitting" Model, Traders Can Apply For Financial Support Of Up To $1 Million (subject To Qualification Review).

- Leveraged Trading : The Specific Leverage Ratio Is Not Clearly Disclosed, And It Is Necessary To Pay Attention To The High Risk.

- Trading Hours : The Cryptocurrency Market Provides 24/5 Trading Services (stocks, Foreign Exchange, Etc. According To Market Opening Hours).

- Execution Speed : No Specific Data Is Disclosed, But "efficient Order Execution" Is Emphasized.

- Liquidity : Claims To Work With Top Liquidity Providers To Ensure Low Spreads And Deep Markets.

- Regulatory Information : No Regulator Or License Number Is Explicitly Listed, Only Mentions Compliance With AML (Anti-Money Laundering) And KYC (Customer Authentication) Policies.

- Security Measures : Protect User Data And Funds With A Cyber Security Protocol , But No Technical Details Are Disclosed (such As Whether Cold Storage Is Used).

- Learning Center : Provide 60 + Instructional Videos Covering Trading Fundamentals To Advanced Strategies.

- Customer Support : Multilingual Customer Service 24 Hours A Day, 5 Days A Week (does Not Specify Whether Live Chat Or Phone Support Is Included).

Analysis Of Potential Advantages And Risks

- Diversified Asset Coverage : A One-stop Shop For Trading Stocks, Cryptocurrencies, Etc., Suitable For Diversified Investment Needs.

- High Capital Support : A Large Amount Of Capital Allocation Is Provided To Approved Traders, Which May Attract Professional Investors.

- Educational Resources : Structured Video Courses Are Helpful For Beginners To Get Started. Lack Of Regulatory Transparency : Lack Of Clear License Information From Authoritative Regulators (e.g. FCA, ASIC), And Compliance Needs To Be Verified Cautiously.

- Leverage Risk : If High Leverage Is Provided (e.g. More Than 1:100), The Risk Of Loss May Be Amplified.

- Cryptocurrency Volatility : The High Volatility Of 200 + Crypto Assets May Not Be Suitable For Conservative Investors.

- Doubt About The Safety Of Funds : No Third-party Audit Or Proof Of Custody Of Funds Has Been Disclosed.

User Data And Market Performance

- Established : 2021 (relatively New Platform).

- Service Scope : Covers 150 + Countries , But Does Not Disclose Specific User Number Or Transaction Volume Data.

Summary Evaluation

FintXpert Sells High Capital Support And Multi-asset Trading , But Its Core Risk Is:

- Lack Of Supervision : Investors Need To Verify The Compliance Of The Platform By Themselves, And Give Priority To Platforms Regulated By FCA, ASIC, Etc.

- Transparency Issues : Undisclosed Leverage Caps, Spread Criteria, And Historical Execution Data.

Suggestions :

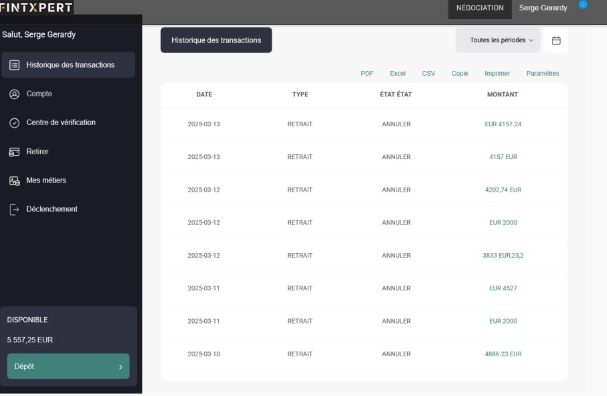

- Test The Withdrawal Process In Small Amounts Before Investing Large Amounts Of Money.

- Carefully Evaluate The Risks Of Highly Leveraged Trading To Avoid Excessive Exposure To Cryptocurrency Fluctuations.

Unable To Withdraw

Unable To Withdraw