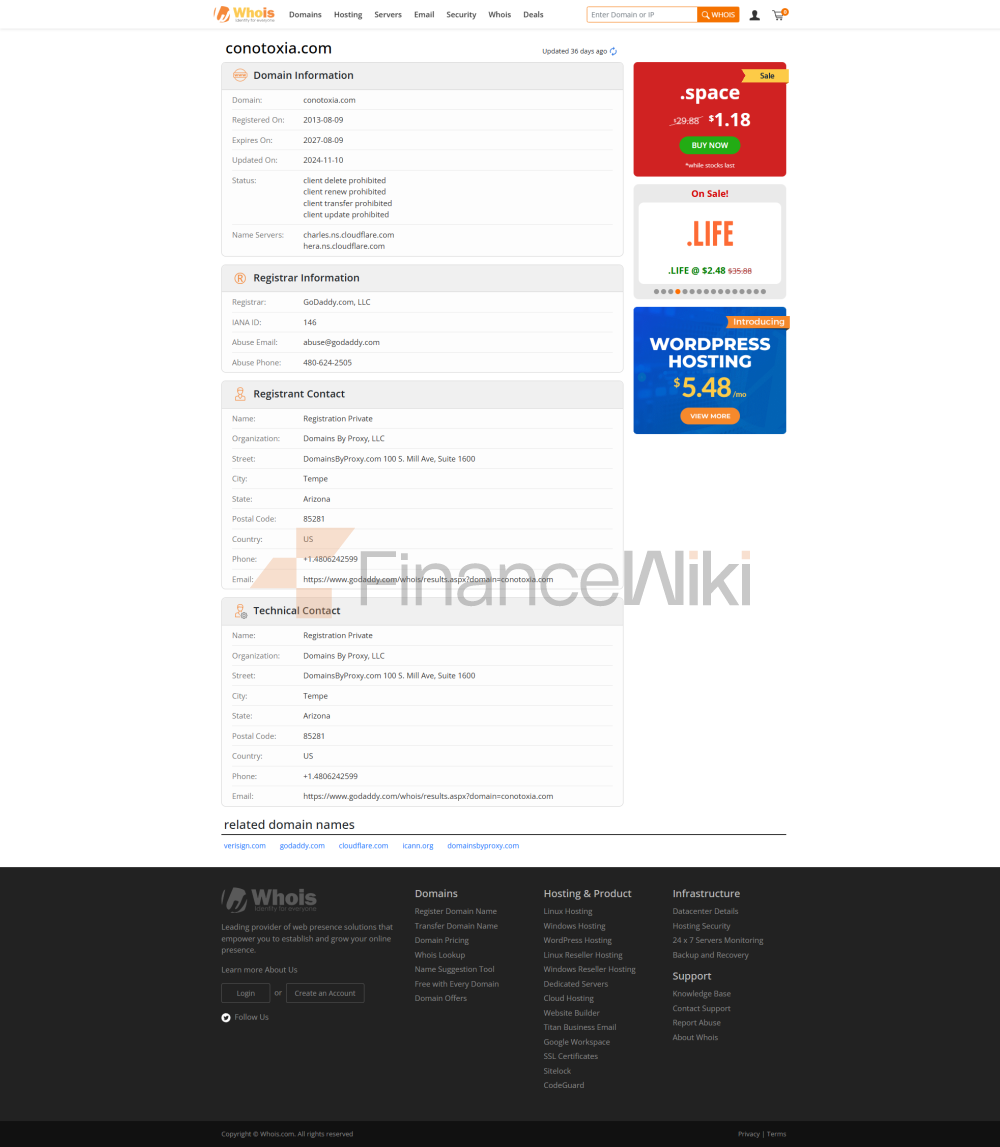

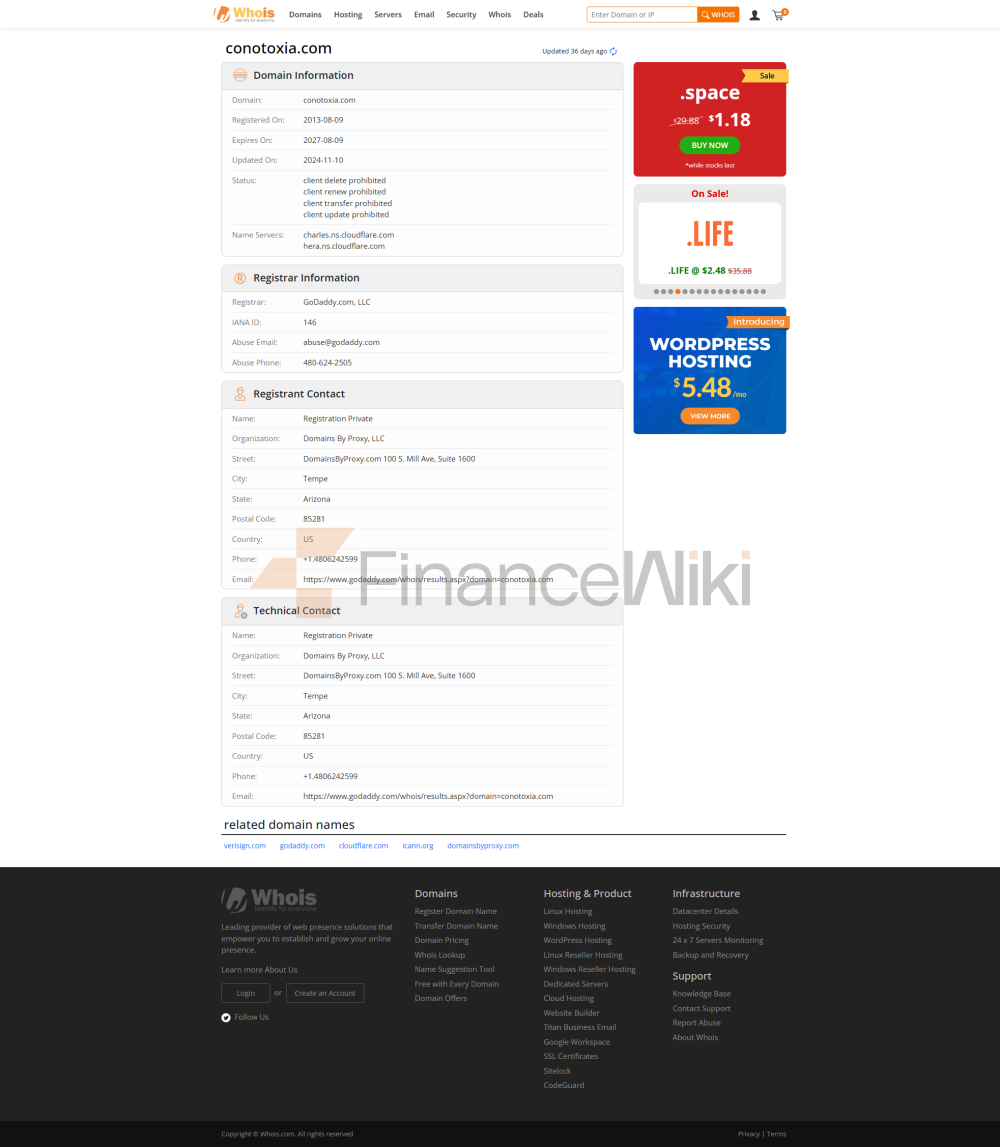

Corporate Overview

Conotoxia Limited Was Established In 2013 And Is Headquartered In Nicosia, Cyprus . As A Comprehensive Financial Services Provider, The Company Specializes In Providing A Diverse Range Of Contracts For Difference (CFDs) Trading Services To Retail And Professional Clients. Conotoxia's Registered Address Is Athalassas, 62, MEZZANINE, 2012 , And This Strategic Location Allows It To Integrate Into The Financial Heartland Of Europe, Enjoying Regional Financial Convenience And Regulatory Advantages.

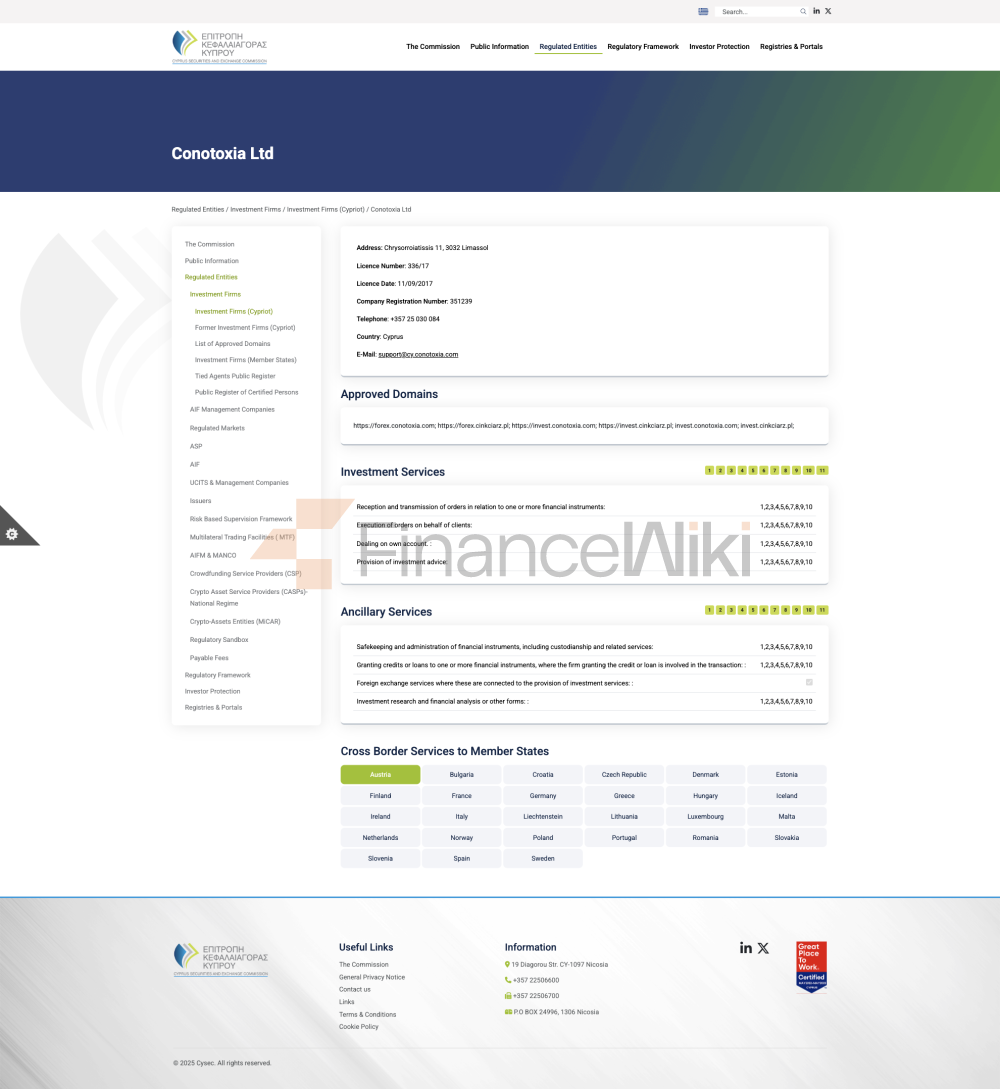

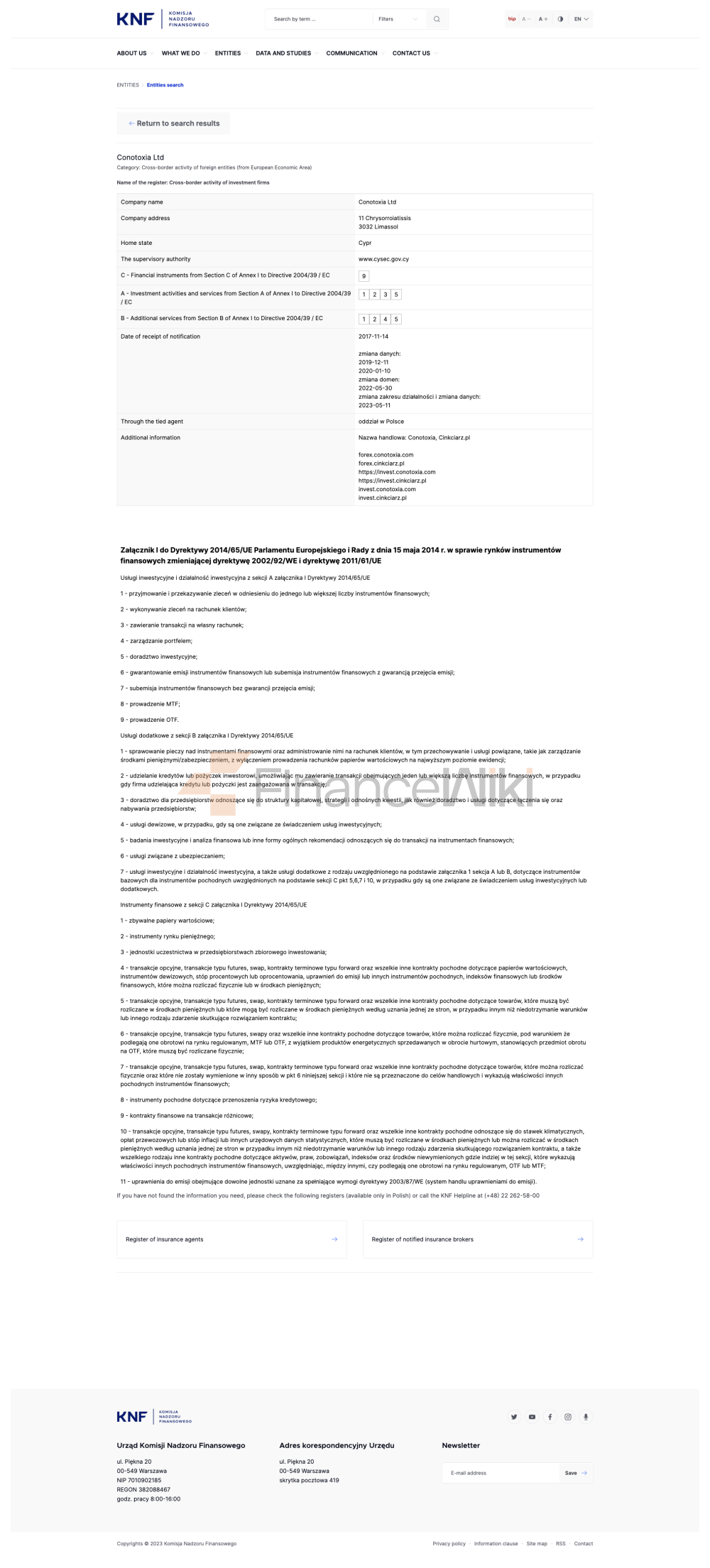

Regulatory Information

Conotoxia Is Regulated By Cyprus Securities And Exchange Commission (CySEC) With Regulatory Number 336/17 . CySEC Is One Of The Strictest Financial Regulators In The European Union, Dedicated To Ensuring The Transparency, Fairness And Protection Of Investors' Rights And Interests In Financial Marekts. Conotoxia Strictly Complies With The Regulatory Requirements Of CySEC, Ensuring That Its Operations Meet High Standards Of Compliance And Security.

Trading Products

Conotoxia Offers A Diverse Range Of CFD Trading Products Covering Forex, Indices, Stocks, ETFs, Commodities, Precious Metals, Cryptocurrencies And Futures . These Products Allow Traders To Speculate On Price Fluctuations Without Actually Holding The Underlying Asset. For Example, Forex CFDs Are Popular Due To Their 24/5 Market Opening Hours And High Liquidity ; Index CFDs Provide Traders With The Opportunity To Speculate On Global Market Trends; Commodities And Precious Metals CFDs Provide Traders With A Means To Hedge Against Inflation. In Addition, Cryptocurrency CFDs Enable Traders To Speculate On The Price Fluctuations Of Digital Currencies Such As Bitcoin, Ethereum .

Trading Software

Conotoxia Offers Traders Two Mainstream Trading Platforms: MetaTrader 5 (MT5) And CTrader . MT5 Is Suitable For Traders Seeking Comprehensive Features And Advanced Analytical Tools, While CTrader Appeals To More Professional Users With Its Cutting-edge Tools And Customized Solutions. In Addition, Conotoxia Has Launched A Mobile App That Allows Traders To Trade In Real Time On Mobile Devices . Both Platforms Offer Demo Accounts, Allowing Users To Choose The Most Suitable Trading Tool According To Their Needs.

Deposit And Withdrawal Methods

Conotoxia's Deposit And Withdrawal Process Is Known For Its Simplicity And Efficiency, Supporting A Variety Of Payment Methods, Including Bank Transfer And Currency Wallet . Customers Can Use EUR, USD, GBP And PLN For Transactions, And The Deposit And Withdrawal Process Is Zero Commission . Withdrawals Support Telegraphic Transfer And SEPA Transfer To Ensure Safe And Fast Return Of Funds To Customers. Conotoxia Emphasizes Compliance And Only Accepts Deposits And Withdrawals From Accounts Under Name To Guarantee Transparency And Security Of Transactions.

Customer Support

Conotoxia Offers 24/7 Customer Support Services In The Languages Polish And English . Customers Can Receive Immediate Assistance Via Phone, Email And Online Chat . The Cyprus Office Is At + 357 250 300 46 And The Polish Branch Is At + 48 224 639 988 . In Addition, Conotoxia Also Keeps In Touch With Its Clients Through Social Media Platforms Such As Twitter And YouTube, Providing The Latest Market Trends And Trading Tutorials.

Core Business And Services

Conotoxia's Core Business Is To Provide Multi-asset Class CFD Trading Services. The Company Meets The Needs Of Different Traders Through Differentiated Leverage Ratios And Flexible Account Types . In Addition, Conotoxia Provides Traders With A Variety Of Trading Tools And Educational Resources, Including Market Analysis, Trading Tutorials And Real-time News , To Help Clients Optimize Their Trading Strategies.

Technical Infrastructure

Conotoxia Adopts Advanced Technical Infrastructure To Ensure The Stability And Security Of The Trading System. The Company Uses High Availability Servers And Advanced Risk Management Tools To Support High-frequency Trading And Large-scale Trading Flows. In Addition, Conotoxia's Trading Platform Supports Multiple Charts And Advanced Indicators , Providing Traders With Comprehensive Market Analysis Functions.

Compliance And Risk Control System

Conotoxia Strictly Complies With The Regulatory Requirements Of CySEC And Has Established A Complete Compliance And Risk Control System. The Company Ensures The Transparency And Security Of Trading Activities Through Measures Such As Real-time Monitoring, Threat And Risk Assessment And Stop Loss Mechanism . In Addition, Conotoxia Also Provides Liability Protection Services To Further Protect The Trading Risks Of Retail Customers.

Market Positioning And Competitive Advantage

Conotoxia Occupies An Important Position In The CFD Trading Market With Its Diverse Trading Products, Flexible Leverage Ratio And Strong Technical Support. The Company's Competitive Advantages Include Extensive Market Tools, Efficient Deposit And Withdrawal Services And 24/7 Customer Support . In Addition, Conotoxia Also Enhances Interaction With Customers Through Social Media And Educational Content To Enhance Branding Impression And Customer Loyalty.

Customer Support And Empower

Conotoxia Is Committed To Empowering Customers Through Educational Resources And Tools . The Company Offers A Variety Of Trading Tutorials And Market Analysis Reports To Help Traders Improve Their Skills And Optimize Their Strategies. In Addition, Conotoxia Also Provides Customers With Practical Practice Opportunities Through Demo Accounts To Help Them Gain Experience In A Real Trading Environment.

Social Responsibility And ESG

Conotoxia Attaches Importance To Social Responsibility And Sustainable Development, And Is Committed To Supporting The Stability And Transparency Of Financial Marekt Through Its Transaction Services. The Company Actively Participates In Environmental Protection And Social Responsibility Projects Within The Industry To Promote The Sustainable Development Of The Financial Industry.

Strategic Cooperation Ecology

Conotoxia Has Established Strategic Partnerships With A Number Of Financial Institution Groups And Technology Companies To Jointly Promote Financial Innovation And Technological Upgrading. These Collaborations Cover The Fields Of Payment Solutions, Risk Management Technology And Market Analysis Tools , Further Enhancing Conotoxia's Comprehensive Competitiveness.

Financial Health

Conotoxia Ensures The Financial Health And Stability Of The Company Through Strict Financial Management And Risk Control. The Company Conducts Regular Financial Audits And Threat And Risk Assessments To Safeguard Its Capital Adequacy Ratio And The Sustainability Of Its Operations.

Future Roadmap

Conotoxia Plans To Continue To Expand Its Business Scope In The Future, Developing More Trading Tools And Services To Meet The Needs Of Global Traders. The Company Is Also Committed To Strengthening Its Technological Infrastructure And Enhancing The Performance And Security Of Trading Systems. In Addition, Conotoxia Also Plans To Expand Its Market Presence And Attract More Customers Through More Education And Promotional Activities.