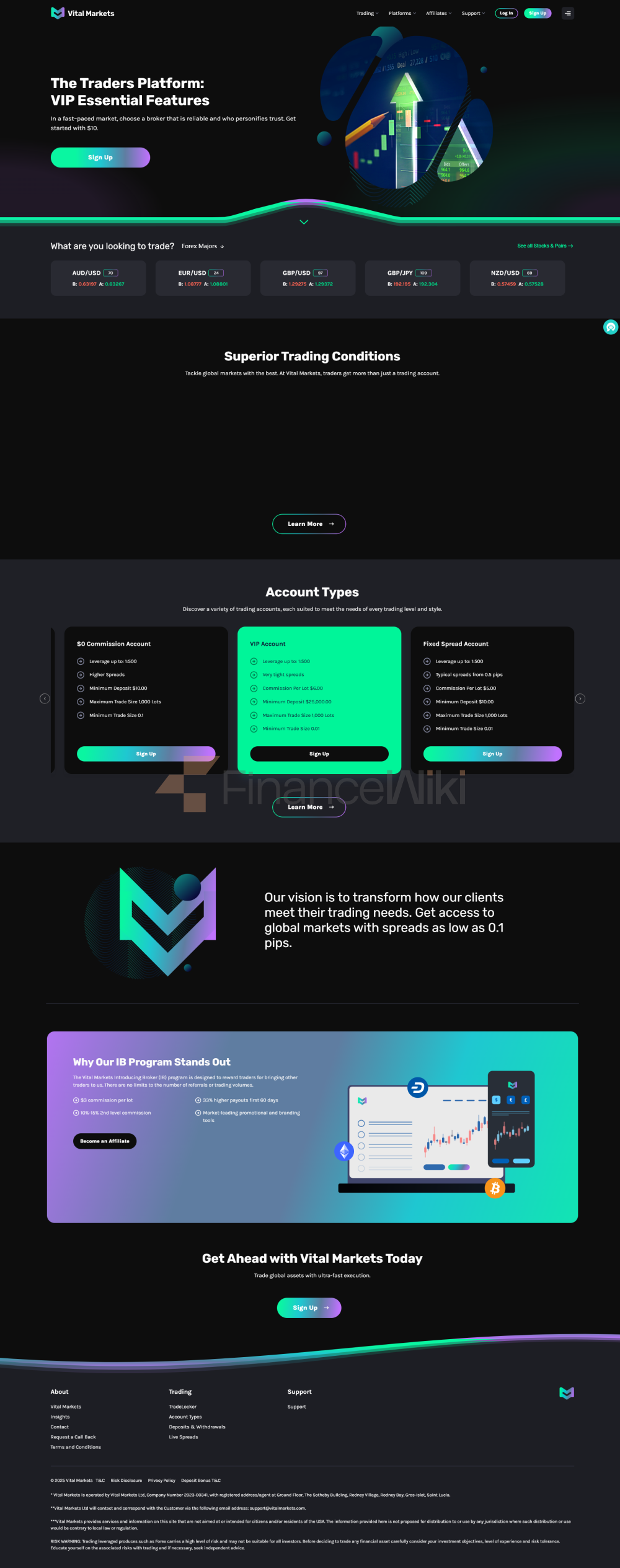

Company Profile

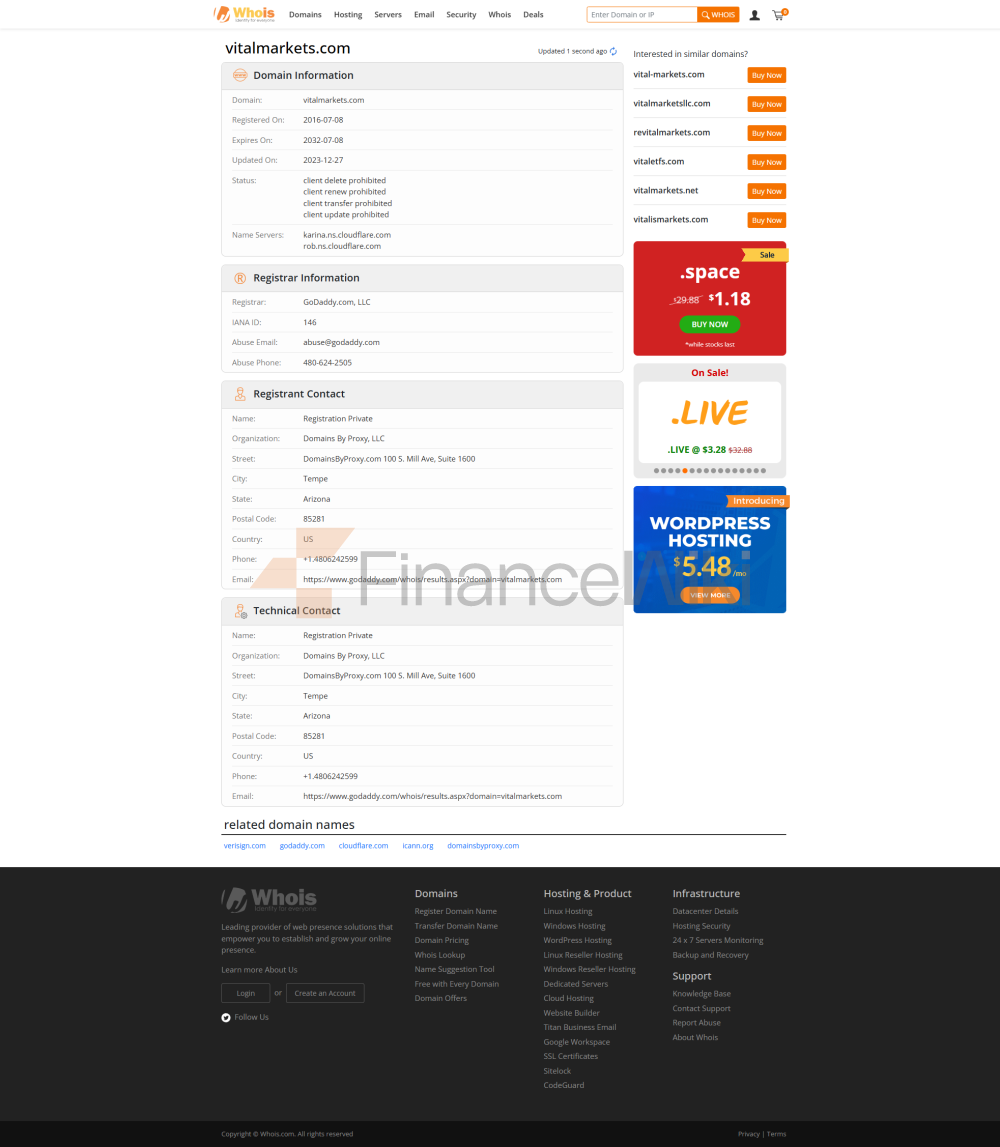

Company Name : Vital Markets Established : 2020 Headquarters Location : China Registered Capital : Undisclosed Regulatory License : None (not Regulated By Any Major Financial Regulator) Who The Company Serves : Global Traders (excluding US Residents) Corporate Structure : Undisclosed Equity Structure : Undisclosed

Vital Markets Is A Forex And CFDs Broker Through MetaTrader 4 (MT4) > And MetaTrader 5 (MT5) Trading Platforms Provide Access To A Wide Range Of Financial Instruments. The Company Supports Cryptocurrency Deposits And Offers Multiple Account Types To Meet The Needs Of Different Traders. However, Due To Its Lack Of Regulatory Qualifications, There Is A Greater Risk In The Protection Of Client Funds And Trading Activities.

2. Regulatory Information

Regulatory License : No Regulatory Authority : No Compliance Statement : No

Vital Markets Is Not Regulated By Any Major Financial Regulator, Which Means That Client Funds And Trading Activities Cannot Be Legally Protected. In Addition, Client Funds And Trading Accounts Are Not Segregated, Further Increasing Latent Risk. Traders Should Choose Such Unregulated Brokers With Caution.

3. Trading Products

Vital Markets Offers The Following Financial Instruments:

- Forex : Includes Major Currency Pairs (e.g. EUR/USD, USD/JPY) As Well As Minor And Exotic Currency Pairs.

- Cryptocurrencies : Supports Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Dogecoin (DOGE) And Tether (USDT).

- Stocks : Stocks From Popular Companies Around The World.

- Index : Covers Important Indices Such As Standard & Poor 500, NASDAQ And Dow Jones.

- Commodities : Includes Commodities Such As Gold, Silver, And Crude Oil.

Core Advantages :

- Traders Can Access Multiple Financial Marekts And Enjoy A Diverse Trading Experience.

- Provides Highly Liquid Markets To Ensure Efficient Trade Execution.

4. Trading Software

Vital Markets Offers The Following Trading Platforms:

- MetaTrader 4 (MT4) : Supports Windows, WebTrader, Android And IOS Devices.

- MetaTrader 5 (MT5) : Similar To MT4, Provides More Advanced Charting And Analysis Tools.

- TradeLocker : An Advanced Platform That Allows Users To Analyze Trading History, Formulate Strategies And Create Custom Indicators.

Core Advantages :

- The Platform Is User-friendly And Suitable For Traders Of Different Experience Levels.

- Offers A Variety Of Charting And Analysis Tools To Help Traders Develop Trading Strategies.

5. Deposit And Withdrawal Method

Deposit Method : Only Cryptocurrency Deposits Are Supported, Including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Dogecoin (DOGE) And Tether (USDT).

- BTC Deposit : Free.

- Other Cryptocurrency Deposits : A 2.5% Processing Fee Is Charged .

Withdrawal Method : Only Cryptocurrency Withdrawals Are Supported.

- Withdrawal Fee : Not Mentioned.

Core Disadvantages :

- Traditional Fiat Currency Deposits Are Not Accepted.

- Limited Payment Options May Not Suit The Needs Of Some Traders.

6. Customer Support

Vital Markets Offers The Following Customer Support Services:

- 24/7 Live Chat : Available 24/7 For Instant Communication.

- Online Messaging System : Allows Customers To Request A Call Back From The Customer Support Team.

- Frequently Asked Questions (FAQs) : Provides Self-service Support Resources.

Core Strengths :

- Live Chat Feature Makes It Easy For Traders To Solve Problems Quickly.

- Multiple Support Channels Are Available To Meet Customer Needs.

Core Weaknesses :

- Lack Of Phone And Email Support.

- Limited Language Selection And May Not Support All Languages.

7. Core Business & Services

Account Type :

- 0 Dollars Commission Account : No Commission, But Higher Spread.

- VIP Account : Lower Spread, But $6 Commission Per Lot.

- Fixed Spread Account : Spreads Start From 0.5 Points, And Commissions Are $5-7 Per Lot.

- Micro Account : Suitable For Small Capital Traders.

- ECN/STP Account : Offers A Low-latency Trading Environment.

Minimum Deposit Requirement :

- VIP Account : $25,000

- Other Account Types : $10

Demo Account : Offers A Demo Account With Virtual Capital Of $100 To $1,000,000, Where Traders Can Test Trading Strategies.

Core Advantages :

- Multiple Account Types To Meet The Needs Of Different Traders.

- Low Minimum Deposit Requirements For Small Capital Traders.

8. Technical Infrastructure

Trading Platform : MetaTrader 4 (MT4), MetaTrader 5 (MT5) And TradeLocker. Leverage Ratio : Up To 1:500 For All Account Types. Spread : The Starting Spread For ECN/STP Accounts Is 0.5 Pips .

Core Strengths :

- High Leverage Provides Traders With More Trading Opportunities.

- Advanced Technical Analysis Tools Provided By The Platform Help Traders Develop Strategies.

9. Compliance And Risk Control System

Compliance Statement : None. Risk Control System : No Explicit Risk Control Mechanism Is Mentioned.

- Due To The Lack Of Supervision, Customer Funds Cannot Be Protected.

- Without Segregated Account Mechanism, Customer Funds May Be At Risk.

10. Market Positioning And Competitive Advantage

Market Positioning :

- Offers A Diverse Range Of Financial Instruments And Trading Platforms That Appeal To Global Traders.

- Low Minimum Deposit Requirements And High Leverage Ratio Attract Small Capital Traders.

Competitive Advantage :

- Offers Multiple Account Types To Meet The Needs Of Different Traders.

- Supports Cryptocurrency Deposits To Meet The Specific Needs Of Cryptocurrency Traders.

11. Customer Support And Empowerment

Customer Support :

- Offers 24/7 Live Chat, Online Messaging And FAQs.

Trading Tools :

- Provides A Trading Calculator To Help Traders Calculate Potential Profits Or Losses.

- Provides A TradeLocker Platform To Support Analysis And Optimization Of Trading Strategies.

12. Social Responsibility And ESG

Social Responsibility : No Specific Social Responsibility Plans Are Mentioned. ESG (Environmental, Social And Governance) : No Mention Of ESG-related Practices Or Policies.

13. Strategic Cooperation Ecology

Strategic Cooperation : No Specific Strategic Cooperation Information Is Mentioned.

14. Financial Health

Financial Transparency : No Financial Health Status Is Disclosed.

15. Future Roadmap

Future Plans : Undisclosed Plans For Future Expansion Or Improvement.

Summary : Vital Markets Offers A Variety Of Trading Tools And Flexible Account Options, But Due To The Lack Of Regulatory And Client Fund Protection Mechanisms, Traders Should Carefully Consider Latent Risks When Choosing.