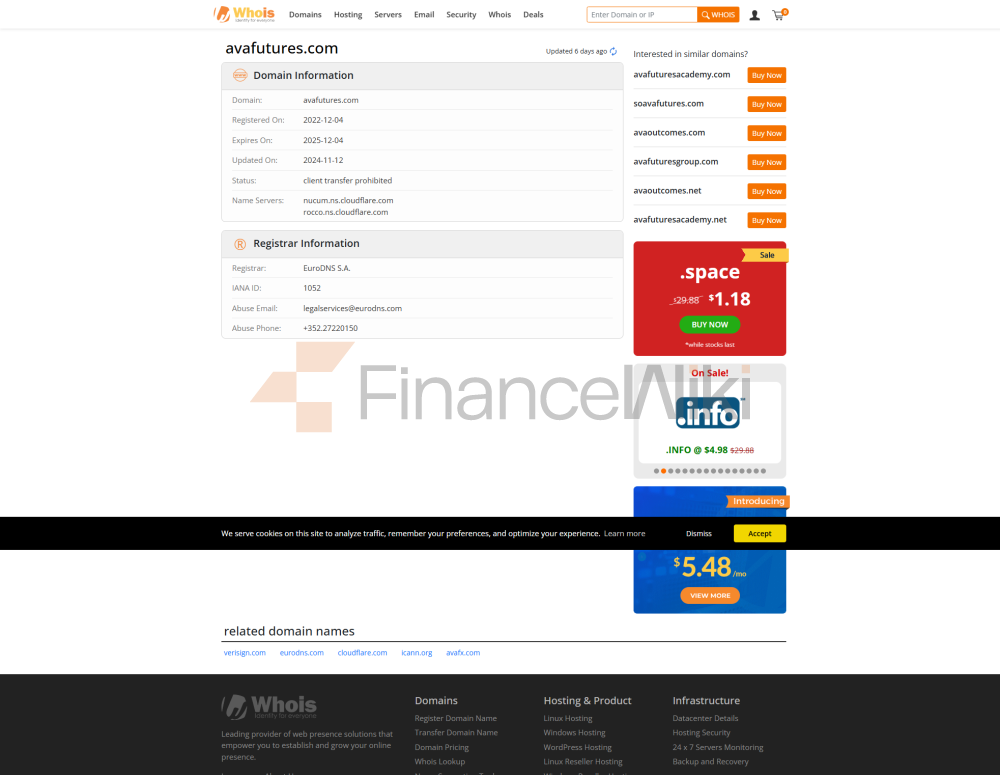

Verified: AvaFutures domain https://www.avafutures.com/, registered in 2022, is a forex trading brokerage company.

AVA Trade EU Ltd - authorised by the Central Bank of Ireland with registration number C53877

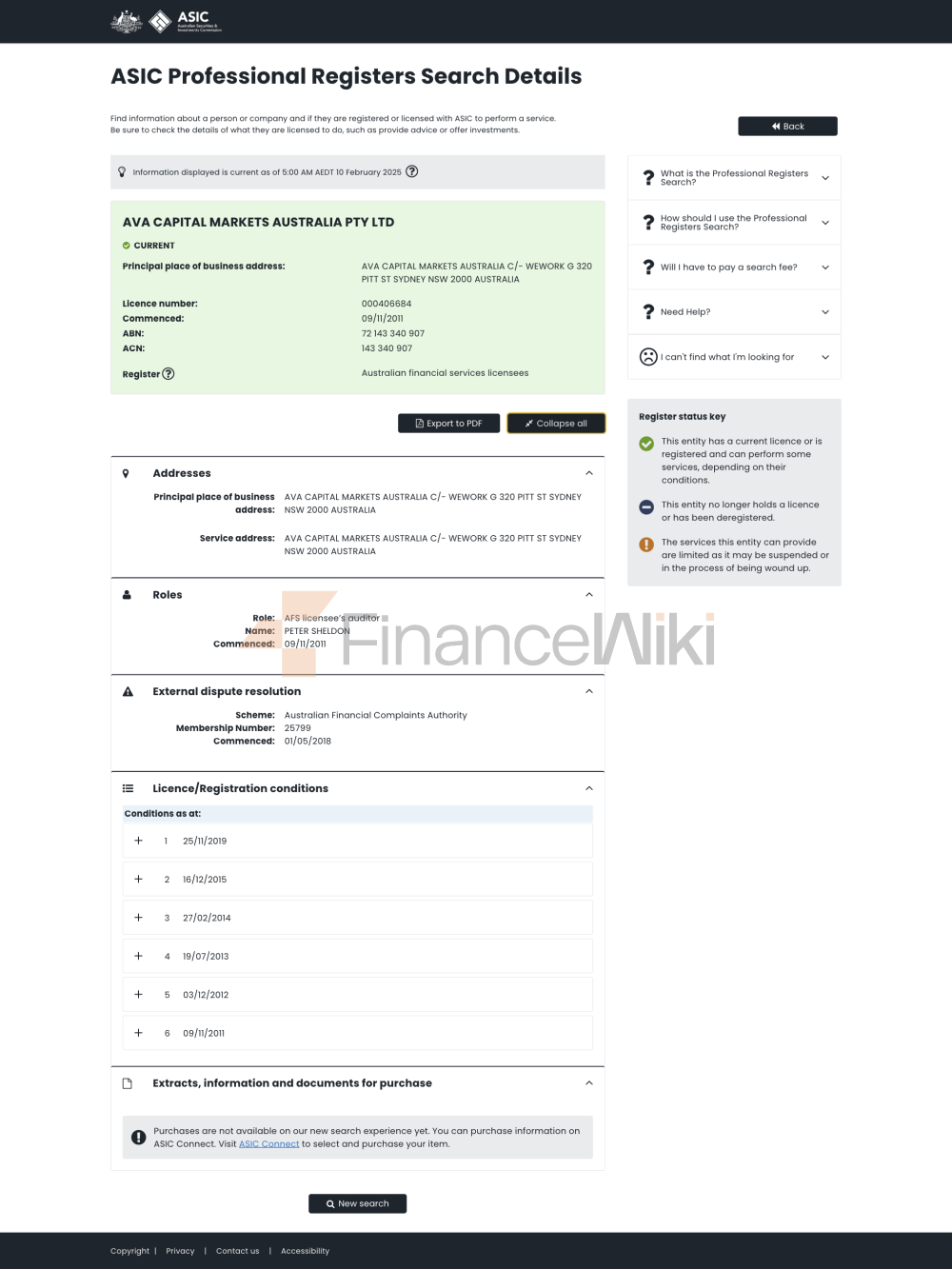

Ava Capital Markets Australia Pty Ltd - authorised by the Australian Securities and Investments Commission (ASIC) with registration number 406684

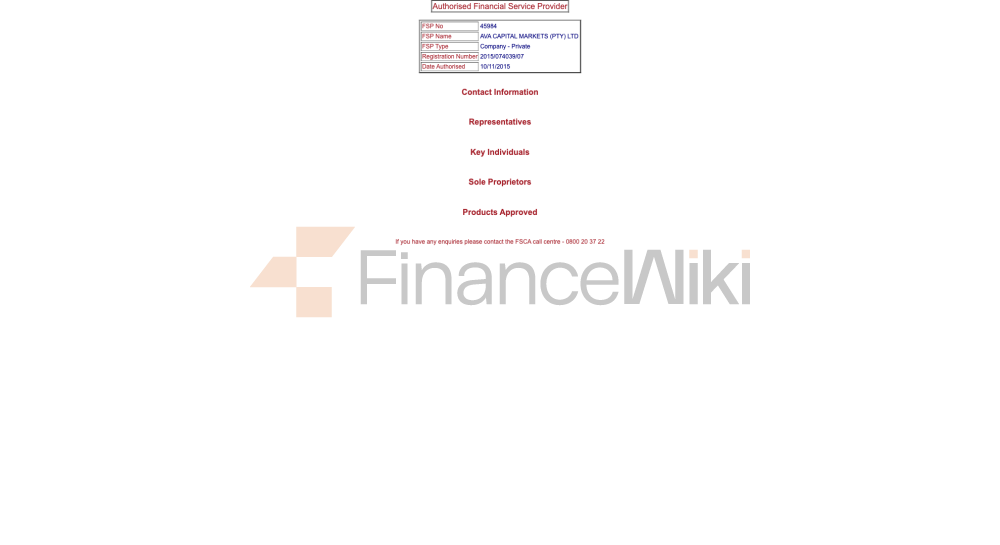

Ava Capital Markets Pty Ltd - Authorised by the Financial Services Authority (FSCA) of South Africa with registration number 45984

Ava Trade Japan KK - Authorized by the Financial Services Authority (FSA) of Japan with registration number 1662 and FFAJ registration number 1574

Ava Trade Middle East Ltd - authorised by FRSA (Abu Dhabi Global Markets), Registration number 190018

to the Internet query:

AvaFutures is a provider of Real Futures trading, a brand of AvaTrade Group. AvaFutures is a well-known large forex trading brokerage company that has been providing forex trading services for decades, is strictly regulated by the Bank of Ireland and many other top institutions, and is one of the established brokers in Ireland.

AvaFutures is another outstanding development for brokers, offering products through an independent website that offers specific trading on the world's most popular futures, with competitive trading conditions and the same quality of service that brokers have come to expect from them. The proposal and futures trading was established through direct access to futures through the Chicago CME Group, one of the largest futures and options regulated exchanges in the United States (click here to learn about CME), which also marks the strong establishment of a customer-centric approach and quality trading solutions.

This broker is best suited for traders looking for real futures trading, as this is the company's main focus. However, due to their nature, real futures are more suitable for experienced traders and are loved by professionals, but beginners can also learn how to trade futures well and get involved.

Pros and Cons

The main advantage of AvaFutures is, of course, its main environment for trading real futures. As a well-regulated broker, its fundamentals are reliable, while good trading conditions are mainly suitable for experienced traders or those who prefer to trade real futures. Its advantages include a diverse range of futures products, the availability of margin trading, a professional MT5 platform with additional tools dedicated to futures trading, and comprehensive educational resources.

The downside is that futures trading may not be suitable for everyone, especially for beginners, so traders looking for a simpler trading solution are better off opting for a CFD or forex trading broker. In addition, since the product is specifically used for futures trading, the range of instruments is fully aligned with futures contracts, which means that there are no other instruments available, such as stocks or bonds.

Account type:

AvaFutures offers single account functionality with a DMA execution model, as the trading instrument is real futures offered through the CME exchange in the United States. Due to the complexity and some norms of futures trading, these tools are indeed more suitable for professional traders, so AvaFutures does not offer a variety of accounts, while traders can access all trading services and benefits through a single account feature.

In addition, AvaFutures marks that there is also no need for an Islamic account, as there is no need to consider interest rates or swap commissions in futures trading, which makes the AvaFutures account suitable for a large number of traders.

FeesFor

AvaFutures fees, there are some specific conditions for pricing due to the peculiarities of futures trading. Therefore, usually the actual futures fee is included in the commission, which is divided into two parts: exchange fee and brokerage fee, in addition to additional fees such as data fee, platform fee, rollover fee, etc.

AvaFutures Brokerage FeesThe brokerage

fee is the first part of the main transaction fee when trading futures, and is also defined by the exchange you are trading on. Since Ava offers futures on two exchanges, CME and Eurex, the fee for trading micro contracts is $0.75 and the fee for E-Mini or standard contracts is $1.75. However, AvaFutures offers a discount on brokerage fees, charging only $0.19 for micro contracts and $0.49 for E-Mini or standard contracts on two exchanges, CME and Eurex.

The second part of theAvaFutures Exchange Fee

transaction fee is the exchange fee. The NFA fee is a fee from the National Futures Association (NFA) and is only available for U.S. exchange-traded instruments at $0.02 per trade.

AvaFutures Rollover/

SwapAvaFutures does not have a contract rollover. Because futures are only traded when the market is open. However, at the end of the futures contract, the trader must close the position in the expiring contract at least two business days before the last trading day, otherwise, AvaFutures will close the position at the market price and charge a fee of $10.

Trading PlatformsFor

the choice of trading platform, AvaFutures insists on using the popular and widely used MetaTrader5. The broker doesn't offer any other platform, which may be seen as a drawback, but most genuine futures brokers do offer mostly their own software or specialized options like NinjaTrader, so AvaFutures' offer cannot be considered limited. In fact, MT5 is particularly well-suited for direct access to trading futures contracts, and is powerful enough to provide a sufficiently sophisticated yet customer-friendly environment.

AvaFutures Web Platform

AvaFutures recommends the use of MT5 Web, which allows trading directly from a web browser. In fact, the web platform is less complex than the desktop version, and it does have fewer trading tools for fees or available, but it has a one-click trading feature that allows for custom trading settings and supports a full suite of account management.

AvaFutures Desktop MetaTrader 5 Platform

The AvaFutures MT5 desktop version is fully functional and comprehensive, with access to over 2,000 indicators, powerful trading tools and insights, and automated algorithmic trading that allows the creation of trading robots using MQL5.

The platform has excellent tools and features to set up notifications and alerts, as well as a variety of order types as well as pending orders, sell stop limits, and buy stop limits. There are various charts on 21 time frames, a comprehensive economic calendar, and in-depth analysis.

The platform is available on both Windows and Mac desktop computers.

AvaFutures Mobile Trader App

The AvaFutures app also supports mobile trading, giving you access to the mobile platform anytime, anywhere. Optimized for futures trading on mobile devices, it offers great interactive charts and a full suite of account management, including trade alerts, push notifications and real-time market data, as well as secure account access via biometric authentication, all on your mobile device.

Trading instrumentsTrading

through AvaFutures, you have access to a wide range of products to trade in the form of real futures or futures contracts on currencies, indices, energies, Treasuries, cryptocurrencies, metals, and soft commodities.

Due to its specificity, AvaFutures' real futures series is widely acclaimed, covering most futures around the world. Traders have access to a wide variety of futures and can choose from micro, mini, or standard futures contracts depending on their risk management strategy. These include E-Mini futures and Micro E-Mini futures such as the E-mini S&P 500 Index, Micro E-mini S&P 500, Micro Dax, etc., as well as European futures such as Euro STOXX 50 and Asia MSCI China (USD), MSCI India (USD), etc. In addition, there are energy sources such as Brent crude oil, natural gas or miniature Henry Hub natural gas, as well as soft commodities such as corn and soybeans. Finally, there are two cryptocurrency futures to choose from, which are Micro Bitcoin and Micro Ethereum.

Deposit

OptionsAvaFuture supports a variety of ways to deposit funds into trading accounts, and we found deposit transfers to be very straightforward and non-commission-free, which is why AvaFutures ranks highly. We recommend that you also contact the support team to provide you with the best options depending on where you live. Available deposit options include:

bank wire transfer,

e-wallets including Neteller, Skrill, and PayPal

Credit or debit card

minimum deposit

AvaFutures minimum deposit depends on the account base currency, for traders from the European Union, the minimum deposit for EUR accounts is $100 or €100.

The broker does not charge any withdrawal fees, and you can also withdraw funds using the same method you used to make a deposit. It is important to note that first you should withdraw the exact same amount as you deposited using the same method, and then you can use other payment methods as well.

EducationAvaFutures

education courses are suitable for beginners who want to learn about futures trading and its ins and outs, as well as for traders of all levels according to the level. The educational courses are of high quality, you can choose from beginner, intermediate or advanced experience levels, and have access to a large number of well-designed learning materials, including lessons, videos, articles, interactive lessons, futures trading basics, and information about futures trading instruments such as stock index futures, etc.

Their educational focus areas include market analysis, risk management, and trading psychologyFor

experienced traders, we offer in-depth market analysis and professional trading strategy sessions on topics such as futures trading strategies, algorithmic trading, and technical analysis. In addition, the broker offers real-time market insights and expert commentary, as well as one-on-one training with the company's experts to help you learn more about trading styles and listen to expert opinions.