Corporate Profile

GTCFX (GTC Financial Services) Is A Global Financial Derivatives Provider Established In 2012 And Headquartered In Dubai, United Arab Emirates. The Company Focuses On Providing High-quality Online Trading Services To Retail And Institutional Clients, Including The Trading Of Financial Products Such As Foreign Exchange, Precious Metals, Energy, Stocks, Stock Indices, Etc. As Of Q3 2023, GTCFX Has Served 985,000 Clients Distributed In More Than 100 Countries.

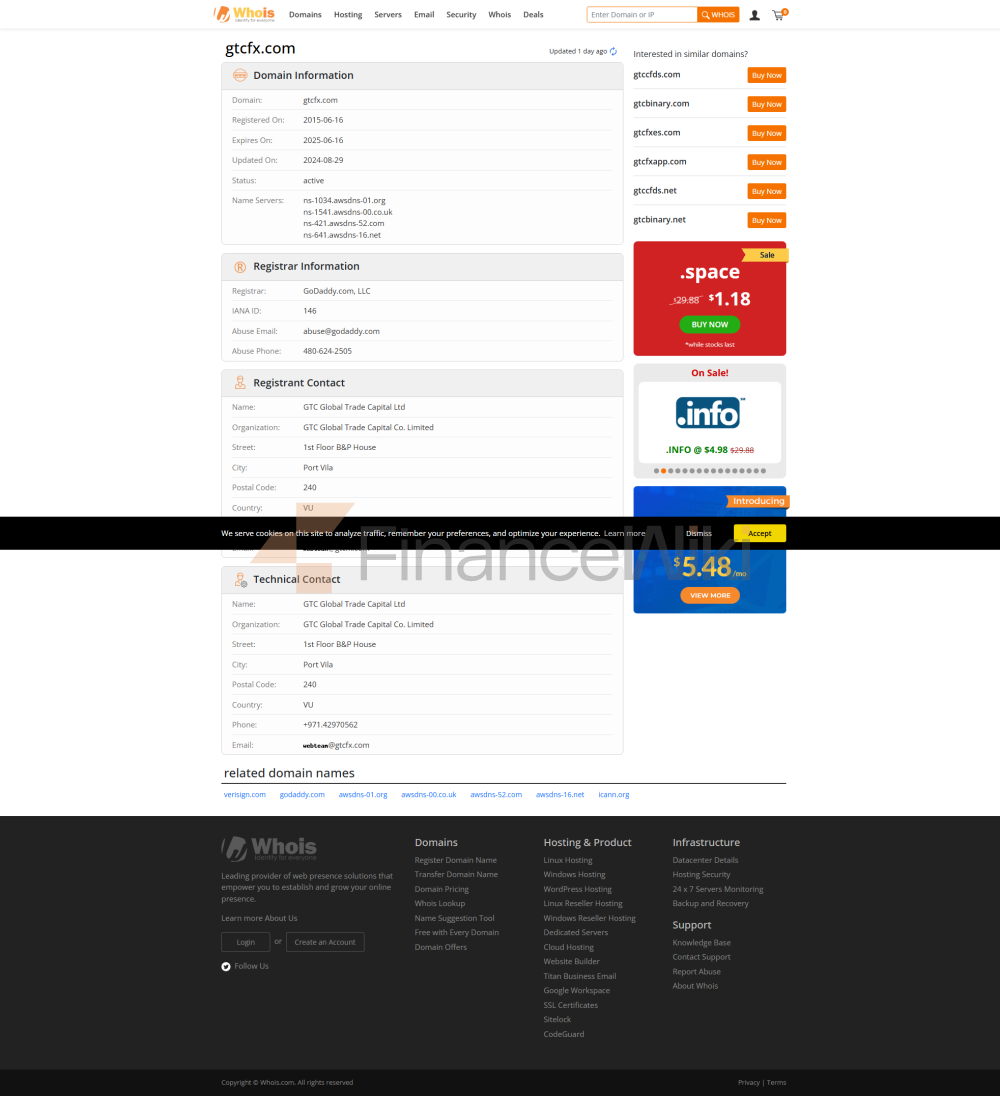

GTCFX, Through Its Subsidiaries, Operates In Multiple Jurisdictions Around The World, Including Mauritius, Saint Vincent And The Grenadines, Vanuatu, Etc. Its Flagship Brands GTCEX And GFX Are Widely Used, Covering More Than 27,000 Trading Instruments.

The Executive Team Of GTCFX Consists Of Professionals With Extensive Industry Experience, And The Advisory Team Includes Senior Experts From Well-known Financial Institution Groups. The Company Is Currently A Member Of Several Industry Associations, Including The Saint Vincent And The Grenadines Financial Services Authority (SVGFSA) And The Mauritius Financial Services Commission (FSC).

Regulatory Information

GTCFX Is Registered In Multiple Jurisdictions Around The World And Has Obtained Corresponding Regulatory Licenses. The Following Is Its Key Regulatory Information:

- Dubai, UAE : GTC Multi Trading DMCC Is Authorised By The Emirates Securities And Commodities Authority (SCA) Under License Number 20200000007 And Specialises In Commodities Brokerage And Clearing.

- Mauritius : GTC Global LTD Is Regulated By The Mauritius Financial Services Commission (FSC) Under License Number GB22200292 And Provides Services To Clients Outside The European Economic Area.

- Saint Vincent And The Grenadines : GTC GLOBAL TRADE CAPITAL LIMITED Is Authorized By The SVGFSA With Registration Number 24503 .

- Vanuatu : GTC Global Trade Capital Co., Limited Is Regulated By The Vanuatu Financial Services Commission (VFSC) With License Number 40354 .

GTCFX's Regulatory Statement Emphasizes Its Compliance With The Laws And Regulations Of Various Jurisdictions And Its Commitment To Protecting The Safety Of Client Funds.

Trading Products

GTCFX Offers A Wide Range Of Financial Trading Products Covering The Following Asset Classes:

- Forex : Supports More Than 80 Currency Pairs, Including Major Currency Pairs Such As EUR/USD And Emerging Market Currency Pairs.

- Precious Metals : Offers Contract For Difference (CFD) Trading On Precious Metals Such As Gold, Silver, Palladium And Platinum.

- Energy : Includes CFD Trading On Energy Products Such As Crude Oil (WTI And Brent), Natural Gas.

- Stocks : Covers Individual Stocks On Major Global Stock Markets, Such As Apple, Google, Amazon, Etc.

- Stock Indexes : Supports Trading Of Major Global Stock Indices, Such As S & P 500, NASDAQ, Dow Jones, Etc.

GTCFX's Target Customers Include Retail Traders, Institutional Investors, And Hedge Funds. Its Trading Products Are Designed To Meet The Needs Of Different Customers.

Trading Software

GTCFX Offers Its Clients A Variety Of Trading Platforms To Support Different Devices And Trading Strategies:

- MetaTrader 4 (MT4) : An Industry-leading Trading Platform That Offers Powerful Chart Analysis Tools, Technical Indicators, And Automated Trading Capabilities.

- MetaTrader 5 (MT5) : A More Powerful Trading Platform That Supports More Chart Types And Strategy Testing.

- CTrader : A Cloud-based Trading Platform That Offers An Intuitive Interface And Enhanced Charting Capabilities.

GTCFX's Transaction Software Supports PC, Mobile End And Web Operation, Ensuring That Customers Can Transact Anytime, Anywhere.

Deposit And Withdrawal Methods

GTCFX Provides A Variety Of Funds Access Methods, Including:

- Bank Transfer : Supports Telegraphic Transfer Services From Mainstream Banks Around The World.

- Credit/Debit Cards : Accept Mainstream Credit Cards Such As Visa And MasterCard.

- Electronic Wallet : Supports Digital Payment Methods Such As Neteller, Skrill, Google Pay, Etc.

- RPN Payments : A Fast Payment Method Suitable For Some Jurisdictions.

GTCFX's Payment Method Selection Is Designed To Provide Customers With A Convenient And Secure Money Handling Experience.

Customer Support

GTCFX's Customer Support Team Provides Services To Customers Through Multiple Channels, Including:

- Email : Support@gtcfx.com Phone : + 800 6677 88

- Online Chat : Contact Customer Service In Real Time Through The Official Website

- Social Media : Provide Support On Facebook, Twitter, Instagram And Other Platforms

GTCFX Is Committed To Providing Customers With Efficient And Professional Support Services To Solve Various Problems During The Trading Process.

Core Business And Services

The Core Business Of GTCFX Includes:

- Retail Forex Trading : Providing CFD Trading Services For Products Such As Foreign Exchange And Precious Metals To Retail Clients.

- Institutional Trading : Providing Customized Trading Solutions For Institutional Investors, Including Liquidity Services And Market Data.

- Partner Program : Providing White Label Services And An Introductory Broker (IB) Partnership Program To Help Partners Quickly Enter The Financial Marekt.

The Differentiating Advantages Of GTCFX Lie In Its Multi-jurisdictional Licenses, Diverse Trading Products And Efficient Trade Execution.

Technology Infrastructure

GTCFX Employs An Advanced Technology Infrastructure To Ensure The Stability And Security Of Trading:

- Server Network : Deploy Servers In Multiple Locations Around The World To Ensure Low-latency Trading.

- AIoT Risk Control System : A Risk Management System Based On Artificial Intelligence And IoT Technology To Monitor Trading Risks In Real Time.

- Cloud Computing Platform : Supports High Scalability And High Availability Of Trading Systems.

GTCFX's Technology System Is Designed To Provide A Safe, Reliable And Efficient Trading Environment.

Compliance And Risk Control System

GTCFX's Compliance And Risk Control System Includes The Following Aspects:

- Regulatory Compliance : Strict Compliance With Financial Regulatory Requirements In Various Jurisdictions.

- Risk Management System : Adopts Multi-layered Risk Control Measures, Including The Management Of Market Risk, Credit Risk And Operational Risk.

- Segregation Of Funds : Client Funds Are Held In Segregated Bank Accounts To Ensure The Safety Of Funds.

- Audit And Compliance Reports : Internal Audits Are Conducted On A Regular Basis And Compliance Reports Are Submitted To Regulators.

GTCFX's Compliance Statement Clearly Demonstrates Its Commitment To Protecting Client Interests And Ensuring Transparency In Trading Activities.

Market Positioning And Competitive Advantage

GTCFX's Market Positioning In The Financial Industry Is A Global, Multi-license Financial Derivatives Provider. Its Competitive Advantages Include:

- Multi-jurisdictional License : Acquired Regulatory Licenses In Multiple Countries, Covering A Wider Range Of Customer Groups.

- Diversified Product Portfolio : Provides More Than 27,000 Trading Instruments To Meet Different Customer Needs.

- Strong Technical Support : Advanced Technology-based Trading System And Risk Management Platform.

- Flexible Payment Methods : Supports Multiple Methods Of Accessing And Withdrawing Funds To Enhance The Customer Experience.

GTCFX Aims To Become The World's Leading Provider Of Financial Derivatives Services.

Customer Support And Empowerment

GTCFX Supports And Empowers Clients In A Number Of Ways:

- Educational Resources : Provides Trading Tutorials, Market Analysis Reports, And Online Seminars.

- Account Manager Services : Provides Dedicated Account Manager Support For Professional Accounts And Institutional Clients.

- Trading Tools : Provides Advanced Technical Analysis Tools And Market Data.

GTCFX Is Committed To Helping Clients Enhance Their Trading Capabilities Through A Comprehensive Range Of Support Services.

Social Responsibility And ESG

GTCFX Actively Practices Social Responsibility In Its Operations, Including:

- Environmental Protection : Supports Environmental Sustainability By Reducing Carbon Emissions And Using Renewable Energy.

- Employee Benefits : Offers Fair Compensation, Career Development Opportunities And Health Benefits.

- Community Support : Support The Development Of Local Communities Through Donations And Volunteer Activities.

The Goal Of GTCFX Is To Become A Responsible Financial Services Provider.

Strategic Collaboration Ecology

GTCFX Has Established Strategic Relationships With Multiple Ecosystem Partners, Including:

- Technology Vendors : Collaborate With Well-known Software And Cloud As A Service Providers To Enhance Technical Capabilities.

- Financial Services Providers : Collaborate With Global Banks And Payment Platforms To Optimize Payment Processes.

- Educational Institutions : Collaborate With Educational Institutions In The Financial Sector To Cultivate Industry Talents.

GTCFX Further Solidifies Its Market Position By Building A Strong Strategic Cooperation Ecosystem.

Financial Health

GTCFX Has A Sound Financial Position. Its Financial Indicators Include:

- Registered Capital : Undisclosed, But The Company Has Sufficient Financial Strength To Support Its Operations.

- Management Scale : As Of Q3 2023, The Management Scale Exceeds $1 Billion .

- Profitability : The Company Has Historically Maintained Stable Profitable Growth.

The Financial Health Of GTCFX Provides A Solid Foundation For Its Continued Development.

Future Roadmap

GTCFX's Future Development Plans Include:

- Product Expansion : Adding More Asset Class Trading Varieties, Such As Cryptocurrencies And Commodity Futures. Technology Upgrade : Continuing To Invest In Technological Innovation, Optimizing Trading Platforms And Risk Management Systems.

- Market Expansion : Enter More Emerging Markets And Expand The Global Customer Base.

- Partnerships : Strengthen Cooperation With Global Financial Institutions Groups And Technology Companies.

GTCFX Is Committed To Becoming A Leading Global Provider Of Financial Derivatives Services.

Unable To Withdraw

Unable To Withdraw