✨ Company Profile

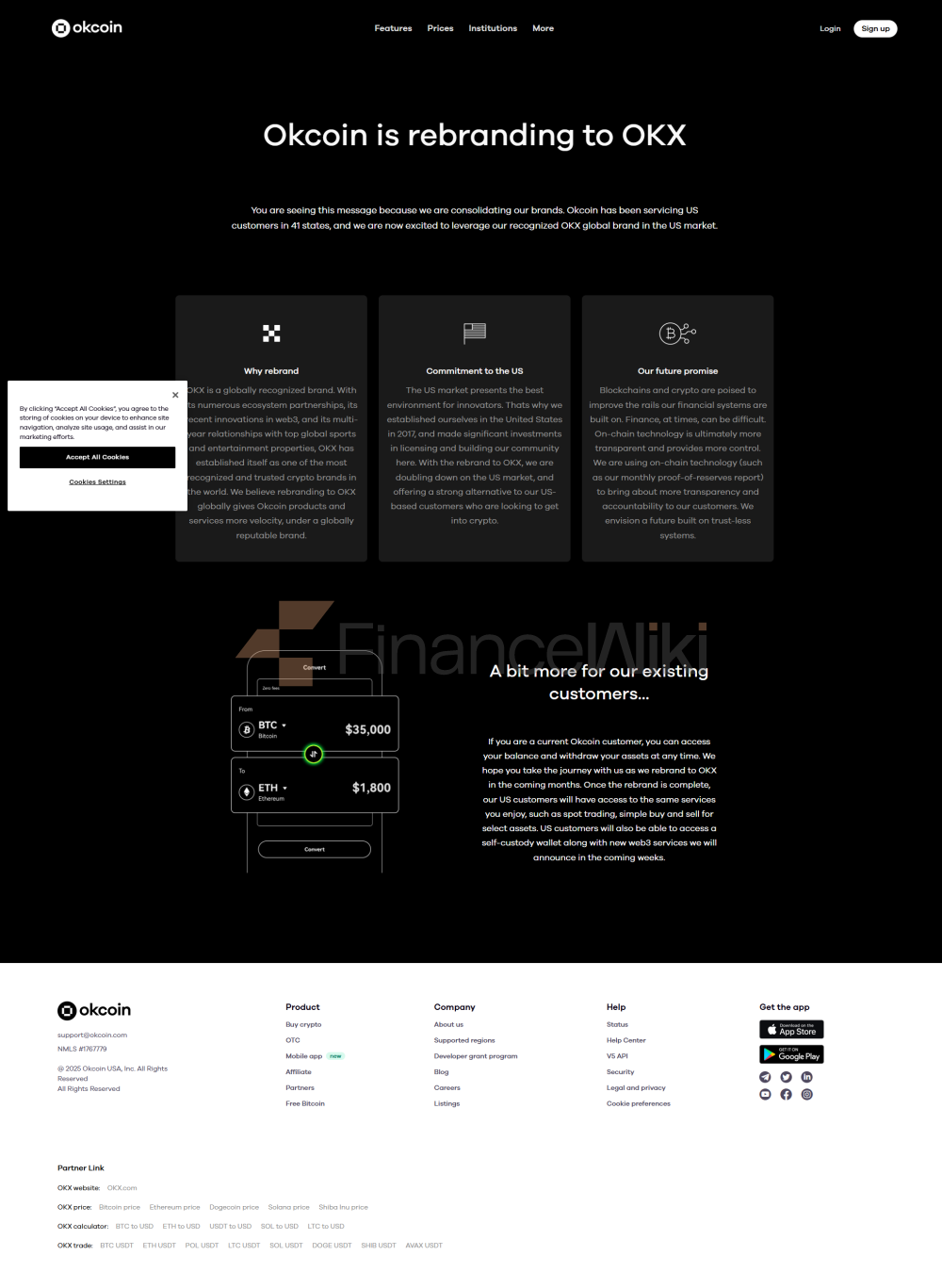

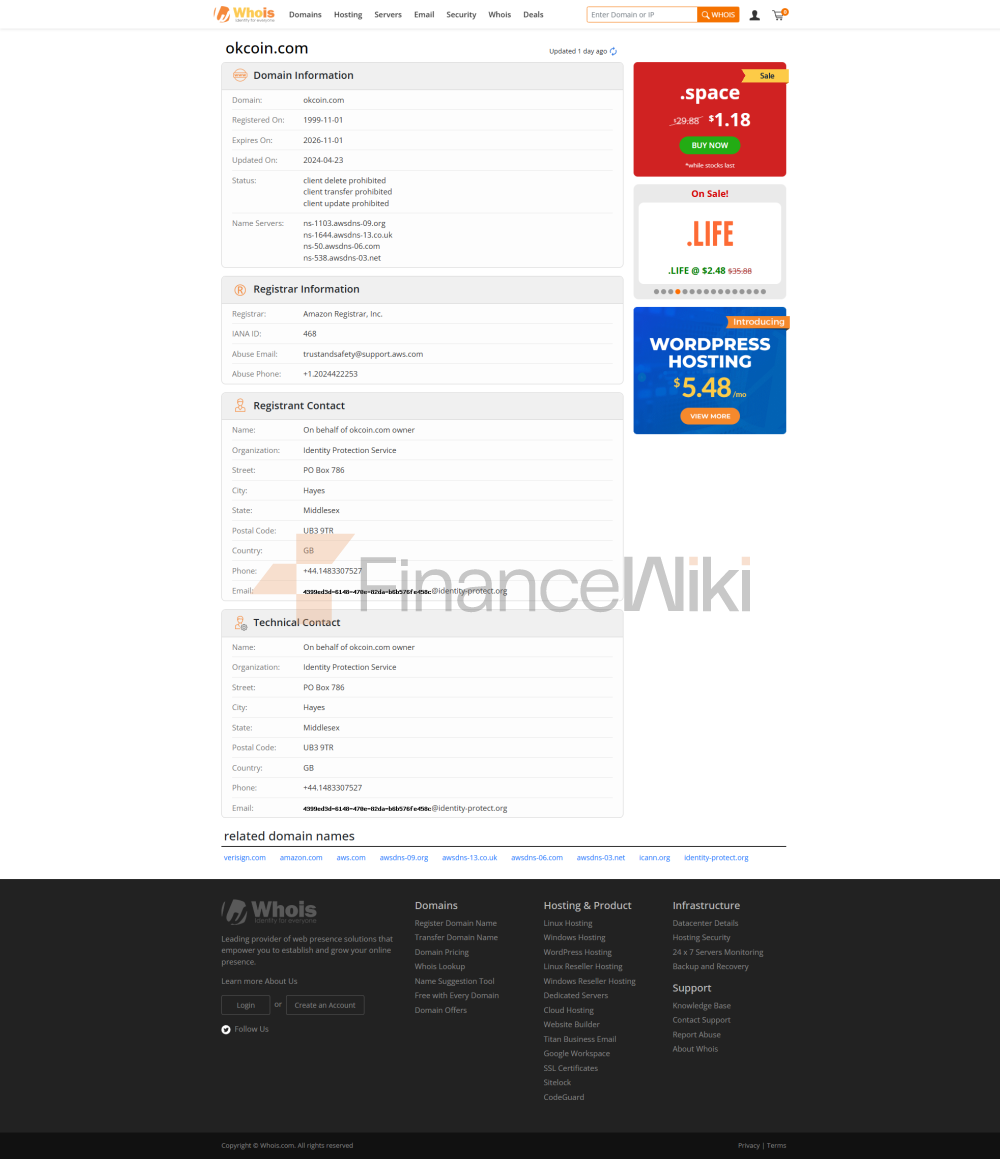

Full name / abbreviation: OKCoin USA Inc. / Okcoin Europe Ltd / OKX SG Pte. Ltd (Singapore)/OKCoin Technology Company Limited (Hong Kong), commonly known as Okcoin, is now (gradually) returning to the unified brand OKX.

Founded: Founded in 2013 in China by Xu Xin (Star Xu).

Country of Registration: Headquartered in California (San Francisco and San Jose), with regional entities or offices in Europe (Malta), Hong Kong, Singapore, Japan and other places.

Head Office Address:

United States: One Sansome St, Suite 3500, San Francisco, CA 94104(Okcoin USA Inc.)

Europe: 66A, The Strand, Tas-Sliema SLM 1022, Malta(Okcoin Europe Ltd, Reg. No. C88193)

📈 Registered capital and shareholding structure

Details of the registered capital were not publicly disclosed. According to PitchBook, OKCoin has received multiple rounds of funding, with Star Xu as the majority shareholder and Changpeng Zhao as one of the co-founders (who still holds a minority stake).

Theparent company structure is relatively privatized, with no public company status, and the equity is not fully transparent, which is more common in VC-driven crypto start-ups.

👥 Key executive backgrounds

Star Xu: Founder and CEO, former tecnology roles at Yahoo/Alibaba, with a rich technical background.

Hong Fang: The current President, this position appears on the Executive Team Review page.

Haider Rafique (CMO) and Jeff Ren (CIO) are OKX executives who have been transferred to Okcoin or held concurrent positions.

📌 Nature and classification

of the company

Nature: A private limited company, not offered by the public.

Business classification: Cryptocurrency Exchange.

Market positioning: A global platform for retail and institutional customers, providing simple trading, on-exchange/over-the-counter trading, professional high-end trading, OTC block trading, API access and other services.

>

🧾 Regulatory information

USA: Okcoin USA Inc. holds a Financial Crimes Enforcement Network (FinCEN) registration: MSB, and a Money Transmitter / Token-to-token / USD-to-token license (NMLS #1767779 in multiple states; see: DE, DC, FL, GA... RI, SC and other states).

Europe: Okcoin Europe Ltd is registered in Malta (Reg. C88193) and is regulated by the MFSA in Malta.

Singapore: OKX SG has been granted a regulatory exemption for Digital Payment Tokens (DPT) under the MAS Payment Services Act.

International/Hong Kong: OKCoin Tech Ltd (Hong Kong), serving global compliance regions.

Other regions: Regulatory approval or "in-principle" license in the Netherlands, Baltics, Dubai, etc.

Regulatory Event: In 2023, the FDIC issued a cease-and-desist order because Okcoin's claims to be "FDIC-insured" deposits were misleading.

💱 trading products and software

Trading target: 20+ digital assets are limited to trading in the U.S. market; The international market offers 300+ crypto assets.

Service Tools:

Spot Simple Trading/Classic/Unified Account;

Pro version: includes advanced stop-limit features;

OTC large account trading;

API/Institutional Access;

Mobile App (iOS/Android), Web, Professional Desktop Client, okcoin.com.

Software features: Support for real-time trading, asset yield scheme ("Earn"), mobile wallet function, Proof-of-Reserves exposure mechanism.

🏦 deposit and withdrawal methods

United States: Support bank ACH transfers, wire transfers, etc., as well as conversion and stablecoin channels. It was falsely claimed that USD deposits were protected by the FDIC, and were later withdrawn.

International: Covering USD and SGD, and gradually expanding to multi-country fiat currency channels (such as SG, AUD, BRL, etc.).

📞 customer support

Multi-language support (English, etc.);

Provide online tickets, emails ([email protected]/okx.com), and phone (888-201-8380);

Supported by regulatory complaint channels (e.g. Maltese arbitrators, U.S. state regulatory channels, etc.).

🎯 Core business and services

Covering ordinary investors (asset-light trading) to institutional and advanced traders;

Provide OTC block trading services, API/institutional access, Earn (return on assets);

Enhanced Proof-of-Reserves.

🧰 Technical infrastructure

Support web UI, native mobile terminal, API access;

Bank-grade secure storage (off-line cold wallets + hot wallets);

Public Proof-of-Reserves Report: Clean Asset Reserves Ratio Exceeds 100% from 2023.

>

✅ compliance and risk control system

Holding multi-country licenses, including FinCEN/MSB, MAS and other regulations;

Regular disclosure of real asset reserves;

Comply with KYC/AML processes;

Corrected FDIC claims to address regulatory investigations design process

📊 Market Positioning & Competitive Advantage

Positioning: A compliance platform for global users and the U.S. market;

Advantages: Strong regulatory background, diversified deposit/withdrawal channels, transparent asset reserves, and both retail and institutional services;

Challenge: Fierce competition in the market and regulatory reputations (FDIC events affect trust).

>

🎓 Customer support and enablement

Provision of learning materials (blogs, industry knowledge, tax guides);

Developer Grants Program;

Proof-of-Reserves page to boost user confidence.

🌍 Social Responsibility and ESG

the introduction of a transparent asset reserve mechanism;

Strengthen global compliance and promote blockchain standards;

Sponsorship of sports (Manchester City, McLaren, Olympic team, etc.) to enhance credibility and influence.

🤝 Strategic cooperation ecosystem

Sports sponsorship: Manchester City Football Club, McLaren F1, Australian Olympics, etc.;

Regional bank partnerships: linkage with local banks in Singapore such as DBS;

Continue to apply for regional regulatory licenses and strengthen the global layout.

💰 Financial health

Not a listed company with limited public financial disclosures;

PitchBook information is shown as profitable or revenue growth-oriented;

There are no public valuation figures, and tens of millions of dollars have been raised in the early days;

Proof-of-Reserves indicate that the asset reserves are sufficient and the risks are more controllable.

🔮 future roadmap

Completed the unified brand transition to OKX (expected 2024-2025)

to launch Web3 wallet and DeFi marketplace services;

Business expansion to more fiat channels (SGD/AUD/BRL, etc.);

strengthen access to regional regulation and strengthen financial compliance;

Expand application scenarios for institutions and enterprises.

summary

Since its inception in 2013, Okcoin (OKX) has gradually developed into a mainstream crypto asset trading platform with international regulatory qualifications, with its rigorous structure, regulatory compliance, diverse business forms, and high transparency as its core selling points.