Corporate Profile

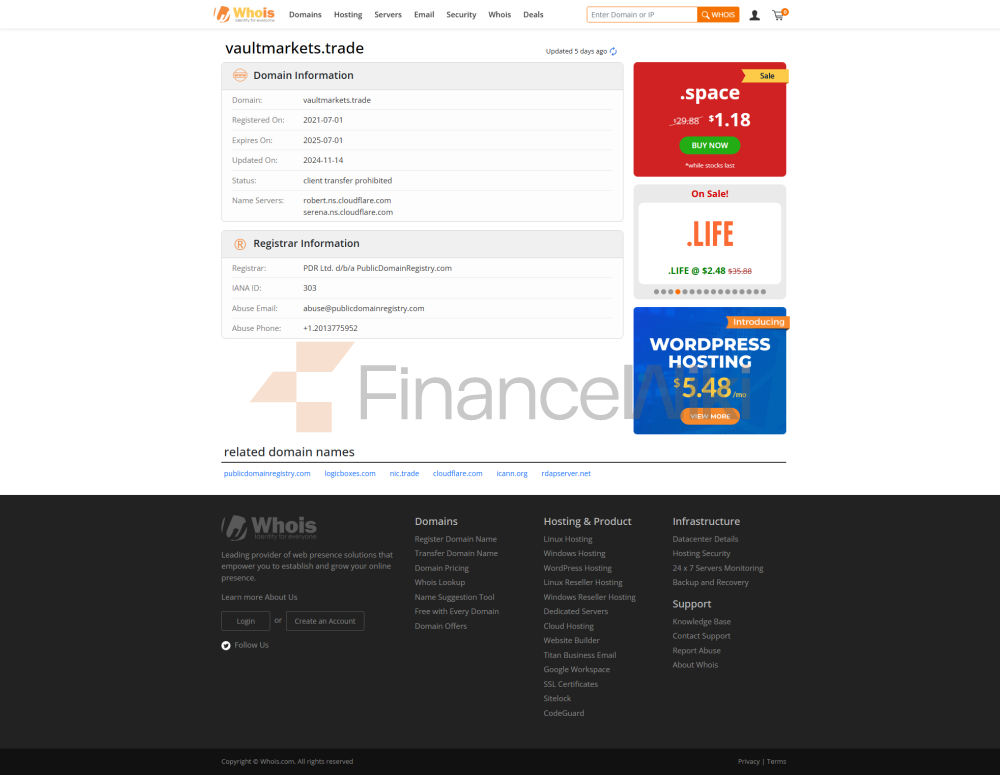

Vault Markets Is A Global Brokerage Firm Headquartered In South Africa, Established Between 2021 And 2022. The Company Has A Registered Capital Of 5 Million South African Rand . Although It Offers A Variety Of Financial Products And Services, It Is Worth Noting That Vault Markets Is Not Currently Regulated By Any Recognized Financial Regulator . This Could Have A Significant Impact On Clients' Trading Decisions.

Regulatory Information Vault Markets Does Not Currently Have Any Official Regulatory Recognition. As An Unregulated Broker, Its Operations Lack Oversight From Major Financial Regulators, Including The Financial Supervisory Authority Of South Africa (FSCA) Or Other International Regulators. Clients Should Evaluate The Relevant Risks When Choosing Such Platforms For Trading.

Trading Products Vault Markets Provides Traders With A Wealth Of Market Tools Covering The Following Major Asset Classes:

- Forex: Covers Trading Of Various Currency Pairs

- Indices: Includes Major Global Stock Indexes

- Commodities: Offers Precious Metals, Energy Commodities, Agricultural Products, Etc.

- Stocks: Allows Trading Of Well-known Listed Company Stocks

- Cryptocurrencies: Includes Major Cryptoassets Such As Bitcoin, Ethereum

Trading Software Vault Markets Offers Traders Two Main Platform Options:

- MetaTrader 4 (MT4) MetaTrader 5 (MT5) Is Renowned For Its Advanced Charting Capabilities And Trading Tools. It Offers More Advanced Analytical Tools And Execution Speed. Additionally, Clients Can Trade On Their Smartphones Using Vault Markets' Mobile App.

Deposit And Withdrawal Methods Vault Markets Accepts A Variety Of Payment Methods, Including:

- Credit Card (Mastercard, Visa)

- Mobile Payment (e.g. MPesa, Ozow)

- Electronic Wallet (e.g. PayFast, Stitch)

- Bank Transfer

Customer Support Vault Markets Provides Multi-channel Customer Support:

- Email: Inquiries Can Be Submitted Through The Official Website

- Online Chat: The Official Website Provides Real-time Online Customer Service

- Social Media: On Facebook Twitter, Instagram And Other Platforms Are Active

- Contact Form: There Is A Special Contact Form On The Official Website

Core Business And Services Vault Markets' Business Revolves Around The Following Core Services:

- Leveraged Trading : Provide Leverage Up To 1:1000 To Help Traders Enlarge Their Investment

- Spread Structure : The Spread Of The Standard Account Starts From 1 Point , While The "Zero Library Account" Starts From 0.0point Low Threshold For Accounts : Minimum Deposit Requirement Is R10 South African Rand

Technical Infrastructure Vault Markets Uses An Industry-standard Technology Platform To Ensure Stable Trading Operation:

- MT4/MT5 As The Main Trading Tool

- Professional Server Facility

- Secure SSL Encryption

- 24/7 Technical Support Team

Compliance And Risk Control System Although Not Officially Regulated, Vault Markets Has Established An Internal Risk Management Framework:

- Negative Balance Protection : Prevent Account Balances From Falling To Negative

- Fund Segregation : Client Funds Are Held In Separate Accounts

- Internal Audit : Regular Internal Reviews Of Trading And Fund Management

Market Positioning And Competitive Advantage Vault Markets' Market Positioning Mainly Relies On The Following Advantages:

- Multi-asset Class Trading : Provide A Comprehensive Selection Of Market Tools

- Flexible Leverage Options : Meet The Needs Of Different Trading Strategies

- Low Spread Trading : "Zero Pool Account" Is Especially Competitive. However, Its Unregulated Status May Have Some Impact On Its Market Reputation. This Can Be A Disadvantage Compared To Regulated Competitors.

Customer Support And Empowering Vault Markets Offers The Following Resources In Customer Support:

- Educational Platform : "Upgrade Your Trading" Page Contains:

- Trading Guide

- Video Tutorial

- Webinar

- Market Analysis Report

- Multi-channel Support : Multiple Touchpoints Covering Email, Live Chat, Social Media, And More

- Trading Platform Training : Help Clients Familiar With The Operation Of MT4/MT5

Social Responsibility And ESG There Are No Specific Measures In Social Responsibility Or ESG By Vault Markets In The Current Public Information.

Strategic Cooperation The Ecological Public Information Does Not Show That Vault Markets Has A Major Strategic Partnership.

Financial Health As A Private Company, Vault Markets' Financial Status Has Not Been Disclosed To The Public. However, Its Registered Capital And Operating Scale Show That It Has A Certain Financial Strength.

Future Roadmap There Is Currently No Clear Future Strategic Plan Released By Vault Markets. However, The Richness Of Market Tools And The Flexibility Of Trading Conditions Indicate That It Is Committed To Attracting A Diverse Customer Base.

The Above Is A Corporate Introduction Of Vault Markets Based On Existing Information. As An Unregulated Broker, Clients Need To Carefully Evaluate The Risks Involved When Selecting Its Services.