Corporate Profile

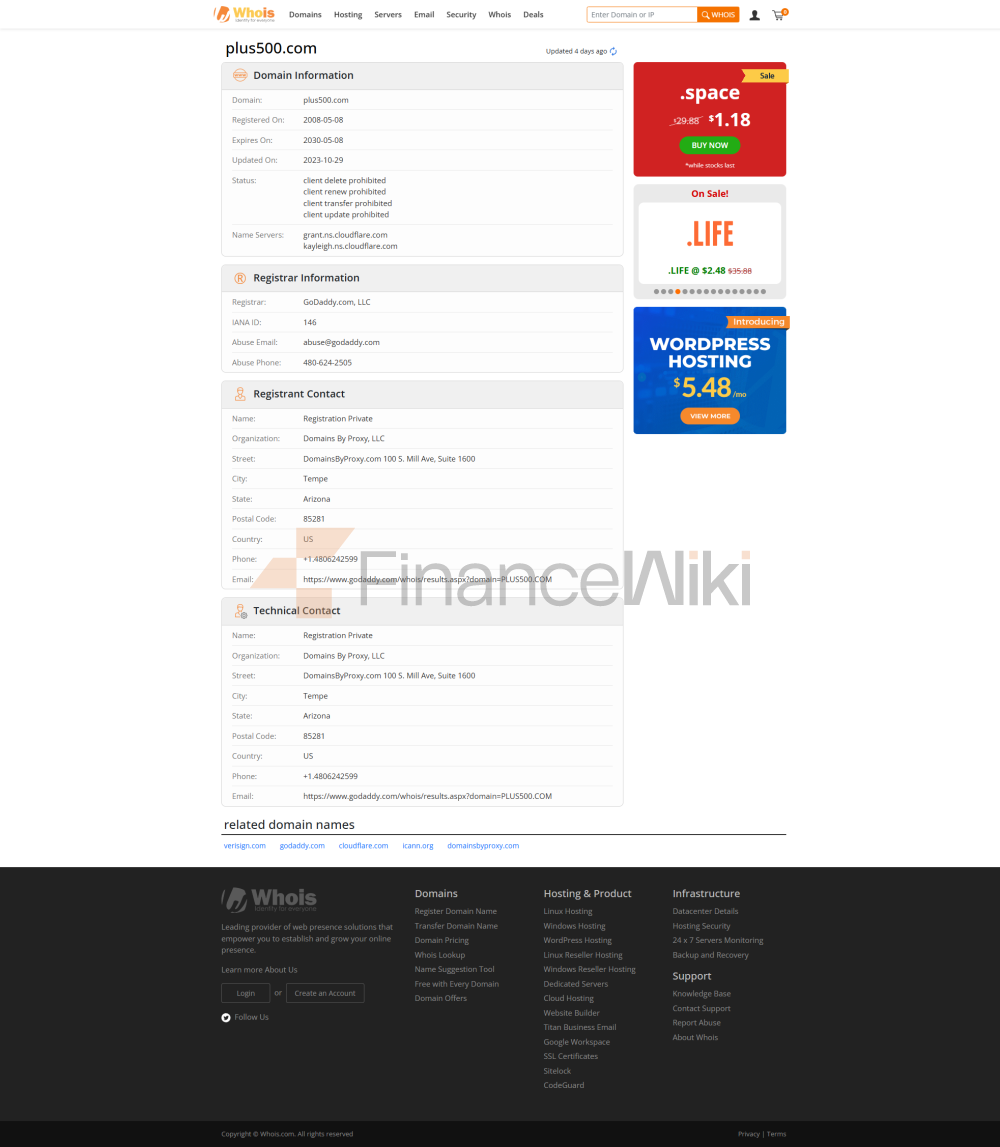

Plus500 Is A Contract For Difference (CFD) Broker Established In 2008 And Headquartered In Sydney, Australia. The Company Aims To Provide Global Investors With A Diverse Range Of Financial Trading Services Covering Markets Such As Stocks, Foreign Exchange, Commodities, Cryptocurrencies, ETFs, Options And Indices. Plus500, Through Its Subsidiaries, Is Registered And Holds Relevant Licenses In Multiple Jurisdictions, Including Australia, The United Kingdom, Cyprus, Singapore And Dubai. The Company Is Committed To Providing An Efficient And Secure Trading Experience To Its Global Clients And Supports Their Needs Through Its Self-developed Trading Platform And A Variety Of Deposit And Withdrawal Methods.

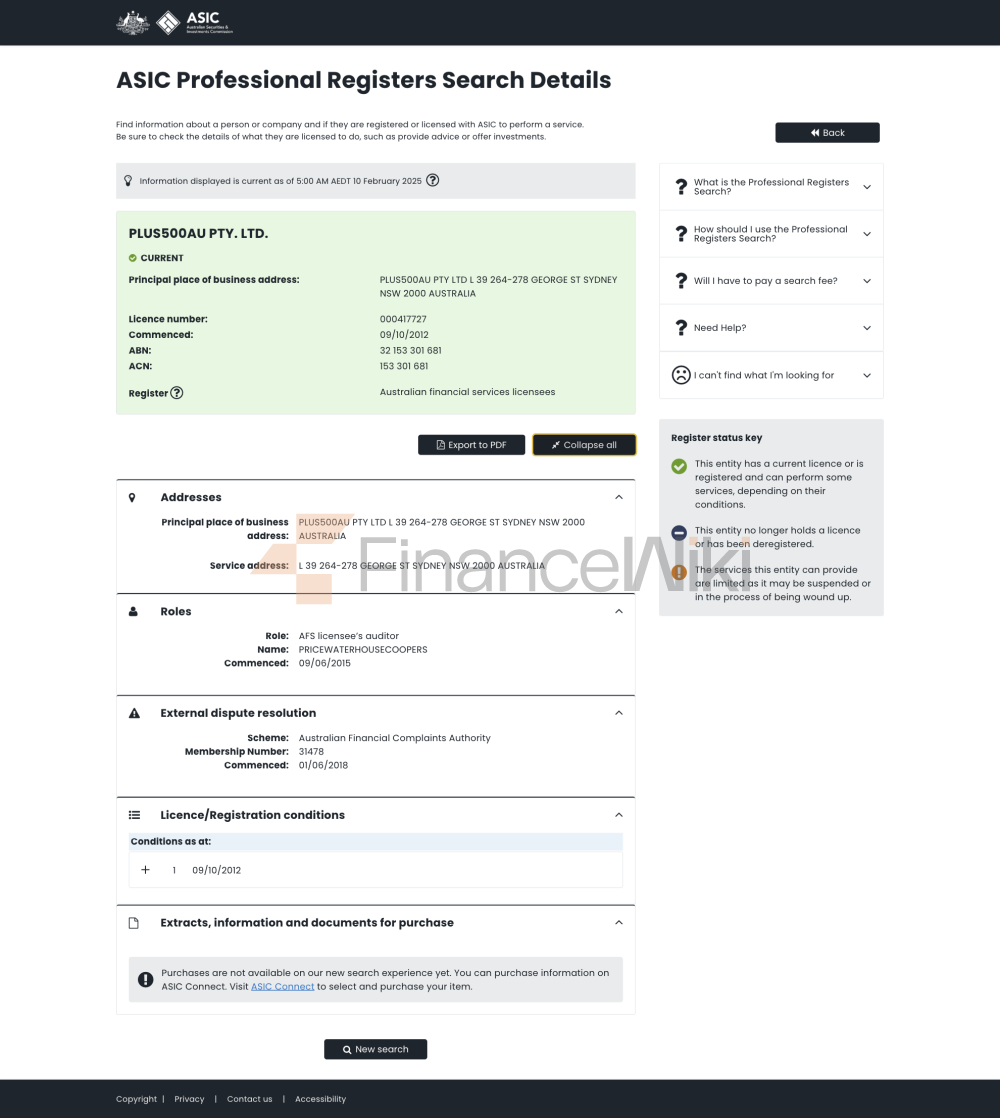

Regulatory Information

Plus500 Holds Financial Licenses In Multiple Countries And Territories. Its Regulatory Information Is As Follows:

- Australia : Plus500AU Pty Ltd Holds A Full License Issued By The Australian Securities And Investments Commission (ASIC) With License Number 417727 .

- United Kingdom : Plus500UK Ltd Is Authorized By The Financial Conduct Authority (FCA) In The United Kingdom With License Number 509909 .

- Cyprus : Plus500CY Ltd Is Regulated By The Cyprus Securities And Exchange Commission (CySEC) Under License Number 250/14 .

- Singapore : Plus500SG Pte Ltd Holds A Retail Foreign Exchange License Issued By The Monetary Authority Of Singapore (MAS) Under License Number CMS100648 .

- Dubai : Plus500AE Ltd Is Regulated By The Dubai Financial Services Authority (DFSA) Under License Number F005651 .

Trading Products

Plus500 Offers Investors A Wealth Of Trading Products, Including:

- Forex : Offers Trading Of Major Global Currency Pairs, Such As EUR/USD, GBP/USD, Etc.

- Stocks : Covers Stocks Of Globally Renowned Companies Such As Apple, Google, Tesla, Etc.

- Commodities : Offers Trading Of Commodities Such As Gold, Crude Oil, Silver, Etc.

- Cryptocurrency : Supports Trading Of Mainstream Cryptocurrencies Such As Bitcoin And Ethereum.

- Indices : Covers The S & P 500, Nasdaq 100, Dow Jones And Other Important Stock Indexes.

- Options : Offers Options Trading Based On Stocks, Commodities And Indices.

- ETFs : Covers A Variety Of Forms Of Exchange Traded Funds.

Trading Software

Plus500 Provides Its Clients With A Powerful Self-developed Trading Platform That Supports Multiple Devices And Operating Systems:

- Mobile Devices : IPhone/iPad And Android Applications That Make It Easy For Clients To Trade At Any Time.

- Desktop : Windows 10 Trading Platform That Provides Rich Trading Tools And Chart Analysis Capabilities.

- Web-side : WebTrader Platform That Supports A Seamless Trading Experience Across Devices.

Deposit And Withdrawal Methods

Plus500 Supports A Variety Of Payment Methods, Including:

- Bank Cards : Visa And Mastercard, Providing Fast Access To Funds.

- Electronic Wallet : PayPal, Trustly, Etc., Easy To Operate And Low Cost.

- Bank Transfer : Supports International Bank Transfers To Ensure The Safety Of Funds.

- Mobile Payments : Like Apple Pay, Providing Convenient Payment Options.

Customer Support

Plus500 Provides Comprehensive Customer Support For Global Customers, Including:

- Multi-language Support : Support English, Simplified Chinese, Traditional Chinese, Czech And Other 28 Languages.

- Online Chat : Through The Live Chat Function Of The Official Website, Customers Can Quickly Get Help.

- Email : Provide Professional Online Mail Support.

- Telefon : Customers Can Contact The Customer Support Team At + 65 3138 9075.

- WhatsApp : Support For Communication Via WhatsApp, Which Is Convenient And Fast.

Core Business And Services

The Core Business Of Plus500 Includes:

- CFD Trading : Provides CFD Trading On A Variety Of Financial Instruments.

- Leverage Trading : Provides Professional Clients With Up To 1:300 Leverage To Help Investors Amplify Their Returns.

- Risk Management Tools : Includes Stop Loss, Take Profit And Trade Limit Functions To Help Clients Control Risks.

- Educational Resources : Provides Trading Guides, Market Analysis, And Educational Videos To Help Clients Improve Their Trading Skills.

Technical Infrastructure

Plus500's Technical Infrastructure Includes:

- High-performance Servers : Ensures Low Latency And High Stability In Transaction Execution.

- Cloud Platform : Supports The Processing Of Large-scale User And Transaction Data.

- Security : Protects Customer Data With SSL Encryption And Multi-factor Authentication.

Compliance And Risk Control System

Plus500 Strictly Complies With Financial Regulations In Various Jurisdictions And Implements A Series Of Risk Control Measures:

- Compliance Statement : The Company Commits To Comply With All Relevant Financial Regulations And Publishes Its Compliance Policy On The Official Website.

- Risk Management System : Including Real-time Monitoring, Market Threat And Risk Assessment And Customer Account Management.

- Anti-Money Laundering (AML) : Implement Strict Customer Authentication And Transaction Monitoring To Prevent Money Laundering.

Market Positioning And Competitive Advantage

Plus500's Market Positioning And Competitive Advantages Include:

- Diversified Products : Trading Products Covering Major Financial Marekts Worldwide.

- Multi-Jurisdiction License : Ensure That Customers Have Access To Legal Trading Services In Different Regions.

- Advanced Trading Platform : Provides A User-friendly Interface And Powerful Analytical Tools.

- Global Methods Of Deposit And Withdrawal : Supports Multiple Payment Methods For The Convenience Of Customers Worldwide.

Social Responsibility And ESG

Plus500 Has Taken The Following Steps In Social Responsibility And ESG:

- Environmental Protection : Reduces Carbon Footprint By Optimizing Server Energy Consumption.

- Social Responsibility : Supports Education And Community Development Projects.

- Corporate Governance : Implements Transparent Management And Regular Financial Disclosure.

Strategic Collaboration Ecology

Plus500 Has Established Partnerships With Several Financial Institution Groups And Technology Companies, Including Payment Platforms, Data Analytics Companies And Cyber Security Vendors, To Enhance Its Service Quality And User Experience.

Financial Health

Plus500's Financial Health Is Reflected In Its Stable Revenue Growth And Sound Capital Structure. Specific Data Can Be Obtained Through Its Annual Report.

Future Roadmap

Plus500's Future Plans Include Continuing To Expand Its Trading Products, Optimizing Trading Platform Functions, And Strengthening Its Presence In The Global Market To Meet The Growing Customer Demand.

Through The Above, You Can See That Plus500, As A World-leading CFD Broker, Provides Efficient And Safe Trading Services To Global Investors With Its Diverse Trading Products, Advanced Technology Platform And Strict Compliance Management System.