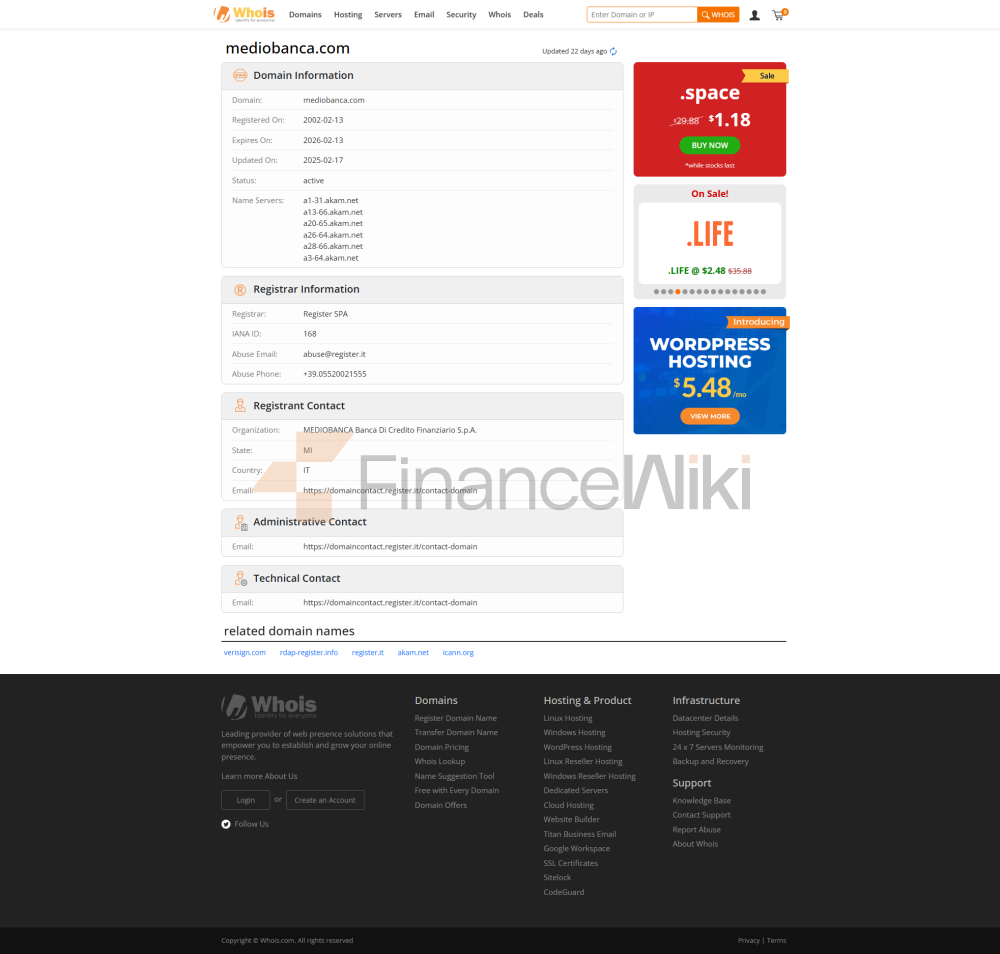

Mediobanca is one of Italy's leading investment banks, founded in 1946 and headquartered in Milan, Italy. It started as a bank that mainly served large corporations and high-net-worth individuals, and over time, it gradually expanded to include wealth management, corporate finance, investment banking and other fields. Mediobanca stands for Mediobanca – Banca di Credito Finanziario S.p.A., and the name "Credito Finanziario" means financial credit, reflecting its deep background in the field of financial services.

Mediobanca's shareholder structure includes a place for both Italian and international investors. It is a publicly listed bank with shares listed on the Milan Stock Exchange under the ticker symbol MB.MI. According to the 2023 public report, Mediobanca's shareholders include a number of international investment funds, banks and retail investors, with the main Italian shares held by major shareholders such as Generali Group and Edizione S.r.l.

Scope of

ServicesMediobanca's business scope covers a wide range of financial sectors, including corporate banking, investment banking services, wealth management and asset management. It provides integrated financial services to large corporations, government agencies, high-net-worth individuals and retail clients. It has a strong presence in Italy, but also has a strong presence in Europe and around the world.

Mediobanca's activities in the Italian and international markets are mainly carried out through its subsidiaries and branches. It has a global network of entities, mainly concentrated in Europe, and provides cross-border services through multiple offices and subsidiaries. Mediobanca's business is not limited to traditional banking branches, but also expands its presence in the global market through digital platforms and private banking services.

In terms of traditional banking services, Mediobanca's offline branch distribution is mainly concentrated in major economic and financial centers such as Milan and Rome. However, with the rapid development of financial technology, Mediobanca has gradually promoted online banking services, enabling customers to enjoy more convenient financial services on a global scale.

Regulation &

ComplianceMediobanca, as an investment bank in Italy, operates under the supervision of the Bank of Italy, the Italian financial regulator. In addition, as a member of the Eurozone, Mediobanca is also regulated by the European Central Bank (ECB). In particular, in the areas of financial stability and anti-money laundering, Mediobanca adheres to European and international financial regulatory standards.

In terms of deposit insurance, Mediobanca is not extensively involved in the retail deposit business and therefore does not participate in deposit insurance schemes normally offered by banks. However, it remains a bank offering a wide range of corporate finance and high-net-worth client services, following the compliance requirements of the EU and global banking systems. In terms of compliance, Mediobanca continues to promote compliance, especially in the areas of risk management, anti-money laundering (AML) and data protection, with strict internal control mechanisms in place.

Financial

HealthMediobanca'sfinancial health performance is solid. In 2023, Mediobanca's total assets were €82.8 billion and its capital adequacy ratio (CET1) was 16.1%, well above the regulatory requirements for EU banks. This figure reflects Mediobanca's resilience in the face of global financial risks.

In addition, Mediobanca's bad debt ratio (non-performing loan ratio) remains low, at 1.5% in 2023. This is a healthy ratio compared to other European banks, reflecting their cautious approach to loan origination and risk control. The Liquidity Coverage Ratio (LCR) is also in line with EU requirements, ensuring the liquidity of banks in their day-to-day operations.

In terms of revenue sources, Mediobanca's revenue comes mostly from investment banking and corporate banking, with M&A advisory and capital markets services as the main sources of revenue.

Deposit & Loan

ProductsMediobanca does not offer a wide range of deposit products in the retail banking sector. Its main businesses focus on corporate finance, investment banking and private banking services. However, Mediobanca also provides customized wealth management services to high-net-worth clients, including savings plans and private banking portfolio management. For high-net-worth clients, Mediobanca offers a variety of investment channels including fund investment, debt financing, real estate investment, etc.

In terms of loan products, Mediobanca's services are mainly focused on bulk corporate finance and M&A loans. In addition, the Private Banking segment offers a variety of loan products, including home loans, consumer loans, and corporate guaranteed loans. For high-net-worth clients, Mediobanca offers personalized loan solutions to help them optimize their asset allocation and financing structure.

List of Common Fees

Mediobanca's fees are mainly focused on investment banking and include M&A advisory fees, securities issuance fees, asset management fees, etc. For investors, Mediobanca's private equity funds, hedge funds and other products will charge management fees and performance sharing. Fees and rates often vary depending on the type of investment product and the degree of customization of the client's needs.

Digital Service

ExperienceMediobanca has always been committed to digital transformation. Its Private Banking division provides a comprehensive range of digital investment services, and clients can conduct online asset management, securities trading, and more through Mediobanca's proprietary platform. In addition, Mediobanca has launched a number of intelligent investment tools to help investors optimize their portfolios and make intelligent decisions through artificial intelligence and machine learning technologies. Mediobanca's app and online platform are user-friendly, allowing customers to access account information in real-time, view portfolio performance, adjust investment allocation, and more.

Quality of Customer

ServiceMediobanca offers a diverse range of services in terms of customer service. Its private banking services not only provide traditional face-to-face consultations, but also provide online support such as phone, email, video conferencing, etc. Clients can access timely and professional guidance on investment advice, market trends and asset allocation through these channels. Mediobanca also maintains interaction with customers through social media platforms, ensuring that customers are kept up to date with the bank's latest services and product information.

Security & Data

ProtectionMediobanca attaches great importance to the security of financial services. As a large investment bank, it adheres to strict data protection regulations, ensuring the confidentiality and security of all client information. The bank has adopted multiple data encryption and firewall technologies and is ISO 27001 certified to ensure the security of its information technology and customer data.

In addition, Mediobanca has established a robust anti-fraud mechanism that monitors all financial transactions in real-time to prevent fraud from occurring. In terms of cybersecurity, Mediobanca regularly conducts security assessments and penetration tests to ensure the security of its financial platform.

Featured Services & DifferentiationMediobanca

has distinct differentiators in the areas of wealth management and investment banking. It provides high-end private banking services and customizes investment solutions for clients. For corporate clients, Mediobanca provides a full range of capital markets solutions, including IPOs, M&A advisories and corporate debt financing. In addition, Mediobanca actively engages in green finance and socially responsible investment, launching investment products related to the Sustainable Development Goals.

Market Position & HonorAs

one of the most influential investment banks in Italy, Mediobanca occupies an important position in the capital markets of Europe and the world. It is not only an important player in the Italian stock market, but also a leader in the field of mergers and acquisitions. Mediobanca has been repeatedly named one of the best investment banks by the Financial Times, the European Mergers and Acquisitions Association and other institutions, demonstrating its deep accumulation and expertise in the field of capital markets and investment banking.