Corporate Profile

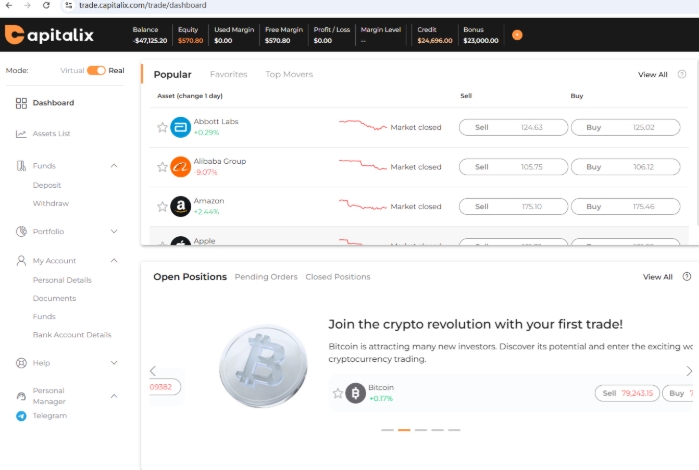

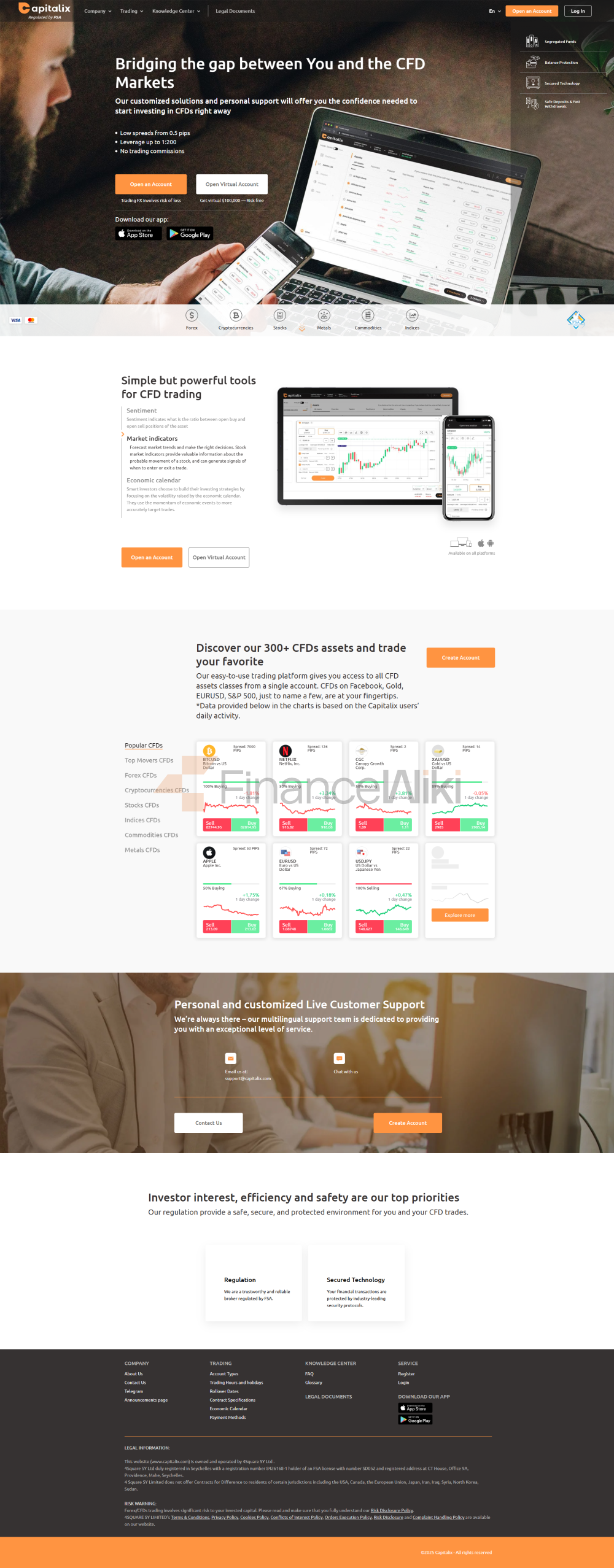

Capitalix, Under The Trade Name 4Square SY Ltd, Is A Self-proclaimed Forex Broker Registered In The Seychelles With Registration Number 8426168-1. Its Official Website Advertises Offering A Wide Range Of Market Instruments, Including More Than 150 Trading Assets Such As Forex, Cryptocurrencies, Stocks, Indices, Commodities And Metals. The Company Claims To Offer Five Real Trading Account Types (Basic, Silver, Gold, Platinum, VIP) And Supports 24/5 Expert Manual Customer Support Services.

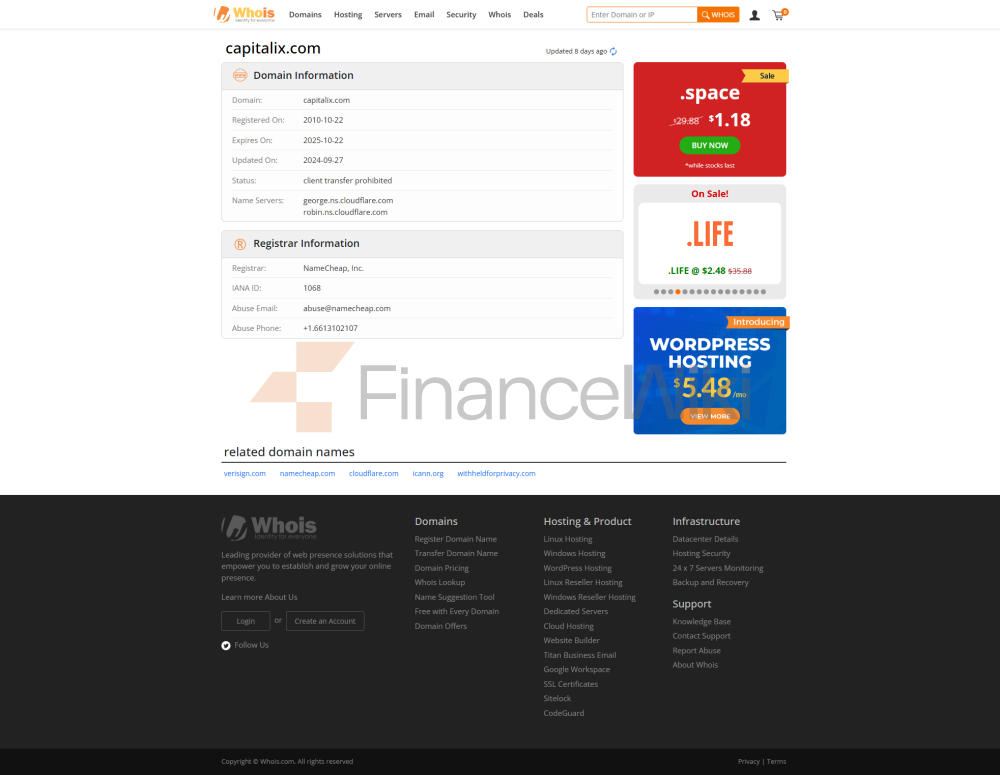

However, According To Publicly Available Information, There Are Doubts About The Actual Operating Background Of Capitalix. Its Domain Name Was Registered On October 22, 2010, But The Company Itself (4Square SY Ltd) Was Established On October 22, 2020, And Its Detailed Business Registration Information Was Not Found. In Addition, Although Its Official Website Claims To Be Licensed By The Seychelles Financial Services Authority (FSA) (license Number Sd052), The Validity Of The License Has Not Been Confirmed.

Regulatory Information

Capitalix Claims To Be Regulated By The Seychelles Financial Services Authority (FSA), License Number Sd052. However, According To The Research Results, The License Was Not Found In The Official FSA Database. In Addition, The License Does Not Mention The Effective Date Or Expiration Date, And The FSA's Contact Information (such As Phone Number) Cannot Be Obtained. This Situation Indicates That The Actual Regulatory Status Of Capitalix Is In Doubt And May Not Be Supervised By Any Effective Financial Regulator.

Trading Products

Capitalix Advertises That It Offers More Than 150 Trading Assets In Financial Marekt, Covering The Following Categories:

- Forex : Including Major Currency Pairs (e.g. EURUSD, USDJPY, GBPUSD), Cross-currency Pairs And Exotic Currency Pairs.

- Cryptocurrencies : Offers A Variety Of Trading Instruments Such As Bitcoin (BTCUSD), Ethereum (ETHUSD), Litecoin (LTUSD) And Ripple (XRPUSD).

- Stocks : Covers Stocks Of Well-known Companies Such As Facebook, Apple, Microsoft, Google, Netflix, Canopy Growth Corporation (CGC) And Alibaba.

- Indices : Traders Can Participate In Popular Indices Such As FTSE-SEP23, NK-SEP23, CAC-SEP23.

- Commodities : Including Brent Crude Oil (BRENT-AUG23), Crude Oil (CL-JUL23), Cotton (LCTT-JUN23), Natural Gas (NGAS-JUL23) And Sugar (SUG-JUL23), Etc.

- Metals : Supports The Trading Of Copper (COPP-JUL23), Platinum (PLAT-JUL23), Silver (XAGUSD) And Gold (XAUUSD).

Despite Offering A Variety Of Trading Products, The Reviews And Feedback From Traders Are Mainly Negative, Especially For Inexperienced Traders And The Problem Of Running Out Of Accounts.

Trading Software

Capitalix Claims To Offer Trading Platforms Such As Web Trading End Points, MetaTrader 4 (MT4) And Mobile Applications. However, Its Official Website Does Not Disclose The Specific Functions And Performance Of The Trading Software In Detail. In Addition, Capitalix No-trade Software Is Mentioned In Traders' Complaints, Which May Be An Important Factor To Further Verify.

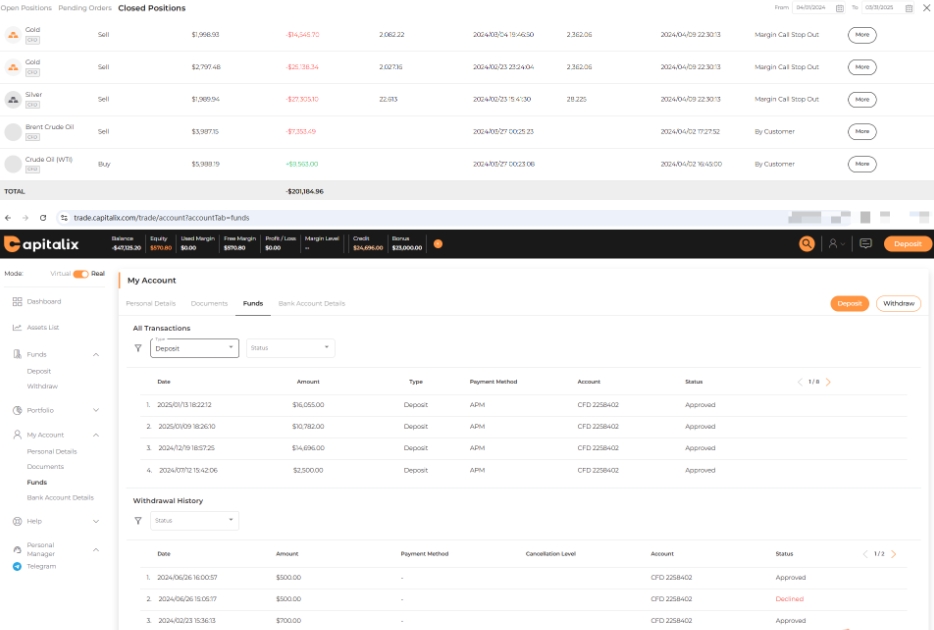

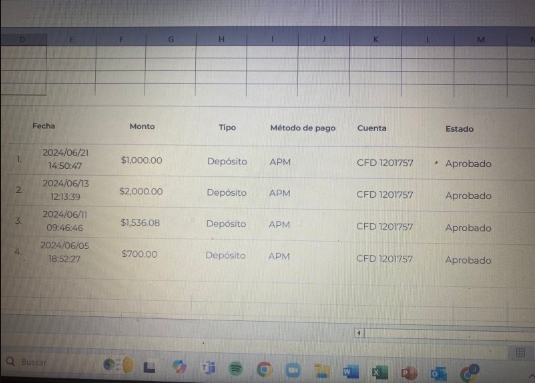

Deposit And Withdrawal Methods

Capitalix Offers A Variety Of Deposit And Withdrawal Methods, Including:

- Credit Card : Visa, Mastercard And Maestro Are Supported.

- Bank Transfer : SWIFT And SEPA Telegraphic Transfer Are Supported.

There Are No Fees For Deposits And Withdrawals, And The Processing Time Is 3 Business Days. However, Users Are Required To Complete The Know Your Customer (KYC) Process And Submit Proof Of Identity And Address Documents. The Minimum Amount For Specific Deposits And Withdrawals Is Not Clear.

Customer Support

Capitalix Provides A Variety Of Customer Support Channels, Including:

- Telephone Support : Provide Multi-regional Contact Numbers, Such As + 971 4574 1810 (AE), + 54 11 5236 2375 (AR), Etc. Email : Support@capitalix.com.

- Live Chat : Communicate In Real Time Through The Official Website.

- Telegram Service : Support Contacting Via Telegram.

However, Feedback From Traders Has Revealed Poor Quality Of Customer Support Services, Especially The Lack Of Effective Assistance When Dealing With Account Issues.

Core Business And Services

Capitalix's Core Business Includes Providing Traders With A Diverse Range Of Financial Instruments And Flexible Trading Conditions To Meet Different Trading Needs. Its Main Services Include:

- Flexible Leverage : Offers Leverage From 1:5 To 1:200, Especially In Forex And Metals Trading Up To 1:200.

- Low Spreads : Claims To Offer Spreads As Low As 0.3 Pips Without Commission.

- Multiple Account Types : Five Account Types Are Available, And Traders Can Choose The Account That Best Suits Their Risk Appetite According To Their Needs.

- 24/5 Trading Hours : Provide 24/7 Trading Services To Meet The Unexpected Needs Of Traders Around The World.

Technical Infrastructure

Capitalix's Technical Infrastructure Includes:

- Web Trading End Point : No Software Download Required, Ready-to-use Trading Methods Are Supported.

- Mobile App : Available On IOS And Android Devices, Enabling Anytime, Anywhere Trading.

However, Its Official Website Does Not Disclose The Specific Performance And Security Of Its Technical Infrastructure In Detail, And There Is No Recognition Of Its Technology Platform In Traders' Comments.

Compliance And Risk Control System

Capitalix Claims To Comply With Industry Standards And Protect Client Funds Through SSL Encryption, But Its Compliance Statement And Risk Management System Have Not Been Verified By An Independent Third Party. Traders' Complaints Mention That Some Traders Have Run Out Of Funds In Their Accounts Without Experience, Suggesting That Its Risk Control System May Be Flawed.

Market Positioning And Competitive Advantage

Capitalix's Market Positioning Is To Provide High Leverage, Low Spreads Trading Services To Global Traders. Its Competitive Advantages Include:

- Low Spreads : Claims To Offer Lower Spreads In The Industry, Especially For High-end Accounts.

- High Leverage : Offers Leverage Up To 1:200, Attracting Traders Seeking High Risk And High Returns.

- Multi-Trading Tools : Offers More Than 150 Trading Assets To Meet The Diverse Needs Of Different Traders.

However, Negative Feedback From Traders Shows That There Are Major Problems With Its Customer Support And Risk Management.

Customer Support And Empowerment

Capitalix Offers Personalized And Customized Real-time Customer Support Services That Support Multiple Languages To Meet The Needs Of Traders Worldwide. However, Feedback From Traders Shows That The Quality Of Its Customer Support Services Is Poor, Especially The Lack Of Effective Support In Handling Account Issues.

Social Responsibility And ESG

Capitalix Does Not Explicitly Mention Its Social Responsibility And ESG (environmental, Social And Governance) Related Initiatives.

Strategic Cooperation Ecology

Capitalix Does Not Disclose Its Strategic Cooperation Ecosystem And Does Not Mention Partnerships With Other Financial Institution Groups.

Financial Health

Capitalix's Financial Health Has Not Been Verified By An Independent Third Party, And Negative Feedback From Traders Indicates That It May Not Have Received Good Financial Support.

Future Roadmap

Capitalix Does Not Disclose Its Future Roadmap, And Does Not Mention Future Development Plans And Goals.

Conclusion

Capitalix Offers A Wide Range Of Trading Products And Flexible Trading Conditions, But There Are Significant Risks Associated With Its Regulatory Status, Customer Support, And Risk Management. Traders Are Advised To Exercise Caution And Exercise Due Diligence When Selecting This Platform.

Inducement Fraud

Inducement Fraud