Corporate Profile

ATFX (full Name: AT Global Markets (UK) Ltd.) Is A Global Online Forex And Contracts For Difference (CFD) Broker Headquartered In London, UK. The Company Was Established In 2014 With Its Registered Address In London, UK. ATFX Is Known For Its Comprehensive Trading Products, Advanced Trading Platforms And Rigorous Risk Management System, Providing High-quality Financial Services To Traders Around The World.

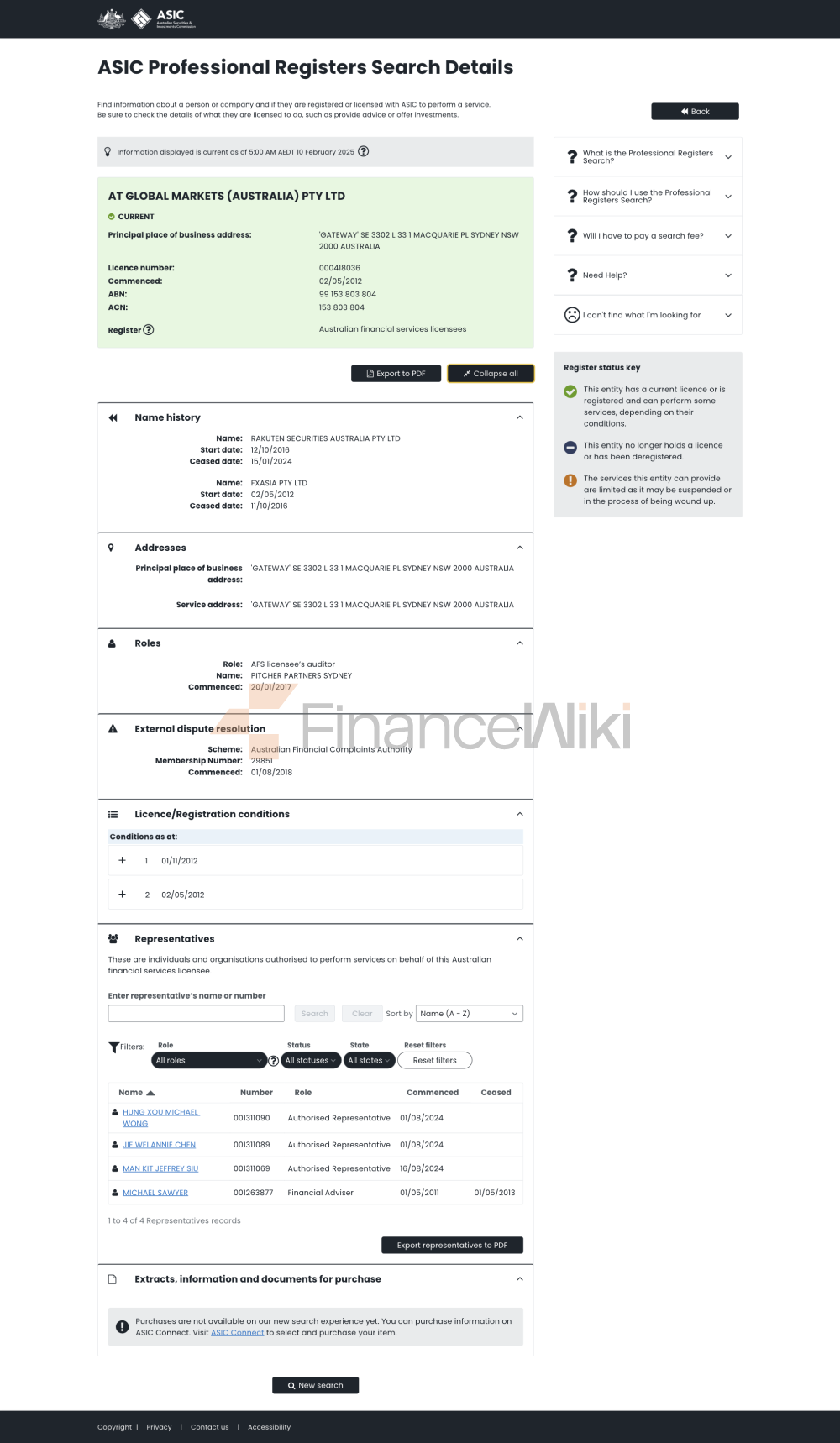

Registered Capital And Regulatory License : ATFX Has A Registered Capital Of £10,000,000 And Holds A License Issued By The Financial Conduct Authority (FCA) (license Number: 760555). In Addition, ATFX Has Obtained A License From The Cyprus Securities And Exchange Commission (CySEC) (license Number: 285/15) And A General Registered Investment Advisory License From The Securities And Commodities Authority (SCA) Of The United Arab Emirates (license Number: 20200000078).

Corporate Structure And Shareholding Structure : ATFX's Management Team Consists Of Experienced Professionals In The Industry. The Company's Shareholding Structure Is Transparent, And The Controlling Shareholder Is AT Global Markets Group. ATFX Is One Of The Important Brands Of The Group, Dedicated To Providing Professional Foreign Exchange And CFD Trading Services To Clients Around The World.

Compliance Statement : ATFX Strictly Complies With The Financial Regulatory Regulations Of The Host Country, Ensuring The Security Of Customer Funds And The Transparency Of Transactions. The Company Is Regularly Audited By Regulatory Authorities And Strictly Enforces Anti-money Laundering (AML) And Counter-terrorism Financing (CFT) Policies.

Regulatory Information

ATFX Is One Of The Regulated Brokers In The World. Its Regulatory Information Is As Follows:

-

Financial Conduct Authority (FCA) : ATFX Holds A License Issued By The FCA (No.: 760555) To Conduct Business Legally In The UK And The European Union. The FCA Is One Of The Strictest Financial Regulators In The World, Ensuring That ATFX Operates In Accordance With High Standards Of Financial Conduct.

-

Cyprus Securities And Exchange Commission (CySEC) : ATFX Also Holds An STP License (No: 285/15) Issued By CySEC, Which Allows It To Provide Foreign Exchange And CFD Trading Services In Cyprus And The European Union Region.

-

United Arab Emirates Securities And Commodities Authority (SCA) : ATFX Has Further Expanded Its Global Reach By Obtaining SCA's General Registered Investment Advisory License (No: 20200000078) In The UAE.

Multiple Regulatory Advantages : ATFX's Multiple Regulatory Qualifications Demonstrate Its Commitment To Compliance Operations While Also Providing A Broader Service Coverage To Clients Worldwide.

Trading Products

ATFX Offers A Wide Range Of Financial Trading Products Covering The Following Major Categories:

-

Forex (Forex) : Offers Trading On Over 40 Currency Pairs, Including Major Currency Pairs (e.g. EUR/USD, GBP/USD, Etc.) And Minor Currency Pairs.

-

Precious Metals : Includes Gold (XAU/USD), Silver (XAG/USD), Platinum (XPT/USD) And Palladium (XPD/USD).

-

Energy : Offers Trading In Energy Products Such As Crude Oil (e.g. WTI And BRENT), Natural Gas, Etc.

-

Indices : Includes Major Global Stock Indices Such As The S & P 500, Dow Jones Industries Average Index (Dow Jones), FTSE 100, Etc.

-

Stocks : Offers More Than 80 Major Stocks, Covering Stocks Of Globally Renowned Companies Such As Apple (AAPL), Google (GOOGL), Microsoft (MSFT), Etc.

Number Of Symbols : ATFX Offers A Total Of More Than 100 Trading Products, Providing Traders With A Wealth Of Choices.

Trading Software

The Core Trading Tool Of ATFX Is MetaTrader 4 (MT4), One Of The Most Popular Foreign Exchange Trading Software In The World. MT4 Supports Desktop, Web And Mobile Versions (iOS And Android), Ensuring That Traders Can Trade At Any Time And Place.

MT4 Features :

- Advanced Charting Tools : Supports Multiple Technical Analysis Indicators Such As RSI, MACD, Bollinger Bands, Etc.

- Intelligent Trading (EAs) : Allows Traders To Use Or Customize Automated Trading Strategies.

- News And Market Reports : Provides Real-time Market News And Analysis To Help Traders Make More Informed Decisions.

- Multilingual Support : MT4 Supports Multiple Languages Including Chinese, English, French, Etc.

VPS Service : ATFX Provides Free VPS (Virtual Private Server) Service For Premium Account Customers To Ensure The Stable Operation Of Trading Strategies.

Deposit And Withdrawal Methods

ATFX Supports A Variety Of Deposit And Withdrawal Methods, Including:

-

Credit/Debit Cards : Visa And Mastercard Are Supported, And The Deposit And Withdrawal Fee Is $0 .

-

Bank Telegraphic Transfer : Traders Can Deposit And Withdraw Funds Through International Bank Telegraphic Transfer, With A Deposit And Withdrawal Fee Of 0 USD And A Processing Time Of 3-5 Business Days .

-

Electronic Wallet : Supports Online Payment Methods Such As Skrill, Neteller And Trustly, With A Deposit And Withdrawal Fee Of 0 USD .

Minimum Deposit Requirement :

- Standard Account: $100

- Edge Account: $5,000

- Premium Account: $10,000

Customer Support

ATFX Offers 24/7 Customer Support In Multiple Languages, Including Chinese. Customers Can Contact ATFX Via:

- Live Chat : 24/7 Live Support.

- Email : Info@atfx.com.

- Telephone : + 44 20 7183 8300 (UK).

Customer Support Languages : ATFX's Customer Support Team Is Able To Provide Services In English, Chinese, French, German, Italian, Portuguese And Spanish.

Core Businesses And Services

ATFX's Core Businesses Include:

- Forex Trading : Provides High Liquidity And Low Spreads In The Foreign Exchange Market.

- CFD Trading : Covers Commodities, Stock Indices, Equities And Energy Markets.

- Precious Metals Trading : Includes Gold And Silver, Traders Can Trade Both Spot And Futures.

Technical Infrastructure : ATFX Uses The Straight Through Processing (STP) Trading Model To Ensure That Trade Orders Are Passed Directly To Liquidity Providers, Avoiding Dealer Intervention. ATFX's Trading Servers Are Located In The World's Most Reliable Data Centers (such As Equinix NY4), Ensuring Transaction Stability And Low Latency.

Compliance And Risk Control System

ATFX's Compliance And Risk Control System Is The Core Of Its Business Operations:

-

AIoT Risk Control System : ATFX Uses A Risk Control System Based On Artificial Intelligence And The Internet Of Things To Monitor Market Fluctuations And Trader Behavior In Real Time To Prevent Market Risks And Operational Risks.

-

Customer Fund Protection : ATFX Keeps Customer Funds Isolated From The Company's Equity Funds To Ensure The Safety Of Customer Funds.

-

Leverage Limits : Depending On Product Type, ATFX Offers Different Leverage Ratios:

- Forex: Up To 50:1

- Precious Metals: Up To 200:1

- Energy: Up To 50:1

- Stock: Up To 20:1

Risk Alert : ATFX Provides Details Before Customers Open An Account Transaction Risk Alerts And Regular Risk Education Materials Are Sent To Clients.

Market Positioning And Competitive Advantage

-

Market Positioning : ATFX Is Positioned For Mid- To High-end Traders Around The World, Providing High-quality Trading Platforms, A Wealth Of Trading Products And Professional Customer Support.

-

Competitive Advantage :

- Multiple Regulatory Qualifications

- Global Trading Products

- Advanced Trading Platform

- High Transparency Operating Model

Future Roadmap

ATFX Plans To Continue To Expand Its Global Presence In The Future, Particularly In Asia And The Middle East. ATFX Also Plans To Further Optimize The Functionality Of Its Trading Platform, Enhance The Trading Experience, And Strengthen Its Social Responsibility And ESG (environmental, Social And Governance) Performance.

Note : All Data In This Article Are Up To The Third Quarter Of 2023 And Do Not Constitute Investment Advice. Traders Should Fully Understand The Relevant Risks And Make Decisions Based On Their Risk Tolerance.

Unable To Withdraw

Unable To Withdraw