Corporate Profile

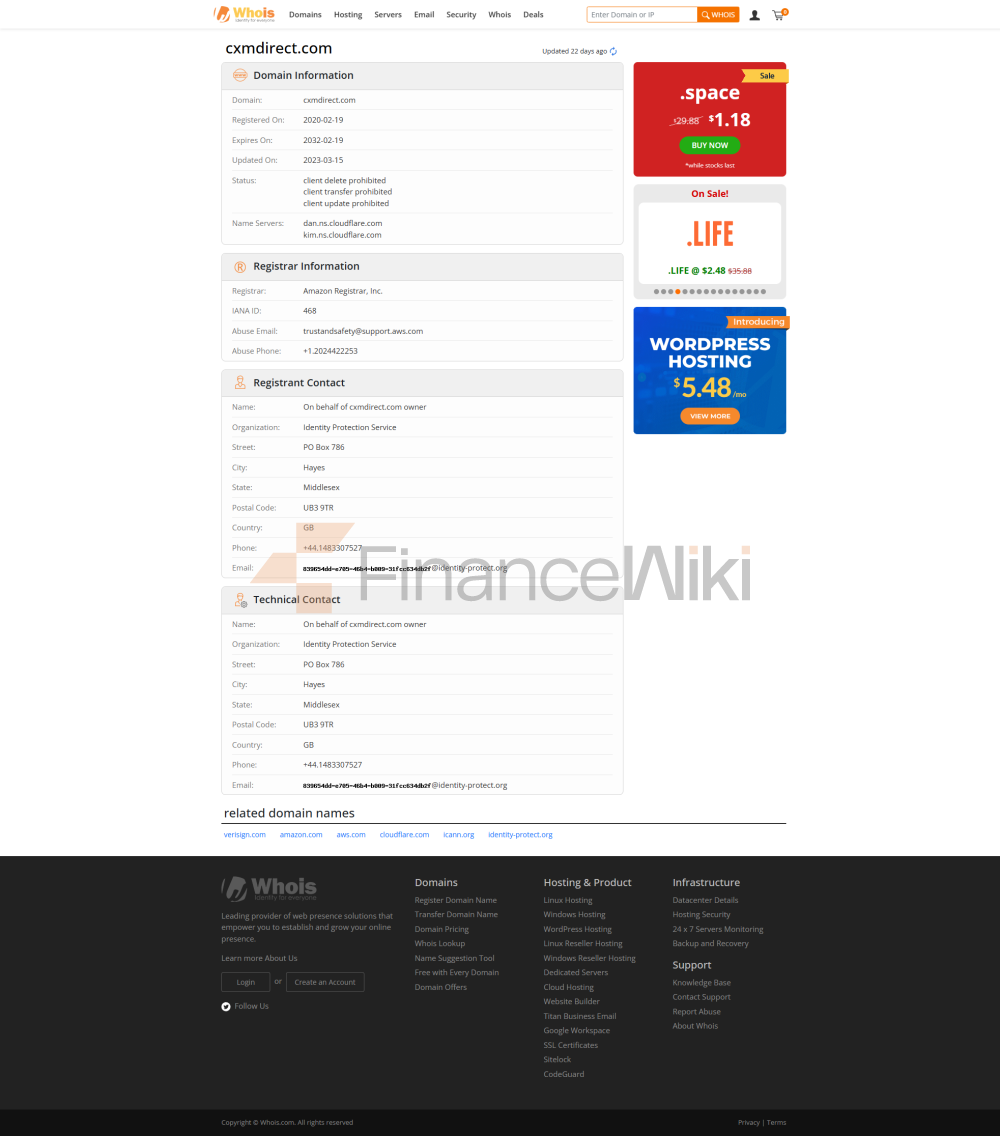

CXM Direct Is A Foreign Exchange Broker Registered In Saint Vincent And The Grenadines, Established On June 23, 2020 And Headquartered In Kingston (Halifax Street, Kingstown VC 0120). The Corporate Entity Is CXM Direct LLC With Registration Number 444. CXM Direct Primarily Provides Financial Trading Services Such As Foreign Exchange, Metals, Indices, Energy And Stocks To Global Traders. It Does Not Provide Services To Residents Of Algeria, Belarus, Canada, China, Cuba, Iran, Myanmar, North Korea, Russia, Sudan, Syria, The United Kingdom And The United States.

Regulatory Information

CXM Direct Is Registered With The Saint Vincent And The Grenadines Financial Services Authority (SVGFSA), But The Agency Does Not Regulate Foreign Exchange Margin Trading, So CXM Direct LLC Is Unregulated. However, CXM Prime Ltd, A UK Registered Subsidiary Of CXM Direct, Is Authorised And Regulated By The UK Financial Conduct Authority (FCA) With License Number 966753 And Authorization Dated December 20, 2022. CXM Prime Ltd Can Only Provide Services To European Institutional Clients And May Not Provide Trading Services To Non-European Retail Clients.

Trading Products

CXM Direct Offers The Following Main Financial Instruments: 1. Currency Pairs: Including EUR/USD, GBP/USD, USD/JPY, Etc., With A Total Of More Than 60 Currency Pairs Available. 2. Indices: Covers Selected Stock Indices Such As UK 100, Germany 30, US 500, Etc. 3. Stocks: Offers Stock Trading Of Large Global Companies Such As Apple, Amazon, Google And Facebook. 4. Commodities: Includes Gold, Silver, Crude Oil And Natural Gas, Etc. 5. Energy: Offers Brent Crude Oil, WTI Crude Oil And Natural Gas, Etc. 6. Metals: Includes Gold, Silver, Platinum And Palladium, Etc.

Trading Software

CXM Direct Provides Customers With Access To The Trading Platforms Of MetaTrader 4 (MT4) And MetaTrader 5 (MT5). Supporting Windows, Android, IOS And MAC Versions, These Platforms Offer Rich Trading Features Including Automated Trading, Customization Of Technical Indicators And The Ability To Trade Directly From Charts. In Addition, CXM Direct Offers PAMM (Percent Allocation Management Module) Services That Allow Traders To Manage Multiple Investor Accounts.

Deposit And Withdrawal Methods

CXM Direct Supports A Variety Of Deposit And Withdrawal Methods, Including: 1. Credit/Debit Card 2. Bank Telegraphic Transfer 3. Electronic Wallet (e.g. Skrill, Neteller) 4. Blockchain Payments (e.g. USDT)

For Verified Customers, Withdrawal Requests Are Usually Processed Within 24 Hours .

Customer Support

CXM Direct Provides A Variety Of Customer Support Methods: 1. Telephone Support: + 44-8085015346 2. Email Support: Support@cxmdirect.com 3. Online Support: Submit A Request Through The "Contact Us" Page Of The Official Website

Core Business And Services

The Core Business Of CXM Direct Includes: 1. Provide A Variety Of Account Types To Meet The Needs Of Different Traders, Including Cents Account, Standard Account, Standard Bonus Account, ECN Account And Islamic Account. 2. Provide High Leverage Trading, And The Maximum Trading Leverage For Some Accounts Is Unlimited. 3. Provide Low Spread Trading, With A Minimum Spread Of 0 Pips. 4. Support EA (Expert Advisor), Scalping And Hedging Trading Functions.

Technical Infrastructure

The Technical Infrastructure Of CXM Direct Includes: 1. Using MetaTrader 4 And 5 Platforms To Provide Efficient Order Execution Speed. 2. Support Multi-spread Trading Mode, The Spread Is Dynamically Adjusted According To Market Volatility. 3. Provide Detailed Market Analysis And Trading Signals To Help Traders Make Informed Decisions.

Compliance And Risk Control System

CXM Direct Strictly Complies With Relevant Laws And Regulations And Ensures Trading Safety Through The Following Measures: 1. Provide No-trader Platform (NDD) Mode To Avoid Conflicts Of Interest. 2. Support Transparent Trading Records And Ensure Traceability Of Transactions. 3. Provide Risk Management Tools Such As Stop Loss And Take Profit Functions. Statement Of Compliance: CXM Direct Holds A UK FCA License (number: 966753), Which Meets The Compliance Requirements Under The European Union MiFID II Framework.

Market Positioning And Competitive Advantage

CXM Direct's Market Positioning And Competitive Advantage Include: 1. Provide Multiple Account Types And Flexible Trading Leverage To Meet Different Trading Needs. 2. Support No-trader Platform Model To Ensure Trading Transparency. 3. Provide Low Spreads And Flexible Commission Structure To Reduce Trading Costs. 4. Support For Multilingual Services Including English, Spanish, Chinese, Arabic, French, Russian And Polish.

Customer Support & Empowering

CXM Direct Provides The Following Support And Empowering Services To Its Clients: 1. Educational Resources: Includes Trading Courses, Webinars And Market Analysis Reports. 2. Virtual Private Server (VPS): Supports Traders To Trade 24/7 Without Interruption. 3. Market Analysis Tools: Provides Real-time Data, Advanced Charts And Technical Indicators.

Social Responsibility & ESG

CXM Direct Fulfills Its Social Responsibility By Focusing On The Following Aspects: 1. Comply With Global Financial Regulatory Regulations And Ensure Safe Trading. 2. Provide A Transparent Trading Environment To Protect The Rights And Interests Of Clients. 3. Help Traders Improve Their Skills Through Education And Market Analysis.

Strategic Cooperation Ecology

CXM Direct Has Established A Close-knit Ecosystem With The Following Partners: 1. Introducing Broker (IB): Allows Partners To Promote Their Services And Receive Commissions. 2. Money Manager: Supports Traders To Manage Multiple Investor Accounts. 3. White Label Solution: Allows Partners To Use Its Brand And Trading Platform.

Financial Health

CXM Direct's Financial Health Includes: 1. Offer A Variety Of Payment Methods To Ensure The Liquidity Of Clients' Funds. 2. Support Highly Leveraged Trading, But Emphasize The Importance Of Risk Management. 3. Enhance Customer Trust Through Transparent Financial Reporting.

Future Roadmap

CXM Direct's Future Roadmap Includes: 1. Expand More Financial Instruments To Meet Customer Needs. 2. Enhance Technical Infrastructure And Optimize Trading Experience. 3. Strengthen Customer Education And Market Analysis Services.