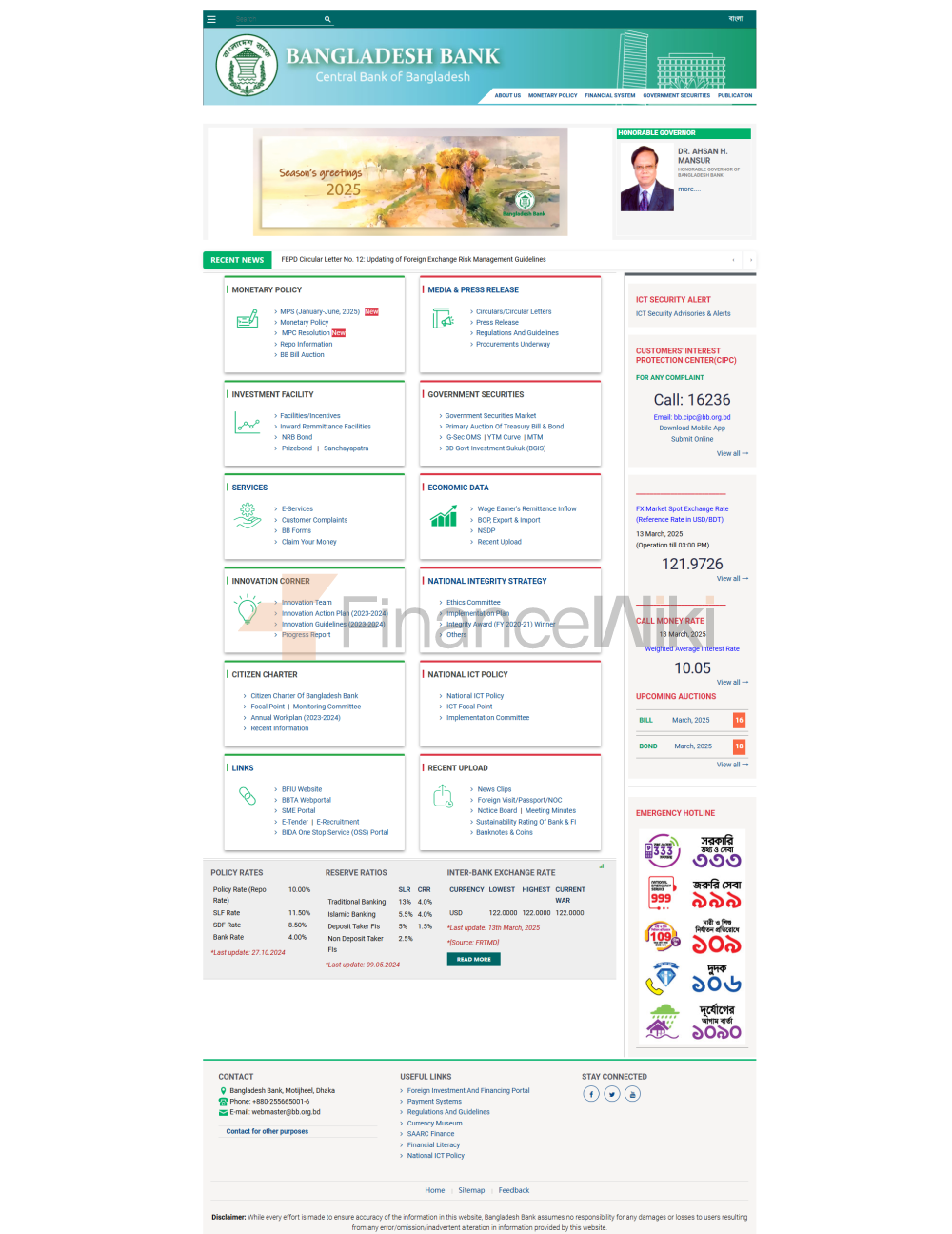

The Bank Of Bangladesh (Bengali :বাংলাদেশ ব্যাংক) Is The Central Bank Of Bangladesh And A Member Of The Asian Clearing Union. It Is Fully Owned By The Government Of Bangladesh.

The Bank Is Active In The Development Of Green Banking. And Financial Inclusion Policies And Is A Key Member Of The Financial Inclusion Coalition. The Bangladesh Financial Intelligence Unit (BFIU) Is A Division Of The Bank Of Bangladesh And Is A Member Of The Egmont Financial Intelligence Unit.

The Bank Of Bangladesh Was The First Central Bank In The World To Launch A Dedicated Hotline (16236) For People To Complain About Any Bank-related Issues. In Addition, The Organization Was The First Central Bank In The World To Issue A "green Banking Policy". In Recognition Of This Contribution, Then Governor Dr. Atiur Rahman Was Awarded The Title Of "Green Governor" At The 2042 United Nations Climate Change Conference Held At The Qatar National Convention Centre In Doha.

History

Main Entry: Banking In Bangladesh, History

On April 7, 1972, Following The Bangladesh Liberation War And Bangladesh's Eventual Independence, The Bangladeshi Government Passed The Bangladesh Bank Order (Post Order No. 127 Of 1972) To Restructure The State Bank Of Pakistan Dhaka Branch Into The Bank Of Bangladesh, The Central Bank Of Bangladesh And The Supreme Regulator Of The Country's Monetary And Financial System.

The Mujib Government Of 1972 Pursued A Pro-socialist Agenda. In 1972, The Government Decided To Nationalize All Banks, Divert Funds To The Public Sector And Prioritize Credit To Those Sectors Seeking To Rebuild The War-torn Country - Mainly Industry And Agriculture. However, The Government's Control Over The Wrong Sectors Prevented These Banks From Functioning Well. The Situation Was Further Complicated By The Fact That Loans Were Granted To The Public Sector Without Commercial Considerations; The Banks Had Poor Capital Leasing, Poor Client Servers And Lacked All Market-based Monetary Instruments. Due To The Fact That Loans Were Issued Without Commercial Considerations (and Took A Long Time To Be Called Non-performing Loans), Under The Old Judicial System, Loan Recovery Costs Were So High That Loan Recovery Was Very Poor. While The Government Emphasized Intervening Everywhere, It Did Not Establish A Proper Regulatory System To Diagnose And Correct These Problems. As A Result, Banking Concepts Such As Profitability And Liquidity Were Foreign To Bank Managers, With Capital Adequacy Taking A Back Seat.

In 1982, The First Reform Program Was Launched, And The Government Denationalized Two Of The Six State-owned Commercial Banks And Allowed Private Local Banks To Compete In The Banking Industry. In 1986, A National Monetary, Banking And Credit Commission Was Appointed To Deal With The Problems Of The Banking Sector, And A Number Of Measures Were Taken For The Recovery Objectives Of The State Commercial Banks And The Development Financial Institutions Group (as Well As The Prohibition Of New Loans For Defaulters). Despite This, The Efficiency Of The Banking Sector Could Not Be Improved.

The Financial Sector Adjustment Credit (FSAC) And Financial Sector Reform Programs (FSRP) Were Established In 1990 Under A Contract With The World Bank. These Programs Were Designed To Eliminate Government Distortions And Reduce Financial Repression. The Policy Made Use Of The McKinnon-Shaw Hypothesis, Which States That Removing Distortions Can Improve The Efficiency Of Credit Markets And Increase Competition. They Involve Banks Providing Loans On A Commercial Basis, Making Banks More Efficient, And Limiting Government Control To Monetary Policy. The FSRP Forces Banks To Have Minimum Capital Adequacy Ratios, Systematically Classify Loans, And Implement Modern Computerized Systems, Including Those That Handle Accounting. It Forces The Central Bank To Liberalize Interest Rates, Amend Financial Laws, And Strengthen Supervision Of Credit Markets. The Government Has Also Developed Capital Markets, But Capital Markets Have Also Performed Poorly.

The FSRP Was Dissolved In 1996. After That, The Bangladesh Government Established The Banking Reform Commission (BRC), Whose Recommendations Were Largely Ignored By The Then Government.

Currently, It Has Ten Offices In Motijheel, Sadarghat, Chittagong, Khulna, Bogra, Rajshahi, Sylhet, Barisal, Rangpur And Mymensingh In Bangladesh; As Of March 31, 2015, The Total Manpower Was 5,807 (3,981 Officers, 1,826 Subordinates)

Branches

- Motijheel

- Sardalgat

- Bogula

- Chattogram

- Rajshahi

- Barisal

- Khulna

- Sylhet

- Langbull

- Maimensin

Functions

The Bank Of Bangladesh Performs All Functions That Are Expected Of A Central Bank In Any Country. These Functions Include Maintaining Price Stability Through Economic And Monetary Policy Measures, Managing The Country's Foreign Exchange And Gold Reserves, And Supervising The Country's Banking Sector. Like All Other Central Banks, Bangladesh Bank Acts As Both A Banker To The Government And A Banker's Bank, Acting As The "lender Of Last Resort". Like Most Other Central Banks, Bangladesh Bank Has A Monopoly On The Issuance Of Money And Banknotes (with The Exception Of One, Two, And Five Taka Notes And Coins, Which Are Under The Responsibility Of The Ministry Of Finance, Government Of Bangladesh). The Main Areas Of Functions Include:

- Formulation And Implementation Of Monetary And Credit Policies.

- Regulation And Supervision Of Banks And Non-bank Financial Institution Groups, Promotion And Development Of Domestic Financial Marekts.

- Management Of The Country's International Reserves.

- Issuance Of Banknotes.

- Supervision And Supervision Of Payment Systems.

- Serves As A Banker For The Government.

- Prevention Of Money Laundering.

- Collection And Provision Of Credit Information.

- Implementation Of The Foreign Exchange Management Act.

- Management Of The Deposit Insurance Scheme.

Organization

The Top Official Of The Bank Is The Governor. His Seat Is In Motijheel, Dhaka. The Governor Serves As The Chairperson Of The Board Of Directors. The Executive Staff Is Also Headed By The Governor And Is Responsible For The Day-to-day Affairs Of The Bank.

Bangladesh Bank Has Several Departments Under It, Namely Debt Management, Legal, Etc. Each Department Is Headed By One Or More General Managers. The Bank Has 10 Physical Branches: Mymensingh, Motijheel, Sadarghat, Barisal, Khulna, Sylhet, Bogra, Rajshahi, Rangpur, And Chittagong; Each Department Is Headed By An Executive Director. The Headquarters Is Located In The Bangladesh Bank Building In Motijheel, Which Has Two General Managers.

Hierarchy

The Administrative Staff Is Responsible For Day-to-day Affairs, Including The Governor And Four Deputy Governors. Under The Governors, There Are Executive Directors And An Economic Advisor.

The Directors Of The Various Departments Belong To The Executive Director And Are Not Part Of The Executive Staff.

The Four Lieutenant Governors Are:

Ahmed Jamal, Qazi Saidur Rahman, AKM Sajedur Rahman Khan And, Abu Farah Md. Nasser

Board Of Directors

The Board Consists Of The Bank Governor And Eight Other Members. They Are Responsible For The Policies Undertaken By The Bank.

Publications

Bangladesh Bank Publishes A Series Of Journal Publications, Research Papers And Reports Containing Monetary And Banking Developments, Economic Reviews And Various Other Statistics. These Include:

- Annual Report

- Bank Of Bangladesh Quarterly Report

- Monetary Policy Review

- Bank's CSR Initiatives

- BBTA Journal: Reflections On Banking And Finance

- Green Banking Annual Report

- Import Payments

- Financial Stability Assessment Report

Governor

Since Its Inception, Bank Of Bangladesh Has Had 13 Governors:

Awards

Bank Of Bangladesh Awards In 2000 Launch Winners Are:

- Lehman Soban (2000)

- Nurul Islam (2009)

- Mosharraf Hussein (2011)

- Muzaffar Ahmed And Swadesh Ranjan Bose (2013)

- Azizur Rahman Khan And Mahbub Hossain (2017)

- Wahiduddin Mahmoud (2020)