General Information

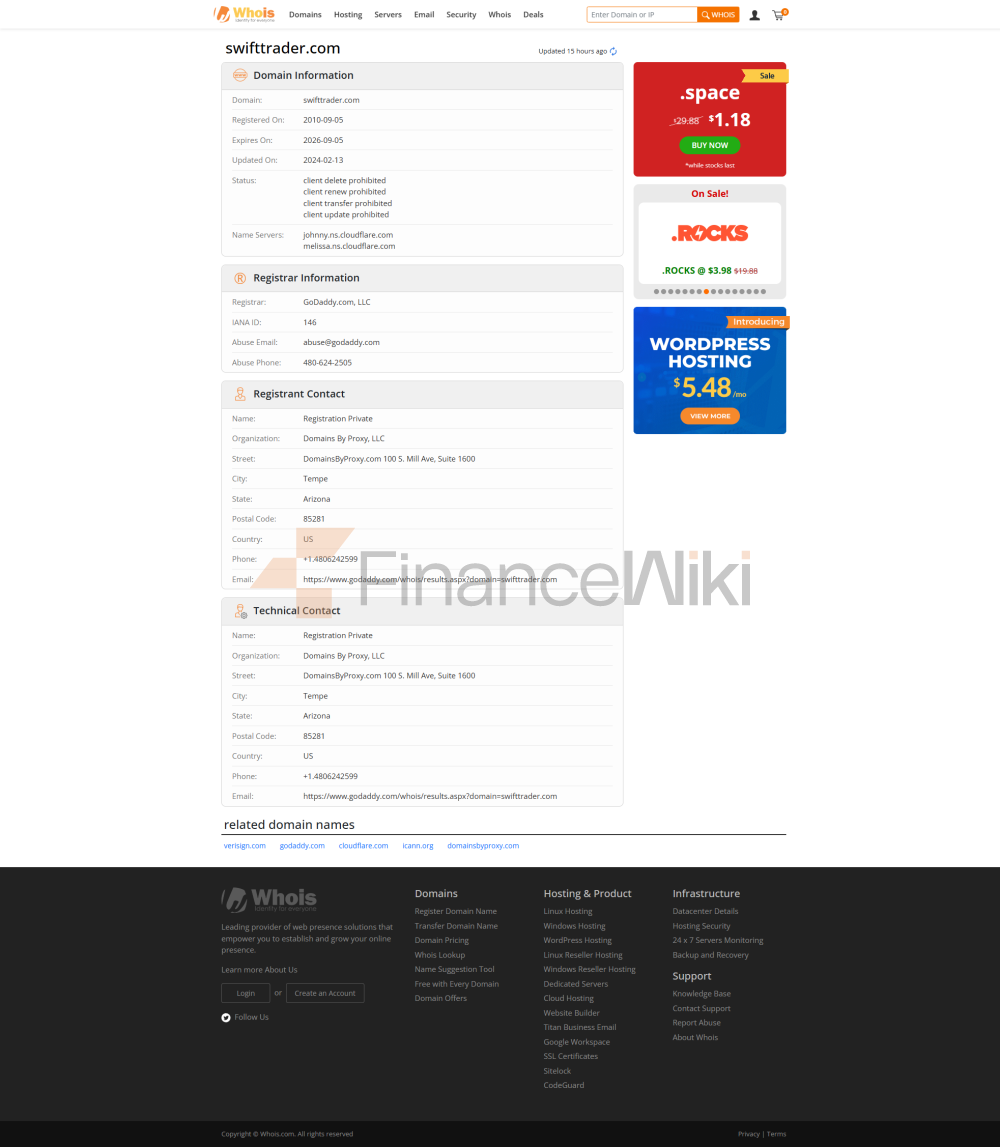

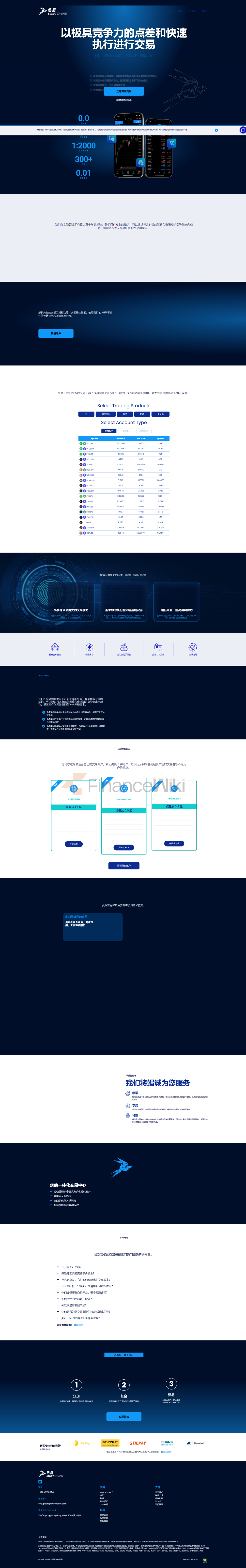

Swift Trader Is A Newly Established Trading Company Based In Comoros. Although Unregulated, It Offers A Wide Range Of Market Instruments Including Forex, Cryptocurrency CFDs, Commodities, Stock Indices And Stock CFDs. Traders Can Choose From A Variety Of Account Types Such As Standard, Mini, Micro, Professional And ECN Depending On Their Different Trading Preferences.

The Minimum Deposit Requirement Is 50 Dollars, Making It Possible For Traders Of Different Funding Levels To Enter The Market. Swift Trader Offers A Maximum Leverage Of 1:1000, Providing Traders With A Wealth Of Trading Opportunities. Traders Can Use The Powerful And Versatile MT5 Trading Platform.

Customer Support Is Available Via Live Chat And Email, Ensuring Help Is Always Available. Deposit And Withdrawal Options Include Credit Cards, Bank Transfers, E-wallets And Crypto Assets, Providing Traders With Flexibility And Convenience.

Pros And Cons

Pros

Broad Range Of Market Tools: Swift Trader Offers Multiple Market Tools Such As Forex, Cryptocurrency CFDs, Commodities, Stock Indices And Stock CFDs, Providing Traders With Full Diversification And Profit Potential.

Diverse Account Types: Offering Multiple Account Types Such As Standard, Mini, Micro, Professional And ECN, Swift Trader Appeals To Traders Of All Levels Of Experience And Risk Appetite, Offering Flexibility And Choice.

Low Minimum Deposit: The Minimum Deposit Requirement Is 50 Dollars, Making Swift Trader Acceptable For Traders With Limited Funds As Well, Allowing Them To Start Trading With A Relatively Small Investment.

High Maximum Leverage: Swift Trader Offers A Maximum Leverage Of 1:1000, Allowing Traders To Amplify Their Trading Positions, Potentially Increasing Profits, But Also With Higher Risk.

Cons:

Offshore Regulation, Higher Latent Risk: This May Expose Traders To Higher Risks, Such As Lack Of Investor Protection And Potential Fraud Or Misconduct.

Limited Company History: As A Company Less Than 1 Year Old, Swift Trader May Lack A Reliable Track Record And Transparency Regarding Its Operations, Which May Be Of Concern.

Limited Deposit And Withdrawal Methods: Swift Trader Offers Limited Deposit And Withdrawal Methods, Including Credit Cards, Bank Transfers, E-wallets, And Crypto Assets, Which May Inconvenience Some Traders Who Prefer More Options Or Faster Transaction Processing.

Market Tools

Swift Trader Offers Forex, Cryptocurrency CFDs, Commodities, Stock Indices And Stock CFDs As Market Tools.

Forex (Forex): Swift Trader Provides Access To Various Currency Pairs On The Forex Market. Traders Can Speculate On Exchange Rate Fluctuations Between Different Currencies Such As EUR/USD, GBP/JPY Or USD/JPY.

Cryptocurrency CFDs: Swift Trader Offers CFD Trading On Various Cryptocurrencies, Allowing Traders To Speculate On The Price Fluctuations Of Digital Assets Such As Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Etc. Without Holding The Underlying Asset.

Commodity Trading: Swift Trader Can Trade Commodities Such As Gold, Silver, Crude Oil, Natural Gas, And Agricultural Products Such As Wheat, Corn, Soybeans, Etc. Traders Can Take Advantage Of The Price Fluctuations Of These Physical Commodities Through CFD Trading.

Stock Indices: Swift Trader Provides Access To Popular Stock Market Indices Around The World, Including The S & P 500, Dow Jones Industries Average Index, Nasdaq Composite Index, FTSE 100, German DAX30, And Nikkei 225. Traders Can Speculate On The Overall Performance Of These Indices.

Stock CFDs: Swift Trader Provides CFDs Trading On Individual Stocks Of Major Companies In The Global Stock Market. Traders Can Trade CFDs On Apple, Google, Amazon, Microsoft, Tesla, Etc. Without Owning The Underlying Stock.

Account Type

Fundiza Offers Multiple Account Types To Meet Different Trading Preferences And Needs: Standard Account, Mini Account, Micro Account, Professional Account, And ECN Account.

Standard Account: This Account Type Offers Bonuses And Allows Traders To Trade All Available Products. It Offers 1000x Leverage And Allows For Swaps. There Are No Specific Commissions For This Account. Traders Can Trade With A Contract Size Of 100,000 And A Minimum Transfer Amount Of $10. The Minimum Volume Is 0.01 Lots And The Maximum Volume Is 100 Lots. Margin Calls And Forced Position Squaring Levels Are Set At 80% And 20% Respectively. Traders Can Place Up To 200 Pending Orders.

Mini Account: Similar To The Standard Account, The Mini Account Also Offers Bonuses, But Only For Forex And Precious Metals Trading Pairs. It Maintains The Same Leverage, Exchange, Commission, Contract Size, Minimum Transfer Amount, Minimum Trading Volume, Maximum Trading Volume, Margin Calls, Forced Position Squaring, And Maximum Number Of Pending Orders As The Standard Account.

Micro Account: The Micro Account Has The Same Model As The Mini Account, But Further Limits The Forex And Precious Metals Trading Pairs. It Also Maintains The Same Leverage, Exchange, Commission, Contract Size, Minimum Transfer Amount, Minimum Trading Volume, Maximum Trading Volume, Margin Calls, Forced Position Squaring, And Maximum Number Of Pending Orders As The Mini Account.

Professional Account: The Professional Account Is Similar To The Standard Account In That It Offers Bonuses And Allows Trading Of All Products. It Offers 1000x Leverage And Allows Swapping. There Is No Specific Commission For This Account. Traders Can Trade With A Contract Size Of 100,000 And A Minimum Transfer Amount Of $10. The Minimum Trading Volume Is 0.01 Lots And The Maximum Trading Volume Is 100 Lots. Margin Calls And Forced Position Squaring Levels Are Set At 80% And 20% Respectively. Traders Can Place Up To 200 Pending Orders.

ECN Account: Unlike Other Accounts, The ECN Account Does Not Offer Bonuses And Allows Traders To Trade All Available Products. It Offers 1000x Leverage And Allows Swapping. There Is No Specific Commission For This Account. Traders Can Trade With A Contract Size Of 100,000 And A Minimum Transfer Amount Of $10. The Minimum Volume Is 0.01 Lots And The Maximum Volume Is 100 Lots. Margin Calls And Forced Position Squaring Levels Are Set At 80% And 20% Respectively. Traders Can Place Up To 200 Pending Orders.

Leverage

With A Leverage Ratio Of 1:1000, Traders Have The Potential To Control Positions That Are 1000 Times Larger Than Their Initial Investment, Which Exposes Them To A Higher Risk Of Market Volatility And Increases The Likelihood Of Margin Calls Or Account Liquidation In The Event Of Adverse Price Fluctuations.

Trading Platform

MT5, Or MetaTrader 5, Is A Powerful And Versatile Trading Platform Provided By Swift Trader. It Provides Traders With A Wide Range Of Features And Tools For Efficient And Effective Trading On Various Financial Marekts. Here Are Some Of The Key Features Of MT5:

MT5 Offers Advanced Charting Features That Allow Traders To Perform In-depth Technical Analysis. It Includes Various Chart Types, Timeframes, And Plotting Tools To Analyze Price Movements And Identify Trading Opportunities.

With MT5, Traders Have Access To A Range Of Financial Instruments, Including Forex Trading, Cryptocurrency CFDs, Commodities, Stock Indices And Stock CFDs. This Provides Traders With A Wealth Of Opportunities To Diversify Their Portfolios And Explore Different Markets.

Deposits And Withdrawals

Swift Trader Offers A Variety Of Deposit And Withdrawal Methods, Including International Bank Telegraphic Transfers, Local Bank Transfers, T Ether And STICPAY, To Meet The Needs Of Customers Worldwide. The Platform Supports Multiple Currencies, Such As USD, JPY And USDT, With Processing Times Ranging From Instant To Days.

Importantly, Swift Trader Ensures That Most Transactions Are Free, Improving The Ease And Accessibility Of Traders Managing Their Funds. Both The Deposit And Withdrawal Processes Are Designed To Be Fast And Secure, With Specific Minimums And Maximums Set For Each Method To Suit Different Trading Needs.

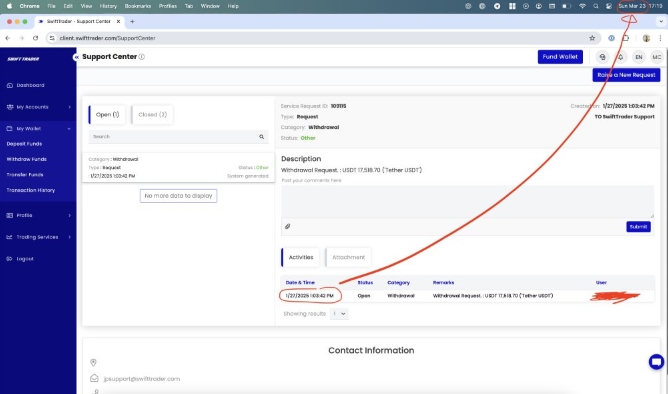

Customer Support

Swift Trader Provides Efficient And Responsive Customer Support Through Two Main Channels: Online Chat And Email.

Online Chat: Swift Trader Provides Online Chat Support Directly On Its Platform, Allowing Traders To Communicate With Customer Support Representatives In Real Time. The Live Chat Feature Gives Traders Instant Access To Help With Accounts, Technical Issues, Trading Issues And Other Issues. Traders Can Initiate An Online Chat Session With A Support Agent Directly From Swift Trader's Website Or Trading Platform, Making It Convenient And Easy To Access.

Email Support: Traders Can Also Contact Swift Trader's Customer Support Team Via Email At Jpsupport@swifttrader.com. Email Support Provides A Convenient Way For Traders To Ask For Help, Submit An Inquiry Or Report A Problem. Traders Can Expect A Prompt Response From The Support Team During Normal Business Hours, And Emails Are Usually Handled Promptly. Email Support Is Available For Non-urgent Inquiries Or Complex Issues That May Require Detailed Explanations Or Documentation.

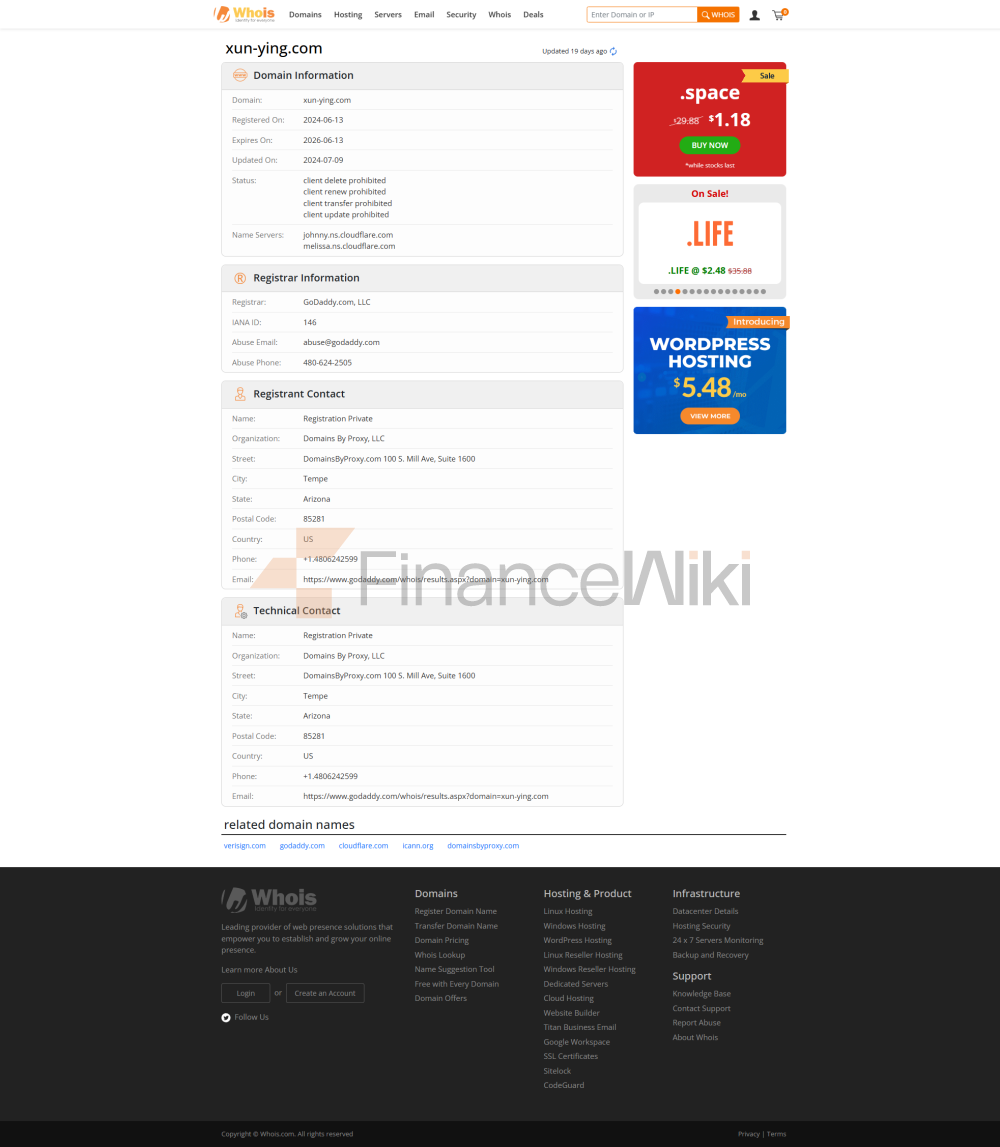

Inducement Fraud

Inducement Fraud