Company Profile

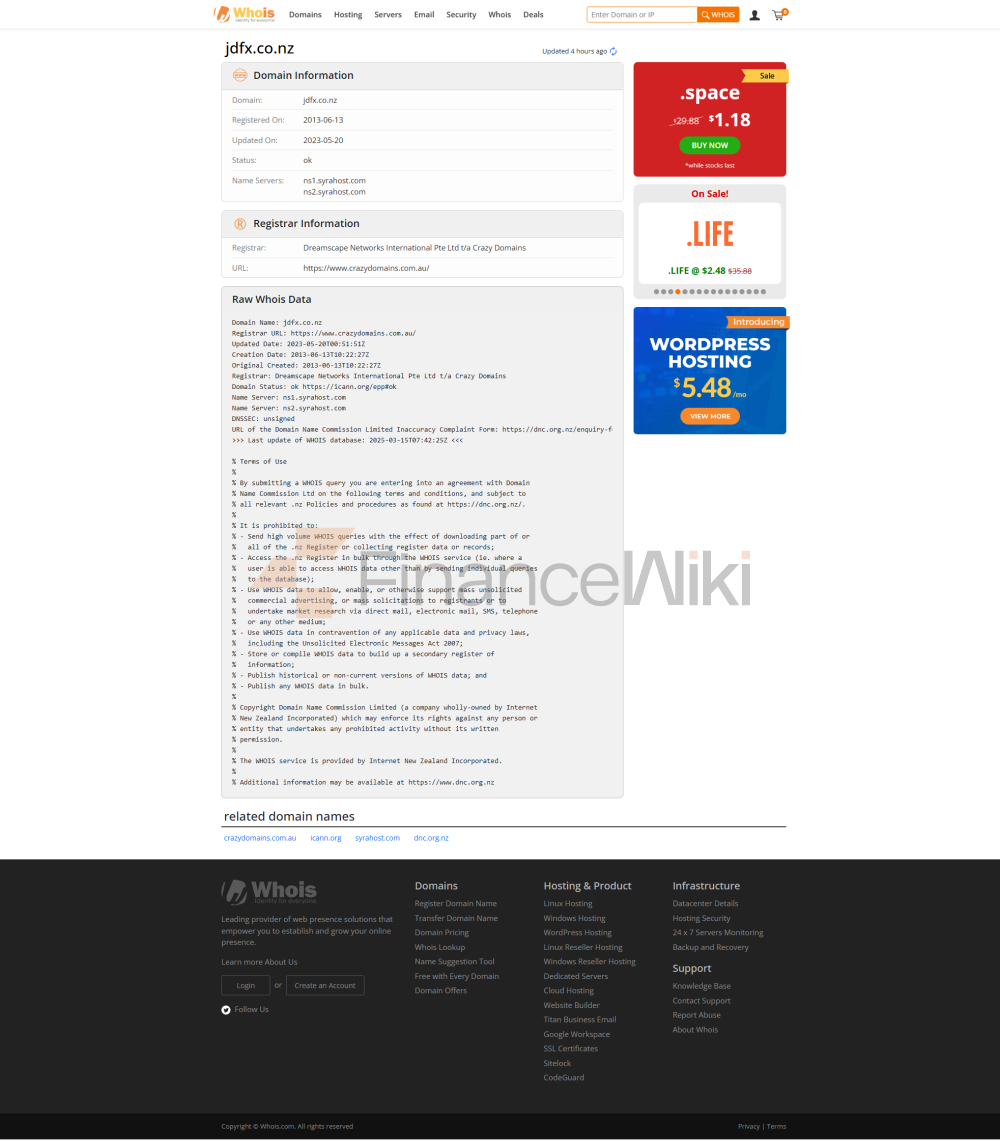

Full Name Of Company : JDFX Established : June 13, 2013 Headquarters Location : New Zealand Registered Capital : NZ $7,500,000

JDFX Is An Online Financial Brokerage Company Headquartered In New Zealand, Established In 2013. With A Registered Capital Of NZ $7,500,000, The Company Is Dedicated To Providing A Diverse Range Of Financial Products And Services To Traders Around The World. JDFX Is Known For Its Competitive Trading Conditions, Transparent Fee Structure And Wide Selection Of Market Instruments. The Company Caters To The Needs Of Different Traders, Both Novice And Experienced Investors, By Offering Multiple Account Types, Flexible Deposit And Withdrawal Methods And An Advanced Trading Platform.

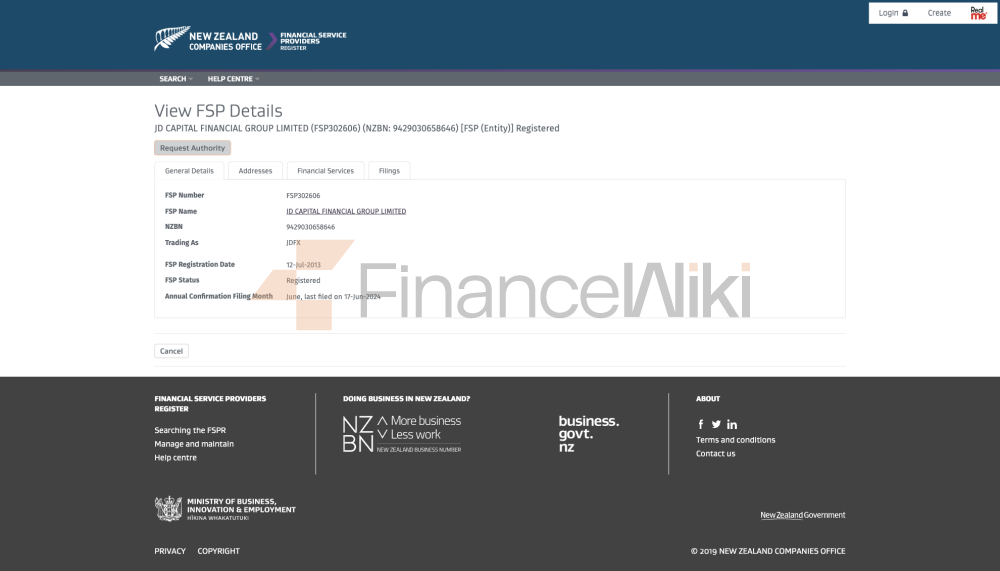

Regulatory Information

Regulatory License : Financial Services Provider Registration (FSPR) 302606 Regulatory Status : Exceeded

JDFX Is Regulated By The New Zealand Financial Marekt Regulator, The Financial Services Provider Registration (FSPR), With License Number 302606. It Is Important To Note That The Regulatory Status Of JDFX Is Marked As "Exceeded", Which May Raise Concerns Among Traders About Its Level Of Regulatory Protection. Despite This, JDFX Adheres To Compliance Standards And Is Designed To Protect The Interests Of Traders.

Trading Products

Tradable Tools : Currency Pairs, Precious Metals, Crude Oil, Indices, Contracts For Difference

JDFX Offers Traders A Comprehensive Range Of Trading Products Covering The Following Markets:

- Currency Pairs : 46 Currency Pairs Are Available, Including Major Currency Pairs And Emerging Currency Pairs.

- Precious Metals : Tradable Gold And Silver, Which Are Important Commodities Influenced By Economic Factors And Geopolitics.

- Crude Oil : Offers Trading In Crude Oil To Help Traders Hedge Against Fluctuations In The Energy Market.

- Indices : Covers Major Global Stock Indices Such As The US Dow Jones Industries Average Index And The UK FTSE 100 Index.

- Contracts For Difference (CFDs) : Offers A Wide Range Of CFDs, Including Commodity And Stock Indices.

These Tools Offer Traders The Flexibility To Build A Diversified Portfolio.

Trading Software

Trading Platform : MetaTrader 4 (MT4) (for PC (Windows), Mobile Devices (iOS/Android))

JDFX Incorporates The MetaTrader 4 (MT4) Platform, Which Is Renowned For Its Reliability, Versatility And Broad Market Coverage. MT4 Supports Multiple Trading Strategies And Offers Advanced Features Such As Automated Trading And Risk Management Tools. JDFX's Trading Platform Is Available For PC And Mobile Devices, Ensuring Traders Can Easily Trade Anytime, Anywhere.

Deposit And Withdrawal Methods

Deposit Methods :

- Local Bank Telegraphic Transfer: 1 Working Day

- International Bank Telegraphic Transfer: 1-2 Working Days, Minimum Deposit Of 100 Dollars, Bank Charges Apply

- Visa/MasterCard: Instant, Minimum Deposit Of 50 Dollars, Free

Withdrawal Methods :

- Local Bank Telegraphic Transfer: 1-2 Working Days

- International Banks Telegraphic Transfer: 3-5 Business Days, Minimum Withdrawal Unlimited, Processing Fee From 35 Dollars

- Visa/MasterCard: 1-2 Business Days, Minimum Withdrawal Of 50 Dollars, Processing Fee 4.5%

JDFX Offers Flexible Deposit And Withdrawal Methods, Ensuring Traders Can Easily Manage Their Funds. For Large Withdrawals, JDFX May Process In Batches To Comply With Bank Regulatory Requirements.

Customer Support

Support Channels :

- Phone: + 64 9 973 2060

- Web Messaging: Direct Sending Via JDFX Website

- Live Chat: Instant Communication Via Chat Feature On Website

- Social Media: Twitter, Facebook (JDCapitalFinancialGroup), Instagram (jdcapitalfx)

- WhatsApp/Telegram: Communication Via The Contact Details Provided

JDFX Offers A Comprehensive Customer Support Service Where Traders Can Access Assistance Through Multiple Channels. However, Some Support Channels May Respond At Different Speeds During Off-peak Hours, And Traders Need To Be Prepared In Advance.

Core Business & Services

Account Type :

-

Gold Account :

- Minimum Deposit: 0 Dollars

- Spread: From 0.0

- Maximum Leverage: 1:400

- Commission Per Lot: 10 Dollars

-

Diamond Account :

- Minimum Deposit: 500 Dollars

- Spread: From 0.0

- Maximum Leverage: 1:400

- Commission Per Lot: 7 Dollars

-

Platinum Account :

- Minimum Deposit: $100,000

- Spread: From 0.0

- Maximum Leverage: 1:100

- Commission Per Lot: $4

JDFX Account Types Are Designed To Meet The Needs Of Different Traders. Gold Accounts Are Suitable For Novice Traders, Diamond Accounts Are Suitable For Medium Investors, While Platinum Accounts Are Designed For High Net Worth Traders And Institutional Investors.

Technical Infrastructure

Platform Features :

- Live Market Data

- Efficient Trade Execution

- Support For Automated Trading (EA System)

JDFX's MT4 Platform Is Equipped With An Advanced Technical Infrastructure That Ensures Traders Can Access Market Data In Real Time And Execute Trades Efficiently. The Platform Also Supports Automated Trading (EA System), Providing More Flexibility For Advanced Traders.

Compliance And Risk Control System

Compliance Statement : JDFX Strictly Complies With Regulatory Regulations And Protects The Interests Of Traders. Risk Management System :

- Stop Loss Protection : Uniformly Set The Stop Loss Level Of 50% To Ensure That Traders' Risks Are Controllable.

- Leverage Control : The Maximum Leverage Is 1:400, Which Is Suitable For Gold And Diamond Accounts, And The Leverage For Platinum Accounts Is 1:100.

JDFX Ensures The Safety Of Traders' Funds Through Strict Risk Control Measures. Despite This, Traders Still Need To Use Leverage Cautiously To Avoid Potential High Risks.

Market Positioning And Competitive Advantage

Competitive Advantage :

- Competitive Spreads: From 0.0 Onwards, Trading Costs Are Low.

- Diversified Trading Tools: Covering A Variety Of Asset Classes To Meet The Investment Needs Of Different Traders.

- Flexible Leverage Ratio: Up To 1:400, Providing Traders With Enhanced Purchasing Power.

- Demo Account Available: Allows Newbies To Practice Strategies In A Risk-free Environment.

Disadvantages :

- Regulatory Status Is Marked As "exceeded", Which May Affect Traders' Trust.

- The Minimum Deposit Requirement For Platinum Accounts Is Higher At $100,000, Limiting Access For Some Traders.

- Base Currency Options Are Limited, And Some Accounts Only Support USD And NZD.

Despite Certain Disadvantages, JDFX Still Attracts A Large Number Of Traders With Its Diverse Trading Tools And Flexible Trading Conditions.

Social Responsibility And ESG

JDFX Has Not Disclosed Its Specific Initiatives In Social Responsibility And ESG (environmental, Social, Governance). However, As A Regulated Financial Institution Group, JDFX Has A Responsibility To Comply With Relevant Laws And Regulations To Ensure The Sustainability And Transparency Of Its Business.

Strategic Cooperation Ecology

JDFX Has Not Disclosed Its Specific Strategic Cooperation Ecosystem Information. However, As An Online Financial Brokerage Company, JDFX May Have Partnerships With Multiple Technology Platforms, Payment Service Providers, And Other Financial Institution Groups To Support The Operation And Growth Of Its Business.

Financial Health

JDFX Has Not Yet Made Public Its Detailed Financial Data. However, Its Registered Capital Is NZ $7,500,000, Indicating The Robustness Of Its Financial Foundation. In Addition, JDFX Has Received Funding Support Through Multiple Rounds Of Financing, Showing Investors' Confidence In Its Business.

Future Roadmap

JDFX Has Not Yet Made Public The Details Of Its Future Roadmap. However, As An Online Financial Brokerage, JDFX May Continue To Expand Its Trading Products And Market Coverage, Optimize Its Technology Infrastructure, And Enhance Its Customer Support Services To Meet Changing Market Demands.

Through The Above Introduction, JDFX Presents The Image Of An Online Financial Brokerage Company That Offers A Wide Range Of Trading Tools And Flexible Trading Conditions. Despite Certain Disadvantages, Its Competitive Advantages And Compliance Still Attract A Large Number Of Traders. Traders Need To Consider Its Regulatory Status, Trading Conditions And Support Services When Choosing JDFX.