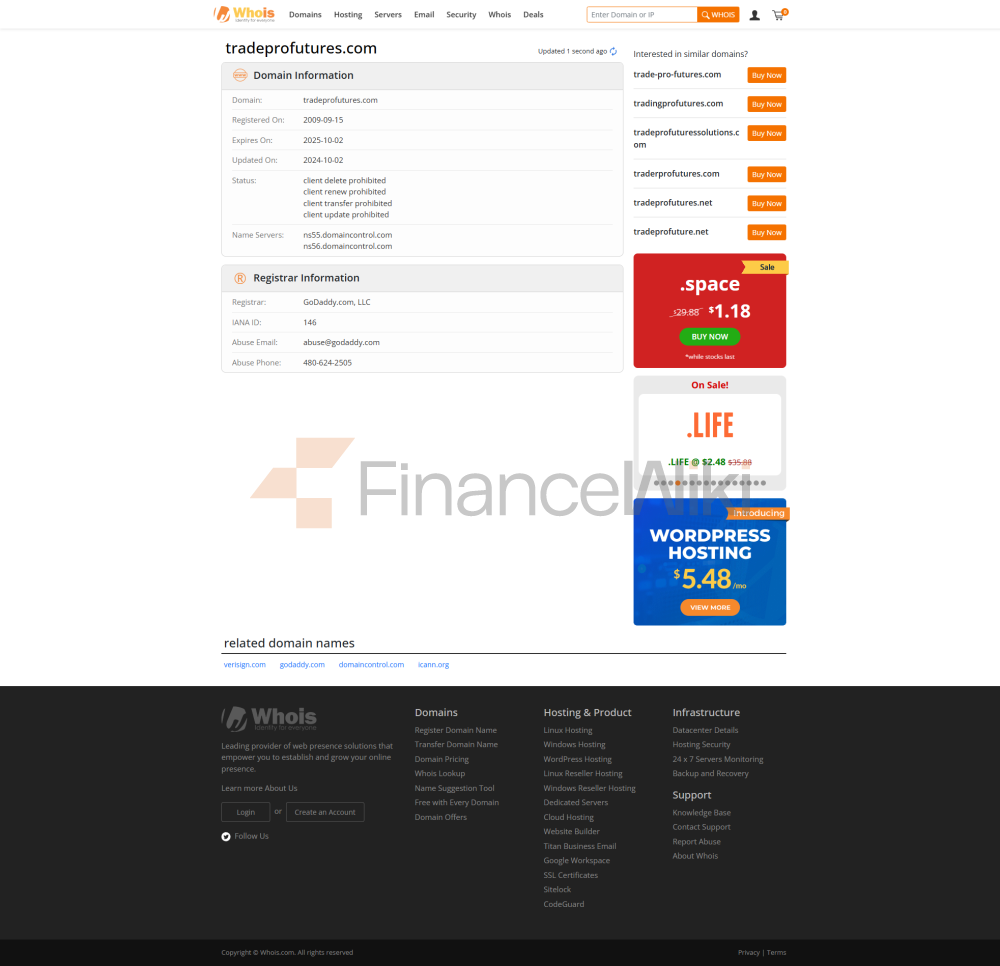

After Verification: TradeProFutures Company Domain Name Was Registered In 2009 And Is A Forex Broker. The Company Is Currently Unregulated. Please Be Aware Of The Risks In Case The Funds Are Damaged.

Note: TradeProFutures As A, Unregulated Broker, Which Means That The Client's Investment May Not Be Adequately Protected. Due To The Lack Of A Regulator To Hold The Company Accountable, The Lack Of Supervision Increases The Risk Of Potential Financial Losses.

If You Invest In An Unregulated Broker, There Is A High Chance That They Will Run Away With Your Hard-earned Money Without Any Recourse. Therefore, Investors Must Be Extremely Cautious And Remind Everyone To Stay Away From These Unregulated As Much As Possible When Choosing A Broker.

According To The Company's Official Website:

TradeProFutures Is A Forex Broker. Trade Pro Futures Offers The Top Platform For Trading Forex On MT4 And Trade Pro Trinity. TradeProFutures.com Offers A Variety Of Forex Currency Pairs, Options And Futures For Individual Investment And Trading Options.

Futures Spread Trading

The Company Claims That Their Platform And Connected Third-party Platforms Can Identify When Futures Contracts Are Part Of The Spread, Thus Providing Lower Margins. This Is Primarily Based On CME SPAN Margin And Is Not Limited To Exchange-traded Spreads. Their Margin Calculator Can Be Used To Enter Each Leg Of The Spread And Its Ratio To Estimate Margin Requirements Before Execution.

Futures Options

Many Of The Same Strategies Used To Trade Stock Options Can Be Applied To Futures Options. They Claim To Be Allowing Clients To Create User-defined Spreads On Exchanges So That Clients Can Enter The Entire Spread Using The Spread Price And Reduce Or Eliminate The Risk Of All Parts Of The Trade Going Unfilled. They Claim To Also Offer More Advanced Options Trading Platforms That Offer Features Like Risk Analysis Modeling And RFQ Or Quote Requests.

API Trading

Create Your Own Custom App! Direct Access To The Low Latency, Accuracy, And Reliability Of Their Trading Network. This Powerful Interface Allows You To Create Applications That React To Your Custom Market Triggers, Execute Trades Based On Algorithms, Create Custom Trading Platforms, Execute Black Box Models, Manipulate Back-office Data, And Much More. They Also Claim To Offer Third-party APIs From Industry-leading Software Vendors Such As Rithmic, CQG, Trading Technologies, And CTS.

Multiple Exchanges

They Claim To Have Access To Futures And Futures Options On CME, CBOT, NYMEX, COMEX, ICE, Small, And EUREX Exchanges.

Lower Intraday Margin

The Company Claims To Offer The Lowest Margin In The Industry, Including $750 Intraday Margin On ES, NQ And YM.

Low Fees

The Company Claims That Their Rates Include All Exchange And NFA Fees. And Claims To Do Their Best To Remain As Competitive As Possible Without Sacrificing Service And Support.

Forex Account

Minimum Account Requirement Is $2,500, Using MT4 Trading Software.

Futures Account

Minimum Account Requirement Is $5,000, Using MT5 Trading Software.

Forex

Low-cost Trading: No Clearing Fees, Exchange Fees, Government Fees, Brokerage Fees, Or Commissions. Brokers Are Compensated For Their Services Through Bid-ask Spreads (under Normal Market Conditions, Bid-ask Spreads May Be Less Than 0.1%, Depending On Leverage).

Leverage: In Forex Trading, A Small Margin Can Control A Larger Total Contract Value (leverage Up To 100:1). This High Leverage Can Lead To Both Large Losses And Large Gains, So Proper Risk Management Is Required.

Liquid: The Forex Market Is Huge (daily Trading Volume Exceeds $3 Trillion) And Extremely Liquid. Under Normal Market Conditions, Traders Can Buy And Sell Instantly Without Being "blocked" In Their Trades.

Traders Can Even Set Up Online Trading Platforms That Automatically Position Squaring (limit Orders) When The Expected Profit Level Is Reached, And/or Position Squaring (stop-loss Orders) When The Trade Is In Opposition To This Position.

Free Demo Accounts, News, Charts And Analysis For Traders: Traders Can Start Trading With Just A Computer And Internet Connection. Traders Can Use A Free Demo Account For Trading Practice And Access Real-time Forex News, Analysis And Charting Services.

Trading Forex 24 Hours A Day, 5.5 Days A Week, The Company's Platform Claims To Provide Access To The Forex Market From Sunday Evening To Friday Afternoon.

Extended Trading Hours Provide Traders With Great Flexibility, Allowing Clients To Trade On Their Own Schedule. Technical Support Is Also Available During Trading Hours.