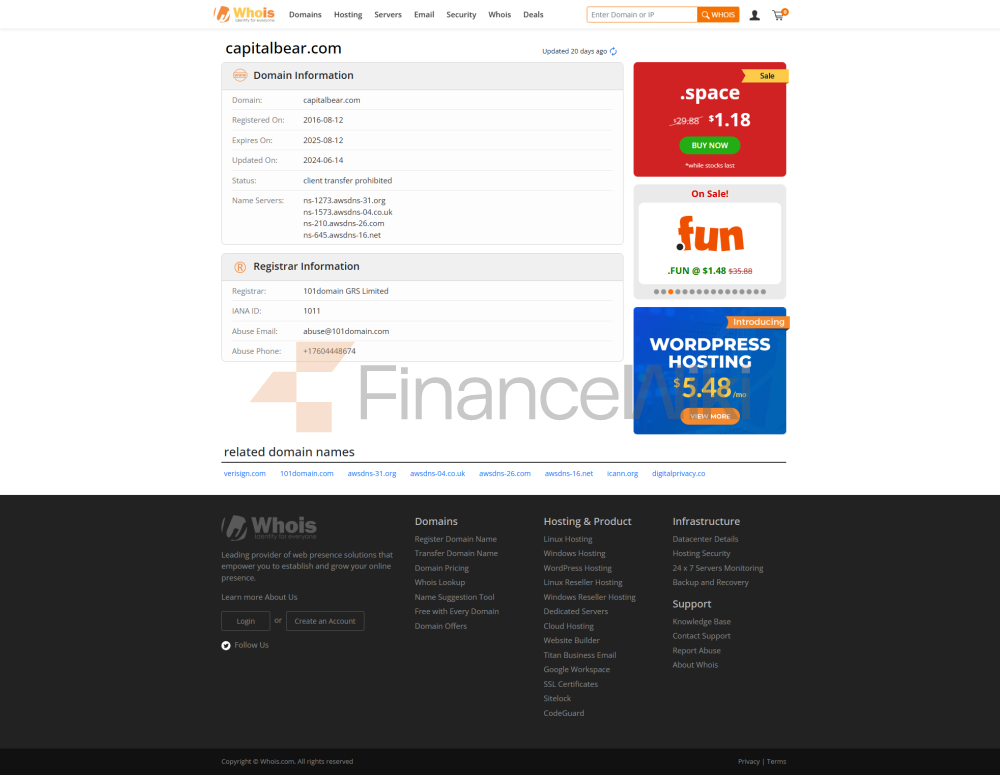

After Detailed Inquiry: CapitalBear Was Registered On August 12, 2016. The Company Does Not Have Any Effective Supervision For The Time Being. Users Should Consider And Pay Attention To Risks When Making Decisions About Platform Trading On A Platform That Lacks The Supervision Of Financial Regulators.

According To The Company's Official Website, They Claim To Be A Foreign Exchange Broker Registered In Saint Vincent And The Grenadines. They Provide Their Clients With A Variety Of Tradable Financial Instruments On Their Web And Mobile App-based Trading Platforms, And Claim To Have A History Of 2-5 Years. They Provide A Variety Of Market Instruments Including Foreign Exchange, Stocks, Cryptocurrencies, Commodities And ETFs. Traders Can Access The Platform Through Web Trading Or The Capital Bear Mobile App. One Of The Distinguishing Features Of Capital Bear Is Its Low, Minimum Deposit Requirement Of As Little As $10, Which Makes It Accessible To Traders Of All Budgets. The Platform Offers Both Demo And Real Accounts, Allowing Users To Practice Their Trading Strategies Before Committing Real Money. Fees On The Platform Include Commission Fees, Idle Fees, And Withdrawal Fees. Capital Bear Accepts Verification Cards, MasterCard, And Visa As Deposit And Withdrawal Methods. Customer Support Is Available Via Phone, Email, And Various Social Media Channels Such As Facebook, Telegram, Instagram, And Twitter. However, There Is No Specific Information On Educational Resources, FAQs, Or Maximum Leverage Offered By The Platform.

Advantages And Disadvantages

Capital Bear Is A Trading Platform That Offers A Wealth Of Trading Tools And A Variety Of Payment Methods, Making It Convenient For Users To Trade. The Platform Ensures Quick Execution Of Orders, Enabling Users To Take Advantage Of Market Opportunities Quickly. It Also Offers Quick Withdrawals, Ensuring Efficient Access To Funds. In Addition, Capital Bear Has A Low Minimum Deposit Of Only $10, Making It Available To A Wide Range Of Traders. The Platform Offers A Demo Account That Allows Users To Practice Trading Strategies Without Risking Real Money.

However, There Are Some Disadvantages To Consider. Capital Bear Does Not Offer MT4 Or MT5, Which May Be The First Choice For Some Traders. It Lacks Specific Regulation, Which May Raise Concerns About The Platform's Transparency And Accountability. There Is No Available Information On Spreads, Which May Make It Difficult For Users To Accurately Assess Trading Costs. The Platform Also Lacks A Comprehensive FAQ Section, Which May Leave Users With Unanswered Questions Or Uncertainty.

Disadvantages

Capital Bear Does Not Offer MT4 Or MT5, Which May Be The First Choice For Some Traders. Its Lack Of Specific Regulation May Raise Concerns About Transparency And Accountability Of The Platform. There Is No Available Information On Spreads, Which May Make It Difficult For Users To Accurately Evaluate Transaction Costs. The Platform Also Lacks A Comprehensive FAQ Section, Which May Leave Users With Unanswered Questions Or Uncertainties. Multiple Payment Methods, No Specific Regulations, Fast Order Execution, And No 24/7 Customer Support.

Services

CapitalBear Advertises That It Offers A Wide Range Of Trading Tools In Financial Marekt, Including Stocks, Forex, Cryptocurrencies, Commodities, And ETFs.

Stocks

Traders Can Find Stocks Of Leading Companies On This Trading Platform. Therefore, Traders Can Enjoy Trading Stocks Of Their Favorite Companies. It Has 200 Stocks To Trade On The Platform.

Forex

Forex Is Another Asset That Traders Can Easily Trade On Capital Bear. Traders Can Find Leading Forex Through This Broker. It Includes USD, JPY, Etc. Traders Can Also Trade Their Favorite Forex Pairs On Capital Bear. It Offers Up To 23 Types Of Forex Trading.

Cryptocurrency

Cryptocurrency Is Very Famous Among Traders Because Of Its Potential To Enable Traders To Earn High Profits. Capital Bear Offers Leading Cryptocurrencies. Traders Can Buy, Hold And Sell Top Cryptocurrencies Such As Bitcoin, Litecoin. It Offers Nearly 39 Cryptocurrencies For Trading.

Commodities

The Broker Offers Traders 4 Commodities For Trading. These Include Silver, Gold, Brent Crude Oil And WTI. Traders Can Place Bets On Such Commodities Using Online Trading Platforms.

ETFs

Capital Bear Stands Out From Other Brokers Because It Offers Traders High ETF Products. Traders Have Access To Nearly 25 ETFs For Online Trading.

Trading Fees

Capital Bear Charges Traders The Following:

Spreads: Traders Who Trade Forex Must Bear The Spread Of Capital Bear. The Broker Offers Competitive Spreads Based On Market Conditions. Underlying Liquidity And Volatility Are Some Of The Factors That Capital Bear Takes Into Account When Determining The Spread.

Swap Fee: Some Traders Hold Positions Overnight On The Trading Platform. In This Case, Capital Bear Charges A Swap Fee. It Is Also Known As An Overnight Fee. Traders Have To Pay A Swap Fee Of 0.1% -0.5%.

Idle Fee: For Trading Accounts That Are Dormant For 90 Days, The Broker Charges An Idle Fee. Capital Bear Charges An Idle Fee Of €10. If Traders Wish To Avoid Such Fees When Trading On Capital Bear, They Must Trade Continuously.

Account Type

CapitalBear Claims To Offer Both Demo And Real Accounts, However The Company Does Not Mention Minimum Initial Deposit Requirements.

Deposit Procedure

1. To Make A Deposit, The Customer Should Make An Inquiry From Their Profile. To Complete The Inquiry, The Customer Should Select Any Payment Method From The List, Fill In All Required Details And Go To The Payment Page.

2. The Processing Time Of The Inquiry Depends On The Selected Payment Method And May Vary From One Method To The Other. In The Case Of The Use Of Electronic Payment Methods, The Transaction Time May Vary From A Few Seconds To A Few Days.

If Direct Bank Telegraphic Transfer Is Used, The Transaction Time Can Be Up To 45 Working Days. The Customer Has The Right To Withdraw The Funds Only To The Payment System Used To Deposit The Funds Into His Account. If It Is Not Technically Possible To Withdraw The Funds To The Payment System Used To Deposit The Funds, An Alternative Payment Method Shall Be Selected And The Payment Details Shall Be In Accordance With The Conditions Specified By The Customer In His Personal Information.

Customer Support

Telephone Contact: + 442036565402

Email: Support @capitalbear.com.

You Can Also Follow Social Networks Such As Twitter, Facebook, Instagram And Telegram.

Company Address: Lighthouse Trust Nevis Ltd, Suite 1, AL Evelyn Ltd Building, Main Street, Charlestown, Nevis