Corporate Overview

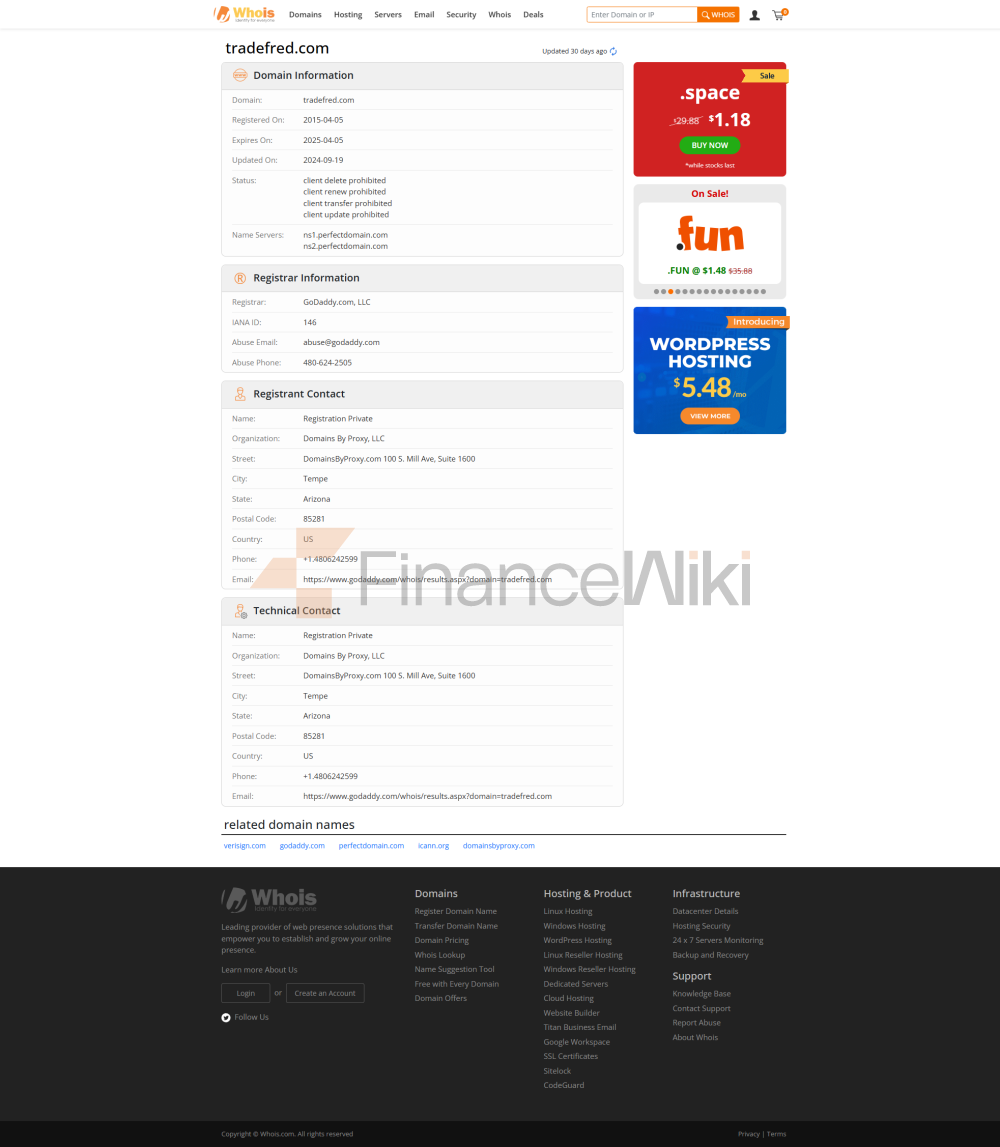

TradeFred Is A Financial Services Company Headquartered In Australia, Registered As BrightFX Capital Pty Ltd , Providing Trading Services For Financial Products Such As Foreign Exchange, Contracts For Difference (CFDs). The Company Opens Its Services To Customers Worldwide Through Its Official Website Https://www.tradefred.com.au , But The Website Is Currently Inaccessible. TradeFred Offers A Variety Of Trading Account Types, Including Standard Account, VIP Account And Islamic No Exchange Fee Account , And Supports 1:50 Leverage .

Regulatory Information

There Are Major Issues With The Regulatory Status Of TradeFred:

- ASIC (Australian Securities And Investments Commission) : TradeFred Does Not Have A Valid License From ASIC. Its License Number 001258580 Indicates That It Is Only Registered As A Designated Representative (AR) And Not A Licensed Financial Services Provider.

- CySEC (Cyprus Securities And Exchange Commission) : TradeFred Has Been Found To Be Using A Suspicious Clone License , Number 342/17 , Which Is Actually Owned By I.F. Greenfields Wealth Ltd .

- Australian Law Requires : Financial Services Companies Operating In Australia Must Hold An AFSL (Australian Financial Services Licence) License Issued By ASIC. TradeFred Has Not Obtained This License, So Does Not Have Legal Qualifications .

Trading Products

TradeFred Offers The Following Financial Products:

- Forex (Forex) : Support Includes Major Currency Pairs Such As EUR/USD, GBP/USD, USD/JPY .

- Contracts For Difference (CFD) : Covers Stocks, Commodities (such As Gold, Crude Oil), Indices And Other Asset Classes.

- Spreads : Spreads Range From 2.0 Pips To 3.0 Pips Depending On Account Type (for Example, The Standard Account Spread Is 2.0 Pips And The Basic Account Is 3.0 Pips ).

Trading Software

TradeFred Offers The Following Trading Platforms:

- MetaTrader 4 (MT4) : Supports Desktop, Web And Mobile Devices, Suitable For Technical Analysis And Automated Trading.

- Web-based Trading Platform : Provides An Intuitive Graphical Interface Suitable For Both Novice And Beginner Traders.

Deposit And Withdrawal Methods

TradeFred Supports The Following Deposit And Withdrawal Methods:

- Bank Transfer Credit/Debit Card

- Transfer Between Brokers

- WebMoney

- Qiwi

Customer Support

TradeFred Provides The Following Customer Support Method:

- Phone Support :

- Australia: + 61-280734453

- UK: + 44-1613942198

- Email Support :

- Support@tradefred.com.au

- Info@brightfxcapital.com

Core Business And Services

TradeFred's Core Business Includes The Following:

- Forex Trading Services : Provides Real-time Exchange Rates And Quotes To Support Trading Of Multiple Currency Pairs.

- CFD Trading : Covers Asset Classes Such As Stocks, Commodities And Indices, And Supports Long And Short Two-way Operations.

- Islamic Account : Provides Trading Services For Muslim Clients With No Interest Exchange.

Technical Infrastructure

TradeFred Uses MetaTrader 4 (MT4) And Web-based Trading Software As Its Technical Infrastructure. MT4 Is A Widely Used Trading Platform That Supports A Variety Of Technical Analysis Tools And Custom Indicators. In Addition, TradeFred Offers A Web-based Platform Suitable For Clients Who Wish To Trade On Mobile Devices.

Compliance And Risk Control System

There Are Significant Problems With TradeFred's Compliance And Risk Control System:

- Compliance : TradeFred Does Not Have An AFSL License From ASIC And Its CySEC License Has Been Proven To Be A Suspect Clone, So It Does Not Have Legal Qualifications.

- Risk Management : TradeFred Offers 1:50 Leverage , But Its Risk Management Capabilities Are At Risk In The Absence Of Effective Supervision.

Market Positioning And Competitive Advantage

TradeFred's Market Positioning Has The Following Problems:

- Lack Of Transparency : Its Official Website Cannot Be Accessed Normally And Does Not Provide Detailed Company Background And Qualification Information.

- No Regulation : TradeFred Has Not Obtained Any Valid Regulatory License And Cannot Guarantee The Safety Of Customer Funds.

- Competitive Disadvantage : TradeFred Is At A Significant Disadvantage In Terms Of Compliance, Transparency And Customer Protection Compared To Legally Regulated Brokers.

Customer Support And Empowerment

TradeFred Provides Basic Customer Support, Including Phone And Email Services. However, The Availability And Responsiveness Of Its Customer Support Channels Have Not Been Verified.

Social Responsibility And ESG

TradeFred Has Not Disclosed Any Social Responsibility Or ESG Related Information.

Strategic Cooperation Ecosystem

TradeFred Has Not Disclosed Any Significant Strategic Cooperation Information.

Financial Health

The Financial Health Of TradeFred Is Not Yet Clear. Due To Its Lack Of Any Regulatory Licenses, There Are Significant Risks To Its Capital Flow And Operational Transparency.

Future Roadmap

TradeFred Has Not Yet Announced A Clear Future Roadmap.

Important Notice : There Are Significant Doubts About The Legality And Compliance Of TradeFred, And Investors Are Advised To Choose A Regulated Financial Service Provider.