Corporate Profile

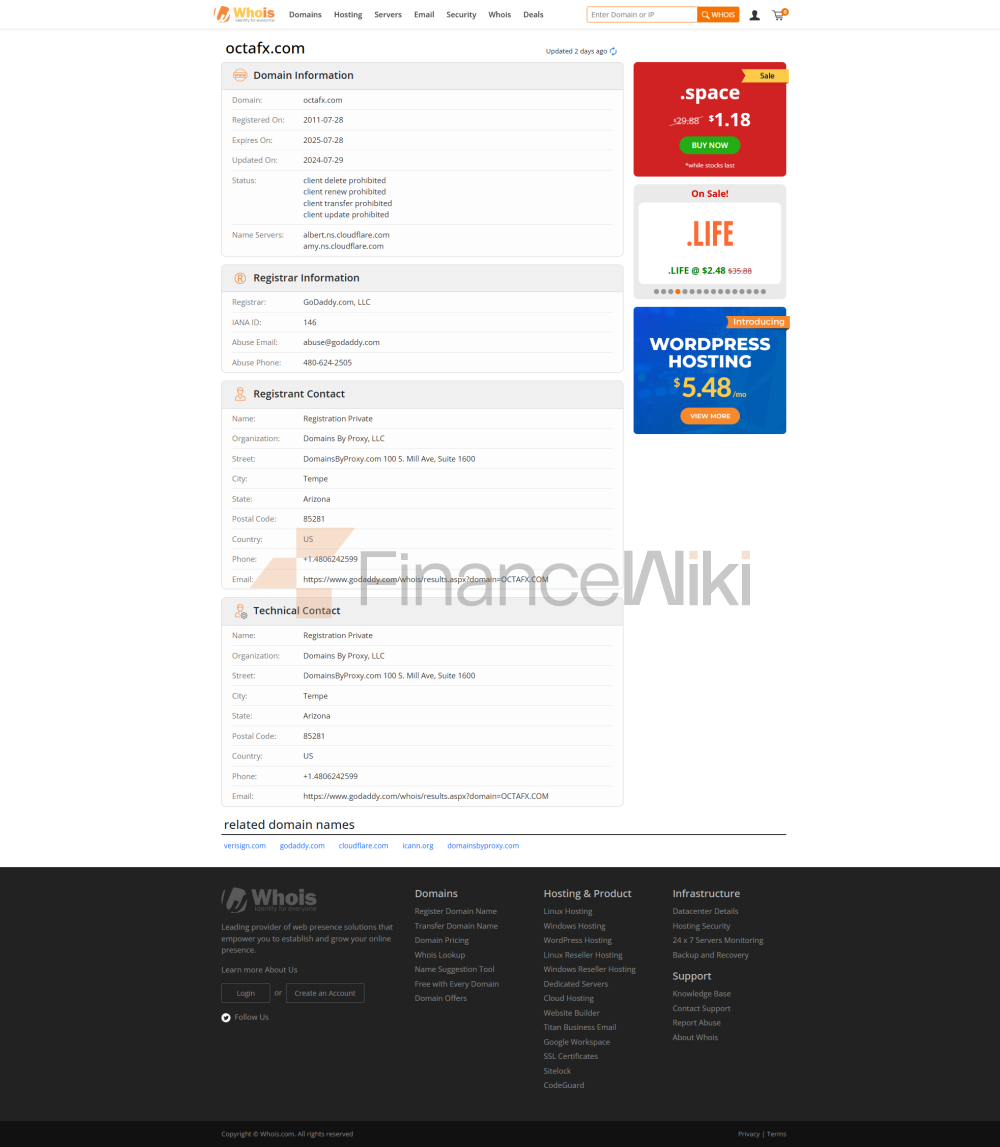

Octa Markets Was Established In 2017 And Is Headquartered In Saint Lucia . It Is A Foreign Exchange Broker Registered In Indonesia And Regulated By The Indonesian Commodity Futures Trading Regulatory Authority (BAPPEBTI). The Company Has A Registered Capital Of Undisclosed And Serves Its Clients Primarily Through The MT5 And CTrader Trading Platforms. As Of October 2023, The Company Offers Trading On 27 Currency Pairs, 2 Precious Metals And 5 Indices , Supporting Leverage Up To 1:500 .

Regulatory Information Octa Markets Holds A License From The Indonesian Commodity Futures Trading Regulatory Authority (BAPPEBTI), But No Relevant Regulatory Information Was Found With The Saint Lucia Financial Services Regulatory Authority (FSRA), Which Led To Questions About Its Compliance. In Addition, The Company Offers A Negative Balance Protection Policy To Ensure The Safety Of Clients' Funds.

Trading Products Octa Markets Offers A Wide Range Of Trading Instruments, Including 27 Currency Pairs, 2 Precious Metals (gold And Silver) And 5 Indices (such As Dow Jones And NASDAQ) . These Products Are Traded Through The MT5 And CTrader Platforms, With A Minimum Difference Of 0.6 Pips For Major Currency Pairs (e.g. EUR/USD).

Trading Software Octa Markets Supports Both The MT5 And CTrader Trading Platforms, Both Of Which Provide Multilingual Support , Covering Simplified Chinese, English, German, Spanish And Many Other Languages. MT5 Is Known For Its Advanced Charting Capabilities And Economic Calendar , While CTrader Features Low Latency And High Execution Speed .

Deposit And Withdrawal Methods Octa Markets Offers A Variety Of Deposit And Withdrawal Methods, Including Neteller, Skrill, Mastercard , Etc. The Minimum Deposit And Withdrawal Amount Is $5 And The Maximum Is $100,000 . Deposit And Withdrawal Processing Fees Are Borne By The Company, But Processing Times May Vary Depending On Queue Length.

Customer Support Octa Markets' Customer Support Includes Live Chat, Phone And Email And Covers Monday Through Friday 08:00 To 24:00 . However, Out-of-hours Customer Support Is Limited And Specific Information On Multilingual Support Is Not Provided.

Core Business And Services Octa Markets Focuses On Providing Clients With Low Spreads, High Leverage And Fast Execution Trading Experience, While Providing Trading Rebates And Educational Resources . However, Some Traders Report Limited Educational Resources And Do Not Offer Demo Accounts.

Technical Infrastructure Octa Markets Uses MT5 And CTrader Platforms To Provide Multi-language Support, Economic Calendar And Market News And Other Functions. It Supports Desktop, Web And Mobile Trading.

Compliance And Risk Control System Octa Markets Implements A Negative Balance Protection Policy To Ensure That Clients' Trading Accounts Do Not Experience Negative Values, While Further Safeguarding The Safety Of Funds Through Segregation Of Client Funds .

Market Positioning And Competitive Advantage As A Foreign Exchange Broker Regulated In Indonesia, Octa Markets Offers Diverse Trading Tools And Low Spreads To Meet The Needs Of Different Traders. However, Its Single Account Type And Limited Customer Support Channels May Limit Its Attractiveness.

Customer Support With Empowering Octa Markets Provides Live Chat, Phone And Email Support, But Does Not Support 24/7 Services. The Company Does Not Disclose Specific Payment Methods, Which May Affect Customer Trust.

Social Responsibility With ESGOcta Markets Does Not Disclose Its Social Responsibility And ESG Policies, Which May Affect Its Rating In Terms Of Sustainability.

Strategic Partnership Ecology Octa Markets Does Not Disclose Information About Its Strategic Partners, Which May Result In Its Limited Market Influence.

Financial Health Octa Markets Does Not Disclose Its Financial Reports, Which May Affect Investors' Assessment Of Its Financial Condition.

Future Roadmap Octa Markets Has Not Disclosed Its Future Development Plan, Which May Lead To Unclear Positioning In The Market.

Summary Octa Markets, As A Regulated FX Broker In Indonesia, Offers A Wide Range Of Trading Tools And Low Spreads, But Lacks Regulatory Transparency, Customer Support And Payment Methods. Investors Need To Choose Carefully.

Serious Slippage

Serious Slippage