name and background<

span style="font-family: sans-serif; color: black" full name of the > bank: Banco Central de la República Argentina (abbreviated as BCRA)

Founded: May 28, 1935

Headquartered in the financial district of Buenos Aires, the capital of Argentina (San Martín Street

). Shareholder Background: BCRA is wholly owned by the Argentine government and is a state-owned institution, not a listed company or a private enterprise. Its management is appointed by the state, reflecting its status as the country's financial core. Due to its central bank nature, BCRA does not operate in a market-oriented manner, but is guided by the country's economic goals.

services and products

The Central Bank of Argentina mainly serves the government, financial institutions and the general public.

for financial institutions: BCRA regulates and directs banks and other financial institutions in Argentina to ensure compliance and stability of the financial system.

to the public: BCRA indirectly serves the public by issuing money, maintaining financial stability, and providing financial education. However, it does not offer financial products that are common to individual or corporate customers, such as savings accounts, loans, or investment wealth management services, which are usually handled by commercial banks.

In general, BCRA's services are mainly at the national level, focusing on macro-control rather than micro-financial services.

> to the government: BCRA, as the financial agent of the state, is responsible for managing the country's foreign exchange reserves, issuing currency, Formulate and implement monetary policy to provide macroeconomic support to the government.

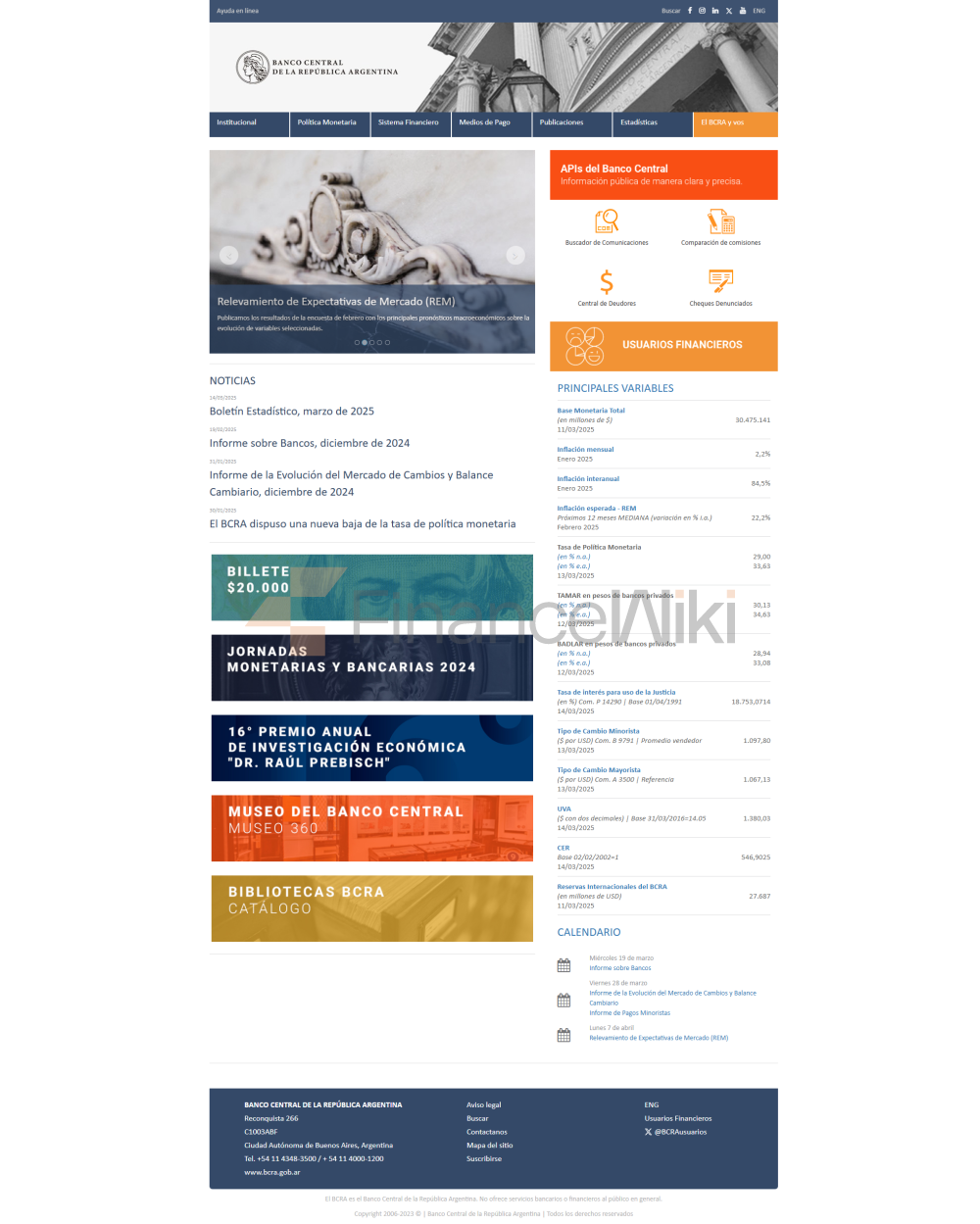

digital service experience<

span style="font-family: sans-serif; color: black" > APP and online banking: BCRA provides mobile banking and online banking services, which can be accessed by users through its official website (https://www.bcra.gob.ar/) visit the relevant platform. These services support core functions such as account management, transfers, bill payments, and more.

Security measures

Central Bank of Argentina has implemented a number of security measures to protect the country's financial system and the safety of customer funds. These include:

Multi-factor authentication: Increases the security of accounts and transactions.

Real-time risk monitoring: Identify and respond to potential financial risks in a timely manner.

Although the technical details are not disclosed, as a central bank, BCRA's security measures need to comply with international standards to maintain the stability of the country's financial system and public trust.

> data encryption technology: to ensure the security of information transmission and storage.

featured services and differentiation<

span style="font-family: sans-serif; color: black"> Central Bank of Argentina is distinguished by its unique position and responsibilities as a central bank. Unlike commercial banks, BCRA does not aim to make a profit and does not directly provide financial products to individuals or businesses, but rather serves the state through the following core functions:

regulation of the financial system: ensuring the stable operation of banks and other financial institutions.

currency issuance: responsible for the design, printing and circulation of the Argentine peso.

Foreign exchange reserve management: Maintain the country's foreign exchange balance and economic stability.

these responsibilities have placed BCRA at the heart of the Argentine financial system, with policies and decisions that have a profound impact on the country's economy. Compared with other banks, BCRA's differentiation is reflected in its macro-control capabilities rather than micro-financial services.

Monetary policy formulation and implementation: Regulate the economy through interest rate adjustment, money supply management, etc.

summary

Central Bank of Argentina, BCRA is a central bank wholly owned by the Argentine government, founded on May 28, 1935, and headquartered in the financial district of Buenos Aires. It covers the entire territory of Argentina and is responsible for setting monetary policy, regulating the financial system, issuing currency and managing foreign exchange reserves. BCRA provides basic digital services and multiple customer service channels, and ensures financial security through data encryption, multi-factor authentication and other measures. As a central bank, BCRA does not directly serve individual or corporate customers, but plays an irreplaceable role in the Argentine financial system by supporting the country's economic operations through its unique functions.