Brand History And Reputation

Marwadi Shares And Finance Limited, Founded In 1992, Is A Financial Services Company And Is The Financial Services Arm Of Marwadi Group With Over 800 Employees Across 104 Locations In India. There Are Also Over 500 Partners With A Strong Community Served By 4 Million + Esteemed Clients. Marwadi Shares And Finance Limited Is Part Of The Marwadi Group Company. The Group Has Ventured Into Financial Services, Education And Solar Energy. Across All Its Ventures, The Group Has Witnessed Steady Growth And Has A Strong Team Of 2,500 + Employees.

Regulatory Compliance

Marwadi Shares And Finance Ltd. Is Regulated By The Financial Regulator Of India With Registration Number: INZ000174730. Comply With Local Financial Regulations And Regulations To Ensure The Safety Of Client Funds And Transaction Transparency.

Products And Services

Equity Derivatives:

Stock Trading Refers To The Buying And Selling Of Company Shares On A Stock Exchange. The Goal Of Stock Trading Is To Profit By Buying Shares At Low Prices And Selling Them At High Prices.

Traders Can Trade Stocks Using A Variety Of Strategies, Including Fundamental Analysis (which Involves Evaluating A Company's Financial And Economic Performance) And Technical Analysis (which Involves Studying Past Market Data To Identify Patterns And Predict Future Price Movements).

Stock Trading Can Be Conducted By Individuals Or Institutions Through A Variety Of Platforms, Including Online Brokerage Accounts And Trading Software. Stock Trading Can Also Be Conducted Through A Stockbroker Or Financial Advisor Who Can Provide Guidance And Advice On The Best Way To Buy Or Sell Stocks.

It Is Important To Note That There Are Risks Involved In Stock Trading And It Is Important To Have A Proper Understanding Of The Market And The Companies You Plan To Invest In. In Addition, Diversifying Your Portfolio Can Help Manage Risk.

Subscription For New Shares:

An Initial Public Offering (IPO) Is The Process By Which A Private Company Issues Shares To The Public For The First Time. This Enables The Company To Raise Funds And Provides Investors With The Opportunity To Buy Shares In The Company. When A Company Goes Public, Its Shares Are Listed On The Stock Exchange And The Public Can Buy And Sell Them.

An IPO Can Provide Investors With The Opportunity To Buy Shares In The Company Before It Goes Public. This May Offer A Price Below Its Late-stage Market Value And The Opportunity To Earn A Decent Return If The Company Performs Well In The Stock Market. However, It Also Carries Higher Risks Due To The Uncertain Performance And Future Prospects Of The Company. Investing In An IPO Requires A Good Understanding Of The Company, The Industry And The Market.

Before Investing In An IPO, It Is Important To Do In-depth Research On The Company, Its Finances, Management And The Industry. In Addition, It Is Also Important To Consider The Valuation Of The Company, The Number Of Shares Issued And The Price Per Share. It Is Also Important To Understand The Risks Involved, Such As The Company Underperforming And To Consider The Liquidity Of The Stock.

Overall, Investing In An IPO Can Be A Potentially Lucrative Opportunity, But It Is Important To Approach It With Caution And Conduct The Necessary Research And Due Diligence.

Depository Services:

Depository Services Are Provided By The Financial Institution Group To Preserve And Assist Securities Such As Stocks And Bonds In Electronic Form Called Demat (Dematerialized Account) Rather Than Physical Form.

Depository Services Include:

Better Delivery: Fast, Instantaneous Delivery Of All Your Securities.

Best Security Practices: Secure Storage And Transfer Methods For All Your Financial Assets.

Cost-Efficiency: Access To Depository Services Without Having To Spend Large Sums Of Money.

Easy Portfolio Management: Get A Better Understanding Of Your Portfolio To Help You Manage It Effectively.

Paperless Trading: No Paperwork Is Required To Participate In Trading.

Mutual Funds:

A Mutual Fund Is An Investment Vehicle That Pools Funds From Multiple Investors To Purchase Securities, Usually Stocks, Bonds, Or Both. The Value A Mutual Fund Holds Is Called Its Net Asset Value (NAV). Investors Buy Shares In A Mutual Fund, And The Price Per Share Is Based On NAV. The Fund Is Managed By A Professional Money Manager Who Makes Investment Decisions On Behalf Of The Fund's Shareholders. Mutual Funds Offer Investors The Benefits Of Diversification And Professional Management, But They Also Come With Fees And Expenses That Can Affect Returns.

Non-Convertible Bonds (NCDs):

NCDs (non-convertible Bonds) Are Fixed-rate Loans Issued By Companies. They Offer Fixed Returns And Have A Specific Maturity Date. Unlike Convertible Bonds, They Cannot Be Converted Into Shares. NCDs Offer Investors An Easy And Secure Way To Earn A Fixed Income.

For More Details, Please Contact Mobile: 85111 60888, 98790 16667, 83208 97726

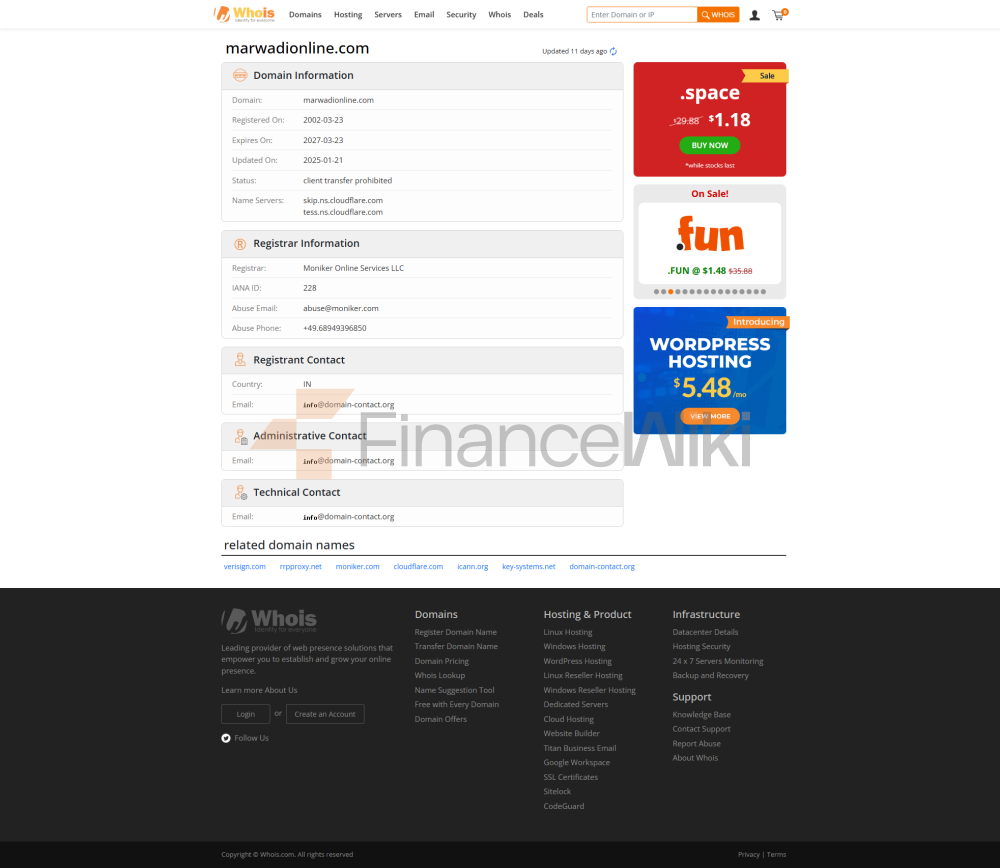

Contact Us

Corporate Office

Marwadi Shares And Finance Limited

Marwadi Financial Plaza, Nana Mava Main Road, Off 150 Feet Ring Road, Rajkot-360001, Gujarat (India)

Tel: 0281-6192000, 7174000

Email: Inquiry@marwadionline.in

Registered Address

>X - Change Plaza, Office Nos. 1201 To 1205, 12th Floor - 53E, Zone-5, Road 5E, GIFT CITY, Gandhinagar - 382355 Gujarat

In Addition, The Brokerage Also Maintains Social Media Such As Facebook, Twitter, YouTube As A Complement To The Client Server To Diversify The Channels Of Clients For Assistance And Communication.