Corporate Profile

VARIANSE Is A UK-based Financial Brokerage Company Established In 2015. The Company Focuses On Providing Global Traders With Trading Services Across Multiple Asset Classes, Including Cryptocurrencies, Forex, Energy, Indices, Metals, And Stocks, Among Others. VARIANSE Meets The Needs Of Different Traders Through Its Innovative Trading Platform, Flexible Account Types, And Personalized Customer Support.

The Company Offers Three Main Account Types:

- Classic Account : Suitable For Retail Traders, With A Minimum Deposit Of 500 Dollars, Direct Market Access, And No Commission For Trading.

- ECNpro Account : Designed For Experienced Traders With A Minimum Deposit Of $5,000 With Spreads From 0 Pips And A More Competitive Commission Structure.

- Prime Account : Tailored For Institutional Clients With A Minimum Deposit Of $50,000 With Negotiable Terms And Conditions.

VARIANSE Supports Multiple Deposit And Withdrawal Methods Including Bank Telegraphic Transfers, Credit/debit Cards, Cryptocurrencies And E-wallets. Customers Also Have Access To 24/7 Customer Support Via Live Chat, Phone And Email.

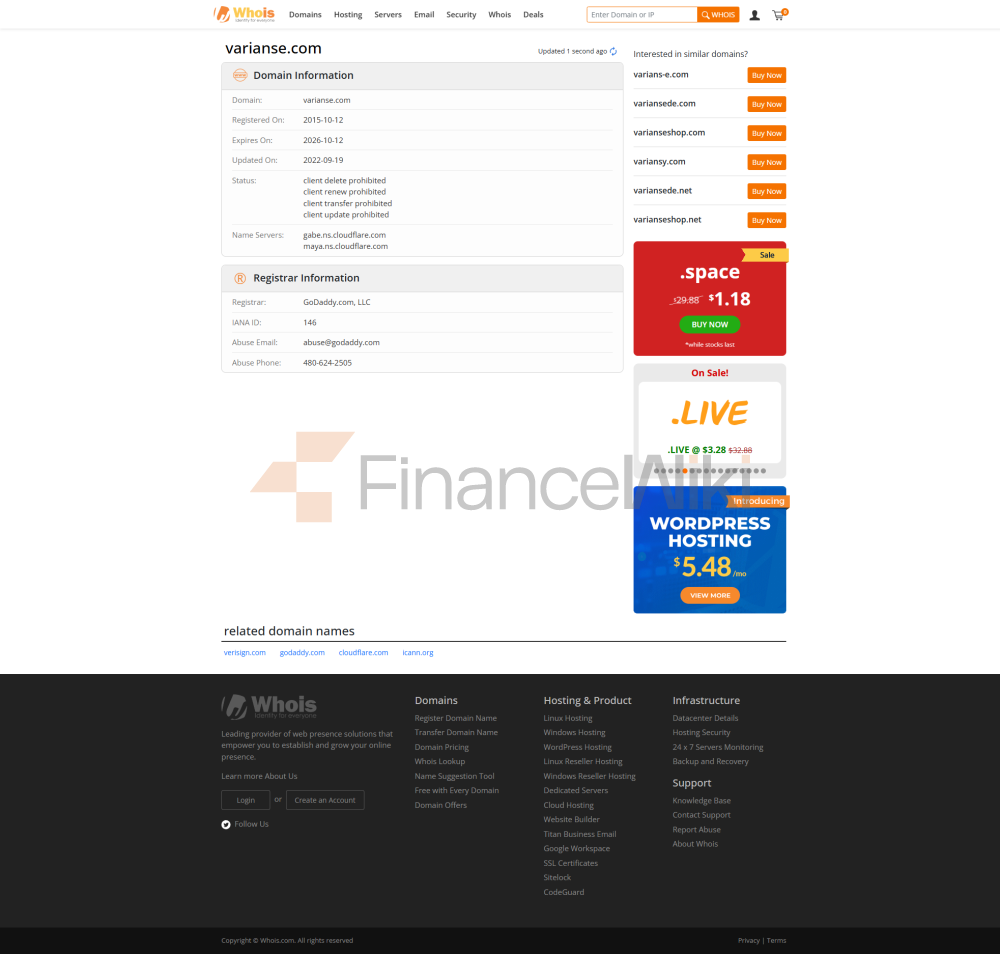

Regulatory Information

VARIANSE Is Registered In The UK And Claims To Be Regulated By The UK Financial Conduct Authority (FCA), But Does Not Hold A Valid FCA Licence. This Regulatory Status Raises Questions About Its Legality.

- Suspicious Clone : VARIANSE's Regulatory Status Is Flagged As "Suspicious Clone", Which Suggests That Its Operations May Not Meet The Strict Requirements Of The FCA.

- Compliance Statement : Although VARIANSE Emphasizes Its Compliance, No Explicit Compliance Statement Or Licence Information Is Provided.

Trading Products

VARIANSE Offers The Following Six Categories Of Trading Products:

- Cryptocurrencies : Including Major Cryptocurrencies Such As Bitcoin, Ethereum, And USD Stablecoins, With Spreads Starting From 0 Pips.

- Forex : Offers 44 Currency Pairs, Including Major Currency Pairs (e.g. EURUSD, USDJPY).

- Metals : Supports The Trading Of Gold And Silver.

- Energy : Offers The Trading Of UK Crude Oil And US Crude Oil.

- Indices : Includes Major Stock Market Indices From The United States, Europe, And Asia.

- Stocks : Offers Trading Options For 121 Stocks, Including U.S. Stocks.

Trading Software

VARIANSE Offers The Following Three Trading Platforms:

- CTrader : Supports Cross-device Use, Offers Level 2 Pricing, Copy Trading, And Advanced Charting Tools.

- MT4 : Supports The Stated Needs Of The Forex Trading Community To Automate Trading Through Expert Advisors (EAs).

- FIX Application Programming Interface : Designed For Experienced Traders And Institutional Clients.

Deposit And Withdrawal Methods

VARIANSE Supports Multiple Deposit And Withdrawal Methods:

- Deposit : Via Bank Telegraphic Transfer, Credit/debit Card, Cryptocurrency And E-wallet. There Is No Fee For Bank Telegraphic Transfer.

- Withdrawal : The Minimum Withdrawal Amount Is 100 Dollars, Which Is Processed By Bank Telegraphic Transfer And Is Usually Completed Within 1 To 3 Business Days.

CUSTOMER SUPPORT

VARIANSE Provides 24/7 Customer Support And Is Available Monday To Friday From 9:00 Am To 6:00 Pm (GMT). Customers Can Get Assistance Via Phone, Email And Live Chat Online.

CORE BUSINESS AND SERVICES

VARIANSE's Core Businesses Include:

- Multi-asset Trading Services : Providing A Diverse Range Of Trading Tools Across Asset Classes.

- Institutional-level Trading Conditions : Meeting The Needs Of High-volume Clients With Negotiable Leverage And Commission Structures.

- Educational Resources : Providing Content Such As Strategy Articles, Risk Management Book Reviews, And Platform Product Reviews To Help Traders Improve Their Skills.

Technical Infrastructure

VARIANSE Provides Direct Interbank Pricing Through Its Low Latency Network, Ensuring Market Access For Traders. Its Technical Infrastructure Supports An Efficient Trading Environment Based On CTrader And MT4, While Meeting The Needs Of Institutional Clients Through The FIX Application Programming Interface.

Compliance And Risk Control System

- Compliance : VARIANSE Emphasizes Its Compliance, But Does Not Provide A Clear Statement Of Compliance Or License Information.

- Risk Control : Offers A Variety Of Account Types And Spread Structures To Meet The Risk Control Needs Of Different Traders.

Market Positioning And Competitive Advantage

VARIANSE's Market Positioning Is To Offer A Variety Of Trading Products And Flexible Trading Conditions, Especially To Be Competitive In Cryptocurrency And Foreign Exchange Trading. Its Competitive Advantages Include:

- 0-spread Cryptocurrency Trading : Especially In BTCUSD Trading, This Is Attractive To Cryptocurrency Traders.

- No Bank Telegraphic Transfer Deposit Fees : Reduced Cost Pressure On Traders.

CUSTOMER SUPPORT AND EMPOWER

VARIANSE Helps Traders Improve Their Skills And Market Understanding Through Its Educational Resources And Trading Tools. Its Customer Support Team Provides 24/7 Advisory Services To Resolve Any Issues Traders May Have During The Trading Process.

SOCIAL RESPONSIBILITY AND ESG

VARIANSE Does Not Explicitly Mention Its Initiatives In Social Responsibility And ESG.

Strategic Cooperation Ecology

VARIANSE Has Not Disclosed Its Strategic Partnerships Or Industry Awards.

Financial Health

As A Company Established For 5-10 Years, The Financial Health Of VARIANSE Has Not Been Clearly Disclosed.

Future Roadmap

The Future Roadmap Of VARIANSE Has Not Been Clearly Disclosed.

The Above Is The Entire Content Of The Company's Introduction. For Further Information, Please Refer To VARIANSE's Official Website Or Contact Its Customer Support Team.