Company Profile

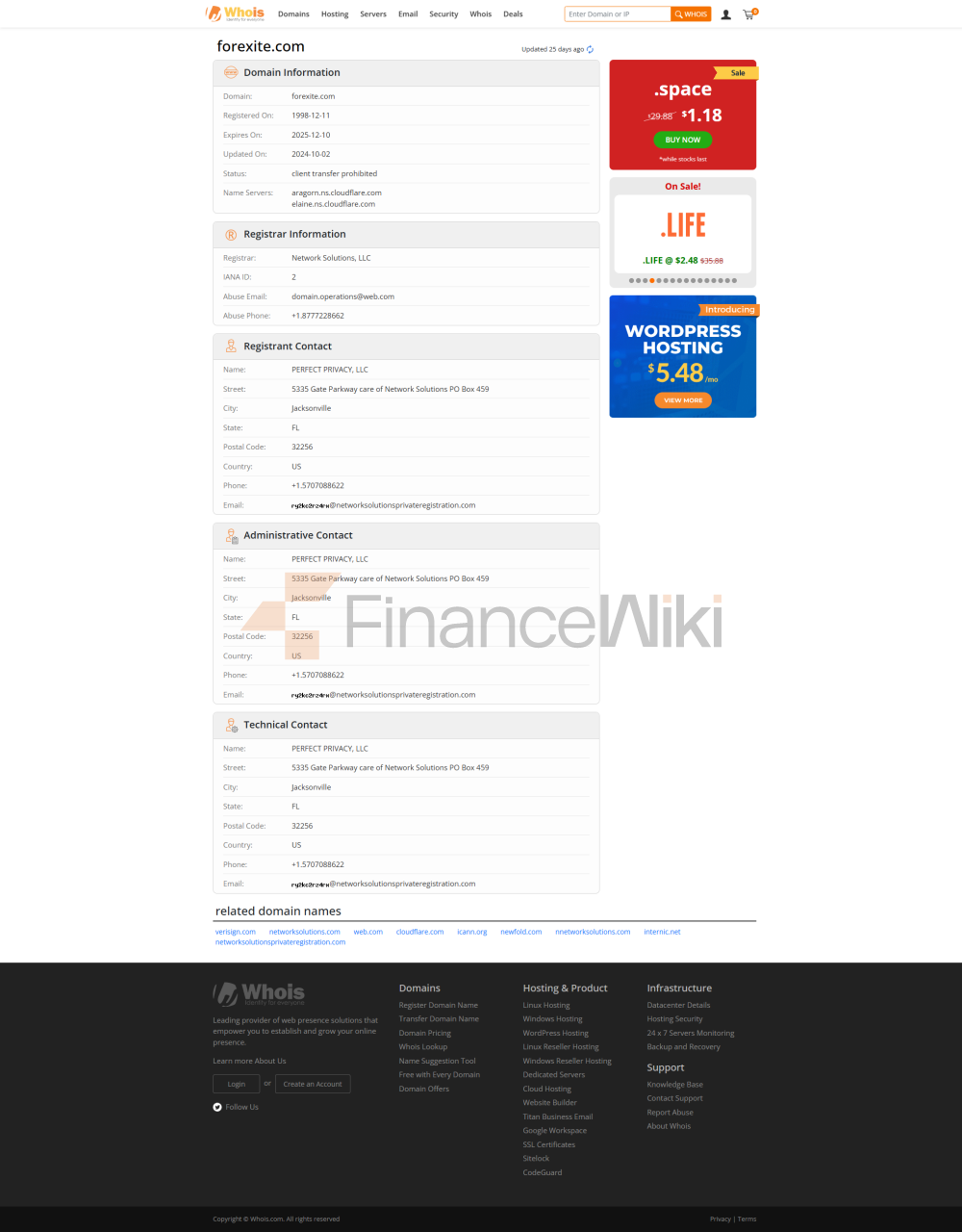

Full Name Of Company : Forexite Ltd Established : December 11, 1998 Headquarters Location : Belize International Business Company Registered Capital : Undisclosed (but Meets The Minimum Registered Capital Requirements Of Belize Business Company) Main Business : Provides Online Trading Services For Foreign Exchange, Precious Metals, Stock Indices, Oil And Gas, And Cryptocurrencies

FOREXITE Is An International Foreign Exchange And Cryptocurrency Broker That Has Been Providing Professional Trading Services To Traders Since 1998. The Company Offers A Diverse Range Of Financial Products And Instruments To Traders Around The World Through Its Proprietary TradeRoom Platform.

Regulatory Information

Regulatory License : IFSC/60/275/TS/19 (issued By The Belize Financial Services Commission FSC) Headquarters Regulatory Authority : Belize Financial Services Commission (FSC) Corporate Structure : Forexite Ltd Operates As An Independent Broker With A Clear Ownership Structure And An Independent Operating Team.

Although Forexite Holds A Legal License, Its Current Operating Status Is Flagged As " Suspicious Clone ", Which May Imply A Latent Risk To Its Legitimacy And Reliability In The Market.

Trading Products

Tradable Instruments :

- Forex: 58 Currency Pairs Are Available, Including Major, Minor And Exotic Currency Pairs.

- Precious Metals: Gold, Silver, Etc.

- Stock Indices: A Variety Of Major Global Stock Indexes (e.g. Dow Jones, S & P 500, Etc.).

- Oil And Gas: WTI Crude Oil, Brent Crude Oil, Etc.

- Cryptocurrencies: Bitcoin, Ethereum, Etc.

Total Number Of Instruments : 75 Tradable Instruments Available As Of 2023, Covering A Wide Range Of Asset Classes.

Trading Software

Trading Platform : TradeRoom

- Features : TradeRoom Is A Proprietary Platform For Forexite, Based On The Web, Providing Basic Trading Functions And Analytical Tools.

- Applicability : Suitable For Novice Traders, But The Functionality And User Experience Of TradeRoom Are Still Insufficient Compared To Mainstream Platforms In The Industry (such As MetaTrader 4/5).

Account Type :

- Live Trading Account: Minimum Deposit Is $1 .

- Demo Account: Not Available.

Leverage : Standard Leverage Is 1:100, No More Than 1:10 Is Recommended To Optimize Risk Management.

Deposit And Withdrawal Methods

Deposit Methods :

- Support Visa And MasterCard Credit Cards.

- Third-party Payment Services: Skrill, WebMoney, RBK Money, Paxum, Etc.

Deposit Currencies : Support Multiple Currencies. Minimum Deposit Amount : $1 .

Withdrawal Methods :- Support Visa, MasterCard And Other Bank Cards.

- Third-party Payment Services: Skrill, WebMoney, Etc.

Withdrawal Time : Depending On The Payment Method, Generally 1-3 Working Days.

Customer Support

Support Channels : Phone, Email. Customer Service Time : 24/5 Service (excluding Weekends).

Contact Information :

- Tel: + 1 718 663 0013

- Email: Info@forexite.com

Educational Resources : Not Explicitly Provided, Traders Need To Learn Through The Platform Tutorial.

Core Business And Services

Differentiating Advantages :

- Low Threshold : Minimum Deposit Is Only $1, Suitable For Novice Traders.

- Flexible Trading Tools : Support For Multiple Currencies And Payment Methods.

- Fixed Spreads : Spreads On Major Currency Pairs Start From 4 Pips, Ensuring Transparent Pricing With No Additional Commissions.

Weaknesses :

- Suspicious Cloning Risk : May Involve Legality And Reliability Issues.

- Single Trading Platform : TradeRoom Has Limited Functionality And Is Not Comparable To Other Mainstream Platforms Such As MetaTrader.

- Limited Educational Resources : Lack Of Systematic Learning Resources.

Technical Infrastructure

Trading System : Web-based TradeRoom Platform That Provides Basic Charting Analysis And Trading Tools. Security : Not Explicitly Stated, But As A Regulated Broker, Basic Cyber Security Measures (such As SSL Encryption) Should Be In Place.

Compliance And Risk Control System

Compliance Statement : Forexite Ltd Complies With The Regulatory Requirements Of The Belize Financial Services Commission (FSC) To Ensure The Safety Of Funds And A Transparent Trading Environment. Risk Management System : Provides A Fixed Spread System To Reduce The Volatility Of Trading Costs, But Higher Spreads (such As 4 Pips For EURUSD) May Increase Trading Costs.

Market Positioning And Competitive Advantage

Market Positioning : _forexite_ Is Positioned To Provide Low Threshold, Flexible Foreign Exchange Trading Services For Novice Traders.

Competitive Advantage :

- Low Barrier To Entry : Suitable For Traders On A Budget.

- Multi-language Support : Not Explicitly Stated, But May Support Multiple Languages To Cater To International Clients.

Competitive Disadvantage :

- Limited Trading Platform : Not Comparable To Established Platforms Such As MetaTrader.

- Suspicious Cloning Risk : May Affect Customer Trust.

Customer Support And Empower

Customer Support : Phone And Email Support, 24/5 Service. Educational Resources : Formal Educational Services Are Not Provided, And Users Need To Learn Through Platform Tutorials.

Social Responsibility And ESG

Social Responsibility : No Relevant Information Is Explicitly Provided. ESG Commitments : No Mention Of Specific Commitments In Environmental Protection, Social Responsibility And Corporate Governance.

Strategic Collaboration Ecology

Significant Collaboration : No Mention Of Strategic Collaboration With Mainstream Financial Institution Groups Or Technology Platforms. Industry Awards : No Mention Of Awards Or Recognition.

Financial Fitness

Registered Capital : Not Disclosed, But Meets Minimum Requirements For Belize Business Companies. Audit And Financial Reporting : No Mention Of Third-party Audits Or Publicly Available Financial Reporting.

Future Roadmap

Future Development May Face Challenges As The Company Is Currently Marked As A "suspect Clone". Whether Forexite Can Solidify Its Market Position By Enhancing Platform Functionality, Enhancing Compliance, And Improving Customer Support Is Worth Further Observation.

SPECIAL NOTE : If You Need To Trade, It Is Recommended To Prefer Brokers With Clear Operating Status And Regulated By Authoritative Regulators To Avoid Latent Risk.