Corporate Profile

AceFxPro, Full Name Ace Global Limited , Is A Multi-asset Broker Founded In 2015 And Headquartered In Saint Vincent And The Grenadines. The Company Offers Clients A Diverse Range Of Trading Services, Including Forex, Commodities, Indices And Cryptocurrencies, Through The Global MT5 Trading Platform . AceFxPro Offers Traders Three Account Types: Standard Account, Professional Account And Flagship Account , Each Corresponding To Different Trading Conditions And Leverage Levels. The Company Emphasizes Its Technical Support And Diverse Offerings, But Lack Of Regulation And Limited Educational Resources May Be A Concern For Some Traders. As Of 2023, AceFxPro Has A Minimum Deposit Requirement Of $200 And Offers A Variety Of Deposit And Withdrawal Methods, Including Visa, MasterCard, Bank Transfer, And Bitcoin .

Regulatory Information

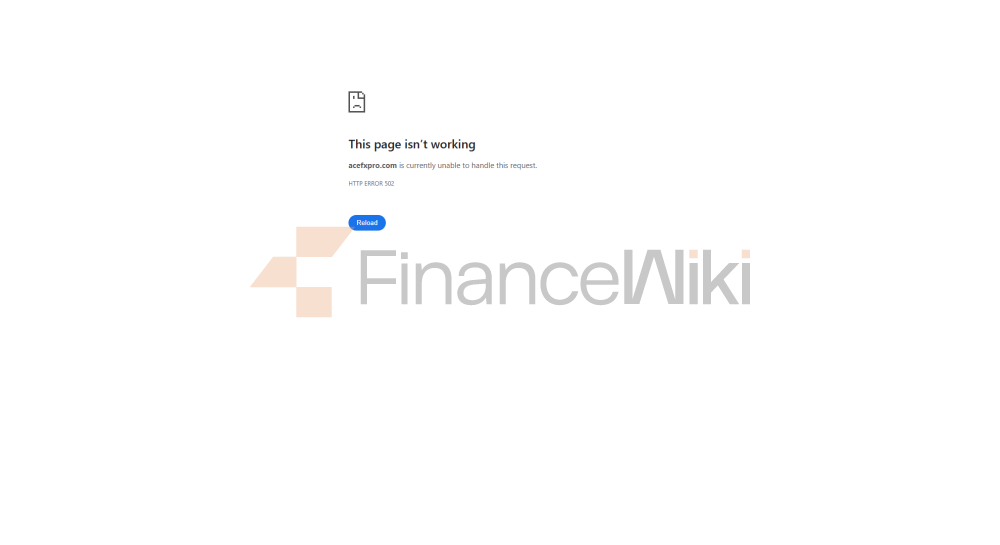

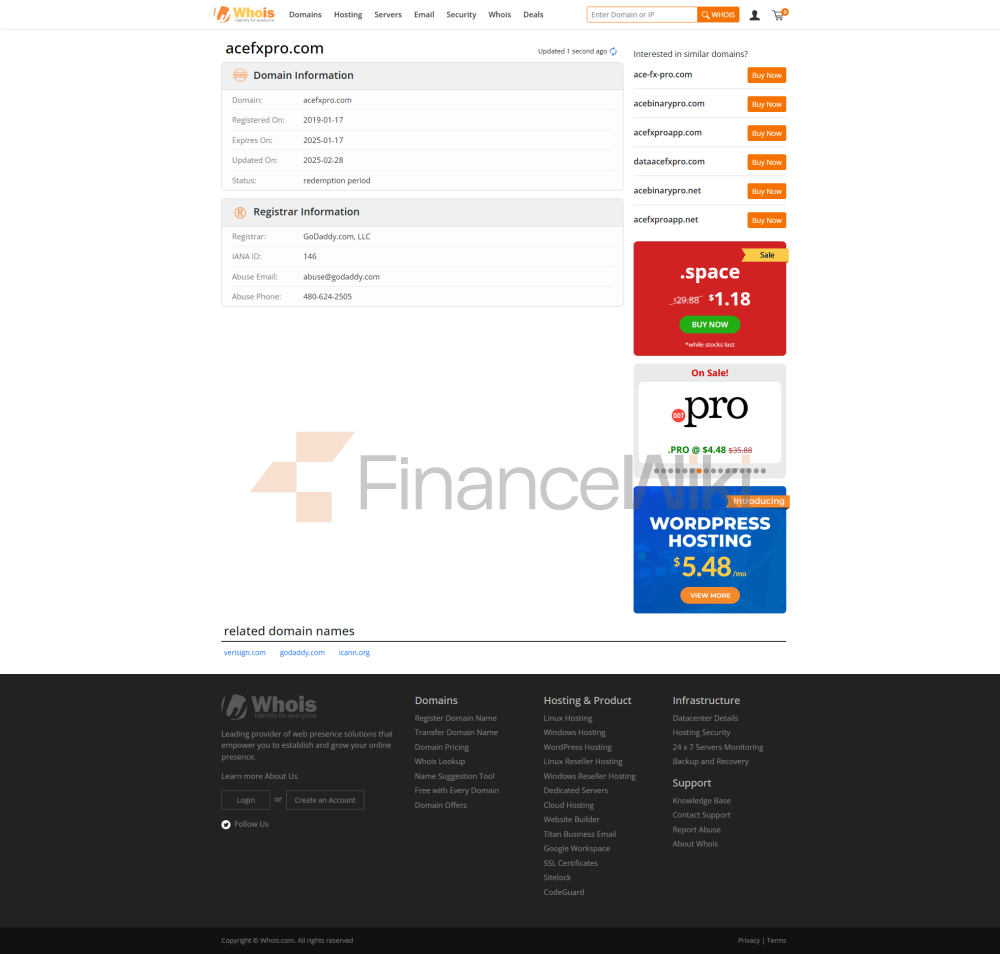

AceFxPro Is Currently A Unregulated Broker . After Verification, Its Regulatory Status On WikiFX Is Listed As "unlicensed" With A Score Of 1.29/10 (as Of January 19, 2023). As An Unregulated Broker, The Trading Environment Of AceFxPro May Cause Concern For Some Traders, Especially Those Who Prefer A Regulated Platform. However, The Company States On Its Official Website That It Follows Industry Best Practices And Client Funds Segregation Policy To Ensure The Safety Of Client Funds.

Trading Products

AceFxPro Offers A Variety Of Market Instruments Including:

- Contracts For Difference (CFDs) : Offers Over 100 CFD Pairs Covering Forex, Commodities And Stock Indices.

- Commodities : Trade Precious Metals (Gold, Silver, Palladium) And Crude Oil.

- Index CFDs : Trade Major Global Stock Indices Such As NASDAQ, DAX And FTSE.

- Cryptocurrencies : Offering More Than 100 Cryptocurrency Pairs, Traders Can Enjoy Competitive Spreads And Transparent Pricing.

Trading Software

AceFxPro Mainly Supports The MetaTrader 5 (MT5) Platform, Which Is Suitable For PC, Mobile And Total Page Browsers. MT5 Offers Advanced Charting Tools, Technical Indicators And One-click Trading Capabilities. In Addition, AceFxPro Also Provides A Web-based Trading Platform That Requires No Download Or Installation, Allowing Traders To Trade Directly Through The Web.

Deposit And Withdrawal Methods

AceFxPro Accepts The Following Deposit And Withdrawal Methods:

- Visa/MasterCard : Credit And Debit Cards Are Supported, And Deposits Can Be Processed Instantly.

- Bank Transfer : Available For International And Local Bank Accounts, Processing Time Is 1-3 Business Days.

- Bitcoin : Cryptocurrency Deposit And Withdrawal Are Supported.

The Minimum Deposit Requirement Is $200 Or The Equivalent In HKD/INR.

Customer Support

AceFxPro Offers Multiple Channels Of Client Server:

- Live Chat : Live Online Support On Its Website.

- Telephone Support : International Hotline Is Available At + 44 239 216 0334.

- Email Support : Customers Can Contact The Customer Service Team Via Support@acefxpro.com.

In Addition, AceFxPro Provides Muslim Clients With Swap-free Accounts . Traders Can Apply For This Service By Sending An Email With Proof Of Belief Attached.

Core Business And Services

The Core Business Of AceFxPro Includes:

- Providing A Variety Of Trading Tools To Meet The Needs Of Different Traders.

- Providing Traders With Advanced Technical Tools And Real-time Market Data Through The MT5 Platform.

- Supporting Different Types Of Accounts, Providing Flexible Leverage And Trading Conditions.

Service Highlights Of AceFxPro Include:

- High Leverage : Standard Accounts Offer Up To 1:500 Leverage , Allowing Traders To Enlarge Their Positions.

- Narrow Spreads : Flagship Accounts Offer Spreads From 0.2 Pips , Suitable For Professional Traders.

- Flexible Commissions : Commission For Professional And Flagship Accounts Starts From $7.00/standard Lot .

Technical Infrastructure

AceFxPro's Technical Infrastructure Is Based On The MT5 Platform, Which Is Known For Its Stability And Reliability. MT5 Supports Multiple Trading Platforms (including Desktop, Mobile, And Web) And Provides Traders With:

- Real-time Price Streams : Ensure Traders Have Access To The Latest Market Data.

- Technical Analysis Tools : Includes Multiple Chart Types And Indicators.

- One-click Trading : Allows Traders To Quickly Execute Buying And Selling Operations.

In Addition, AceFxPro Supports Cross-device Trading, Allowing Customers To Synchronize Transactions Across Multiple Platforms.

Compliance And Risk Control System

Although AceFxPro Is Currently Unregulated, Its Statement Follows Industry Best Practices And Provides Customer Funds Segregation Policy To Ensure The Safety Of Customer Funds. The Company's Risk Management Measures Include:

- Forced Position Squaring : Set A 50% Forced Position Squaring Level To Prevent Accounts From Going Through Positions.

- Leverage Limits : Different Account Types Correspond To Different Leverage Caps.

- Swap Management : Swap-free Accounts For Muslim Clients.

Market Positioning And Competitive Advantage

The Market Positioning Of AceFxPro Is Mainly Focused On Providing A Variety Of Trading Tools And Highly Flexible Trading Conditions. Its Competitive Advantages Include:

- Diversified Products : Covers Forex, Commodities, Indices And Cryptocurrencies.

- High Leverage : Suitable For Traders With High Risk Tolerance.

- MT5 Platform : Offers Advanced Trading Tools And Technical Analysis.

However, The Disadvantages Of AceFxPro Include:

- Unregulated : May Raise Concerns Among Some Traders.

- Limited Educational Resources : Insufficient Support For Beginners.

Customer Support And Empowerment

AceFxPro's Customer Support Channels Include Live Chat, Phone And Mail, But Its Educational Resources Are Limited. The Company Provides Frequently Asked Questions (FAQs) Covering Basic Questions Such As Account Opening, Trading Instruments, And Deposits And Withdrawals. However, Compared To Regulated Brokers, AceFxPro Has Limited Educational Resources And May Not Be Suitable For Beginners.

Social Responsibility And ESG

AceFxPro Does Not Explicitly Mention Social Responsibility And ESG (environmental, Social, Governance) Initiatives On Its Official Website. However, As A Multi-asset Broker, Its Indirect Contributions May Include Promoting Liquidity And Diversity In Financial Marekt.

Strategic Cooperation Ecosystem

AceFxPro Does Not Disclose Its Strategic Partnerships. However, Its Collaboration With The MT5 Platform Is An Important Part Of Its Technical Infrastructure.

Financial Health

As AceFxPro Is Currently Unregulated, Its Financial Health Relies Mainly On Its Policy Of Segregation Of Client Funds And The Transparency Of The Company. The Company States That It Follows Industry Best Practices, But The Lack Of Oversight From An Independent Regulator May Increase Financial Exposure.

Future Roadmap

AceFxPro Has Not Made Public Its Future Roadmap, But It Is Committed To Attracting Different Types Of Traders By Offering A Diverse Range Of Products And Flexible Trading Conditions.