At Royal Camel, You Can Participate As A Trader In Major Markets In Europe, Asia, The United States, And Latin America, Investing In A Diverse Range Of Assets Including Stocks, Indices, Bonds, And More. But Currently It Is Not Regulated.

Advantages And Disadvantages

Advantages

- Diverse Trading Products

Disadvantages

- No Regulation

- High Minimum Deposit

- A Newly Established Company With Limited Experience

- No Contact Channels Provided

Is Royal Camel Legal?

Royal Camel Operates Its Business Under Regulation. In Addition, It Is Registered 2024-03-12. Its Current Status Is ClientDeleteProhibited, ClientRenewProhibited, ClientTransferProhibited And ClientUpdateProhibited, Which Means That The Domain Is Subject To Deletion, Renewal, Transfer And Renewal By Customers.

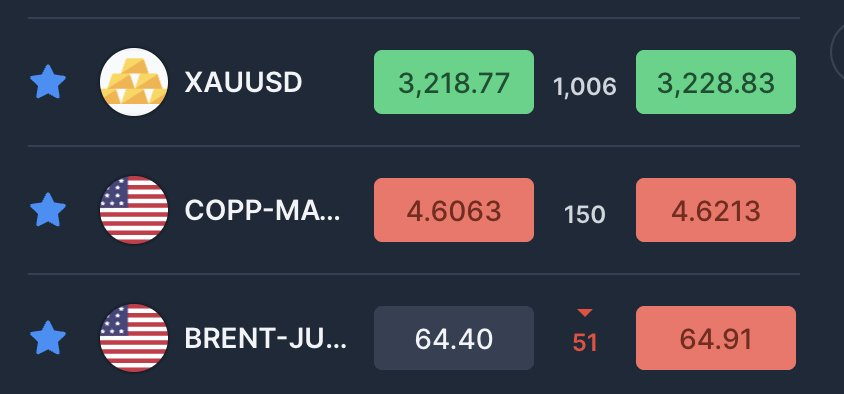

What Can Be Traded On Royal Camel?

Royal Camel Supports More Than 3000 Instruments Including Forex, Indices, Commodities, CFDs And ETFs.

Account Types

In Royal Camel, You Can Choose From Three Types Of Live Accounts: Classic Account, Silver Account And Gold Account. But It Is Worth Noting That They Require A Minimum Deposit Of 200 Dollars, 1000 Dollars And $25,000 Respectively, Which Is Quite High Compared To Other Brokers.

Trading Platform

Royal Camel Offers The Sirix Trader Trading Platform. Traders Can Take Advantage Of The Options Menu To Perform Various Actions, Including Finding Assets To Invest In, Controlling Operations, Monitoring Trades, Viewing History, Managing Positions, Displaying Charts With Different Indicators And Accessing Trading Signals.

Summary

In Conclusion, Royal Came Is A Newly Established Forex Broker That Offers A Wide Range Of Trading Products. But Since It Is Not Regulated And Requires A High Minimum Deposit, It Is Not Suitable For Beginners.

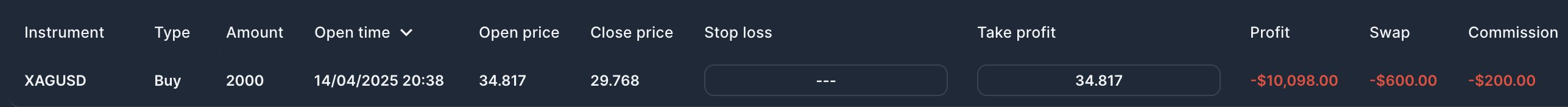

Other Exposure

Other Exposure