Corporate Profile

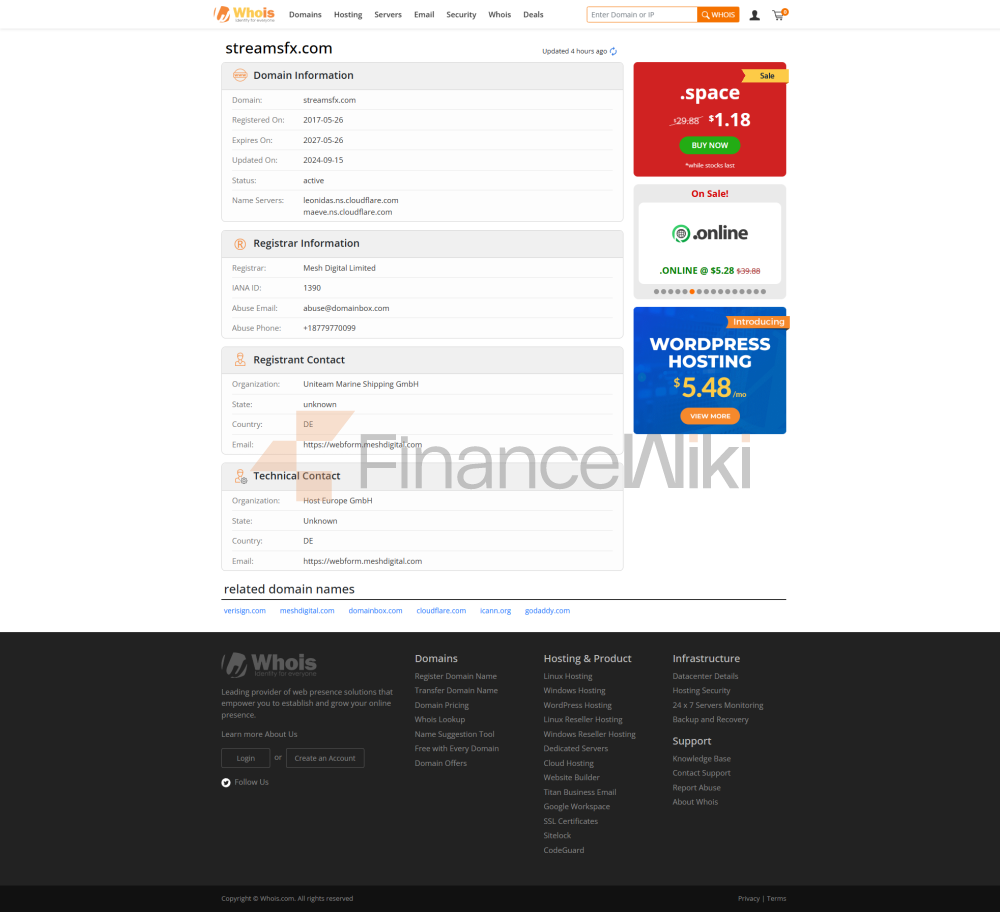

StreamsFX Is A Forex Broker Registered In Cyprus And Claims To Offer Trading Services In A Wide Range Of Financial Instruments Including Commodities, Forex, Indices And Precious Metals. However, There Are Serious Issues With Its Compliance And Regulatory Information That Need To Be Highly Valued By Potential Clients.

Regulatory Information

StreamsFX Claims To Be Regulated By The Cyprus Securities And Exchange Commission (CySEC) And Provides A License Number 376/19 . However, This License Information Has Been Confirmed To Be A Clone. Currently, StreamsFX Does Not Hold Any Valid Regulatory Licenses And Its Operations May Violate Local And International Financial Regulations. Therefore, Investors Need To Be Highly Vigilant About Trading Activities With This Platform.

Trading Products

StreamsFX Claims To Offer Trading Services For The Following Financial Instruments:

- Commodities

- Forex

- Indices

- Precious Metals

However, As The Company Is Not Regulated And The Website Is Inaccessible, Clients Cannot Verify The Specific Information Of These Trading Products, Including The Range Of Options For Trading Assets, Leverage Ratios, Spreads, Etc.

Trading Software

StreamsFX Uses MetaTrader4 (MT4) As Its Trading Platform. MT4 Is A Trading Platform That Is Widely Used In The Forex Market And Supports Windows, MAC, IOS And Android Devices. It Is Suitable For Investors With Different Trading Experience And Levels. However, Due To Compliance Issues With StreamsFX, The Actual Operating Environment And Security Of The Trading Platform Cannot Be Guaranteed.

Deposit And Withdrawal Methods

The Deposit And Withdrawal Methods Offered By StreamsFX Include Visa, Mastercard, Maestro Credit/debit Cards, Skrill And Neteller E-wallets, As Well As Bank Transfers. However, Due To The Unregulated Platform, The Safety Of Customers' Funds Cannot Be Guaranteed.

Customer Support

StreamsFX Provides The Following Customer Support Contact Details:

- Tel: + 357 25055782

- Email: Support@streamsfx.com

However, Potential Customers Are Advised To Further Verify The Platform's Qualifications And Reliability By Phone Or Email.

Core Business And Services

StreamsFX's Core Business Is To Provide Traders With Trading Services For A Wide Range Of Financial Instruments, Including Commodities, Foreign Exchange, Indices And Precious Metals. However, Due To Its Unregulated And Inaccessible Website, Customers Are Unable To Obtain Detailed Information About Its Specific Trading Products And Services.

Technical Infrastructure

Due To The Unregulated Nature Of StreamsFX, Specific Information About Its Technical Infrastructure Cannot Be Verified On A Case-by-case Basis. However, Considering Its Claim To Use MetaTrader4 As A Trading Platform, It Is Expected That Its Trading Environment Will Match The Standard Features Of This Platform.

Compliance And Risk Control System

StreamsFX Claims To Run An AIoT Risk Control System, Which Aims To Enhance Trading Security And Risk Management Capabilities Through Artificial Intelligence And Internet Of Things Technologies. However, Due To Its Unregulated Nature, The Specific Operating Mechanism And Effectiveness Of This Risk Control System Cannot Be Verified.

Market Positioning And Competitive Advantage

StreamsFX Is Positioned As A Diversified Forex Broker That Offers Trading Services For A Variety Of Financial Instruments. However, The Issue Of Unregulated And Inaccessible Websites Has Seriously Affected Its Market Credibility And Competitive Advantage.

Customer Support And Empowerment

StreamsFX Provides Phone And Email Support, But In View Of Its Compliance Issues, It Is Recommended That Potential Customers Verify Other Channels Before Choosing The Platform To Ensure Its Safety And Reliability.

Social Responsibility And ESG

Because StreamsFX Is Not Regulated And Has Compliance Issues, Its Performance In Social Responsibility And ESG Cannot Be Evaluated. Therefore, Investors Need To Be Highly Vigilant About Trading Activities With This Platform.

Strategic Cooperation Ecosystem

StreamsFX Does Not Disclose Its Strategic Partner Information, So Its Specific Position And Influence In The Industry Ecosystem Cannot Be Evaluated.

Financial Health

Because StreamsFX Is Not Regulated, Its Financial Health Cannot Be Reliably Evaluated. Therefore, Investors Need To Be Highly Vigilant About Trading Activities With This Platform.

Future Roadmap

StreamsFX Has Not Made Its Future Roadmap Public. Given That Its Website Is Inaccessible And There Are Compliance Issues, Its Future Development Prospects Are Subject To Great Uncertainty. Prospective Customers Are Advised To Check With Other Channels Before Choosing This Platform To Ensure Its Security And Reliability.