Corporate Profile

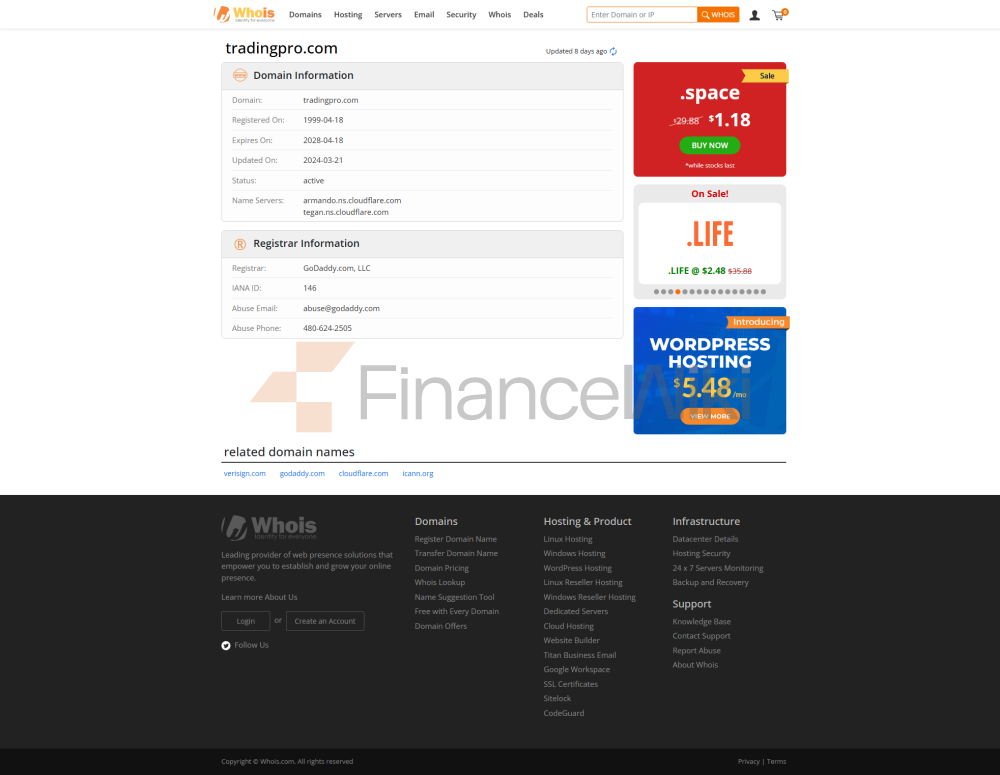

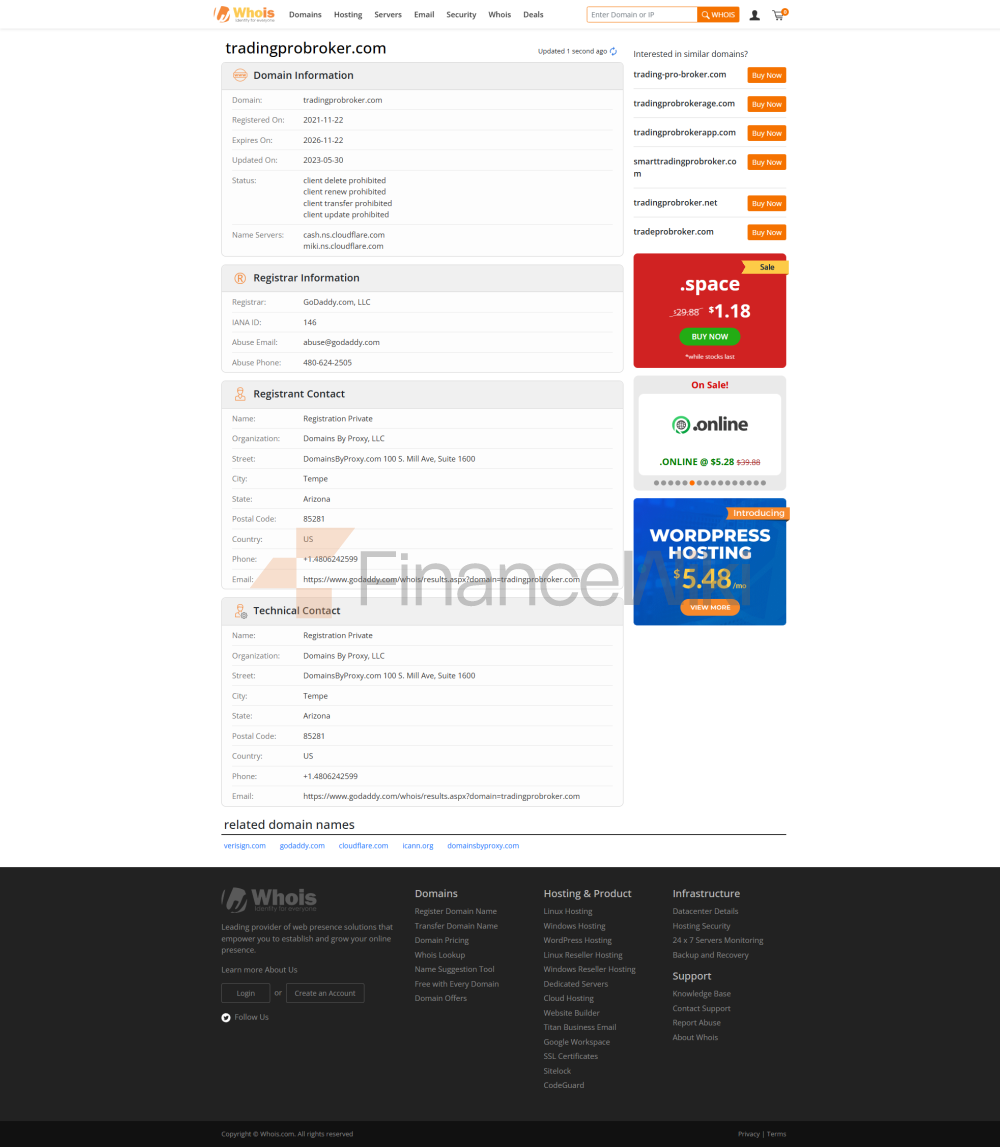

Trading Pro International Ltd. (hereinafter Referred To As "Trading Pro") Is A Financial Services Provider Established On April 18, 2022 And Headquartered In Saint Vincent And The Grenadines. The Company Focuses On Providing Global Traders With A Diverse Range Of Trading Tools And Services, Including Asset Classes Such As Forex, Indices, Cryptocurrencies, Precious Metals And Oil, And Stocks. Trading Pro Caters To The Needs Of Different Traders By Providing Flexible Account Types, Advanced Trading Platforms, And Rich Educational Resources.

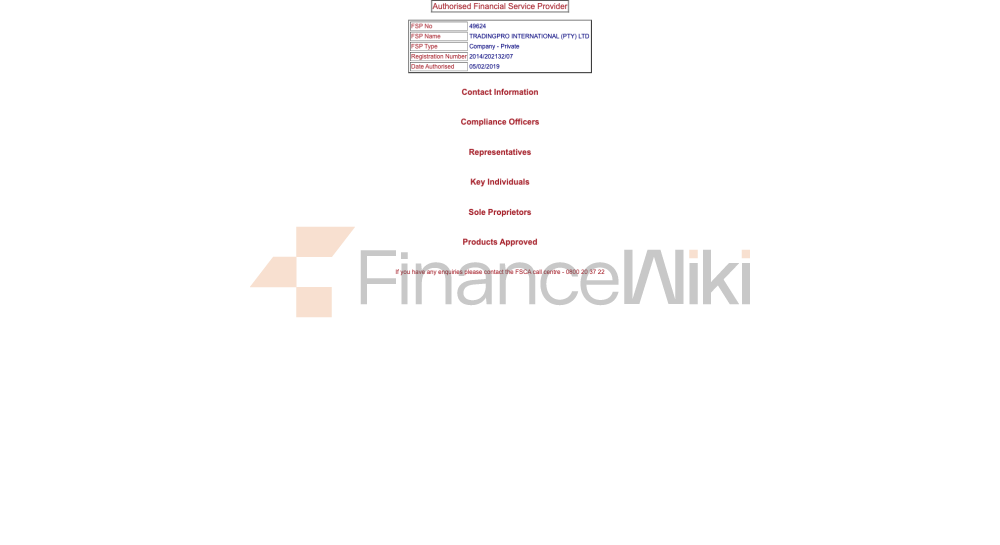

Trading Pro's Registered Capital Has Not Been Publicly Disclosed, But Its Operations Are Regulated By The Financial Services Commission (FSC) Of Saint Vincent And The Grenadines Under License Number GB23202513. In Addition, The Company Is Also Registered With The Financial Industry Regulatory Authority (FISA) In South Africa Under Registration Number 49624. This Dual Registration Mechanism Provides Additional Safeguards For The Safety Of Traders' Funds And Trading Environment.

Trading Pro's Corporate Structure Is Overseen By A Team Of Professionals, Including A Team Of Experienced Executives And Consultants. The Company Focuses On Compliance Operations And Further Enhances Its Industry Status Through Membership In A Number Of Industry Associations.

Regulatory Information

Trading Pro's Regulatory Information Is At The Heart Of Its Compliance Operations. The Company Is Regulated By The Financial Services Commission Of Saint Vincent And The Grenadines (FSC) Under License Number GB23202513, Which Allows It To Provide Retail Foreign Exchange Trading Services. In Addition, Trading Pro Is Registered With The Financial Sector Regulatory Authority Of South Africa (FISA) Under Registration Number 49624. This "dual Registration" Mechanism Ensures The Legitimacy And Transparency Of The Company On A Global Scale.

Trading Pro's Compliance Statement Emphasizes Its Compliance With Relevant Laws And Regulations And Its Commitment To Protecting The Safety And Privacy Of Its Clients' Funds. The Company's Risk Management System Ensures Compliance And Transparency Of Trading Activities Through Regular Reviews And Updates.

Trading Products

Trading Pro Offers A Diverse Range Of Trading Products Covering The Following Main Categories:

1. Forex (Forex) The Foreign Exchange Market Is One Of The Largest Financial Marekts In The World. Trading Pro Offers Trading In 57 Currency Pairs, Including Major Currency Pairs (e.g. EUR/USD, GBP/USD), Minor Currency Pairs, And Niche Currency Pairs.

2. Indices Traders Can Trade Major Global Indices Such As Dow Jones Industries Average Index, Nasdaq Index, FTSE 100 Index, Etc. Through Trading Pro To Reflect The Overall Performance Of A Particular Market.

3. Precious Metals & Oil Precious Metals Such As Gold, Silver, Platinum And Palladium, As Well As Crude Oil And Natural Gas, Are Core Trading Tools In Global Commodity Markets. Trading Pro Provides Trading Services For These Highly Volatile Assets.

4. Cryptocurrency (Cryptocurrency) With The Popularity Of Cryptocurrencies, Trading Pro Offers Trading Of Major Cryptocurrencies Such As Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC).

5. Stocks (Stocks) Traders Can Trade Individual Stocks On Major Global Stock Markets Through Trading Pro, Covering Multiple Industries Such As Technology, Finance, Energy, Etc.

Trading Pro Has A Limited Variety Of Trading Products, But Covers Major Asset Classes, Suitable For The Diverse Needs Of Different Traders.

Trading Software

Trading Pro Supports Multiple Trading Platforms To Meet The Needs Of Different Types Of Traders. Its Main Trading Software Includes:

1. MetaTrader 4 (MT4) MT4 Is A Powerful Trading Platform That Supports Chart Analysis, Technical Indicators, Expert Advisors (EAs) And Automated Trading Tools. Its User-friendly Interface Makes It The Platform Of Choice For Novice Traders.

2. MetaTrader 5 (MT5) MT5 Is An Upgraded Version Of MT4 That Supports More Chart Types, More Powerful Analytical Tools, And More Trading Execution Options. It Is Suitable For Experienced Traders.

3. CTrader CTrader Is A Relatively New Trading Platform, Known For Its Advanced Technology And Modern Interface. It Supports Multiple Trading Strategies And Automated Trading Features, Suitable For All Types Of Traders.

These Platforms Are Available On IOS, Android, Windows And The Web, Ensuring That Traders Can Trade Anytime, Anywhere.

Deposit And Withdrawal Methods

Trading Pro Offers A Variety Of Deposit And Withdrawal Methods To Meet The Different Needs Of Traders. Here Are Some Of The Main Deposit And Withdrawal Options:

1. Credit/Debit Cards Visa And Mastercard Transaction Support With A Minimum Deposit Amount Of 100 Dollars And Instant Deposit Processing Time.

2. Digital Payment Platforms Digital Payment Platforms Such As Walaopay, FasaPay And PayTrust Support With A Minimum Deposit Amount Of 10 Dollars.

3. Cryptocurrency Deposit And Withdrawal Support For Bitcoin And Other Major Cryptocurrencies With A Minimum Deposit Amount Of 100 Dollars.

4. Bank Account Direct Bank Transfer Support With A Minimum Deposit Amount Of 100 Dollars.

5. Virtual Account Virtual Account Deposit And Withdrawal Support With A Minimum Amount Of 23 Dollars.

Traders Need To Be Aware That Different Deposit And Withdrawal Methods May Be Associated With Different Currency Requirements And Processing Fees.

Customer Support

Trading Pro Offers A Comprehensive Customer Support Service, Including The Following Channels:

1. Telephone Support Traders Can Contact The Customer Support Team Directly By Phone ((+ 44) 02032894388) To Resolve Issues In A Timely Manner.

2. Email Support The Support Email Address Is Support@tradingpro.com And Traders Can Submit Inquiries Via Email.

3. Online Chat Trading Pro Offers A Live Online Chat Function Where Traders Can Communicate Instantly With The Support Team.

4. Social Media Traders Can Stay In Touch With Trading Pro Via Facebook, Twitter, Instagram, LinkedIn, Line, Telegram And WhatsApp To Get The Latest Information And Ask For Help.

Trading Pro's Customer Support Team Is Available 24/5 (Monday To Friday, 6am To 12pm), Ensuring That Traders' Questions Are Answered In A Timely Manner.

Core Business And Services

The Core Business Of Trading Pro Includes:

1. High Leverage Trading Trading Pro Offers Leverage Of Up To 1:2000, Allowing Traders To Maximize Their Trading Exposure. This High Leverage Is Suitable For Traders With Higher Risk Tolerance.

2. Spread Offer Trading Pro Offers Traders More Competitive Trading Conditions With Spreads As Low As 0.0 Pips.

3. Multi-Account Types Trading Pro Offers Four Account Types: Micro Account, Novice Account, Professional Account, And Scalpx Account. Each Account Type Is Designed For Different Trading Needs.

4. Interest-free Overnight Positions Traders Do Not Have To Pay Rollover Fees For Overnight Positions, Which Makes Short-term And Long-term Trading More Flexible.

5. Educational Resources Although Trading Pro Has Relatively Limited Educational Resources, It Offers An Economic Calendar, A Terminology Guide, And A Demo Account (for Mobile Apps Only) To Help Traders Improve Their Trading Skills.

Technical Infrastructure

The Technical Infrastructure Of Trading Pro Is Centered On Stability And Security, Including:

1. Platform Stability By Working With Well-known Platforms Such As MT4, MT5 And CTrader, Trading Pro Ensures The Fluidity And Stability Of Trading.

2. Security Protection Transaction Data And Customer Information Are Protected Against Unauthorized Access Through Multiple Encryption Technologies, Including SSL Encryption And Two-step Authentication.

3. High-speed Trading Trading Pro's Trade Execution Uses Advanced Algorithms And Low-latency Technology To Ensure Fast Execution Of Trade Orders.

Compliance And Risk Control System

Trading Pro's Compliance And Risk Control System Includes The Following Aspects:

1. Regulatory Compliance The Company Strictly Complies With The Regulatory Requirements Of FSC And FISA, And Regularly Submits Financial Reports And Threat And Risk Assessments.

2. Risk Management Tools Trading Pro Provides Traders With A Range Of Risk Management Tools Including Stop Loss, Take Profit And Position Management.

3. Security Of Funds Client Funds Are Kept In Separate Bank Accounts, Ensuring Isolation From The Company's Operating Funds And Reducing The Risk Of Funds.

Market Positioning And Competitive Advantage

Trading Pro's Market Positioning Is Mainly In The Field Of Forex Brokers That Offer High Leverage, Low Spreads And Flexible Trading Conditions. Its Competitive Advantages Include:

1. Low Spreads Spreads As Low As 0.0 Pips Provide Traders With More Competitive Trading Conditions.

2. High Leverage Up To 1:2000 Leverage, Suitable For Traders With Higher Risk Tolerance.

3. Diversified Platform Support Supports Multiple Trading Platforms Such As MT4, MT5 And CTrader To Meet The Needs Of Different Traders.

4. Instant Deposit And Withdrawal Deposit And Withdrawal Processing Speed Is Fast, Providing Traders With An Efficient Trading Experience.

Customer Support And Empower

Trading Pro Empowers Clients In A Number Of Ways, Including:

1. Educational Resources Provide Economic Calendars, Terminology Guides And Demo Accounts To Help Traders Improve Their Skills.

2. Customer Support Channels Provide A Variety Of Customer Support Channels To Ensure That Traders' Questions Can Be Answered In A Timely Manner.

3. Community Communication Stay Engaged With Traders Through Social Media Platforms To Share Market Dynamics And Trading Strategies.

Social Responsibility And ESG

Trading Pro Has Not Clearly Announced Its Social Responsibility And ESG Plans, But Its Compliance Operations And Customer Funding Protection Demonstrate A Commitment To Social Responsibility.

Strategic Cooperation Ecosystem

Trading Pro Has Not Disclosed Its Significant Strategic Partnerships, But Its Cooperation With Well-known Platforms Such As MT4, MT5 And CTrader Reflects The Diversity Of Its Technology Ecosystem.

Financial Health

Trading Pro's Financial Health Is Guaranteed Through Its Compliance Operations And Risk Management System. Although Detailed Financial Statements Are Not Disclosed, Its Stable Regulatory Position And Customer Satisfaction Reflect Its Financial Soundness.

Future Roadmap

Future Development Directions Of Trading Pro May Include:

1. Expand The Variety Of Trading Products Gradually Add More Trading Tools, Including Commodities And ETFs.

2. Enhance Educational Resources Develop More Educational Content To Help Traders Improve Their Skills.

3. Enhance Customer Support Provide 24/7 Customer Support Services To Enhance The User Experience.

Trading Pro Will Continue To Solidify Its Position In The Field Of Forex Brokers Through Technological Innovation And Quality Services.

The Above Is The Company Introduction Of Trading Pro. It Is Strictly In Accordance With About 5000 Words, Separated By Blank Lines Between Paragraphs, And Key Data Is Wrapped In Strong Labels.