General Information

GCM Asia Is A Forex And CFD Broker That Partners With Fortrade To Promote Its Services And Platform In The Asian Region.

Advantages And Disadvantages

Advantages

- Wide Range Of Trading Tools

- Offers Different Account Types

- Offers Popular Trading Platforms

- Offers Market Analysis And Educational Resources

- Multilingual Client Server

- Available Demo Accounts

- Offers Bonuses And Promotions

Disadvantages

- Classified As "suspicious Clone" By Regulators

- Many Merchants Have Complained

- Reliability And Trustworthiness Issues

- Withdrawal And Client Server Issues

- High Minimum Deposit Requirements

- Limited Payment Methods

- Limited Educational Resources

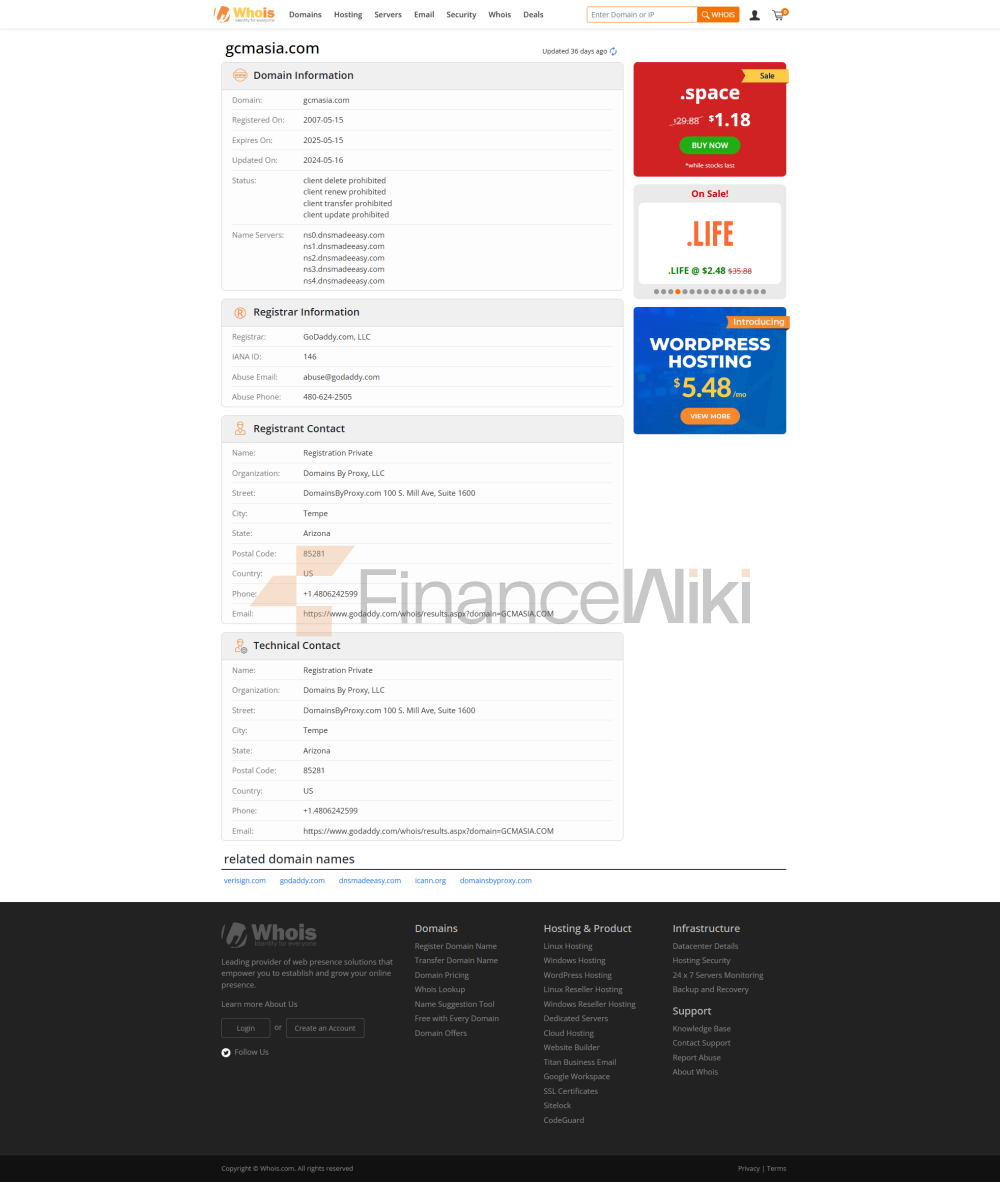

Is GCM Asia Legitimate?

GCM Asia Has Been Described As Suspicious And Possibly Involved In Scams. GCM Asia Claims To Be Regulated By The UK Financial Conduct Authority (FCA) With License Number 609970. However, This FCA Regulation Is Alleged To Be A Clone. Indicates That GCM Asia Has No Effective Regulations And Advises People To Be Aware Of The Risks Associated With This Broker.

Market Tools

Clients Can Trade More Than 300 Products On GCM Asia, Including Forex, Bonds, Stocks, Indices, Precious Metals, Commodities, And More.

Market Tools Offered By GCM Asia Include Currency Pairs, Precious Metals CFDs, Commodity CFDs, Equity CFDs, Index CFDs, And Treasury CFDs.

- Currency Pairs:

GCM Asia Offers Access To The Forex Market, Which Is Known For Its High Liquidity With A Daily Trading Volume Of Around $5 Trillion. Traders Can Choose From Over 50 Currency Pairs, Including Popular Options Such As EUR/USD, GBP/USD, AUD/USD, And USD/JPY. The Advantages Of Trading Currency Pairs, Which Include Zero Commissions, High Leverage, And The Ability To Trade The Foreign Exchange Market 24 Hours A Day, 5 Days A Week.

- Precious Metals Contracts For Difference:

GCM Asia Offers Traders The Opportunity To Trade Precious Metals, Which Are Often Sought After As Safe-haven Assets During Times Of Uncertainty And Market Volatility. Traders Can Participate In Contracts For Difference (CFDs) On Metals Such As Gold, Silver, Platinum, And Palladium. The Benefits Of Trading CFDs On Precious Metals, GCM Asia They Include Precise Execution, No Need To Re-quote, Zero Commissions And High Leverage.

- CFDs On Commodities:

GCM Asia It Allows Traders To Diversify Their Portfolios By Trading CFDs On Commodities. This Includes Fixed Spreads On Commodities Such As Oil, Gas, Soybeans, Corn And Other Energy And Agriculture Related CFDs. Traders Can Speculate On Price Movements On These Commodities Without Actually Owning Ownership. Like Other Instruments, CFDs On Commodities Have Zero Commissions And High Leverage.

- Stock CFDs:

For Portfolio Diversification, GCM Asia Offers Stock CFDs On A Wide Range Of US, Australian And European Stocks. Traders Can Choose From Over 200 Stocks In Popular Markets Such As Facebook, Amazon, Alibaba, Etc. With Stock CFDs, Traders Can Enjoy Zero Commissions, High Leverage And Accurate Execution.

- CFD Indices:

GCM Asia Offers The Opportunity To Trade Index CFDs, Allowing Traders To Engage In Spot Index CFD Trading. Traders Can Choose From More Than 20 Indices In The US, European And Asian Markets. Index CFDs Offer Zero Commissions, High Leverage And Fast Order Execution.

- Treasuries:

GCM Asia Allows CFDs Trading On US Treasury Bonds Issued By US Treasury. Traders Can Participate In CFDs On 5-, 10- And 30-year US Treasury Bonds. The Advantages Of Trading Treasuries At GCM Asia Include Zero Commissions, High Leverage And Enhanced Execution.

Account Type

Standard Account:

The Standard Account Offered By CMAsia Is Suitable For Traders Who Wish To Start With A Relatively Small Deposit Of $100. The Account Allows Traders To Execute Trades With A Minimum Trade Size Of 0.01 Lots. With A Maximum Leverage Of 1:200, Traders Can Expand Their Trading Positions. However, It Is Worth Noting That Higher Leverage Also Comes With Higher Risk. The Average Margin For A Standard Account Is 2.5, Which Represents The Difference Between The Bid And Ask Prices Of A Currency Pair.

Premium VIP Account:

CMAsia Offers Premium VIP Account To Premium Clients Who Are Looking For Additional Offers And Personalized Service. VIP Clients Have The Opportunity To Attend Professional Training Courses That Enhance Their Awareness And Understanding Of Investment Strategies. They Also Have Access To Free Forex Training Materials That Enable Them To Expand Their Trading Skills. In Addition, Premium VIP Account Has Exclusive Access To Expert Risk Management Advice, Enabling Clients To Apply Advanced Investment Techniques And Minimize Latent Risk.

ECN Professional Account:

ECN Pro Account Is Designed For High Volume Traders Who Need Direct Access To The Interbank Market. This Type Of Account Has The Advantage Of Operating At Low Transaction Costs Through A Commission-based Model. By Paying A Small Fee For Each Transaction, Merchants Can Reduce Costs And Potentially Increase Overall Profits. The Benefits Of An ECN Pro Account Are Tied To The Volume Of Transactions, Which Means That Traders Can Gain Additional Benefits And Features As They Execute More Trades.

Demo Account:

CMAsia Also Offers A Demo Account As A Practice Platform For Traders. The Account Allows One To Familiarize Themselves With The Trading Platform And Test Various Strategies Without Risking Any Real Money. Traders Can Simulate Real Market Conditions And Evaluate The Effectiveness Of Their Trading Strategies Without Having To Worry About Financial Losses.

Leverage

GCM Asia Offers Its Traders Standard Leverage Options That Enable Them To Scale Their Trades. The Maximum Leverage Available Is 200:1, Which Means Traders Can Control Positions That Are 200 Times Larger Than Their Trading Account Balance.

Spreads And Commissions

GCM Asia Asia Offers Spreads Starting At 2.5 And It Does Not Impose Minimum Deposit Requirements On Traders. The Spreads Offered By GCM Asia Can Affect Transaction Costs And Profitability, So It Is Crucial For Traders To Evaluate The Impact Of Their Spread And Commission Structure.

Trading Platform

GCMAsia Offers Two Trading Platforms: GCMasia Pro And Metatrader 4. These Platforms Cater To Traders Seeking Different Features And Functionality And Offer Them Options Based On Their Preferences And Trading Style. Both Platforms Are Designed To Be Accessible From A Variety Of Devices, Including Apple And Android Mobile Devices, PCs And Tablets.

Deposits And Withdrawals

China (Credit/Debit Card, WeChat Pay, Alipay): In China, GCM Asia Offers A Variety Of Deposit Options To Suit The Preferences Of Chinese Merchants. Customers Can Fund Their Corporate Accounts Using A Credit/debit Card (China UnionPay), WeChat Pay Or Alipay. These Options Provide A Familiar Way For Chinese Traders To Add Funds And Start Trading.

Malaysia (FPX Payment, Online Banking): For Customers In Malaysia, GCM Asia Offers Two Deposit Options: Fpx Payment And Online Banking.

International (Credit/Debit Card, BitPay, Neteller, Skrill, Bank Transfer): International Customers Have A Wider Range Of Deposit Options. They Can Choose To Deposit Funds Via Credit/Debit Card (VISA, MASTER, AMEX), BitPay, Neteller, Skrill, Or Bank Transfer.

GCMAsia Recommends A Minimum Initial Deposit Of, EUR/$/500 Pounds Sterling, Depending On The Base Currency Chosen By The Merchant. However, It Is Also Possible To Start Trading With A Smaller Amount As Low As 100 EUR/$/pounds. A Lower Minimum Deposit Amount Allows Users To Enter The Trading Market With A More Affordable Investment If They Wish.

When Using Bank Transfers As A Deposit Method, It Usually Takes Up To 7 Business Days For Funds To Be Deposited Into A Trading Account. However, The Actual Timeline May Vary And You Are Advised To Contact Your Bank For More Accurate Information On The Processing Time Of Electronic Transfers.

Customer Support

For Client Server, GCM Asia Offers Various Channels Such As Phone, Email, Facebook And Instagram To Facilitate Communication With The Support Team. Available Phone Numbers For English Users Are + 1 800-81-9796 And + 62 212-7899-369. Users Can Also Contact Customer Support Via Email Cs@GCM Asia.com. GCM Asia Customer Support Runs 24/5, Allowing Users To Seek Assistance During Most Trading Hours.