Corporate Profile

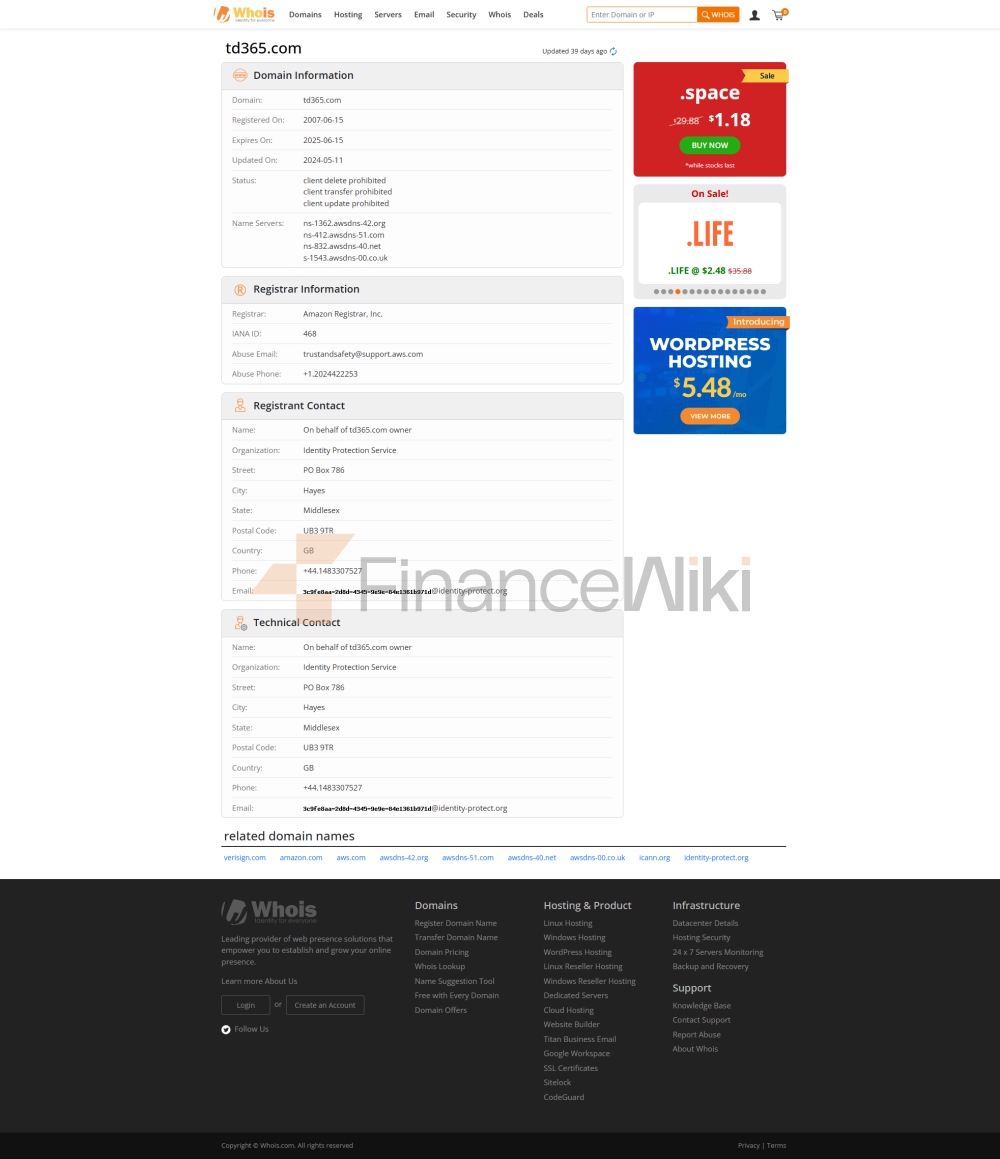

TD365 Is An Online Forex Broker Registered In The Bahamas, Established In 2021. Although The Company Allows Clients To Trade A Wide Range Of Financial Instruments, Including Currency Pairs, Indices, Commodities, Metals, Energy, Cryptocurrencies And Stocks, It Has Less Than Two Years Of Operating History And Currently Does Not Have A Valid Regulatory License. This May Pose A Latent Risk To Traders And Requires Careful Consideration.

Regulatory Information

TD365 Has Not Yet Obtained Any Valid Regulatory Licenses, Which Means That Its Operations Are Not Subject To The Supervision Of The Relevant Financial Regulators. Depending On The Legal Environment In The Bahamas, Brokers May Be Required To Comply With Local Regulations, But There Is Currently No Clear Regulatory Information Available. This Can Be A Major Concern For Traders Seeking A High Degree Of Regulatory Protection.

Trading Products

TD365 Offers A Wide Range Of Trading Products Including:

- Currency Pairs : E.g. EUR/USD

- Index : E.g. UK 100, Germany 40

- Commodities : Includes Gold, Silver, Etc

- Metals

- Energy

- Cryptocurrencies

- Stocks

These Products Are Able To Meet The Needs Of Different Traders, Especially In Terms Of Trading Diversity.

Trading Software

TD365 Offers The Following Trading End Points:

- MetaTrader4 (MT4) : This Is The World's Leading Forex Trading Platform That Supports Numerous Trading Tools And Chart Analysis Functions.

- CloudTrade : A Cloud-based Trading Platform That Supports Trading Of Indices, Commodities, Stocks And Foreign Exchange.

Currently, TD365 Does Not Offer The MetaTrader5 (MT5) Platform, Which May Pose Certain Restrictions On Its Services.

Deposit And Withdrawal Methods

TD365 Allows Customers To Access Funds In The Following Ways:

- Bank Transfer

- Credit Card

However, TD365 Does Not Provide Detailed Information On Deposit And Withdrawal Fees, Processing Times, And Arrival Times. This Lack Of Transparency May Affect Traders' Trust.

Customer Support

Customer Support Information For TD365 Is As Follows:

- Language : English

- Service Hours : 24/5 (5 Days A Week, 24 Hours A Day)

- Contact :

- Email: Support@TD365.com

- Tel: + 44 203 180 5566

- Address : First Floor, Bay View Room, 308 East Bay Street, Nassau, Bahamas

Although The Support Channels Are Comprehensive, The 24/5 Service Hours May Not Be Sufficient To Meet The Needs Of All Traders, Especially During Weekends When Immediate Assistance May Not Be Available.

Core Business And Services

TD365's Core Services Include:

- Multiple Trading Instruments : Covers Currency Pairs, Indices, Commodities, Cryptocurrencies And Stocks, Etc.

- Fixed Spreads : For Example, EUR/USD Has A Spread Of 0.6 Pips And UK 100 Is 0.4 Pips.

- Leverage : Provides Leverage Up To 1:200, Which Can Meet The Needs Of Traders To A Certain Extent, But TD365's Leverage Level Is Relatively Conservative Compared To 1:500 Or Higher Leverage In The Industry.

- Zero Minimum Deposit : Clients Can Start Trading With A Minimum Deposit Of $0, Which Is Especially Beginner Friendly.

Technical Infrastructure

TD365's Technical Infrastructure Relies Mainly On Its Choice Of Trading Platforms, Including MT4 And CloudTrade. MT4, As One Of The Most Popular Trading Platforms In The World, Has Powerful Features And An Extensive Support Community, While CloudTrade Offers A Cloud-based Solution With Some Flexibility And Customizability. However, TD365 Does Not Yet Offer The MT5 Platform, Which May Limit Its Technical Competitiveness.

Compliance And Risk Control System

TD365 Does Not Currently Have Any Valid Regulatory Licenses And Does Not Explicitly Mention Its Risk Management Or Compliance System. This Could Pose A Challenge To Its Reputation And Credibility, Especially With Regard To Traders' Concerns About The Safety And Transparency Of Their Funds.

Market Positioning And Competitive Advantage

- Market Positioning : TD365 Is Positioned To Provide A Diverse Range Of Trading Tools And A Flexible Trading Platform To A Broad Group Of Traders.

- Competitive Advantage :

- Offers A Wide Range Of Trading Tools Covering Multiple Asset Classes.

- The Policy Of Fixed Spreads And Zero Minimum Deposits Is Attractive To Beginners And Small Amount Traders.

- Offers The MT4 Platform, Which Is One Of The Preferred Tools For Global Traders.

- Competitive Disadvantage :

- Lack Of A Valid Regulatory License, Which May Increase The Risk For Traders.

- No Detailed Deposit And Withdrawal Policy, Low Transparency.

- No Educational Resources Or Demo Accounts Are Provided, Which May Limit The Growth Of Novice Traders.

Customer Support & Empowerment

TD365 Does Not Currently Offer Educational Resources Such As Video Courses, Seminars Or Trading Guides On Its Website. This May Pose A Certain Barrier For Novice Traders, Making It Difficult To Improve Their Trading Skills And Knowledge. In Addition, TD365 Also Does Not Mention The Provision Of Demo Accounts, Which May Limit The Ability Of Traders To Practice Trading In A Risk-free Environment.

Social Responsibility Vs. ESG

TD365 Has Not Yet Explicitly Mentioned Its Initiatives In Social Responsibility Or ESG (Environmental, Social, Governance). This May Make It Unattractive Among Traders Who Are Focused On Corporate Social Responsibility.

Strategic Cooperation Ecology

TD365 Has Not Disclosed Any Major Strategic Collaborations Or Industry Awards At This Time. This May Have Some Impact On Its Visibility And Credibility In The Market.

Financial Health

TD365 Has Not Disclosed Its Financial Position, Including Key Metrics Such As Management Size, Revenue, Profit, Etc. This May Make It Difficult For Traders To Evaluate Its Financial Soundness.

Future Roadmap

TD365 Has Not Yet Announced Its Future Development Plan Or Roadmap. This Could Make Its Long-term Prospects In The Market Uncertain.