Corporate Profile

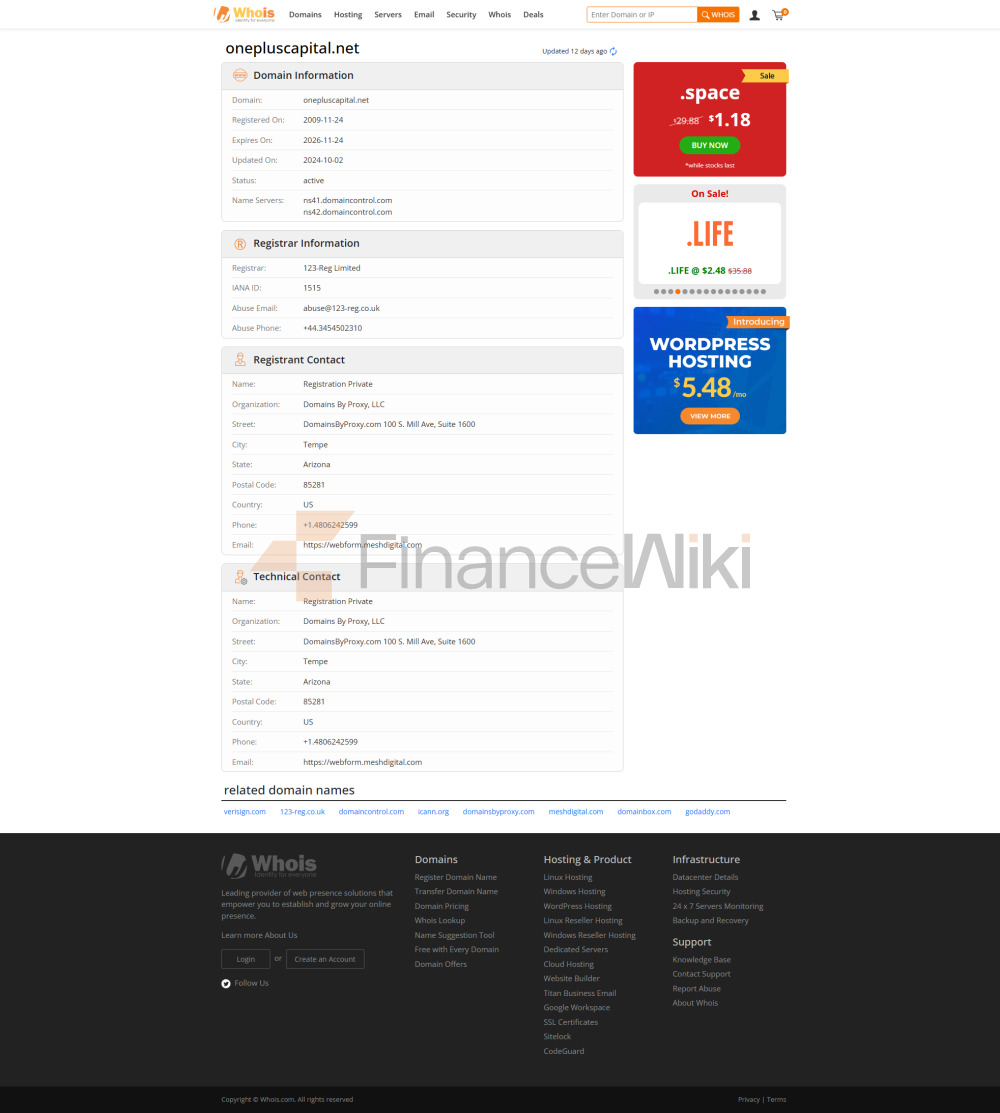

One Plus Capital Is A Financial Company Registered In Cyprus, Established In 2010 And Headquartered In Nicosia. As A Member Of Oneworld Group , The Company Focuses On Providing Comprehensive Investment And Financial Services To High Net Worth Individuals And Corporate Clients. Its Business Scope Includes Portfolio Management, Investment Consulting, Provident Fund Solutions, Brokerage, Corporate Finance, Custody And Custody And Other Services. The Company Helps Clients Achieve Asset Appreciation With Its Open-architecture Investment Management Approach And Diverse Selection Of Financial Instruments.

Regulatory Information

One Plus Capital Limited Is Regulated By The Cyprus Securities And Exchange Commission ( CySEC ) With License Number 111/10 And Operates As A Cyprus Investment Company. This Regulatory Qualification Ensures Compliance And Transparency In The Company's Operations, Providing Legal Safeguards For The Safety Of Clients' Funds. CySEC's Regulatory Framework Requires The Company To Follow Strict Standards Of Capital Adequacy, Risk Management And Client Protection, Further Enhancing Client Trust.

Trading Products

One Plus Capital Offers Clients A Wide Selection Of Financial Instruments Covering The Following Asset Classes:

- Forex (Forex) : Offers Trading Services In Nearly 120 Currency Pairs.

- Contracts For Difference (CFDs) : Supports Trading In Nearly 3,000 Assets, Including Stocks, Indices, Commodities And Cryptocurrencies.

- Exchange Traded Funds (ETFs) : Offers A Diverse Range Of ETF Products To Help Clients Track Market Indices Or Sector-specific Performance.

- Stocks And Bonds : Clients Can Trade Stocks And Bonds In Major Global Stock Markets Through The Company's Platform.

Trading Software

Although The Company's Website Does Not Explicitly Mention Specific Trading Software, Based On Industry Standards, One Plus Capital May Support Popular Platforms Such As MetaTrader 4 (MT4) And MetaTrader 5 (MT5) . Known For Their Powerful Analytical Tools, Charting Capabilities, And Automated Trading Such As Trading Robots, These Platforms Are Able To Meet The Needs Of Different Traders.

Deposit And Withdrawal Methods

One Plus Capital Does Not Specify The Specific Methods Of Deposit And Withdrawal On Its Official Website, Which May Be Due To The Lack Of Account Info Or Part Of Privacy Protection. However, Based On Industry Practice, The Company May Support The Following Deposit And Withdrawal Methods:

- Bank Transfer : Deposit And Withdrawal Operations Directly From The Customer's Bank Account.

- Electronic Wallet : Fast Deposit And Withdrawal Through Mainstream E-wallet Services Such As Neteller, Skrill.

- Credit/Debit Card : Supports Common Payment Methods Such As Visa And MasterCard.

Customer Support

One Plus Capital Provides A Variety Of Customer Support Channels To Ensure That Customers Can Get Help In A Timely Manner:

- Live Chat : Through The Live Chat Function Of The Official Website, Customers Can Instantly Contact The Support Team.

- Email : Customers Can Send Inquiries Or Support Requests Through The Mailbox Info@onepluscapital.net .

- Phone : During Business Hours, Customers Can Contact The Support Team At + 357 22 873760 .

- Fax : For Customers Who Need Fax Communication, The Company Provides The Fax Number Of + 357 22 873889 .

- Social Media : One Plus Capital Is Active On Facebook And LinkedIn , Through Which Customers Can Interact With The Company And Access The Latest Market Information.

Core Business & Services

One Plus Capital's Core Business Includes:

- Portfolio Management : Constructs A Customized Portfolio Based On The Client's Financial Objectives, Risk Tolerance And Investment Horizon, And Regularly Monitors And Adjusts To Ensure Optimal Performance.

- Investment Consulting : Provides Personalized Investment Strategy Advice Covering Wealth Management, Market Analysis And Risk Management.

- Provident Fund Solutions : Provides Multi-employer Provident Fund Schemes For Private Sector Employees To Help Clients Optimize Provident Fund Performance.

- Brokerage : Provides Clients With Trading Services In Global Equity Markets And Provides Market Information And Analytical Support.

- Corporate Finance : Assists Companies In Formulating Financing Plans, Including Operational Financing, Hedging Solutions And Asset Restructuring, Etc.

- Custody And Custody Services : Provides Secure Storage And Efficient Management Of Investment Positions, Including The Collection Of Dividends And Income, And Proxy Voting Services.

Technical Infrastructure

One Plus Capital's Technical Infrastructure Supports Its Diverse Range Of Products And Services. Although The Company Does Not Disclose Technical Details In Detail, It Can Be Inferred That It Has Adopted The Following Technical Solutions:

- Straight-through Processing (STP) : As An STP Broker, One Plus Capital Passes Client Orders Directly To Liquidity Providers, Ensuring Transparency And Efficiency Of Transactions.

- Low Latency Trading : With Optimized Network And Server Configurations, The Company Is Able To Provide Clients With Fast Trade Execution And Market Quote Updates.

- Security Measures : The Company Employs Multi-layered Security Measures Including Data Encryption, Firewalls And Intrusion Detection Systems To Protect Customer Information And Transaction Security.

Compliance And Risk Control System

One Plus Capital Excels In Compliance And Risk Management System:

- CySEC Regulation : As A CySEC Regulated Company, One Plus Capital Is Subject To Strict Compliance Requirements Including Capital Adequacy, Segregation Of Customer Funds And Risk Management Measures.

- Risk Management System : The Company Adopts The AIoT Risk Control System (i.e. The Risk Management Technology Combined With Artificial Intelligence And The Internet Of Things) To Identify And Avoid Latent Risks Through Real-time Monitoring And Data Analytics. The Application Scenarios Of The System Include The Management Of Market Volatility, Liquidity Risk And Operational Risk.

- Customer Funds Protection : Customer Funds Are Strictly Isolated From The Company's Equity Funds And Stored In Separate Bank Accounts To Ensure That Customer Funds Are Not Affected In The Event Of Financial Problems In The Company.

Market Positioning And Competitive Advantage

One Plus Capital Has The Following Competitive Advantages In The Market:

- Open Architecture Approach : Working With Multiple Brokers, The Firm Is Able To Give Clients Access To A Wide Range Of Financial Instruments And Markets, Providing Greater Investment Flexibility.

- Customized Services : Highly Personalized Investment Solutions And Services Tailored To The Needs Of High Net Worth Clients And Businesses.

- Diversified Range Of Services : From Investment Management To Corporate Finance, One Plus Capital Provides Clients With A Full Stack Of Financial Services To Meet Their Comprehensive Financial Needs.

Customer Support And Empowerment

One Plus Capital Supports And Empowers Clients In A Number Of Ways:

- Educational Resources : The Company May Provide Online Educational Resources To Help Clients Improve Their Investment Knowledge And Trading Skills.

- Market Analysis : Provide Decision Support To Clients Through Professional Market Analysis And Research Reports.

- Trading Tools : Provide Advanced Trading Tools And Platforms To Help Clients Execute Their Trading Strategies More Effectively.

Social Responsibility And ESG

One Plus Capital Excels In Social Responsibility And ESG (environmental, Social, Governance):

- Corporate Social Responsibility : The Company Participates In Community Development Projects And Supports Education, Health And Environmental Causes.

- Sustainable Investing : Helps Clients Integrate Sustainability Goals Into Their Portfolios By Offering ESG Investment Products.

Strategic Collaboration Ecosystem

One Plus Capital Further Expands Its Service Network By Establishing Strategic Partnerships With Several Financial Institution Groups And Industry Partners. These Partnerships Include:

- Liquidity Providers : Partnering With Leading Global Liquidity Providers To Ensure Clients Orders Can Be Executed At The Best Price.

- Technology Partners : Works With Technology Solution Providers To Optimize The Performance Of Their Trading Platforms And Risk Management Systems.

Financial Health

As Of 2023Q3, One Plus Capital Is Financially Sound:

- Capital Adequacy : Meets CySEC's High Standards To Ensure The Company's Financial Stability And The Safety Of Client Funds.

- Management Scale : The Company Manages Assets Of More Than 1 Billion USD , Showing Its Strong Performance In The Market And Customer Trust.

Future Roadmap

One Plus Capital Plans To Further Expand Its Business And Market Influence In The Future:

- Global Layout : Plans To Establish Branches In Emerging Markets Such As Asia, The Middle East And Africa To Expand Its Customer Base.

- Technological Innovation : Continues To Invest In Cutting-edge Technologies Such As Artificial Intelligence, Big Data And Blockchain To Optimize Its Services And Customer Experience.

- ESG Integration : Deepens Its Practices In Sustainable Investing And Corporate Social Responsibility To Become A Leader In ESG Investing.