company

profileFull name: AxiTrader Limited

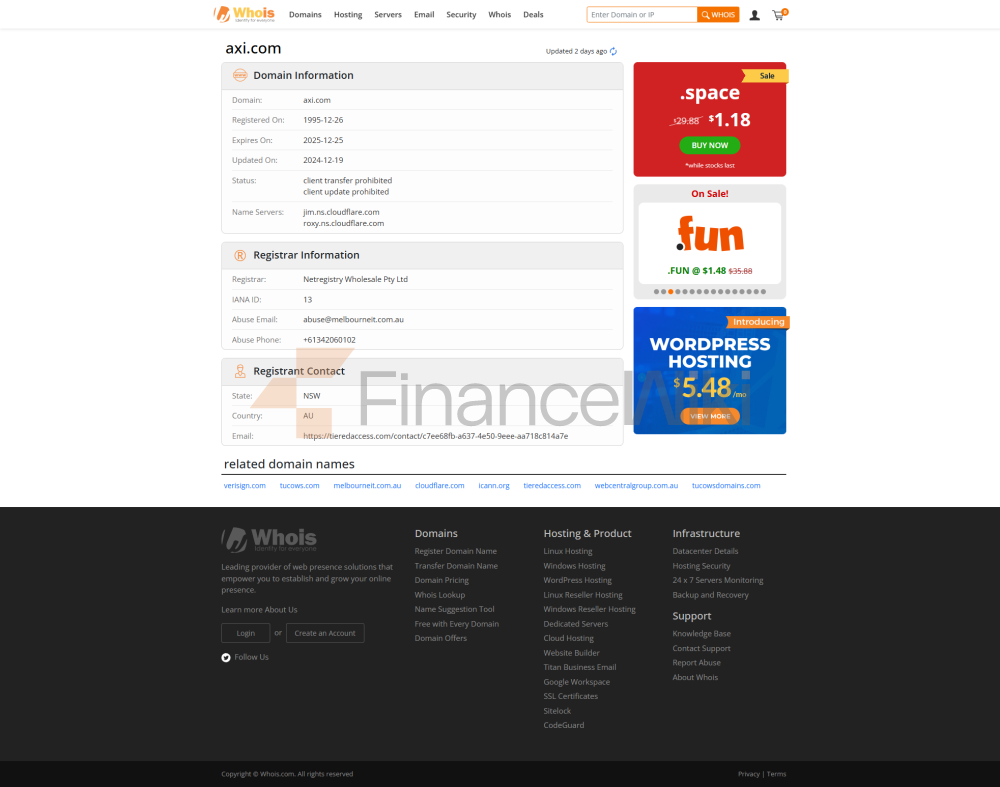

Founded: December 26, 1995Headquarters

Location: Sydney,

AustraliaRegistered Capital: Undisclosed (Capital structure of regulated entity meets regulatory requirements)

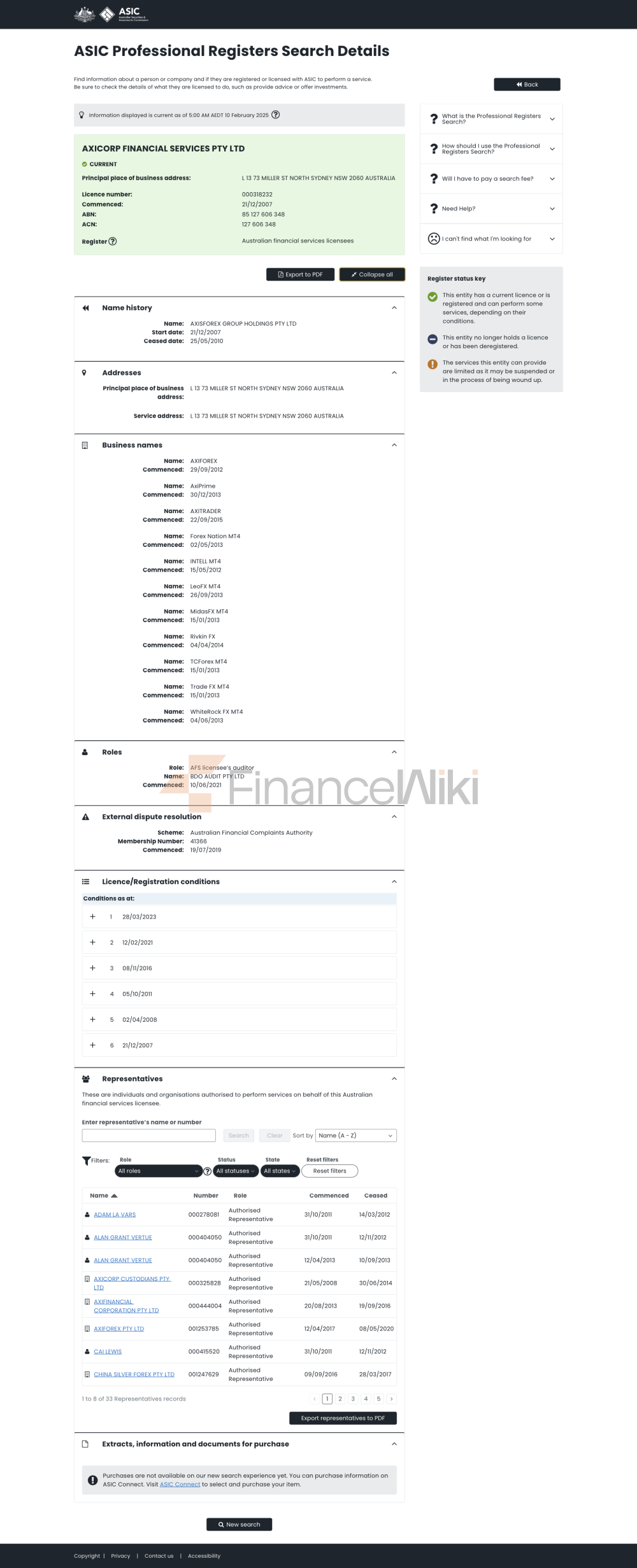

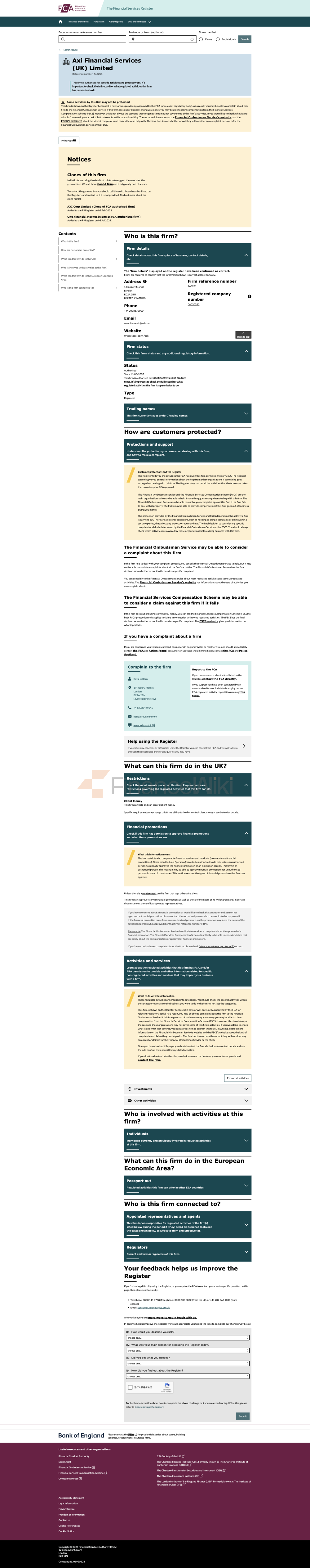

Regulatory License:

- Australian

Securities and Investments Commission (ASIC) License Number: 318232

New Zealand Financial Market Authority (FMA) License Number: 518226

Financial Conduct Authority (FCA) License Number:

466201 Dubai Financial Services Authority (DFSA) Reference Number: F003742

Executive Background: He has extensive industry experience in the areas of financial services, technology development and market operations.

Advisory Team: Composed of world-renowned financial experts and market analysts, providing strategic guidance and market insights.

Members of industry associations: Member of the Australian Securities and Investments Commission, member of the New Zealand Financial Market Authority, member of the Financial Conduct Authority of the United Kingdom, etc.

Compliance Statement: AxiTrader strictly adheres to international regulatory standards to ensure transparency and compliance, providing clients with a safe and secure trading environment.

core business

main business areas: Provide CFD trading services for foreign exchange, stocks, indices, commodities, initial public offerings (IPOs) and cryptocurrencies.

Target Audience: For retail traders and institutional investors, including novice and experienced traders.

Technical platform:

MetaTrader 4 (MT4): Works on a wide range of devices, offering real-time prices and advanced analytical tools.

MetaTrader 5 (MT5): Available in select regions, it supports more complex trading strategies and advanced charting features.

Risk management mechanism:

AIoT risk control system: Combines artificial intelligence and Internet of Things technology to monitor market fluctuations and abnormal trading behaviors in real time to ensure transaction security.

Leverage control: The maximum leverage ratio is 500:1, which is dynamically adjusted according to the customer's risk tolerance.

trading

productsAxiTrader offers more than 260 trading instruments in the following categories:

Forex: This includes major currency pairs (e.g. EUR/USD, GBP/USD) and emerging market currency pairs.

Stocks: Offers stock trading of globally renowned companies such as Apple, Microsoft, etc.

Indices: Includes the Dow Jones Industrial Average, NASDAQ, etc.

Commodities: CFD trading on gold, crude oil, silver and other commodities is available.

Cryptocurrencies: Includes mainstream cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), etc.

Initial Public Offering (IPO): Offering clients the opportunity to participate in the subscription of new shares.

trading software

MetaTrader 4 (MT4): for Windows, Mac, iOS and Android systems, support real-time trading and a variety of technical indicators.

MetaTrader 5 (MT5): Offers more advanced charting features and strategy tester tools, currently available in select regions.

deposit and withdrawal

methodsAxiTrader offers a variety of deposit and withdrawal methods, including:

credit/debit cards: Visa and MasterCard.

Bank Transfers: International and local bank transfers are supported.

Cryptocurrencies: These include Bitcoin (BTC) and Ethereum (ETH).

E-wallets: Skrill, Neteller, Fasapay, etc.

There are no fees for all deposit and withdrawal methods, but international bank transfers may incur additional fees that will be charged by the bank.

customer

supportAxiTrader offers 24/5 multilingual customer support, including English, Chinese, Spanish, and more. Customers can get help via phone, email, and online chat.

Core Business & Services

Capital Allocation Plan: AxiSelect provides up to $1,000,000 in funding to potential traders to help them grow their trades.

Demo Trading Account: Offers 30 days of free demo trading to support clients to practice their trading strategies.

technical

infrastructureAxiTrader uses an ECN execution model to ensure direct access to the market and avoid middleman intervention.

MT4 NexGen Platform: Provides a low-latency, high-stability trading environment.

Virtual Private Server (VPS): A dedicated server for advanced traders to ensure the stability of trade execution.

Compliance & Risk Control

SystemRegulatory Compliance: AxiTrader is supervised by a number of international regulatory bodies to ensure transparency in operations and the safety of client funds.

Capital allocation: Continuously optimize the capital structure to ensure liquidity and solvency.

Risk Management: Adopt multiple risk management mechanisms, including comprehensive monitoring of market risk, operational risk and credit risk.

Market Positioning & Competitive

AdvantageAxiTrader is the platform of choice for traders around the world with its wide range of trading products, powerful technology platform and flexible account settings.

Customer Support & Enablement

Resources: A wealth of learning resources are available, including video tutorials, eBooks, and market analysis reports.

Client Activities: Regularly hold trading competitions and market seminars to enhance clients' trading skills.

Social Responsibility and ESG

AxiTrader actively fulfills its corporate social responsibility and supports educational, environmental and community development projects.

Strategic Cooperation

EcosystemAxiTrader has established strategic partnerships with a number of well-known financial institutions and technology platforms to further expand its service scope and market influence.

Financial

HealthFinancial Condition: As of the third quarter of 2023, AxiTrader is in a strong financial position with a capital adequacy ratio in line with regulatory requirements.

future roadmap

AxiTrader plans to further expand its product line in the future, improve the performance of the technology platform, and deepen its presence in emerging markets.

Serious Slippage

Serious Slippage