Basic Information & Regulators

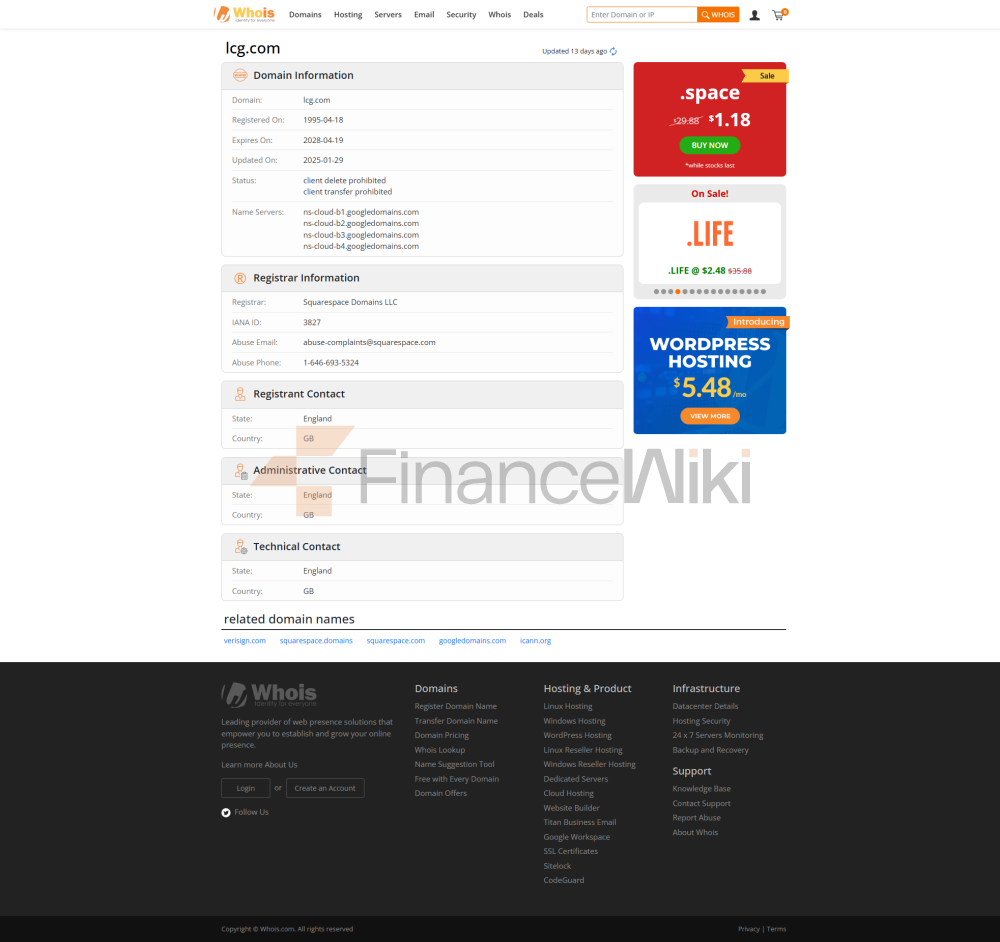

London Capital Group Was Established In 1996 And Is Headquartered In London, United Kingdom. It Has Been An Online Trading Provider For More Than Two Decades, Dedicated To Providing Competitive Prices, Advanced Technology And Professional Services To All Types Of Investors. Regarding Regulation, London Capital Is, Authorized And Regulated By The Financial Conduct Authority (FCA) Under The Regulatory License: 182110.

Security Analysis

The Company Is Regulated By Only One Single As Well As The Regulator - The Financial Conduct Authority (FCA) In The United Kingdom.

Main Business

LCG Provides Investors With 7000 Financial Trading Instruments Across 8 Major Asset Classes, Including Foreign Exchange, Indices, Commodities, Stocks, Bonds & Interest Rates, Common Options, Exchange Funds. Forex Products Have CFDs In More Than 60 Currencies, And Popular Varieties In Markets Such As Europe, America, British Pound And British Pound Are Readily Available. Commodities Include Precious Metals Such As Gold And Silver, Energy Such As US Crude Oil And Brent Crude Oil, Soft Commodities Such As Coffee And Sugar. Stocks Cover 3,500 Stocks In The UK, US And European Markets.

Accounts & Leverage

LCG Has Set Up Islamic Accounts And ECN Accounts. Islamic Accounts Are Called Interest-free Accounts, Meaning There Is No Overnight Or Rollover Interest On Positions Held. LGG Offers Interest-free Accounts For Traders Who Believe In Islam. The Minimum Deposit For ECN Accounts Is $10,000. The Company Uses Dynamic Leverage On The Trading Platform To Adjust According To The Size Of The User's Trading Position. As The User's Trading Position Rises, The Maximum Leverage Will Be Reduced Accordingly.

Spreads & Commissions

The Minimum Spread In The Main Foreign Exchange Market Is 1.3 Euros And Pounds, The Minimum Spread In The Special Market Is 3 Pips In Swiss Francs And Yen, The Minimum Spread In The Australian Market Is 2.1 New Zealand Dollars, And The Minimum Spread In The Emerging Market Is 10 Pips Offshore In US Dollars.

The Minimum Spread Is 0.3 For Spot Gold And 0.025 For Spot Silver. The Minimum Spread Is 0.2 For Spot Index Products, 0.3 For Futures Index Products, 3 For Crude Oil Products And 1 For Energy Futures. The Minimum Spread Is 0.6 For Metals Futures And 1 For Soft Commodities. The Minimum Spread Is 2 For Bonds, 2 For Interest Rates And 0.2% For ETFS. Overnight Interest On Foreign Exchange Is Calculated As The Difference Between The Base Interest Rate Of The Denominated Currency Minus The Base Interest Of The Base Currency +/- 1%.

Trading Platform

LCG Trader, LCG's Innovative Multi-asset Trading Platform, Offers A Wide Range Of Market Data, Charts, News And Analysis To Help Investors Build Their Own Trading Strategies And Can Be Used On Laptops, Tablets And Mobile Phones. Clients Can Also Trade On The Popular MetaTrader 4 (MT4) Forex Trading Platform. The Platform Is Available In 39 Languages And Offers A Combination Of Free Indicators, Automated Trading And Advanced Charts As Well As A Range Of Trading Tools, Technical Indicators And Graphical Objects.

Deposit And Withdrawal

LCG Supports Credit Card, Debit Card, Bank Telegraphic Transfer And Online Payment Platform Skrill. Credit Card Deposits Will Be Charged A 2% Processing Fee, And Third-party Deposits Will Not Be Accepted. Withdrawals Are Generally Completed Within One Working Day And Arrive In The User's Bank Account Within 1-5 Days. Overseas Customers Who Use MasterCard Or International Bank Transfer To Deposit Will Be Charged A £20 Processing Fee When Withdrawing.