Corporate Profile

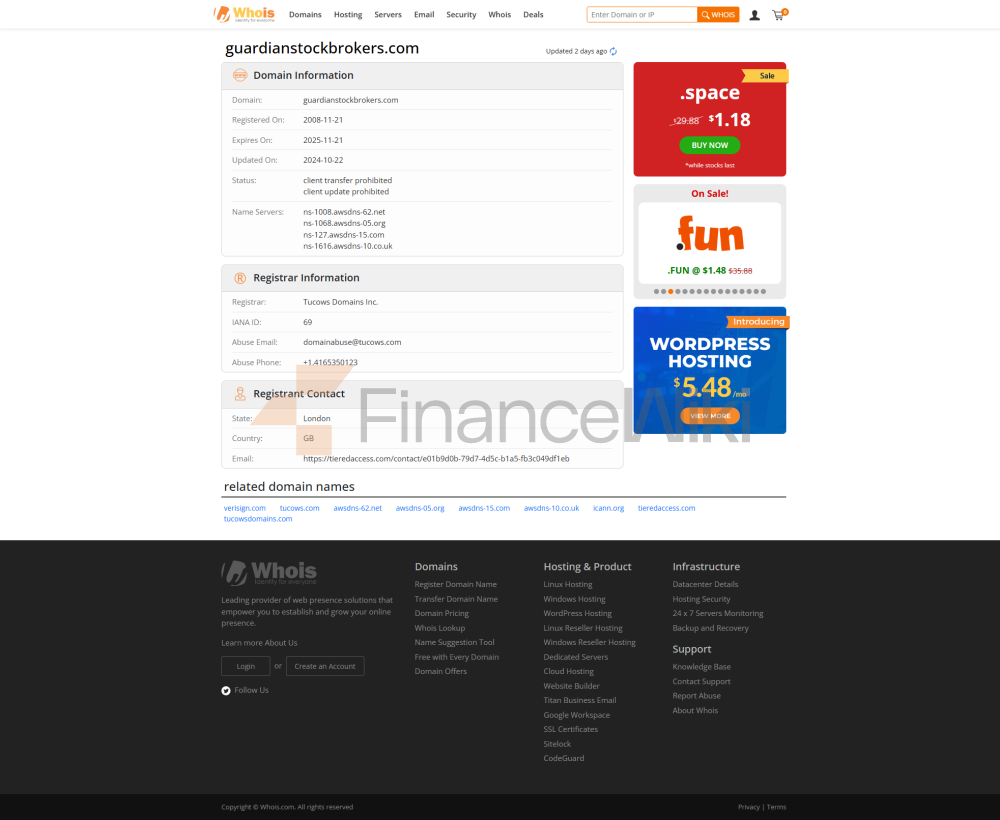

Guardian Stockbrokers Is A Financial Services Provider Headquartered In United Kingdom , Established In 2019 . The Company Is Regulated By The Financial Conduct Authority (FCA) In The United Kingdom With License Number 492519 , But Its Scope Of Operation Has Expanded Beyond The Specific Business Areas Authorized By The FCA. Guardian Stockbrokers Specializes In Providing Clients With Trading Services On A Range Of Financial Derivatives, Including Contracts For Difference (CFDs) And Spread Betting On Markets Such As Forex, Indices, Stocks, Commodities, Bonds, Sectors And Interest Rates. The Company Supports Traders Of Different Experience Levels Through A Diverse Range Of Trading Platforms And Technology Solutions.

Regulatory Information

Guardian Stockbrokers Operates Under The Regulatory Framework Of The Financial Conduct Authority (FCA) In The United Kingdom. The Specific Scope Of Business Is Limited By License Number 492519 . However, The Company Has Been Found To Be Operating Beyond Its Mandate, Particularly In The Investment Advisory Business Related To Foreign Exchange Trading. This Operation Beyond The Mandate May Pose Potential Compliance Risks, And Investors Need To Carefully Evaluate When Choosing This Platform. As The Main Financial Regulator In The United Kingdom, The FCA Is Responsible For Overseeing The Compliance Of Financial Service Providers, Ensuring Their Compliance With Relevant Laws And Regulations And Protecting Consumer Rights.

Trading Products

Guardian Stockbrokers Offers Trading Services For A Wide Range Of Financial Instruments, Covering The Following Major Markets:

- Forex Market: Traders Can Participate In The Trading Of Major Global Currency Pairs, Including EUR/USD (EUR/USD), GBP/USD (GBP/USD), Etc. Stock Index Market: Offers Trading Opportunities On World-renowned Stock Indices, Such As The UK FTSE 100 (FTSE 100), Germany DAX 30 And The US Standard & Poor 500 (S & P 500), Etc.

- Stock Market: Traders Can Trade Thousands Of Stocks Worldwide, Covering Well-known Companies Such As Apple (AAPL), Google (GOOGL), Amazon (AMZN).

- Commodity Market: Offers Trading In Commodities Such As Gold, Silver, Crude Oil (Brent And US Crude).

- Other Markets: Including Bonds, Industry Indices, Interest Rates, Etc.

These Products Offer Traders A Diverse Range Of Investment Options, Allowing Them To Trade Flexibly Based On Market Conditions And Individual Strategies.

Trading Software

Guardian Stockbrokers Offers Clients A Variety Of Trading Platforms To Meet The Needs Of Different Traders:

- Web Platform: Browser-based Trading Interface, No Download Or Installation Required, For Quick-starting Traders.

- Trading App: Available For IOS And Android Devices, Supports Mobile Trading, Provides Real-time Price Data And Analytical Tools.

- MetaTrader 4 (MT4): A Globally Renowned Trading Platform That Supports Advanced Chart Analysis, Automated Trading (via Expert Advisor EA) And Multiple Order Types.

- ProRealTime: An Advanced Platform Focused On Technical Analysis, Providing Real-time Data, Backtesting Capabilities And Trading Signals.

The Diversity And Functionality Of These Platforms Enable Them To Meet The Diverse Needs Of Traders From Beginner To Advanced.

Deposit And Withdrawal Methods

Guardian Stockbrokers Offers Clients A Variety Of Deposit And Withdrawal Methods, Including:

- Bank Transfer: Withdrawal And Withdrawal Of Funds Via British Pound Telegraphic Transfer (CHAPS) Or International Telegraphic Transfer (SWIFT).

- Credit/Debit Cards: Major Credit And Debit Cards Such As Visa And MasterCard Are Supported.

- Electronic Payments: Customers In Some Countries Can Use Local Payment Methods To Complete The Deposit And Withdrawal Of Funds.

The Processing Time And Method Of Deposits And Withdrawals May Vary By Region And The Selected Payment Method. For Specific Information, Please Consult Customer Support.

Customer Support

Guardian Stockbrokers Provides Multi-channel Customer Support Services To Ensure That Customers Can Receive Timely And Effective Assistance During The Transaction Process. Customers Can Contact The Support Team At:

- Tel: 020 7638 6996

- Email: Newaccounts@guardianstockbrokers.com

The Customer Support Team Is Usually Available 24/7 On Weekdays And The Main Language Is English. In Addition, The Company Website Also Provides Detailed Trading Guides, Educational Resources And Frequently Asked Questions (FAQs) To Help Customers Solve Problems On Their Own.

Core Business And Services

Guardian Stockbrokers' Core Business Is To Provide Online Trading Services For Financial Derivatives To Retail Traders. The Company Offers Traders Flexible Investment Options Through Its Diverse Trading Platforms And Extensive Coverage Of Market Instruments. The Following Are The Differentiating Advantages Of The Core Business:

- Extensive Coverage Of Market Instruments: Offers Trading Of Multiple Assets Such As Foreign Exchange, Stock Indices, Stocks, Commodities, Etc.

- Multi-platform Support: Suitable For Traders With Different Trading Styles And Experience Levels.

- Demo Account: New Traders Can Practice Trading Through A Demo Account Without Taking Real Capital Risks.

Technical Infrastructure

Guardian Stockbrokers Relies On Advanced Technical Infrastructure To Support Its Trading Platform And Trading Services. The Company Uses A Stable And Reliable Server And Network Architecture To Ensure Smooth Trade Execution And Low Latency. In Addition, The Use Of Platforms Such As MetaTrader 4 And ProRealTime Further Enhances Traders' Analytical Capabilities And Trading Efficiency.

Compliance And Risk Control System

Guardian Stockbrokers Has Established A Corresponding System In Compliance And Risk Management To Ensure The Safety Of Customer Funds And The Transparency Of Transactions:

- Compliance Statement: The Company Strictly Complies With The Regulatory Requirements Of The UK FCA, Although Its Operation Scope Is Beyond The Scope Of Authorization.

- Risk Management Tools: Offers A Variety Of Risk Management Tools Including Stop Loss Orders, Limit Orders And Margin Management.

- Protection Of Client Funds: Under The Regulatory Requirements Of The FCA, Client Funds Are Kept Segregated From The Company's Working Funds.

However, Due To Its Operating Behavior Beyond The Scope Of Authorization, Investors Still Need To Be Vigilant About Its Latent Risk.

Market Positioning And Competitive Advantage

Guardian Stockbrokers' Market Positioning Is Mainly Aimed At Retail Traders, Especially Investors Who Wish To Participate In The Foreign Exchange, Commodity And Stock Markets. Its Competitive Advantage Is Reflected In The Following Aspects:

- Wide Product Coverage: Offers A Variety Of Financial Instruments To Meet The Investment Needs Of Different Traders.

- Multi-platform Support: Provides A Flexible Trading Environment For Clients With Different Trading Styles.

- Demo Account: Helps New Traders Become Familiar With The Platform And Trading Strategies In A Risk-free Environment.

However, With Operating Actions Beyond The Scope Of Authorization And Potential Trading Costs (spreads, Commissions, Overnight Funding Fees) Are Its Main Disadvantages.

Customer Support And Empowering

Guardian Stockbrokers Empowers Its Clients In A Number Of Ways, Including:

- Educational Resources: Provides Trading Guides, Webinars, And Advanced Analytical Tools To Help Traders Improve Their Skills.

- Regular Market Analysis: Provides Traders With Support In Their Trading Decisions Through Market Reports And Technical Analysis.

- 24/7 Customer Support: Provides Customer Support Services In Multiple Languages During Trading Hours.

Social Responsibility And ESG

Currently, Guardian Stockbrokers Does Not Disclose In Detail Its Social Responsibility And ESG (environmental, Social, Governance) Related Initiatives In Its Public Information. As A Financial Services Provider, It May Be Necessary To Further Strengthen Information Disclosure And Practices In These Areas In The Future.

Strategic Cooperation Ecology

Guardian Stockbrokers' Key Strategic Partners Include Its Technology Platform Providers (such As MetaQuotes And ProRealTime) And Payment Service Providers. In Addition, The Company May Partner With Other Financial Data Analytics Companies To Enhance Its Market Analysis Capabilities.

Financial Health

As Of Now, Guardian Stockbrokers Has Not Disclosed Its Specific Financial Data (such As Revenue, Profit Or Balance Sheet). However, The Fact That It Is Regulated By The FCA Indicates That It Has Certain Capital Strength And Operational Stability.

Future Roadmap

The Future Development Of Guardian Stockbrokers May Focus On The Following Areas:

- Compliance Improvement: Adjust Its Business Operations To Strictly Comply With The Scope Of The FCA's Authorization.

- Product Innovation: Launch More Financial Instruments And Services That Meet Market Demand.

- Technology Upgrade: Further Optimize The Trading Platform And Analytical Tools To Enhance The User Experience.

In Conclusion, Guardian Stockbrokers Offers Traders A Wealth Of Investment Options Through Its Diverse Trading Products And Platforms, But Investors Need To Carefully Evaluate Its Potential Compliance Risks And High Transaction Costs.