Corporate Profile

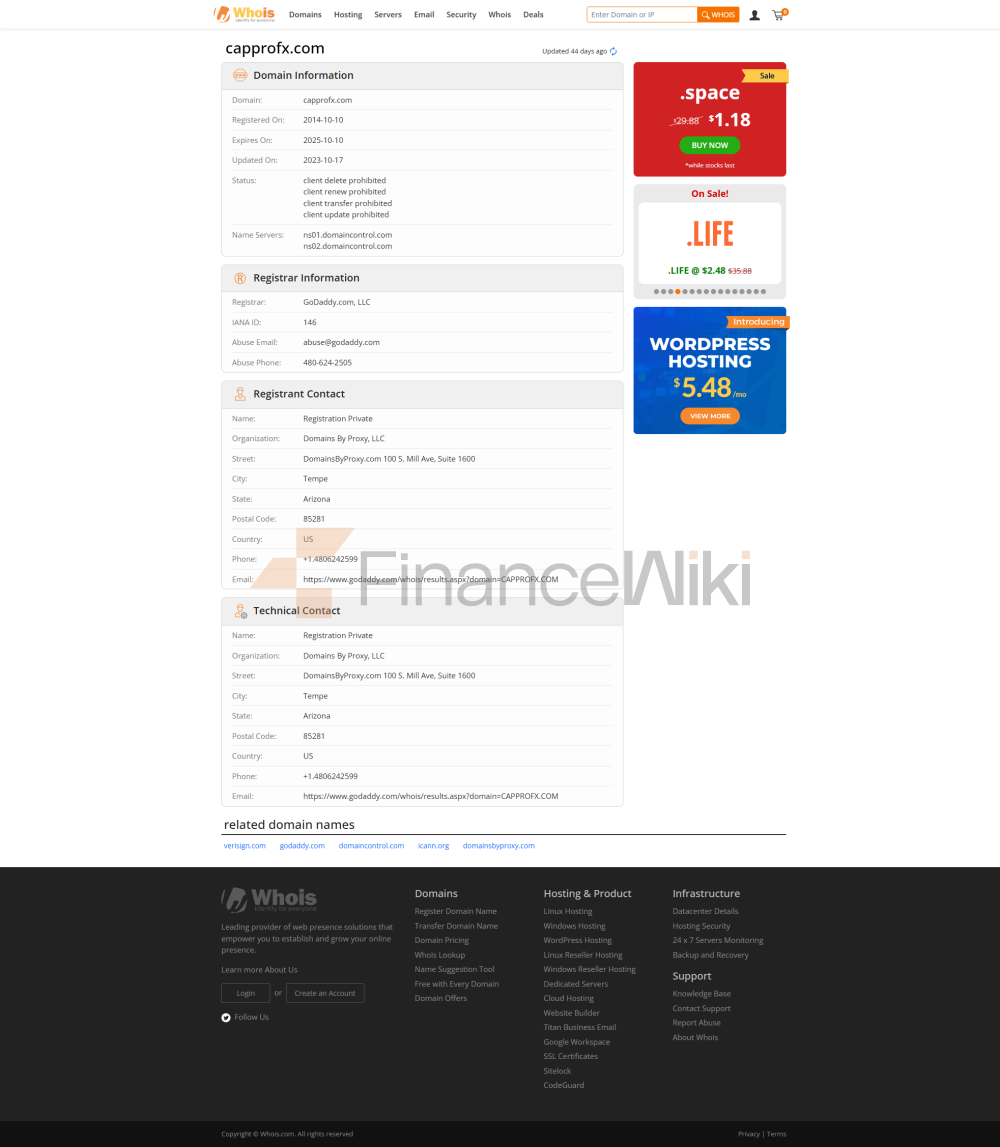

Founded In 2014 , Cappra FX Is A Brokerage Company Specializing In Foreign Exchange, Commodity And Index Trading . It Serves Individual Traders, Institutional Traders, Hedge Funds, Commercial Entities, Brokerage Firms And Money Managers Worldwide , And Is Committed To Providing Efficient Services To All Types Of Traders, Meeting The Different Needs From Novice To Veteran Professionals.

Regulatory Information

Cappra FX Is Currently Without Effective Supervision . Although It Offers A Variety Of Trading Tools And Flexible Trading Conditions, The Lack Of Supervision By Regulators May Raise Concerns About Compliance, Transparency, And The Protection Of Traders' Rights And Interests. Therefore, Traders Are Advised To Give Preference To Brokers Regulated By Relevant Financial Regulators (e.g. FCA, ASIC, Etc.) When Choosing A Platform.

Trading Products

Cappra FX Offers The Following Trading Products:

- Forex: Offers 64 Currency Pairs , Including Major Currency Pairs (e.g. USDJPY, AUDUSD, EURGBP) As Well As Minor Currency Pairs.

- Commodities: Covers 4 Metals (such As Gold, Silver, Platinum And Palladium), Providing Traders With The Opportunity To Participate Directly In The Commodity Market.

- Index: Offers 12 Index Contracts For Difference (CFD) , Such As Dow Jones, Nasdaq, Etc., Helping Traders Capture The Volatility Of Major Global Stock Markets.

Trading Software

Cappra FX Offers Two Popular Trading Platforms:

- MetaTrader 4 (MT4): Known For Its User-friendly Interface And Powerful Technical Analysis Capabilities, It Supports Automated Trading.

- MetaTrader 5 (MT5): Adds More Features To MT4, Including More Timeframes, Order Types, And Economic Calendars.

Both Platforms Are Industry Standards And Suitable For Traders Of Different Experience Levels.

Deposit And Withdrawal Methods

Cappra FX Offers A Variety Of Deposit Methods:

- Fast Payment: Through Electronic Payment Methods Such As Skirll, Webmoney, Neteller, Etc., Usually Within 30 Minutes.

- Bank Transfer: Domestic Telegraphic Transfer And Bpay Deposits Are Processed At Night , International Telegraphic Transfer Takes 3-4 Days .

The Withdrawal Process Involves Completing The Necessary Application Forms And Submitting Them By 03:00 GMT, Which Can Be Processed On The Same Day.

Customer Support

Cappra FX Supports Customers Through Multiple Channels:

- Tel: + 44 7723 964613 (please Note That Phone Bills May Be Higher) Email: Accounts@capprofx.com

- Online Contact Form: Submit Questions Through The Official Website

Core Business And Services

Cappra FX's Core Business Includes Foreign Exchange Trading, Commodity Trading Trade With Index CFDs And Support Traders By Providing Information Such As Daily Trade Analysis, Market Reviews And Video Reviews. At The Same Time, Its Flexible Leverage Options (1:1 To 1:1000) And Floating Spreads (starting At 1 Pip) Provide Traders With A Wide Range Of Operating Space.

Technical InfrastructureCappra FX Uses The MetaTrader 4 And MetaTrader 5 Platforms To Provide Efficient Execution Speed And A Reliable Trading Environment. The Technical Features Of MT4 And MT5 Greatly Enhance Traders' Ability To Analyze The Market And Execute Trades.

Compliance And Risk Control System

The Specifics Of Cappra FX's Compliance And Risk Management System Are Not Available Due To A Lack Of Regulation. However, As A Trader, Extra Attention Should Be Paid To The Platform's Transparency And Risk Control Measures And Use Tools Such As Stops To Manage Risk When Necessary.

Market Positioning And Competitive Advantage

Cappra FX Occupies A Unique Position In The Highly Competitive Forex Market By Offering Demo Accounts , Multiple Contact Channels, Flexible Leverage Options, And A Wide Range Of Trading Products. In Addition, Its Supported MT4 And MT5 Platforms Also Provide Convenience To Attract Different Types Of Traders.

Customer Support And EmpowermentCappra FX Offers Its Clients Comprehensive Trading Support, Including Real-time Assistance Through Multiple Channels. In Addition, By Providing Daily Trading Analysis And Market Reviews, Clients Are Able To Better Understand Market Dynamics And Make More Informed Trading Decisions.

Social Responsibility And ESG

Currently, Cappra FX Has Limited Public Information On Social Responsibility And ESG (environmental, Social And Governance). Traders Are Advised To Consider Its Performance In These Aspects Comprehensively When Choosing A Platform.

Strategic Cooperation EcologyStrategic Cooperation Information Of Cappra FX Is Not Public. Typically, Such Partnerships May Include Liquidity Providers, Software Vendors And Market Data Analytics Companies, Among Others.

Financial Health

The Financial Status Of Cappra FX Is Not Publicly Disclosed. Traders Should Ensure The Safety Of Funds And The Continuity Of Trading By Choosing A Platform With Good Financial Health.

Future Roadmap

As A Non-regulated Forex Broker, The Future Development Roadmap Of Cappra FX Is Not Publicly Available Yet. Traders Are Advised To Keep An Eye On Changes In Its Services And Policies And To Contact The Platform Directly For The Latest Information If Necessary.

Summary

Cappra FX, As A Non-regulated Forex, Commodity And Index Trading Platform, Offers A Wealth Of Trading Opportunities For Different Types Of Traders With Its Diverse Trading Products And Flexible Trading Conditions. However, Its Lack Of Regulation May Pose Latent Risks To Traders' Rights And Interests. When Choosing A Platform, Traders Should Weigh Its Advantages Against Latent Risks And Make Decisions Cautiously.