Company OverviewFounded

in 1992, Saxo Bank is a global financial services organization headquartered in Hellerup, Denmark. As of 2023, Saxo Bank has served clients in more than 120 countries around the world, with $16 billion in assets under management and more than 125,000 transactions per day. With more than 30 years of industry experience, Saxo Bank focuses on providing retail and institutional clients with a diverse range of financial products and services, including foreign exchange, contracts for difference (CFDs), stocks, bonds, commodities, futures, options, ETFs, mutual funds and managed portfolios.

Saxo Bank's global presence enables it to provide clients with cross-market access and multi-asset trading services, with a strong technology infrastructure, a rigorous risk management system and compliant operations in line with global regulatory standards.

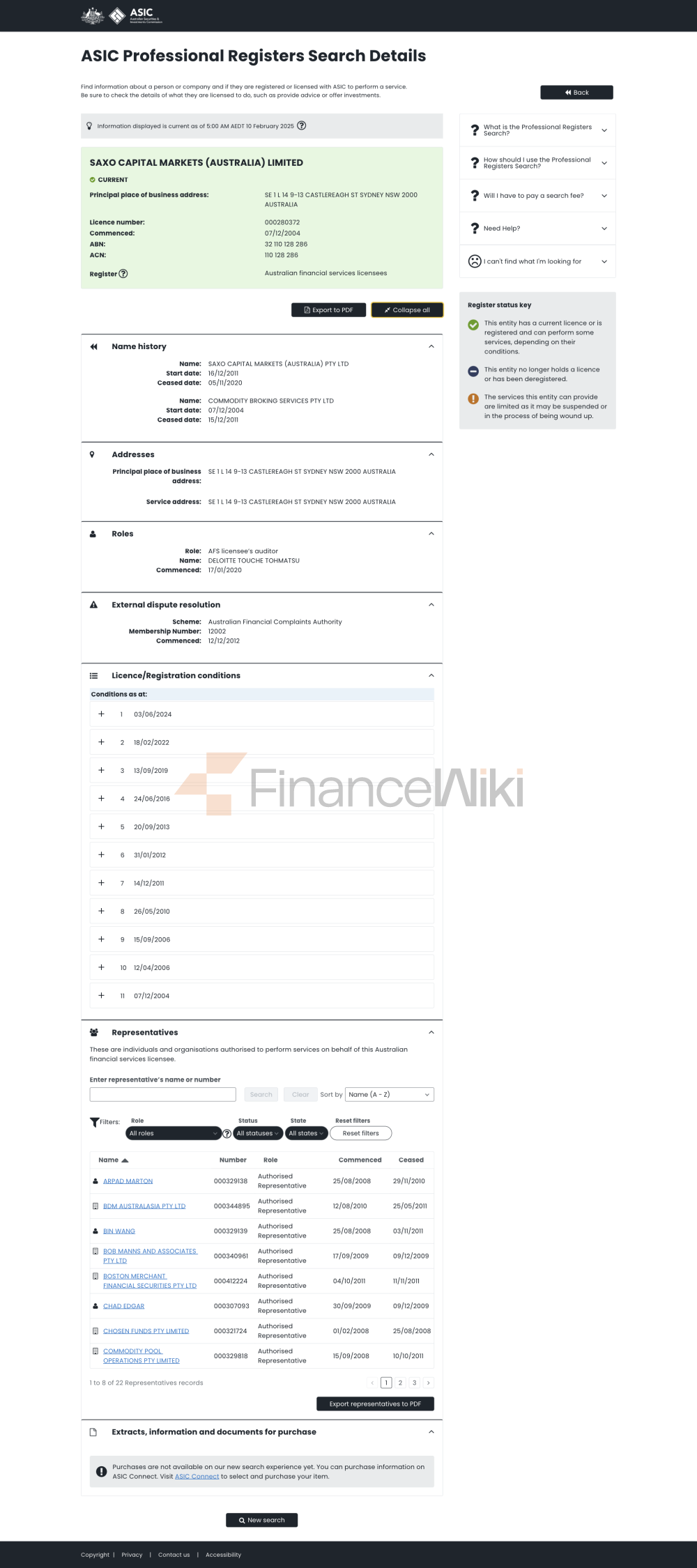

Regulatory

InformationSaxo Bank AG is a financial institution regulated by regulators in many countries, and its global operations are strictly regulated by relevant laws and regulations. The following are the main regulatory licenses and compliance statements of Saxo Bank:

Financial Conduct Authority (FCA) Saxo Bank is regulated by the FCA in the United Kingdom under license number FRN 1149. As the world's leading financial regulator, the FCA ensures compliance and transparency for Saxo Bank in the UK market.

The Financial Services Agency of Japan (FSA) Saxo Bank is regulated by the FSA in the Japanese market and holds a retail foreign exchange trading license, ensuring that its operations in Japan comply with local laws and regulations.

French Financial Market Authority (AMF)In the French market, Saxo Bank is regulated by the AMF, ensuring that the sale and service of its financial products meet the highest standards of the French financial market.

Swiss Financial Market Supervisory Authority (FINMA) Saxo Bank is regulated by FINMA in the Swiss market, ensuring that its operations in Switzerland comply with strict financial regulatory requirements.

Saxo Bank of the Monetary Authority of Singapore (MAS) holds a retail foreign exchange trading license issued by MAS in the Singapore market, ensuring that its operations in Singapore meet the highest standards of Singapore's financial markets.

Compliance Statement: Saxo Bank strictly adheres to all applicable financial regulations and regulatory requirements to ensure that its business operations around the world are legal, transparent and in the interests of its clients. The company adopts strict risk management measures and internal control processes to protect the security of customer assets and transaction transparency.

Trading

ProductsSaxo Bank offers a broad portfolio of financial products across a wide range of asset classes to meet the needs of different clients. The following are Saxo Bank's main trading products:

Contracts for Difference (CFDs) Saxo Bank offers a wide range of CFD products, including Forex, Commodities, Stocks and Indices, providing clients with flexible trading options and high leverage.

FuturesSaxo Bank supports trading more than 250 futures on 25 exchanges around the world, covering markets such as equity indices, energy, agricultural commodities and interest rates.

Commodities Saxo Bank offers a wide range of commodity trading options, including gold, silver, crude oil and natural gas, to meet the needs of customers investing in the commodity markets.

Equity Saxo Bank offers trading services on more than 23,500 stocks in more than 50 markets around the world, covering major financial markets such as New York, London, Hong Kong and Tokyo.

Bond Saxo Bank provides trading services for more than 5,900 government and corporate bonds worldwide, providing clients with a stable source of income.

ETF Saxo Bank provides trading services for more than 7,000 ETFs, covering major investment sectors such as technology, healthcare, and environment.

Mutual Funds Saxo Bank offers more than 17,700 mutual funds managed by the world's top fund managers.

Managed PortfolioSaxo Bank provides professional portfolio management services to its clients, with personalized investment advice provided by an experienced investment team.

Trading software

Saxo Bank provides customers with powerful trading tools to meet the needs of different traders. Here are the main trading software of Saxo Bank:

SaxoTraderGOSaxoTraderGO is a multi-asset trading platform that combines trading, analysis and risk management. Its features include:

- Enhanced Trading Tickets

- Innovative risk management system (e.g. Account Shield)

- Diverse order types (stop-loss orders, cancel all orders, etc.)

- Detailed margin occupancy and alarm function

SaxoLiteSaxoLite is Saxo Bank's mobile trading platform designed for trading Hong Kong and U.S. stocks, supporting real-time quotes, order management and portfolio analysis.

SaxoTraderPROSaxoTraderPRO is a high-performance trading tool that is primarily used to manage and execute orders. Its features include:

- In-depth market analysis

- Efficient order execution

- Multi-asset class trading support

deposit and withdrawal

methodsSaxo Bank offers a variety of deposit and withdrawal methods to meet the needs of customers' money management needs. The following are the main deposit and withdrawal methods at Saxo Bank:

Credit/debit card customers can deposit and withdraw funds via credit or debit cards such as Visa, MasterCard, Maestro, etc.

Wire transfer customers can deposit and withdraw funds via bank wire transfer.

E-wallet Saxo Bank supports a variety of e-wallet deposit and withdrawal methods, including PayPal, Skrill, etc.

Fee Description: Saxo Bank does not charge additional fees for deposits and withdrawals, but a processing fee of €40 may be charged for manual withdrawal requests.

Customer

SupportSaxo Bank provides customers with a comprehensive customer support service that ensures that customers receive professional assistance during the trading process. Here are Saxo Bank's customer support services:

Multilingual supportSaxo Bank offers customer support in multiple languages such as English, Chinese, Danish, and more.

Live chat customers can get in touch with Saxo Bank's customer service team via the live chat function.

Phone SupportSaxo Bank offers a 24/5 phone support service to ensure that customers receive timely assistance during trading days.

Educational Resources Saxo Bank provides customers with a wealth of educational resources, including trading guides, market analysis and risk warnings, to help them improve their trading skills.

Core Business &

ServicesSaxo Bank's core business includes retail foreign exchange trading, CFD trading, equity trading, bond trading, commodities trading and managed portfolio services. The company provides efficient, transparent and secure trading services to its customers through a strong technical infrastructure and a strict risk management system.

Differentiators: Saxo Bank's core competitive advantage lies in its global service network, rich financial portfolio and world-class technology platform. The company continues to innovate and optimize its services to meet the trading needs of its clients in the multi-asset market.

Technology

InfrastructureSaxo Bank uses a world-class technology infrastructure to ensure that its trading services around the world are efficient, secure and transparent. Here are the key technical advantages of Saxo Bank:

SaxoTraderGO platform, a multi-asset trading platform, supports trading across multiple asset classes and offers powerful analytical and risk management capabilities.

Cloud computing servicesSaxo Bank uses cloud computing technology to ensure the stability and scalability of its trading system.

Data SecuritySaxo Bank uses the latest data encryption technology to ensure the security and privacy of customer data.

Compliance & Risk Control

SystemSaxo Bank strictly adheres to global financial regulatory standards and adopts advanced risk management techniques to ensure the safety of customers' assets and transaction transparency. The following are Saxo Bank's key compliance and risk control measures:

Regulatory ComplianceSaxo Bank holds financial licenses in several countries and strictly adheres to the requirements of local regulators.

Risk Management System Saxo Bank employs a comprehensive risk management system that includes market risk, credit risk and operational risk management.

Funds SegregationSaxo Bank separates client funds from the company's own funds to ensure the safety of client funds.

Leverage controlSaxo Bank sets different leverage ratios according to the type of customer (retail or professional) to ensure that the transaction risk is controllable.

Market Positioning & Competitive Advantage

Saxo Bank is positioned as a global, multi-asset financial services provider. Its competitive advantages are:

- Rich financial product portfolio

- Robust technology infrastructure

- Compliant operations in line with global regulatory standards

- Professional customer support services

Social Responsibility & ESG

Saxo Bank actively participates in social responsibility activities to support sustainable development and environmental protection. The company promotes the sustainable development of the financial industry through cooperation with a number of environmental organizations around the world.

Strategic PartnershipEcoSaxo

Bank has established strategic partnerships with a number of world-renowned financial institutions and technology companies to jointly promote innovation and development in the financial industry. The following are Saxo Bank's key partners:

- Fintech companies: Partnered with a number of fintech companies to optimize trading systems and risk management processes.

- Industry associations: Saxo Bank is a member of several international financial industry associations and actively participates in the development and promotion of industry standards.

Financial HealthSaxo

Bank is in a healthy financial position with strong capital strength. As of 2023, Saxo Bank has assets under management of US$16 billion and an average daily trading volume of more than 125,000 transactions, demonstrating the company's strong performance in global financial markets.

Roadmap for the

futureSaxo Bank plans to further expand its global footprint, optimize its technology infrastructure, and drive innovation in financial products in the future. The company will continue to strengthen its relationships with global partners and enhance its competitiveness in the multi-asset market.