Corporate Profile

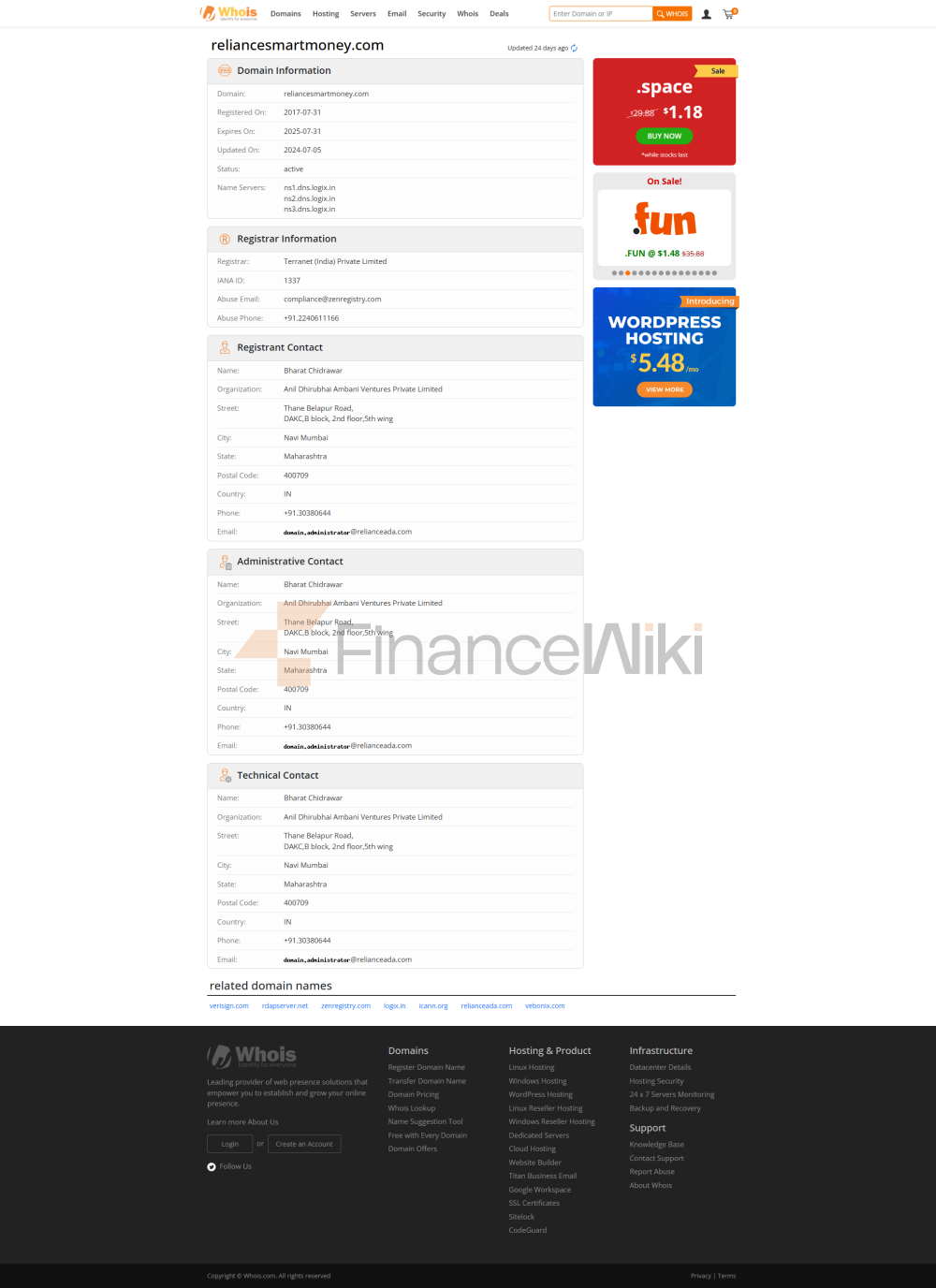

Reliance Securities Limited Is One Of The Leading Financial Services Companies In India, Offering A Full Range Of Brokerage And Investment Services Under Its Brand Reliancesmartmoney.com . As A Subsidiary Of Reliance Capital, One Of The Largest Integrated Financial Groups In India, Reliance Securities Has Created A "neutral Financial Services Marketplace" Through Reliancesmartmoney.com , Enabling Users To Easily Manage Their Financial Needs.

The Platform Offers Investors A Wide Range Of Financial Products And Services, Including Mutual Funds, Stocks, Loans, Insurance, PMS (portfolio Management Services), Corporate Deposits, Bonds And More. Its Goal Is To Enhance The Investment Experience Of Its Users Through A Digital Platform While Providing Rich Educational Resources And Tool Support.

Regulatory Information

Reliance Securities Limited Is Regulated By The Board Of Supervisors Of The Stock Exchanges Of India (SEBI) With Registration Number INZ000172433 . As A Regulated Financial Institution Group, Reliance Securities Ensures That Its Operations Comply With The Legal And Regulatory Requirements Of Financial Marekt In India. SEBI Oversees Its Business, Including Trading Activities, Safety Of Client Funds And Compliance.

Reliance Securities Also Follows The Guidelines Of The Reserve Bank Of India (RBI) And Other Relevant Regulators To Ensure That Its Products And Services Comply With The Requirements Of The Country's Financial Regulations.

Core Business And Services

Reliancesmartmoney.com Offer A Diverse Range Of Financial Products And Services Covering The Following Areas:

- Stock Trading: Users Can Invest In Stocks In The Indian Market, Including NSE And BSE, Through The Platform.

- Mutual Funds: Offer Open-ended And Closed-end Funds, Covering Mixed Equity-debt, Pure Debt, Etc.

- Portfolio Management Services (PMS): Providing Customized Portfolios To High Net Worth Clients Through Professional Managers.

- Insurance Products: Including Life Insurance And Health Insurance.

- Trading Instruments: Such As Exchange Traded Funds (ETFs), Stock Futures And Options, Currency Futures And Options, Etc.

- Corporate Deposits And Bonds: Providing Fixed Income Products Such As Time Deposits And Corporate Bonds.

- Loan Products: Including Home Loans, Personal Loans And Business Loans.

Technical Infrastructure

Reliance Securities Uses Advanced Trading Platforms Such As Insta Xpress And Insta Plus To Meet The Needs Of Different Traders. These Platforms Support Real-time Quotes, Trading Analysis, And Market Research Capabilities To Help Users Make Informed Investment Decisions.

Insta Xpress Is A Cloud-based Platform That Supports Multi-device Access And Provides Powerful Analytical Tools Such As Heatmap View And Single View Portfolio To Help Users Quickly Gain Market Insights. Insta Plus, On The Other Hand, Is A Desktop Trading Platform Suitable For Professional Investors And Institutional Clients.

Compliance And Risk Control System

Reliance Securities Follows Strict Compliance And Risk Control Standards To Protect The Safety Of Client Funds And Ensure The Transparency Of Its Operations. Here Are Some Key Measures:

- SEBI Licensing: Ensure That All Trading Activities Comply With Regulatory Requirements.

- Client Funds Segregation: Client Funds Are Segregated From Company Working Funds To Reduce Risk.

- Risk Management System: Including Monitoring Of Market Risk, Credit Risk And Operational Risk.

- Anti-Money Laundering Measures: Implementation Of Strict KYC (Know Your Customer) Processes To Prevent Money Laundering Activities.

Market Positioning And Competitive Advantage

Reliance Securities Has A Strong Position In The Indian Financial Services Market. With Its Parent Company's Comprehensive Financial Background And The Advantages Of Digital Platform, It Provides Customers With One-stop Financial Services. Its Core Competitive Advantages Include:

- Strong Brand Endorsement: As A Subsidiary Of Reliance Capital, Reliance Securities Enjoys A High Level Of Trust And Branding Impression In The Market.

- Digital Platform: Provide Convenient Online Financial Services Through Reliancesmartmoney.com , Reaching A Wide Range Of Customer Groups.

- Broad Product Portfolio: Offer A Diverse Range Of Financial Products To Meet The Investment And Financing Needs Of Different Customers.

- Compliance And Safety: Strict Compliance With Regulatory Requirements To Ensure The Safety Of Customer Funds.

Customer Support

Reliance Securities Provides 24/7 Client Server Support To Ensure That Clients Can Receive Timely Assistance During The Trading And Investment Process. The Specific Schedule Is As Follows:

- Monday To Friday: 8am To 8pm.

- Saturday: 10am To 6pm.

- Sunday And Public Holidays: Closed.

Customers Can Contact Customer Service In The Following Ways:

- Tel: 022 - 4168 1200

- Social Platforms:

- Facebook: Https://www.facebook.com/RSmartMoney

- Instagram: Https://www.instagram.com/Rsmartmoney

- X: Https://x.com/RSmartMoney

- YouTube: Https://www.youtube.com/RSmartMoney

- Blogs And Articles: Covering Topics Such As Market Analysis, Trading Strategies, Investment Tips, And More.

- Webinars And Video Tutorials: Online Courses Led By Experts To Help Users Master Market Dynamics And The Use Of Trading Tools.

- Community Forums: Users Can Exchange Experiences And Share Insights With Other Traders.

- Its Social Responsibility Practices Include:

- Environmentally Friendly: Reduce The Use Of Paper Documents Through Digital Platforms And Reduce The Impact On The Environment.

- Social Contribution: Support Education, Health Care And Other Social Good Causes.

- Transparency In Governance: Follow The Highest Standards Of Governance To Ensure Transparency And Fairness In The Company's Operations.

Strategic Cooperation Ecology

Reliance Securities Has Established Strategic Partnerships With Several Financial Institution Groups And Technology Enterprises To Expand Its Product And Service Capabilities. These Collaborations Cover:

- Technology Collaboration: Collaborating With Tech Firms To Develop Efficient Trading Platforms And Data Analytics Tools.

- Financial Collaboration: Collaborating With Other Financial Institution Groups To Provide A Diverse Range Of Financial Products And Services.

Financial Fitness

Reliance Securities, As A Regulated Financial Institution Group, Has A Sound Financial Position, Sufficient Capital And Good Risk Resilience. According To The Data As Of 2023Q3 , Its Registered Capital And Capital Adequacy Ratio Meet Regulatory Requirements.

Future Roadmap

Reliance Securities Plans To Continue To Expand The Scale Of Its Digital Platform And Further Enhance Its Technology Infrastructure And Customer Support Services In The Future. Its Future Development Strategies Include:

- Driving Fintech Innovation: Investing In Technologies Such As AI, Big Data, And Blockchain To Enhance Transaction Efficiency And Service Experience.

- Expanding International Markets: Exploring Investment And Cooperation Opportunities In Overseas Markets And Expanding Its Global Footprint.

- Deepening Customer Education: Helping Customers Improve Their Financial Literacy Through More Educational Resources.

Educational Resources

Reliance Securities Provides A Wealth Of Educational Resources Through Reliancesmartmoney.com To Help Investors Enhance Their Trading And Investment Skills. These Resources Include:

Social Responsibility And ESG

Reliance Securities Adheres To Social Responsibility And Focuses On Environmental, Social And Governance (ESG) Principles.