Aspect Information

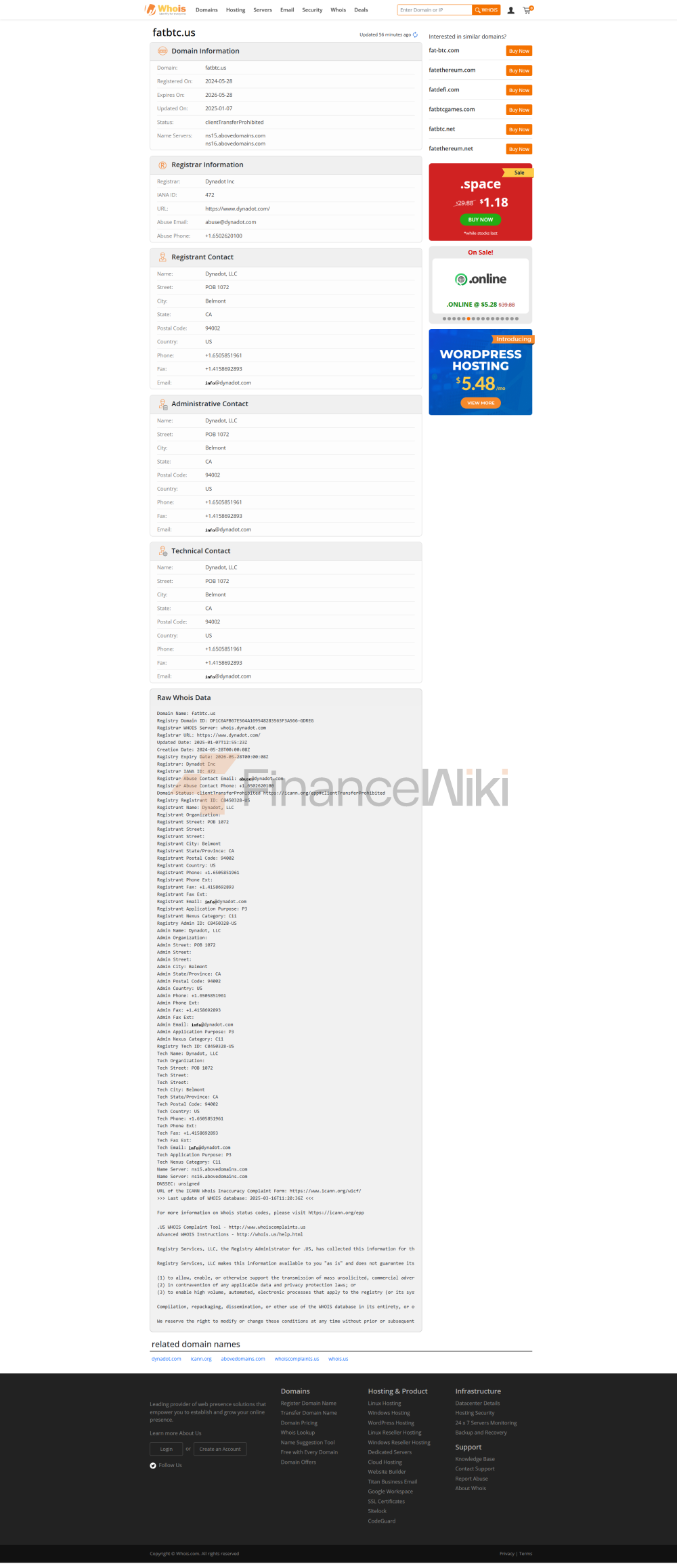

Company Name: Fatbtc

Registered Country: Seychelles

Year Established: 2019

Regulatory Authority: Unregulated

Number Of Cryptocurrencies Available: 100 +

Fees: 0.2% For Those Who Place An Order, 0.2% For Those Who Eat An Order

Payment Methods: Bank Transfer, Debit Card, Cryptocurrency, P2P Transactions

Customer Support: Email, Social Media

General Understanding Fatbtc

Fatbtc Is A Company Established In 2019 And Registered In Seychelles Cryptocurrency Exchange. The Platform Offers Trading In Over 100 Cryptocurrencies, Including Major Cryptocurrencies Such As Bitcoin, Ethereum, And Tether. With A 24-hour Trading Volume Of $5 Million, Fatbtc Offers A Moderate Trading Environment. The Exchange Operates According To A Maker-Taker Fee Structure, Where Maker Pays 0.2% And Taker Pays 0.2%. However, It Is Worth Noting That Fatbtc Currently Lacks Effective Regulation And May Present Latent Risks Due To The Lack Of Regulation. Traders Should Exercise Caution When Considering Trading On This Platform.

Pros And Cons

Pros:

- Wide Range Of Cryptocurrencies: Fatbtc Offers Multiple Cryptocurrency Options That Are Attractive To Traders Interested In Various Digital Assets.

- Moderate Trading Volume: The Exchange Has A 24-hour Trading Volume Of $5 Million, Providing Good Liquidity For Trading.

- Security Measures Implemented: Fatbtc Claims To Prioritize Security With Cold Storage, Multi-signature Wallets, 2fa And SSL Encryption, Enhancing User Funds Protection.

- Multiple Payment Methods: Users Can Choose From Multiple Payment Methods, Including Bank Transfers, Credit/debit Cards, And Cryptocurrencies, Providing Flexibility.

- Transparent Fee Structure: The Exchange Maintains A Simple Fee Structure, Charging A Flat Rate Of 0.2% To Both Pending And Eating Orders.

Disadvantages:

- Lack Of Regulation: Fatbtc Operates In An Unregulated Environment, Potentially Exposing Users To Higher Risks And A Lack Of Regulatory Safeguards.

- Cryptocurrency Removals: The History Of All Delisted Cryptocurrencies For This Trade, Which May Affect Traders Holding These Assets.

- Relatively High Fees (0.2%): Fatbtc Charges Market Makers And Order Eaters A Relatively High Transaction Fee Of 0.2% Compared To Some Competitors.

- Unregulated Environment: Lack Of Regulation Can Lead To Uncertainty In Terms Of Security, Dispute Resolution, And Overall Platform Reliability.