A General Understanding Of MidasFX

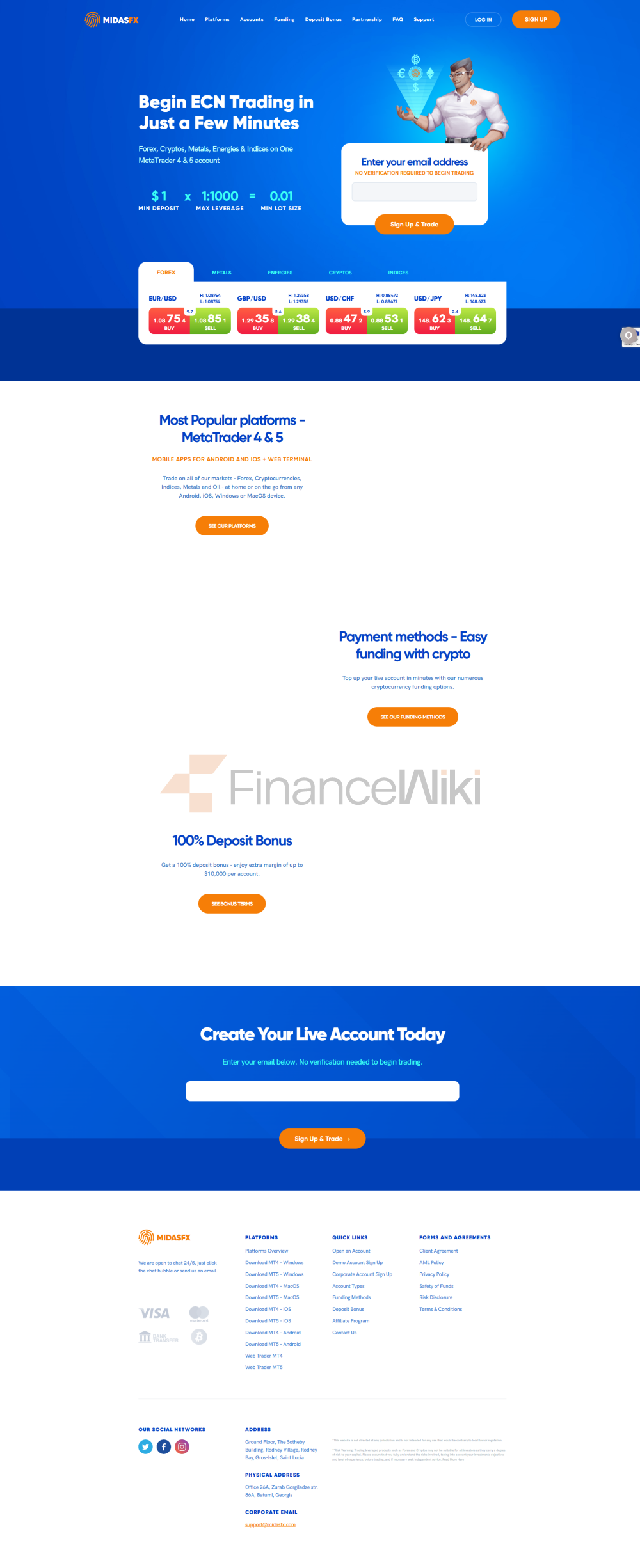

MidasFX Is A Foreign Exchange Broker Established In 2020 With Its Registered Place In Saint Vincent And The Grenadines, A Sovereign Island Country In The Caribbean. To Cater To A Global Audience, The Broker Offers A Range Of Services, Including Forex Trading On The Following Platforms: MetaTrader 4 And 5. Clients Have The Flexibility To Choose Between Different Account Types, Including, Electronic Communication Networks, And STDs, And, Leverage, Depending On 1:1000. One Of The Distinguishing Features Of MidasFX Is Its Cryptocurrency-centric Approach To Account Financing, Offering Multiple Cryptocurrency Options Such As Bitcoin, Tether, Ethereum, And More. This Broker Emphasizes Direct Market Access And Offers Live And Demo Account Options To Traders With Varying Levels Of Experience.

Regulatory Information

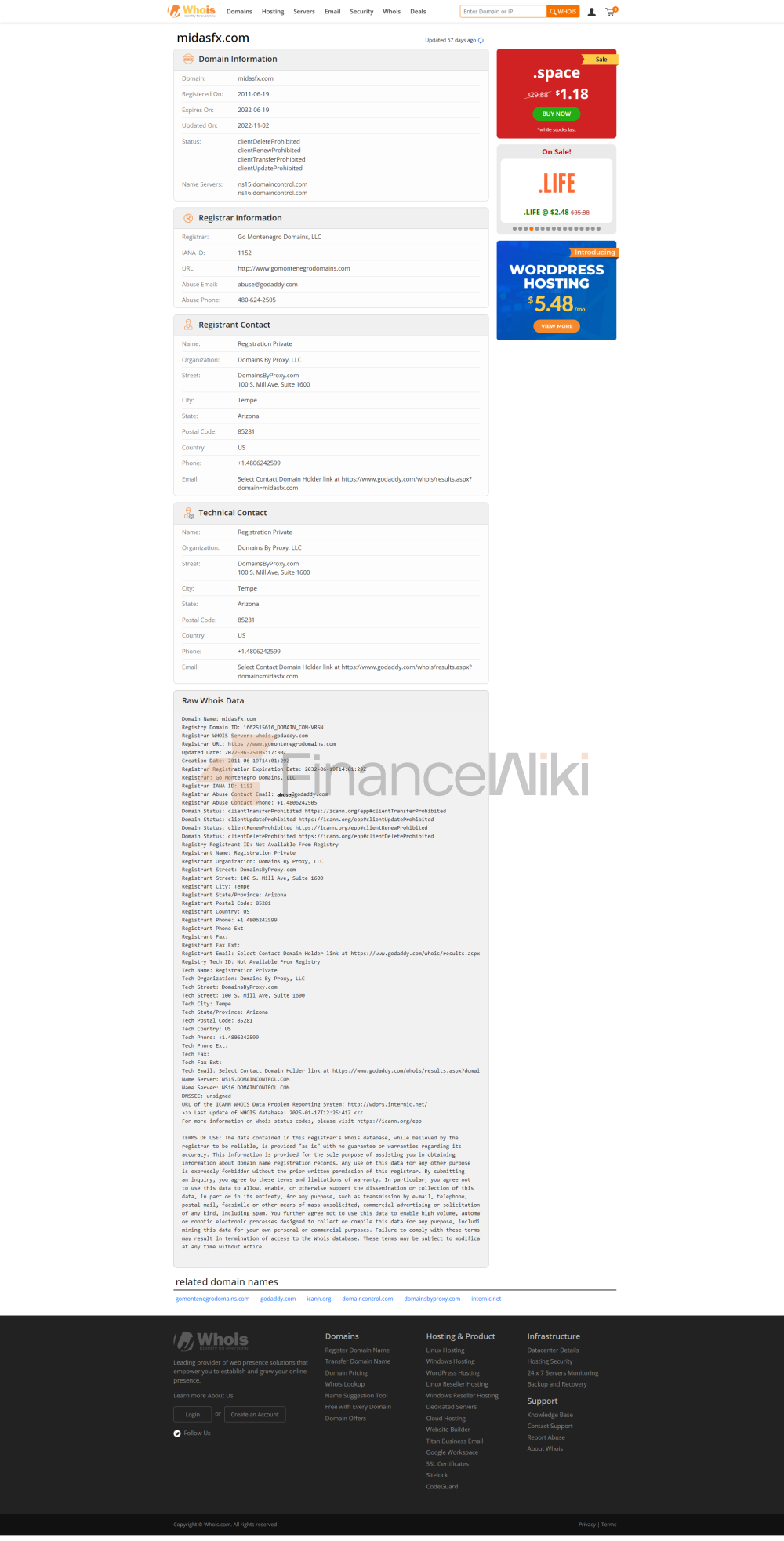

MidasFX Operates Without Clear Regulatory Oversight, Which Is An Important Point For Potential Investors To Consider. Lack Of Regulation Means That Brokers Do Not Adhere To Strict Standards Set By Recognized Financial Regulators. This Can Create Latent Risk For Traders As Recourse May Be Limited In The Event Of A Dispute Or Issue With The Broker.

Investors Must Be Aware That Trading With An Unregulated Broker Carries Inherent Risks, Including Potential Loss Of Capital. Before Making Any Investment Decision, Traders Should Conduct Thorough Research And May Seek Independent Financial Advice To Understand The Implications Of Trading With Unregulated Entities.

Pros And Cons

Pros: High Leverage, Low Minimum Deposit Amount, Diverse Account Options, Multiple Platform Options, Cryptocurrency Financing

Cons: Unregulated Status, Limited Tradable Asset Information, Lack Of Educational Resources, Potential Hidden Fees, No Mention Of Security Measures

Pros:

High Leverage: MidasFX Offers High Leverage Up To 1:1000, Which Amplifies Potential Profits.

Low Minimum Deposit: The Initial Deposit Requirement Is Only $1, Suitable For All Levels Of Traders.

Diverse Account Options: The Broker Offers Multiple Account Types, Including ECN And STD, Catering To Different Trading Preferences.

Multiple Platform Options: Traders Can Use MetaTrader 4 And 5, Available On A Wide Range Of Devices Including Mobile Devices And The Web.

Cryptocurrency Financing: MidasFX Supports A Range Of Cryptocurrency Deposit Methods, Providing Flexibility For Account Funding.

Cons:

Unregulated Status: The Broker Operates Without Specific Regulation, Which May Present Latent Risks To Traders.

Information On Limited Tradable Assets: While They Mention Offering Forex, Cryptocurrencies, And Other Assets, No Detailed Details Are Provided.

Lack Of Educational Resources: The Broker's Website Does Not Appear To Provide Comprehensive Educational Materials For Traders.

Potential Hidden Fees: If There Is No Clear Regulatory Oversight, There May Be Hidden Fees Or Charges That Are Not Explicitly Mentioned.

No Mention Of Security Measures: The Broker's Website Does Not Explicitly Mention Security Measures To Protect Traders' Funds And Data.

Market Tools

MidasFX Offers A Diverse Range Of Trading Products To Meet The Needs Of Modern Traders. They Offer Access To The Foreign Exchange Market, Allowing Traders To Participate In Major Currency Pairs Such As EUR/USD, GBP/USD. For Those Interested In The Dynamic World Of Digital Assets, MidasFX Facilitates Cryptocurrency Trading. In Addition, Traders Can Venture Into Global Index Markets, Speculate In Precious Metals, And Explore The Energy Sector, Which Includes Commodities Such As Oil.

Forex: This Includes Major Currency Pairs Such As EUR/USD, GBP/USD, USD/CHF, And USD/JPY.

Cryptocurrencies: They Offer Trading In Various Cryptocurrencies Such As Bitcoin, Ethereum, Litecoin, Ripple

Indices: They Offer Trading In Various Global Indices, But The Specific Indices Are Not Detailed On The Home Page.

Metals: This Includes Precious Metals Such As Gold And Silver.

Energy: Includes Oil And Other Energy Commodities.

Account Types

MidasFX Offers Two Different Account Types On Two Different Platforms To Meet The Different Needs Of Traders: Mt5.ecn, Mt5.std, Mt4.ecn And Mt4.std. All Of These Accounts Feature Generous Leverage Of 1:1000 And Traders Can Choose From A Wide Range Of Account Currencies Including USD, EUR, GBP, JPY And CAD. The Minimum Trade Size Is Set At 0.01 Standard Lots And The Stop Loss Level Is Maintained At 40%.

All Accounts Offer Direct Market Access To A Range Of Products Including Forex, Cryptocurrencies, Indices And Metals. ECN Accounts On MT4 And MT5 Offer Spreads Starting From 0 Pips And Charge A Commission Of $5 Per $100,000. In Contrast, STD Accounts Offer Spreads Starting From 0.7 Pips And Charge No Commission.

Leverage

MidasFX Offers Traders A Competitive Maximum Leverage Of 1:1000, Allowing Them To Expand Their Trading Positions And Potentially Increase Profits. This High Leverage Is Suitable For A Wide Variety Of Trading Products, Including Forex Pairs, Cryptocurrencies, Indices, Metals, And Energy.

Traders Must Understand That While Higher Leverage Can Amplify Profits, It Can Also Increase Potential Losses. The Specific Leverage Levels For Each Trading Product May Vary, And It Is Crucial For Traders To Check The Exact Leverage Settings In Their Trading Platform Or Consult The Broker's Customer Support For Details.

Spreads And Commissions

MidasFX Offers Two Types Of Accounts: Original Spreads (ecn) And Spreads Only (std) Accounts On Mt4 And Mt5. Spreads And Commissions For MidasFX Vary Depending On The Account Type.

For ECN Accounts, Spreads Start At 0 Pips And A $5 Commission Is Charged For Every $100,000 Traded.

Spreads For STD Accounts, On The Other Hand, Start At 0.7 Pips And No Commission Is Charged.

It Is Worth Noting That Spreads And Commissions May Vary Depending On The Specific Product Being Traded.

Trading Platforms

MidasFX Offers Traders The Well-known Metatrader 4 And Metatrader 5 Platforms, Ensuring A Comprehensive Trading Experience. These Platforms Are Available On A Wide Range Of Devices And Operating Systems.

MetaTrader For Mac OS:

MidasFX Offers Metatrader 4 And Metatrader 5 Installations Pre-packaged Into Standalone Mac Applications For The Convenience Of Users. This Allows Traders To Start Trading Immediately On Their IOS Computers Or Laptops.

MetaTrader Mobile Apps:

MidasFX Offers Mobile Apps For Android And Ios. These Apps Allow Users To Trade Over 100 Instruments On A Wide Range Of Markets Anytime, Anywhere. Whether Trading Forex, Cryptocurrencies, Indices Or Metals, MidasFX's Mobile Apps Offer A Comprehensive Mobile Trading Experience.

MetaTrader For Windows:

Users Can Choose MetaTrader 4 Or MetaTrader 5 Desktop To Enjoy The Industry's Lowest Spreads And Fastest Execution Speeds From PC. The Platform Allows Users To Start Trading Within 5 Minutes, Without Further Verification, Simply By Registering With An Email Address.

MT WebTrader:

MT WebTrader Enables Users To Trade Without Downloading Any Software. Users Can Access Their MetaTrader 4 And MetaTrader 5 Accounts Directly From Their Browser In A Safe And Secure Manner.

These Platforms Are Based On Well-known And Widely Accepted Analytical Trading Systems. In Addition, The Data Transmitted On The MT4 Platform Is Encrypted, Ensuring That Private Information And Funds Remain Safe From Potential Threats.

Deposit And Withdrawal

MidasFX Offers A Variety Of Deposit Methods, Mainly Focusing On Cryptocurrencies.

Deposits Usually Require Blockchain Confirmations, And The Time Required For These Confirmations May Vary. It Is Also Worth Noting That Deposits Are Usually Faster Than Withdrawals.

For Withdrawals, All Transactions Within The Original Deposited Amount Must Be Made Using The Same Method As Deposits. Any Subsequent Withdrawals Can Be Made Using Any Of The Broker's Withdrawal Options. There Is A Withdrawal PIN Code, Which Is An Added Security Measure.

Additionally, Internal Transfers Are Also Possible, But Specific Details About Fees And Processing Times Are Not Detailed. One Thing To Note Is That Third-party Deposits Are Not Accepted, And Any Such Deposits Will Be Returned To The Sender, Who Bears All Transaction Costs.

CUSTOMER SUPPORT

MidasFX Takes Customer Support Very Seriously And Sees It As The Cornerstone Of Their Success. They Provide A Personalised And Personalised Experience To Meet The Unique Needs Of Their Customers. The Support Team Is Available 24 Hours A Day, 5 Days A Week, Ensuring They Are Available To Help Whenever The Market Is Open. Customers Can Easily Contact The Support Team Through The Live Chat Feature Available On Their Website, Which Can Be Accessed By Clicking The Chat Button In The Bottom Right Corner Of Any Page. Also, For Those Who Prefer Email Correspondence, They Can Do So Via "support @midasFX.com".

CONCLUSION

MidasFX Is A Forex Broker That Offers Trading Services On The Metatrader 4 And Metatrader 5 Platforms. While It Offers A Range Of Features, Including A Focus On Cryptocurrency Financing Options And Trading Bonuses, Significant Concerns Remain. The Broker Has High Withdrawal Fees, Strict Bonus Strings Attached, And Lacks A Clear Regulatory Status. In Addition, While The Broker Promotes A Variety Of Traditional Payment Methods, The Main Option Available Is Cryptocurrencies. The Conditions And Features Of The Different Platforms Of MidasFX Vary Widely Compared To Typical UK And European Union Regulated Brokers, Stressing The Importance For Traders To Exercise Caution And Conduct Thorough Research Before Using The Platform.