What Is Coinlion?

Coinlion, A US-based Exchange Founded In 2017. Offering Over 100 Cryptocurrencies, Coinlion Has A 0.11% Trading Fee And Affordable Prices. With A 24-hour Trading Volume Of $1 Billion, It Is A Dynamic Trading Venue.

Pros And Cons

Coinlion Excels In These Areas:

- Regulated By NMLS And DFI, Ensuring A Well-regulated Trading Environment.

- With An Intuitive And Simple Interface, Coinlion Caters To Users At All Levels, From Novice To Experienced Traders.

- Coinlion Has Impressive Fees And Maintains A Competitive Advantage, Especially In Favor Of Manufacturers Over Takers.

- Liquidity Is Strong And 24-hour Trading Volume Exceeds $1 Billion.

- Providing Knowledge To Users, Coinlion Stands Out By Providing A Range Of Educational Materials On Cryptocurrencies And Trading Exploration.

- Large Selection Of Cryptocurrencies: Coinlion Only Lists Over 100 Cryptocurrencies, Fewer Than Some Other Exchanges.

Coinlion Lacks These Areas:

- Coinlion Does Not Offer Margin Trading, While Some Other Exchanges Offer Margin Trading Capabilities.

- Coinlion Does Not Provide 24/7 Customer Support.

- Coinlion Requires Users To Complete Kyc/aml Verification Before They Can Start Trading.

- Coinlion Charges High Withdrawal Fees For Certain Cryptocurrencies.

Stipulates

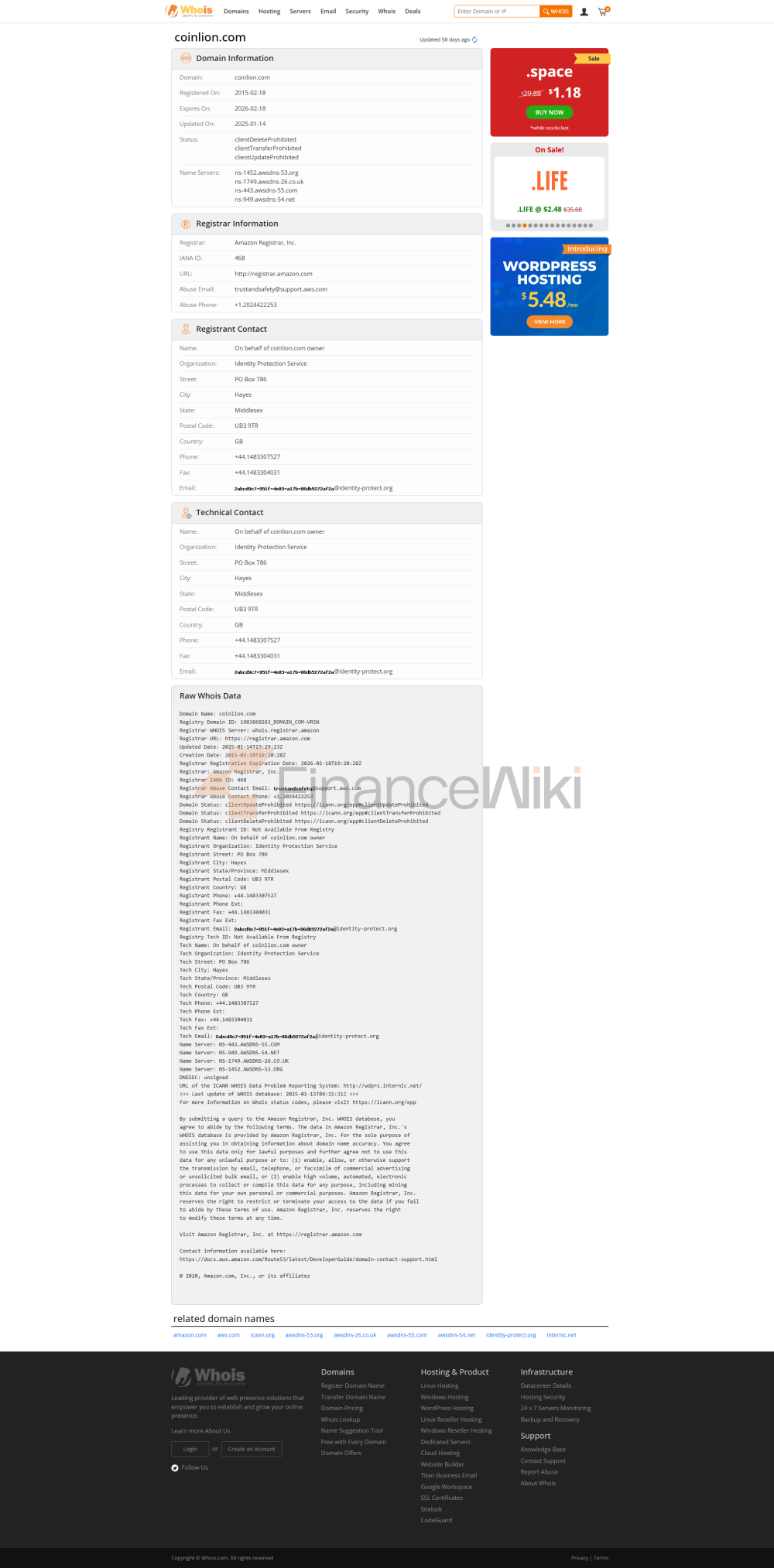

Coinlion Is A US-based Regulated Financial Institution Group That Holds Two Licenses: A Money Transfer License (MTL) And A Digital Currency License.

The Company Is Authorized To Transmit Currencies, Including Digital Currencies, And To Operate Within The Digital Currency Space. Coin Lion, LLC Is Regulated By The National Multi-State Licensing System (NMLS). The National Mortgage Licensing System And Registry (NMLS) Is A Database Of Mortgage Originators (MLOs) In The United States. The NMLS Was Created By The Consumer Financial Protection Bureau (CFPB) To Help Consumers Find Licensed MLOs And Prevent Mortgage Fraud.