Corporate Profile

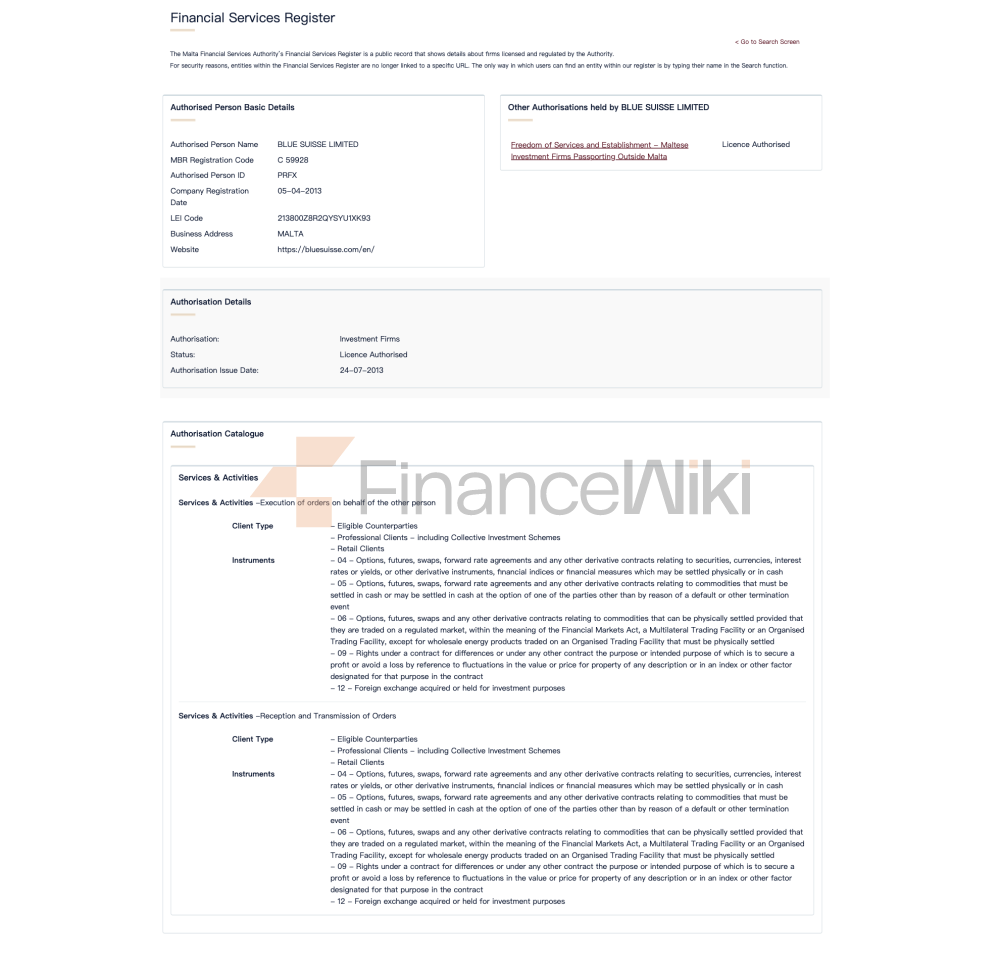

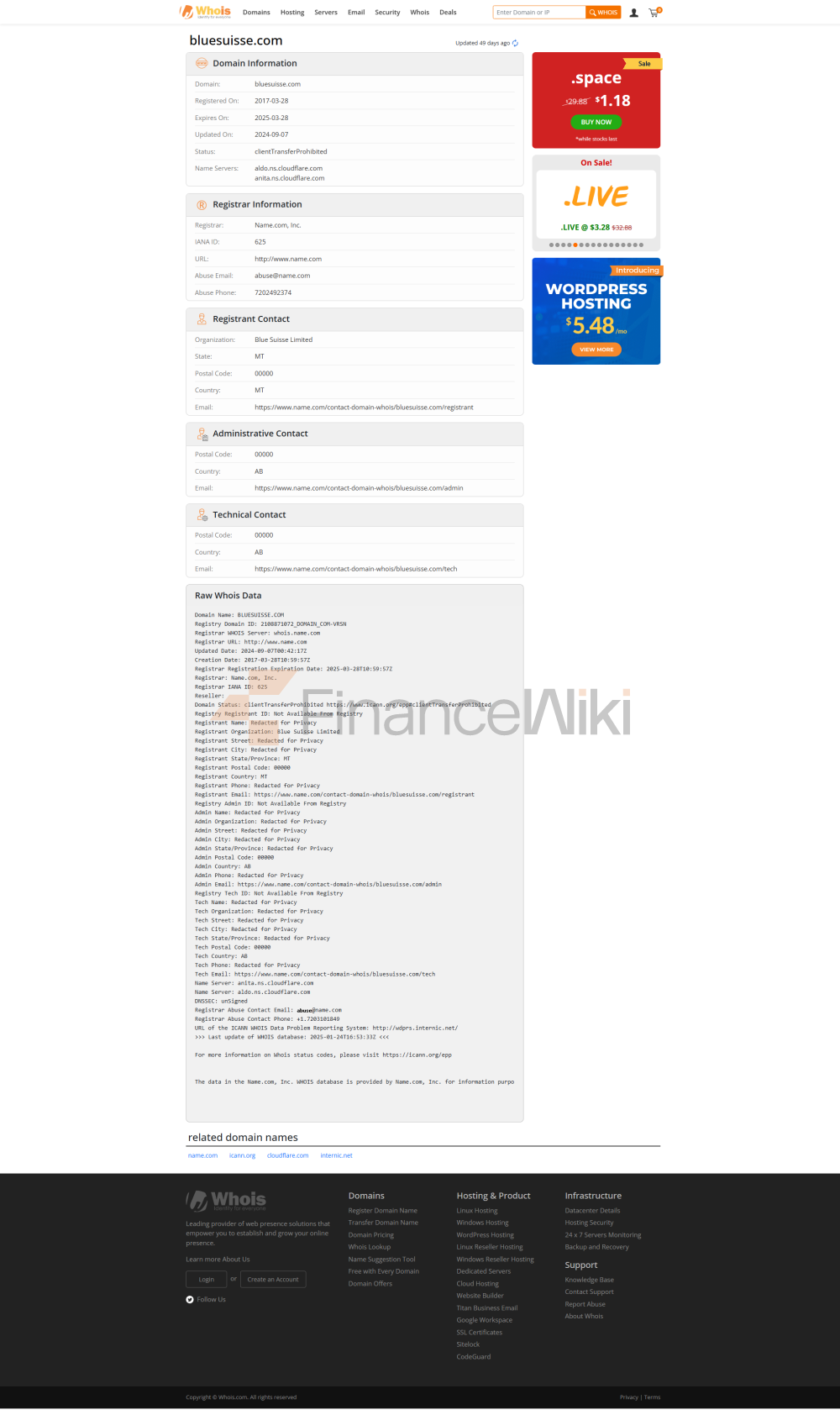

Blue Suisse Is An Online Forex Broker Regulated By The Malta Financial Services Authority (MFSA). The Company's Full Name Is Blue Suisse Limited With Registration Number C59928. It Is Headquartered On The Island Of Gozo, Malta And Has Offices In Berlin, Germany. The Company Was Established In 2013 And Officially Launched Its Official Website In 2017. Blue Suisse Mainly Provides Trading Services For Private And Institutional Clients On A Wide Range Of Financial Products, Including Foreign Exchange Currency Pairs, Stocks, Indices And Commodities.

Regulatory Information Blue Suisse Is Strictly Regulated By The Malta Financial Services Authority (MFSA) And Holds A Category 2 Investment Services License With License Number IS/59928. The License Allows Blue Suisse To Offer Trading Services In A Wide Range Of Financial Instruments Including Forex, Indices, Stocks And Commodities. In Addition, Blue Suisse Also Follows The Relevant Standards Of The Markets In Financial Instruments Directive (MiFID) To Ensure That Its Operations Comply With The Financial Regulatory Requirements Of The European Union.

Trading Products Blue Suisse Offers Investors More Than 130 Financial Products , Mainly Including The Following Categories:

- Forex Currency Pairs : Blue Suisse Offers Trading In A Wide Range Of Currency Pairs, Allowing Investors To Invest Based On Exchange Rate Fluctuations.

- Index : Investors Can Participate In The Trading Of Major Global Indices, Such As Dow Jones Index, Nasdaq Index, Etc., Through Index Contracts For Difference (CFDs).

- Stocks : Investors Can Trade Stocks Of Well-known Global Companies, Such As Apple, Google, Tesla, Etc.

- Commodities : Covers The Trading Of Major Commodities Such As Crude Oil, Gold, Silver And Platinum.

Trading Software Blue Suisse Offers A Variety Of Trading Platforms To Meet The Needs Of Different Traders:

- MetaTrader 4 (MT4) : Provides A Wealth Of Technical Analysis Tools, Trading Indicators And Automated Trading Functions, Suitable For Novice And Intermediate And Advanced Traders.

- MetaTrader 5 (MT5) : Compared To MT4, MT5 Adds More Advanced Features, Such As More Order Types And Economic Calendars.

- TraderMaster : Focuses On Social Trading And Signal Trading, Allowing Traders To Replicate The Actions Of Other Professional Traders.

- Mobile Trading Software : Trade Anytime, Anywhere Via Mobile Devices, Supporting Real-time Quotes And Chart Analysis.

- ProBlue Trader, CRM, MAM And DSP : Provides More Advanced Trading And Account Management Capabilities For Institutional Clients And High Net Worth Investors.

Deposit And Withdrawal Methods Blue Suisse Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Credit Cards : Visa And MasterCard

- Bank Transfer : EUR, USD, GBP And Other Currencies

- Electronic Payment Platform : Skrill, Neteller And Other Deposits And Withdrawals Take 1-2 Working Days To Arrive, And Support Multi-currency Trading Accounts. Advantage : Traders Can Flexibly Access Funds In A Variety Of Ways, Supporting Multi-currency Transactions. Cons : The Minimum Deposit Requirement Is High, And Some Trading Products May Involve Additional Fees.

Customer Support Blue Suisse Provides 24/7 Multilingual Customer Support. Traders Can Get Help By Phone, Email, And Online Chat. Support Languages Include English, German, Chinese, French, Etc. In Addition, Blue Suisse's Official Website Provides Detailed Trading Guides, Educational Resources, And Frequently Asked Questions (FAQs) To Help Traders Get Started Quickly.

Core Business And Services Blue Suisse's Core Business Includes Trading Services For Foreign Exchange, Stocks, Indices, And Commodities. The Company Meets The Needs Of Different Investors Through Three Account Types (Denim Blue, Blue Sky, And Sapphire Blue). The Specific Features Of The Account Type Are As Follows:

- Denim Blue : The Minimum Deposit Requirement Is 500 Dollars , Suitable For Novice And Small And Medium-sized Traders.

- Sky Blue : The Minimum Deposit Requirement Is $5,000 , Suitable For Medium-sized Traders.

- Sapphire Blue : The Minimum Deposit Requirement Is $50,000 , Suitable For High Net Worth And Institutional Clients. Each Account Type Offers The Same Trading Products And Services, But Spreads And Transaction Costs Vary.

Technical Infrastructure Blue Suisse Uses Straight-through Processing (STP) Technology To Ensure That Trade Orders Are Delivered Directly To The Market, Reducing Transaction Delays And Slippage. In Addition, The Company Uses Advanced Trading Platforms And Cyber Security Measures, Including SSL Encryption And Firewall Protection, To Ensure The Security Of Traders' Data And Funds.

Compliance And Risk Control System Blue Suisse Strictly Adheres To The Compliance Requirements Of The MFSA, Ensuring That Its Operations Meet The Highest Standards Of European Union Financial Marekt. The Company's Risk Management Measures Include:

- Client Funds Segregation : Trader Funds Are Held In Segregated Bank Accounts, Completely Segregated From The Company's Working Funds.

- Collateral Management : For High-risk Transactions, The Company Will Require Customers To Pay Additional Collateral.

- Market Risk Monitoring : Identify And Respond To Latent Risks By Monitoring Market Fluctuations In Real Time.

Market Positioning And Competitive Advantages Blue Suisse's Main Competitive Advantages In The Field Of Foreign Exchange Brokerage Include:

- Multi-language Support : The Official Website Provides 10 Language Versions, Covering Global Investors.

- Diversified Trading Platforms : Support MT4, MT5, TraderMaster And Other Trading Platforms.

- Institutional-level Services : Provide Professional Account Management And Technical Support For High Net Worth Clients And Institutional Investors. However, The Company Has Certain Disadvantages In The Following Areas:

- Higher Minimum Deposit Requirements : Compared To Other Brokers, Blue Suisse Has A Higher Minimum Deposit Threshold, Which May Limit The Choice Of Some Small And Medium Investors.

- Higher Spreads And Transaction Costs : The Spreads And Transaction Costs Of Some Trading Instruments Do Not Have Significant Advantages In The Industry.

Customer Support & Empowering Blue Suisse Empowers Clients In A Number Of Ways, Including:

- Educational Resources : Provides Trading Guides, Market Analysis Reports And Video Tutorials To Help Traders Improve Their Skills.

- Risk Management Tools : Includes Features Such As Stop Loss, Take Profit And Order Types To Help Traders Control Risk.

- Real-time Market Data : Provides Real-time Quotes And Historical Data To Help Traders With Technical Analysis.

Social Responsibility And ESGBlue Suisse Does Not Explicitly Mention Specific ESG (Environmental, Social And Governance) Policies On Its Official Website, But As A Regulated Financial Institution Group, The Company Should Comply With Relevant Environmental Protection And Social Responsibility Regulations. In The Future, Blue Suisse May Need To Further Strengthen Its Information Disclosure And Practices In The ESG Field.

Strategic Cooperation Ecological Blue Suisse Has Not Yet Made Public Its Material Strategic Cooperation Information. However, As A Regulated Forex Broker, The Company May Enter Into Partnerships With Multiple Banks, Payment Platforms And Fintech Companies To Optimize Its Trading Technology And Client Server.

Financial Health As Of The Third Quarter Of 2023, Blue Suisse's Financial Health Is Not Publicly Available. However, As A Regulated Financial Institution Group, The Company Must Regularly Submit Financial Reports To The MFSA To Ensure That Its Capital Adequacy Ratio Meets Regulatory Requirements.

Future Roadmap The Future Development Direction Of Blue Suisse May Include:

- Product Innovation : Launch More Financial Products And Services To Meet The Diverse Investment Needs Of Customers. Technology Upgrade : Optimize The Trading Platform And Cyber Security System To Enhance The User Experience.

- Market Expansion : To Further Expand The Global Market, Especially In Emerging Markets Such As Asia And The Middle East.

Summary Blue Suisse Is A Foreign Exchange Broker Regulated By The Malta Financial Services Authority, Offering A Diverse Range Of Financial Products And Trading Instruments. The Company Has Attracted Global Investors With Multilingual Support And Institutional-level Services, But Also Faces Challenges With Higher Minimum Deposit Requirements And Higher Transaction Costs. In The Future, Blue Suisse Needs To Continue Its Efforts In Product Innovation, Market Expansion And Technological Upgrades To Maintain Its Competitiveness In The Industry.