Company

OverviewJFD Brokers (hereinafter referred to as "JFD") is a professional online forex and CFD broker founded in 2011 and headquartered in Limassol, Cyprus. The company also has offices in Germany and Spain to expand its global reach. With its diversified product portfolio, advanced trading platform and regulated business model, JFD provides a safe and transparent trading environment for global traders.

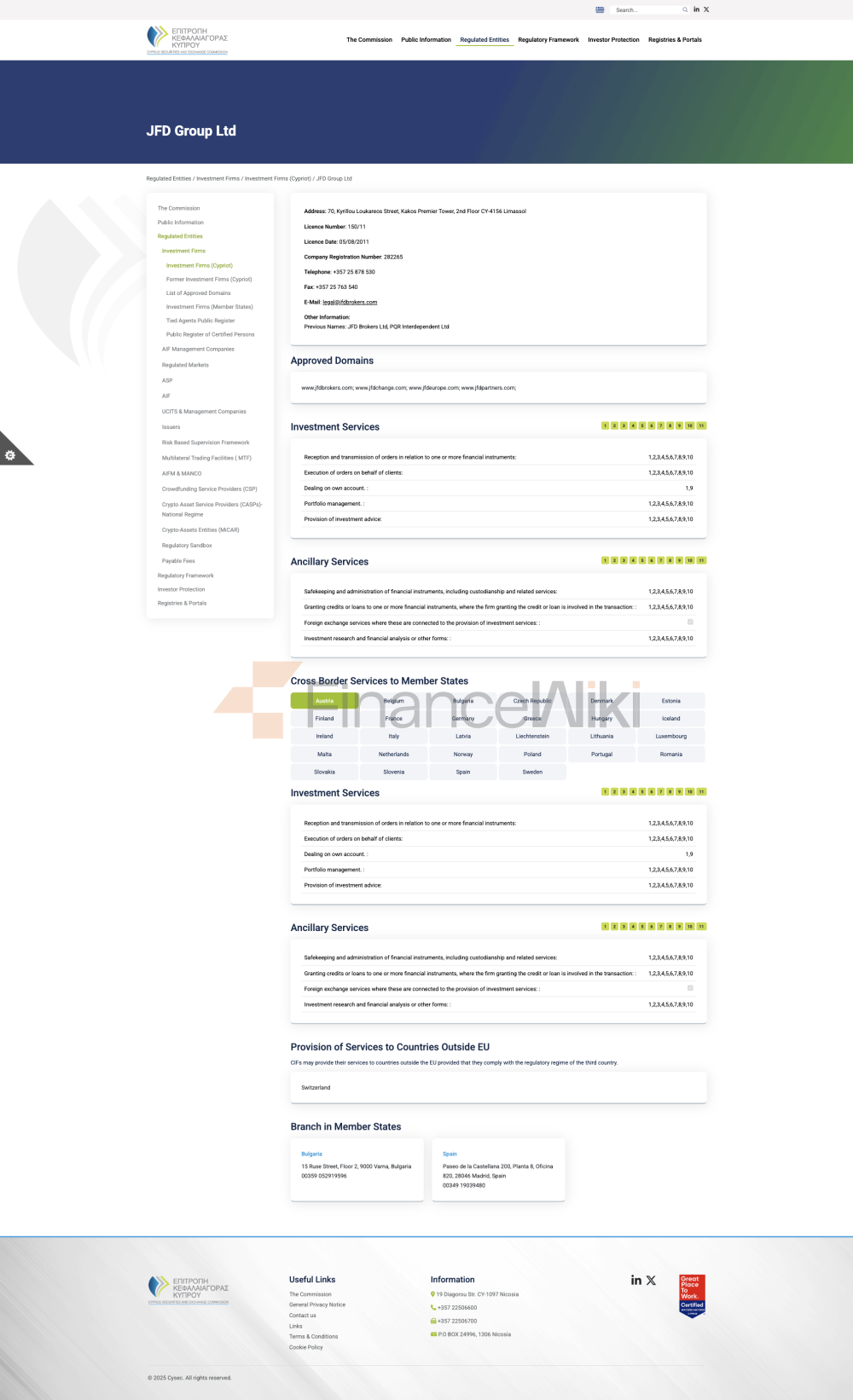

Regulatory InformationJFD

is licensed by a number of authoritative regulatory agencies to ensure that its operations meet strict financial regulatory standards:

German Federal Financial Supervisory Authority (BaFin): JFD obtained a retail foreign exchange license issued by BaFin in Germany with license number 120056.

Vanuatu Financial Services Commission (VFSC): JFD is also licensed as a retail forex license by VFSC under license number 17933.

Cyprus Securities and Exchange Commission (CySEC): JFD holds a straight-through license number 150/11 issued by CySEC.

In addition, JFD fully segregates client funds from its operating funds and holds them in segregated accounts with Barclays Bank in the UK to further ensure the safety of funds.

trading productsJFD

provides investors with a wide range of financial trading tools, covering multiple asset classes to meet the needs of different traders:

Forex: Includes major currency pairs (e.g. EUR/USD, USD/JPY) and minor currency pairs.

Precious Metals: Provides trading in precious metals such as gold and silver.

Stocks: Covers major global stocks such as Apple, Google, Tesla, etc.

Indices: including S&P 500, Dow Jones, FTSE 100, etc.

Commodities: covering energy products such as crude oil and natural gas.

Cryptocurrencies: Offer trading in digital assets such as Bitcoin, Ethereum, etc.

ETFs and ETNs: Offering investors access to exchange-traded funds.

trading software

JFD provides traders with market-leading and critically acclaimed trading platforms, including:

MetaTrader 5 (MT5): An upgraded version of MT4, MT5 supports more than 1,500 instruments across 9 asset classes. It is more powerful and suitable for advanced traders.

STOCK3: Browser-based platform that supports social trading, with over 1,500 instruments across 9 asset classes, customizable desktop and free widgets.

MetaTrader 4 (MT4): Available on desktop, web, and mobile, it offers more than 500 instruments from 8 asset classes, including Forex, Precious Metals, Indices, and more. MT4 also supports a pure market maker mode, connecting up to 20 limited partners (LPs) to ensure fair and direct trading.

deposit and withdrawal methodsJFD

provides traders with a variety of convenient deposit and withdrawal methods, including:

Safecharge, Skrill, NETELLER, SOFORT, etc. are supported.

No Fee Withdrawals: JFD does not charge any withdrawal fees, but banks may charge transfer fees.

Electronic payment by bank transfer (SEPA or non-SEPA):

customer supportJFD

provides comprehensive customer support, ensuring that traders can get help at any time:

24/5 Multi-language Support: Support multiple languages such as English, German, French, etc.

Contact:

phone support: +49 40 87408688.

Email support: support@jfdbrokers.com.

Live chat: Real-time communication through the official website.

core business and servicesJFD's

core business covers the following aspects:

Retail foreign exchange trading: provides trading services for individual traders in foreign exchange, CFDs and other products.

TECHNOLOGY-DRIVEN TRADING PLATFORM: PROVIDE TRADERS WITH AN EFFICIENT AND TRANSPARENT TRADING EXPERIENCE THROUGH MT4, MT5 AND STOCK3 PLATFORMS.

Educational resources: Trading guides, market analysis, and webinars are available to help traders improve their skills.

Technical InfrastructureJFD's

trading platform and trading system are based on an advanced technical architecture:

Multi-platform support: Desktop, mobile and web are supported to meet the needs of different trading scenarios.

Powerful data analysis tools: provide technical indicators and chart analysis functions to help traders formulate strategies.

Low-latency trading: Ensure fast order execution with low latency.

compliance and risk control systemJFD

strictly complies with the compliance requirements of relevant regulatory authorities and ensures the effectiveness of risk management through the following measures:

Leverage limit: Leverage from 1:30 to 1:400 is provided according to the regulations of different jurisdictions to ensure that the trading risk is controllable.

Risk segregation: Client funds are completely segregated from the company's operating funds and are deposited in third-party bank accounts.

Stop-loss and Margin Call: 50% stop-loss level and 100% margin call are provided to prevent excessive losses on the account.

Market Positioning and Competitive AdvantageJFD

stands out in the market with the following advantages:

Abundant trading products: Provide more than 1,500 instruments in 9 asset classes to meet different trading needs.

Advanced trading platform: MT4, MT5 and STOCK3 provide traders with an efficient and flexible trading experience.

Transparent pricing: Competitive spreads and commission fees are available to ensure clear trading costs.

Multiple Regulation: Obtain regulatory approvals from CySEC, BaFin and VFSC to enhance customer trust.

Customer Support & EmpowermentJFD

empowers traders by

demo accounts : A free demo account is available to help traders practice their strategies in a risk-free environment.

Educational resources: Advance your traders' skills with trading guides, market analysis, and webinars.

Multilingual support: Ensure that customers around the world can receive timely and professional service.

Social Responsibility & ESG

JFD is committed to fulfilling its social responsibilities, including:

Sustainable development: Support environmental protection and social welfare projects to promote sustainable development.

Protecting the interests of customers: Ensuring the safety of customer funds through transparent operations and strict compliance requirements.

strategic cooperation ecologyJFD

has established strategic cooperative relations with a number of well-known institutions and organizations:

Membership of industry associations: Join a number of international financial industry associations to enhance the influence of the industry.

Technology partners: Collaborate with technology providers such as MetaQuotes to optimize the functionality of the trading platform.

financial healthJFD

ensures the company's sound operation through rigorous financial management and capital adequacy assessments. The company is regularly audited by regulators to ensure financial transparency and health.

future roadmap

JFD plans to continue to expand its global presence in the coming years, including:

market expansion: access to more emerging markets, Increase customer reach.

Product Innovation: Introducing more trading tools and educational resources to enrich traders' choices.

Technology upgrades: Continuously optimize the trading platform to improve user experience.