Corporate Profile

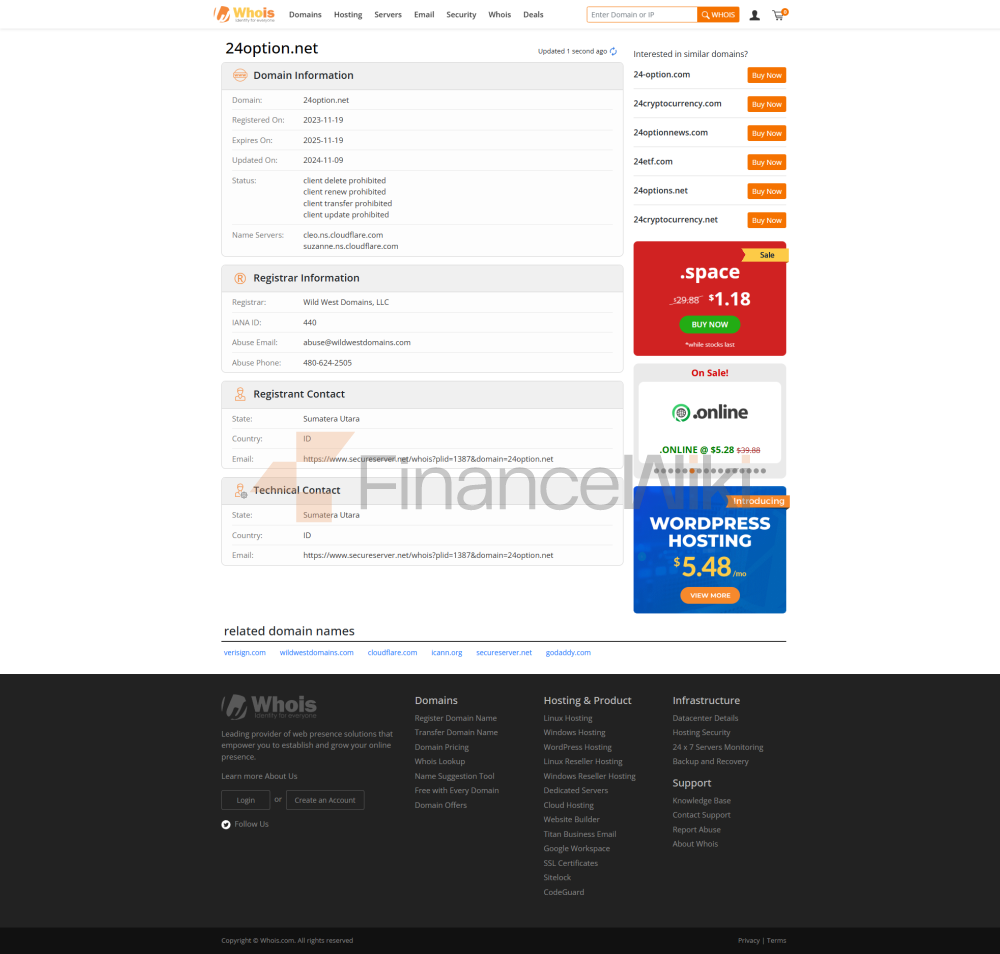

Best24option Is An Online Platform That Provides Foreign Exchange And Cryptocurrency CFD Trading. According To Whois Query Information, The Domain Name (best24option.com) Of The Platform Was Registered On July 3, 2022, And Was Acquired By The Existing Operation Team And Used As The Official Website On July 4, 2024. However, After Verification, There Is No Real Corporate Entity On The Platform.

Regulatory Information

Best24option's Official Website Claims That It Has Legal Qualifications, But After Verification, It Was Found That There Are Problems With The Company Registration Information And Regulatory Authorization It Provides. The Following Is The Key Regulatory Information:

- Company Registration Information : The Information Displayed On The Official Website Shows That BEST TRADE 24 LIMITED Was Registered In The UK On July 13, 2021 With Registration Number 13508208 . However, According To Public Data From The UK Companies House And The Financial Conduct Authority (FCA), The Company Was Cancelled On January 17, 2023 And Has Not Obtained Any Legal Financial Licenses In The UK.

- Regulatory Statement : Best24option's Compliance Statement Does Not Mention The Specific Regulator Or License Number, Which Poses A Significant Compliance Risk.

Trading Products

Best24option Offers The Following Financial Instruments For Traders To Choose From:

- Forex Currency Pairs : Such As EUR/USD, GBP/USD, Etc.

- Precious Metals : Such As Gold (XAU/USD), Silver (XAG/USD), Etc.

- Commodities : Such As Crude Oil (Crude Oil), Natural Gas, Etc.

- Index : Such As Dow Jones Index, S & P 500 Index, Etc.

- Cryptocurrencies : Such As Bitcoin (BTC/USD), Ethereum (ETH/USD), Etc.

Trading Software

Best24option Does Not Explicitly State The Trading Software It Uses, Nor Does It Provide Any Download Links Or Details. This Reduces The Transparency Of The Platform And Increases The Risk For Investors.

Deposit And Withdrawal Methods

Best24option Supports The Following Deposit And Withdrawal Methods:

- Credit/Debit Card : Supports Multiple Currencies, The Arrival Time Is Instant, And The Minimum Deposit Amount Is $5 .

- POLI : Only Supports AUD, The Arrival Time Is Instant, And The Minimum Deposit Is AUD 5 .

- Bank Transfer : The Arrival Time Is 1-3 Days , And The Minimum Deposit Amount Is Not Clear.

- Cryptocurrency : Support Bitcoin, Ethereum, Etc., The Arrival Time Is Instant, And The Minimum Deposit Is $5 Or The Equivalent Currency .

Withdrawal Method :

- Credit/debit Card : The Withdrawal Fee Is 3.5% , And The Minimum Withdrawal Amount Is Not Clear.

- Telegraphic Transfer : The Fee Varies By Currency And Is Approximately $30 .

- Cryptocurrency : Withdrawal Processing Time Is 1-2 Days And Minimum Withdrawal Amount Is $30 .

Customer Support

Best24option Provides The Following Contact Details:

- WhatsApp : + 44 7931 872039.

- Email : Info@baseminingf.com.

However, The Platform Does Not Have An Official Account On Mainstream Social Media (such As Facebook, Twitter, Instagram, Etc.) And Lacks A Transparent Channel For Customer Communication.

Core Business And Services

Best24option's Core Business Includes Foreign Exchange And Cryptocurrency CFD Trading. Its Main Services Include:

- Multiple Trading Accounts : Offers Three Investment Plans, Starter Pack, Gold Pack And Platinum Pack, Which Provide Different ROI And Withdrawal Processing Times Respectively.

- High Return Promise : Although Its Return Rate Far Exceeds The Market Norm, It Does Not Provide Detailed Investment Process Instructions Or Risk Warnings, Which Poses A Large Risk.

Technical Infrastructure

Best24option Does Not Disclose Specific Information About Its Technical Infrastructure, Including The Stability And Security Of The Trading System. This Has Increased Investors' Doubts About Its Technical Capabilities.

Compliance And Risk Control System

Best24option's Compliance And Risk Control System Has The Following Problems:

- Suspicious Company Background : The Company's Claimed History And Registration Information Have Been Verified To Be Inaccurate, And The Company Has Been Cancelled In The UK.

- Lack Of Regulatory Authority : There Is A Significant Compliance Risk Due To The Lack Of Any Legal Financial Licenses.

- High Return Commitment : Provides A Return On Investment That Far Exceeds The Market Norm, And May Involve The Risk Of A Ponzi Scheme.

Market Positioning And Competitive Advantage

Best24option's Market Positioning And Competitive Advantage Are Not Clear, And There Is A Lack Of Clear Differentiated Services. Its Main Advantages Include:

- Rich Trading Products : Offer A Variety Of Financial Instruments. Multiple Account Options : Offer Four Trading Accounts For Investors To Choose From.

Customer Support And Empowerment

Best24option Does Not Provide Any Educational Resources Or Training Materials, And Investors Do Not Have Access To Basic Market Learning And Risk Prevention Knowledge. Its Customer Support Channels Are Limited, And It Lacks Transparency And Reliability.

Social Responsibility And ESG

Best24option Does Not Disclose Its Social Responsibility And ESG Related Information, And Lacks Attention To Social And Environmental Issues.

Strategic Cooperation Ecology

Best24option Does Not Disclose Its Strategic Cooperation Information, And Lacks Cooperation With Other Financial Institution Groups Or Technology Platforms.

Financial Health

Best24option's Financial Health Cannot Be Verified, And There Is A Lack Of Transparent Financial Reporting And Audit Information.

Future Roadmap

Given That Best24option Has Many Compliance And Transparency Issues, Its Future Development Path Is Still Unclear. Investors Should Treat This Platform With Caution And Avoid Potential Financial Exposure.

Summary

Best24option, As An Online Platform That Provides Foreign Exchange And Cryptocurrency CFD Trading, Has Many Compliance And Transparency Issues. Its Company Background Has Low Credibility, Lacks Legal Regulatory Authorization, And Provides Unusually High Return On Investment, Which Increases The Risk For Investors. Investors Are Advised To Fully Understand Its Latent Risks And Make Decisions Carefully Before Choosing This Platform.