Corporate Overview

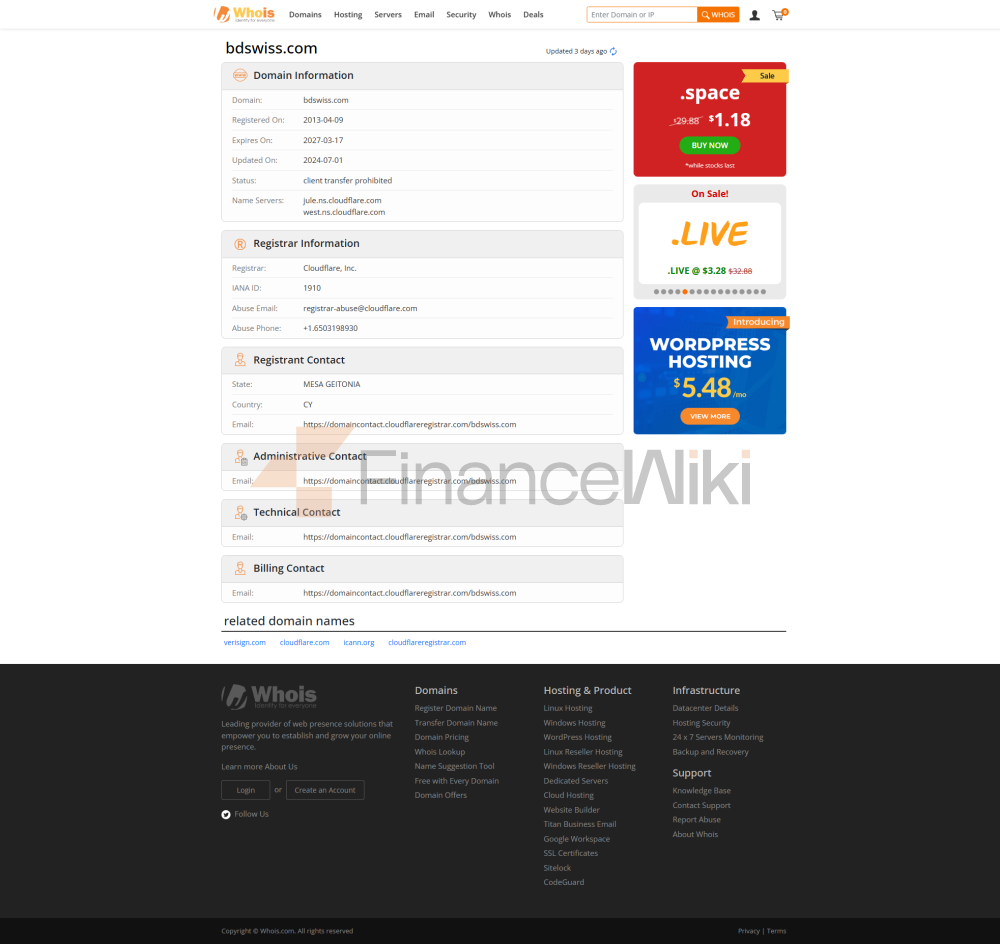

BDSwiss , Full Name BDS Swiss Markets Global Services Ltd, Is A Forex And Contracts For Difference (CFD) Broker Established In 2012 And Headquartered In Eben, Mauritius. The Company Focuses On Providing Global Investors With A Wide Range Of Financial Products And Services, Including Forex, Commodities, Stock Indices, Cryptocurrencies And More. As Of 2023, BDSwiss Has Served More Than 1 Million Clients And Is One Of The World's Leading Financial Groups.

BDSwiss's Brand Operation History Dates Back To 2012 And Was Originally Established In Kirchberg, Near Zurich, Switzerland. The Company Currently Operates Globally And Manages Various Businesses Under Its Holding Company, BDSwiss Group In Zug, Switzerland. As An International Financial Group, BDSwiss Is Committed To Providing Investors With The Best Trading Experience Through Advanced Technology And High-quality Client Server.

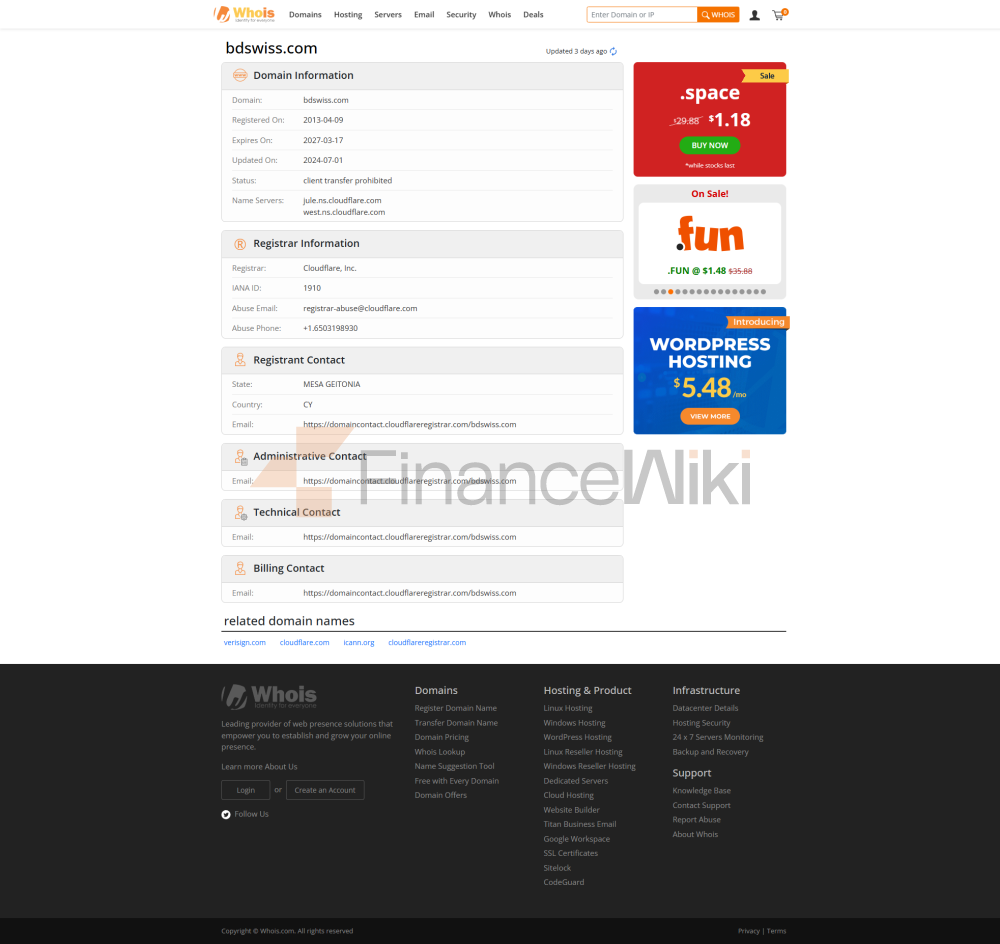

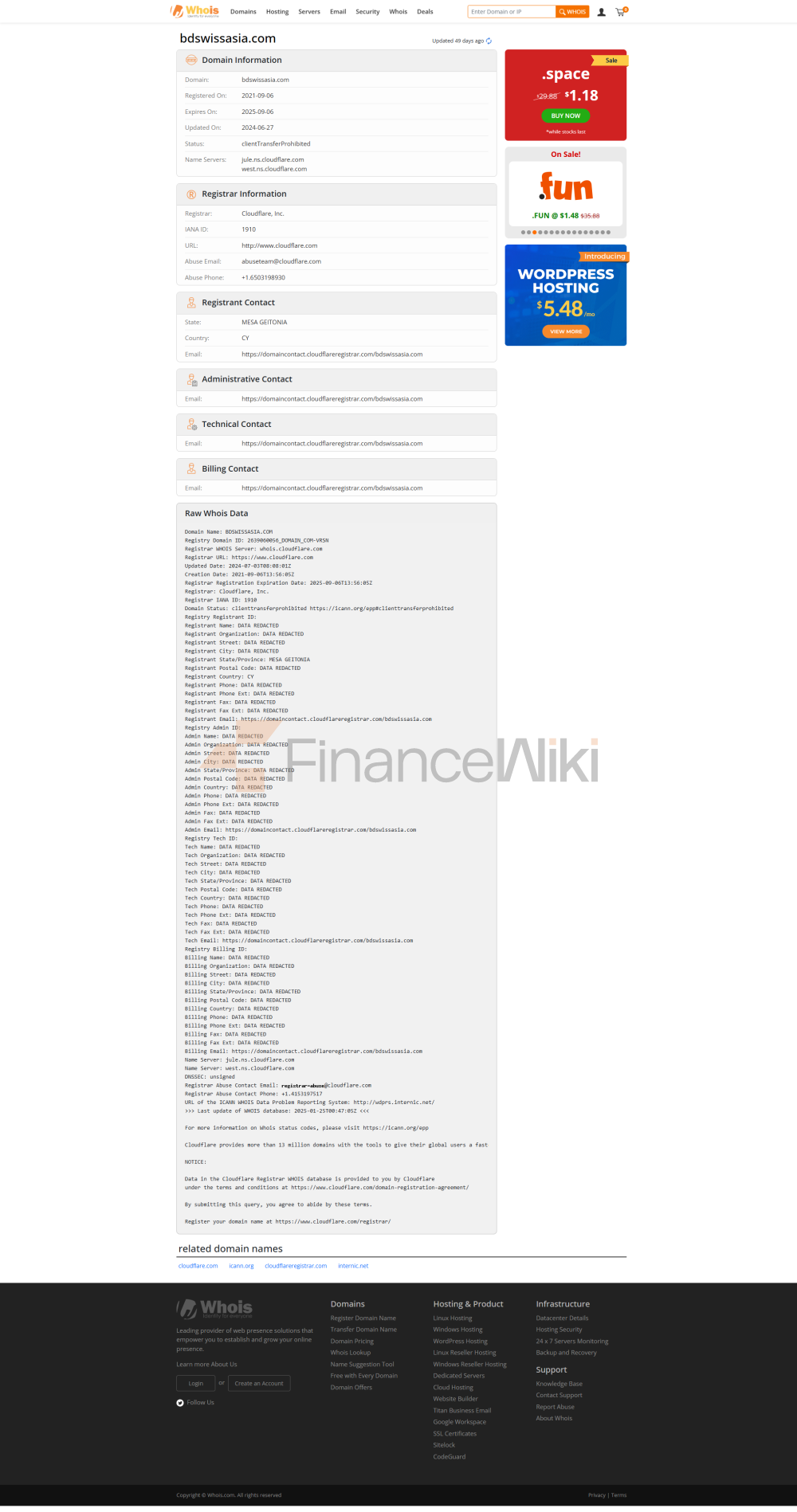

Regulatory Information

BDSwiss Strictly Adheres To The Financial Regulatory Frameworks Of Multiple Countries And Regions Around The World, Ensuring The Transparency, Security And Compliance Of Its Operations. The Following Is The Main Regulatory Information Of BDSwiss And Its Subsidiaries Worldwide:

- Mauritius Financial Services Commission (FSC) : BDS Markets Is Regulated By The Mauritius FSC With Regulatory Number C116016172.

- Seychelles Financial Services Authority (FSA) : BDS Ltd Is Regulated By The Seychelles FSA.

- Cyprus Securities And Exchange Commission (CySEC) : Viverno Markets Ltd Is Regulated By CySEC With Regulatory Number 199/13.

- South African Financial Sector Conduct Authority (FSCA) : BDSWISS MARKETS SA (PTY) LTD Is Regulated By FSCA With Regulatory Number 49479.

- Moeli International Services Authority (MISA) : BDS Investments LTD Is Regulated By MISA With Regulatory Number T2023244.

These Regulators Are Internationally Recognized Authorities That Ensure BDSwiss Compliance In Various Financial Products And Services, Ensuring The Safety Of Clients' Funds And Trading Experience.

Trading Products

BDSwiss Offers Investors A Rich Selection Of Financial Products Covering Multiple Asset Classes, Including The Following:

- Forex : Covers Major Global Currency Pairs Such As EUR/USD (EUR/USD), GBP/USD (GBP/USD), Etc., Providing Investors With 24-hour Trading Opportunities.

- Commodities : Includes Precious Metals And Energy Products Such As Gold, Silver, Crude Oil, Etc., To Help Investors Hedge Against Inflation Risk Or Capture Commodity Price Fluctuations.

- Stock Indices : Offers Trading On Major Stock Indices Such As The S & P 500 Index (S & P 500) And The Dow Jones Industries Average Index (Dow Jones), Enabling Investors To Participate In The Volatility Of Global Stock Markets.

- Cryptocurrency : Offers CFD Trading Of Major Cryptocurrencies Such As Bitcoin (BTC) And Ethereum (ETH) To Meet Investors' Demand For Emerging Asset Classes.

- ETF : Covers Exchange Traded Funds That Track Various Types Of Assets, Providing Investors With A Diverse Range Of Investment Options.

Through A Diverse Range Of Trading Products, BDSwiss Helps Investors Build A Suitable Trading Portfolio Based On Market Trends And Investment Goals.

Trading Software

To Facilitate Efficient Trading For Clients, BDSwiss Offers A Variety Of Trading Platforms As Follows:

- MetaTrader 4 (MT4) : Developed By MetaQuotes Software, It Is Popular For Its Intuitive Interface, Powerful Technical Analysis Tools, And Automated Trading Capabilities. MT4 Supports A Variety Of Trading Order Types, Including Instant Execution And Pending Orders, And Allows Users To Customize Indicators And Scripts.

- MetaTrader 5 (MT5) : An Upgraded Version Of MT4 That Offers More Comprehensive Timeframes, Technical Indicators, And Improved Charting Tools. MT5 Supports Not Only Foreign Exchange Trading, But Also Stock And Commodity Futures Trading, Suitable For Professional Traders.

- BDSwiss Mobile App : An Application Specially Developed For Mobile Devices, Providing Real-time Market Analysis, Order Management And Multilingual Customer Support To Meet The Needs Of Traders To Trade Anytime, Anywhere.

These Platforms Are Internationally Recognized Trading Tools, Providing Investors With An Efficient And Reliable Trading Environment.

Deposit And Withdrawal Methods

BDSwiss Supports A Variety Of Deposit And Withdrawal Methods To Meet The Different Needs Of Customers:

- Credit Cards : Including VISA, MasterCard, Maestro, Etc.

- Electronic Wallet : Supports Skrill, Neteller, AstroPay, Etc.

- Bank Transfer : Including International Telegraphic Transfer, SEPA Telegraphic Transfer, Etc.

- Cryptocurrency Payment : Some Accounts Support Cryptocurrency Access.

The Minimum Deposit Requirement Is $10, And The Maximum Withdrawal Amount For Credit Cards Is €/$/£2,000. There Are No Fees For Deposits And Withdrawals. The Processing Time Varies According To Different Payment Methods. Bank Telegraphic Transfers Usually Take 1-4 Working Days.

Customer Support

BDSwiss Provides Customers With Multi-channel Customer Support Services:

- Online Chat : 24/5 Multi-language Support. Customers Can Communicate With Customer Service Through The Official Website At Any Time.

- Email Support : Customers Can Send Emails Through Support@bdswiss.com To Get Professional Answers.

The Customer Support Team Is Committed To Providing Timely And Professional Assistance To Ensure That Investors Can Be Quickly Resolved When They Encounter Problems During The Trading Process.

Core Business And Services

BDSwiss's Core Business Includes Foreign Exchange Trading, CFD Trading And Related Financial Services. The Service Target Covers Retail Clients And Institutional Investors, Providing Flexible Leverage Options, Diverse Account Types And Advanced Trading Tools. The Company, Through Its Technology Platform, Ensures Fast Execution Of Transactions And Market Depth, Helping Clients Seize The Best Trading Opportunities.

Technical Infrastructure

BDSwiss Adopts Advanced Technology Infrastructure To Ensure The Stability And Security Of Transactions. The Company Uses An Efficient Server Network And A Low-latency Trade Execution System To Provide Customers With An Excellent Trading Experience. At The Same Time, Its Technical Support Team Continuously Optimizes The Platform Performance To Ensure The Stable Operation Of The System Under High Trading Volume.

Compliance And Risk Control System

BDSwiss Strictly Complies With The Compliance Requirements Of Various Regulatory Agencies To Ensure That Its Business Operations Comply With International Financial Regulatory Standards. The Company's Risk Control System Includes Threat And Risk Assessment, Leverage Limits, Stop Loss Tools, Etc., To Reduce The Risk Of Customers In Highly Leveraged Transactions. In Addition, The Company's Compliance Department Regularly Reviews Internal Processes To Ensure That All Operations Comply With Regulatory Requirements.

Market Positioning And Competitive Advantage

As A Leading Global Forex And CFD Broker, BDSwiss' Competitive Advantage Is Reflected In The Following Aspects:

- Diversified Trading Products : Provide More Than 1,000 Trading Instruments To Meet The Needs Of Different Investors.

- Flexible Leverage Options : Maximum Leverage Up To 1:1000, Adapting To Clients With Different Risk Tolerance.

- Multi-platform Support : MT4, MT5, WebTrader And Mobile Apps, Providing A Comprehensive Trading Solution.

- Advanced Trading Technology : Low Latency Trade Execution, Multi-lingual Customer Support For Improved Trading Efficiency And Customer Experience.

Customer Support And Empowerment

BDSwiss Helps Clients Improve Their Trading Skills And Market Understanding By Providing Educational Resources And Tools. These Resources Include Real-time Market Analysis, Trading Signals, Educational Workshops And One-on-one Support To Ensure Clients Are Better Equipped To Respond To Market Fluctuations And Changes.

Social Responsibility And ESG

As A Responsible Financial Group, BDSwiss Is Committed To Fulfilling Its Social Responsibility. The Company Takes Active Measures In Environmental Protection, Social Equity And Governance (ESG), Including Reducing Carbon Footprint, Supporting Community Development And Enhancing Corporate Transparency. Through These Efforts, BDSwiss Is Committed To Contributing To The Sustainable Development Of Global Financial Marekt.

Strategic Cooperation Ecology

BDSwiss Has Established Strategic Partnerships With A Number Of Well-known Financial Institution Groups And Technology Companies To Enhance Their Service Capabilities And Market Influence. These Collaborations Cover Multiple Areas Such As Technological Innovation, Risk Management, Client Server, Etc., Ensuring That The Company Remains Competitive In The Ever-changing Market Environment.

Financial Health

BDSwiss Has A Sound Financial Position. Through Strict Internal Management And Risk Control, It Ensures That The Company Maintains Stable Operations In A Highly Volatile Market Environment. The Company's Financial Reporting And Audit Results Comply With Regulatory Requirements, Providing Investors With Reliable Financial Protection.

Future Roadmap

BDSwiss Plans To Further Expand Its Financial Products And Services In The Future, Including Launching More Cryptocurrency Trading Pairs, Optimizing Trading Platform Functions, And Strengthening Customer Education Resources. Through Continuous Technological Innovation And Market Expansion, BDSwiss Is Committed To Becoming A Trusted Financial Partner For Investors Around The World.

The Above Is A Corporate Profile Of BDSwiss, Based On Reliable Information To Help Investors Gain A Comprehensive Understanding Of The Company's Background, Services And Market Positioning.

Unable To Withdraw

Unable To Withdraw