The Official Website Of VIG Investment Is Temporarily Unavailable For Unknown Reasons, So We Can Only Collect Some Relevant Information For Reference Only.

VIG Investment Is A Brokerage That Offers A Range Of Trading Services And Tools. Their Platform Of Choice Is The Powerful And Widely Used Metatrader 5, Which Offers Advanced Charting Tools, Numerous Technical Indicators, And Automated Trading Functions. Vig Offers A Wide Range Of Market Trading Tools, Including Forex, Indices, Commodities, And Contracts For Difference (CFDs). Their Client Server Is Available 24 Hours A Day On Weekdays, Providing Email And Phone Support To Meet The Needs Of Their Clients.

VIG Investment Alternative Brokers

There Are A Lot Of Alternative Brokers VIG Investment Depends On The Specific Needs And Preferences Of The Trader. Some Popular Options Include:

Ally Invest - Known For Its Powerful Client Server And User-friendly Platform, Ally Invest Is A Good Choice For Both Beginners And Seasoned Investors Who Want A Simple Online Trading Experience.

VIG Investment Is Known For Its Low-cost Index Funds And ETFs And Is Recommended For Long-term Investors Who Prioritize Low Fees And Diversified, Passive Investment Strategies.

TradeStation - With Robust Trading Technology And A Wide Range Of Tradable Securities, TradeStation Is An Excellent Choice For Active Traders, Especially Those Interested In Futures And Options.

Is VIG Investment Safe Or A Scam?

Firstly, The Lack Of Regulation, Is A Major Red Flag. Regulatory Oversight Is Essential For The Brokerage Industry To Ensure That Companies Operate Fairly And Transparently. Regulators Have Established Standards Such As Segregation Of Funds (separating Client Funds From Company Funds), Adequate Capital, And Arm's Length Transaction Practices. VIG Investment Has Raised Serious Questions About Its Legality And The Safety Of Client Funds Due To Its Lack Of Regulation.

Second, The Numerous Reports Of Inability To Withdraw Funds And Allegations Of Fraud Are Vexing. The Inability To Withdraw Funds Is One Of The Most Serious Problems A Trader May Face In Front Of A Broker. This Not Only Prevents Traders From Making A Profit, But Also Prevents Their Initial Deposit, Which Can Lead To Significant Financial Losses.

In View Of These Points, It Is Recommended To Take VIG Investment With Caution. While The Company Offers Some Attractive Features, Such As Various Trading Tools And 24-hour Customer Support, These Positives Are Heavily Offset By Concerns About Its Regulatory Status And Withdrawal Issues.

Market Instruments

VIG Investment Offer, Forex (Forex) Trading, Which Involves The Buying And Selling Of Currency Pairs. Traders Can Speculate On The Value Of One Currency Against Another With The Aim Of Profiting From Exchange Rate Fluctuations.

Indices, Trading On VIG Investment Allows Traders To Speculate On The Price Movements Of Various Global Stock Indices. These Indices Are Essentially A Portfolio Of Leading Stocks In A Particular Region Or Industry. Traders Can Build Positions Based On Their Views On The Overall Market Or Industry Performance Without Trading Individual Stocks.

CFDs, Are Derivatives VIG Investment Offers. They Allow Traders To Speculate On The Rise Or Fall In The Price Of Various Global Financial Marekts (e.g. Stocks, Indices And Commodities). When Trading CFDs, You Do Not Own The Underlying Asset, But Trade Based On The Price Movement Of That Asset.

VIG Investment Also Offers Commodities Trading, Where Traders Can Speculate On The Price Of Physical Commodities Such As Gold, Silver, Oil Or Agricultural Commodities. Commodity Trading Can Be A Way To Hedge Against Inflation Or Take Advantage Of Price Changes Caused By Supply And Demand Factors.

Leverage

The VIG Instrument Claims That The Maximum Leverage Is 1:500, But It Also Offers Different Leverage Depending On Different Asset Classes.

VIG Investment Offers, And The Maximum Leverage For Forex Trading Is Up To 1:400. This Means That Traders Can Open Positions Up To 400 Times Their Initial Deposit. For Example, With An Account Balance Of $1,000, A Trader Can Theoretically Control A Position Of Up To $400,000. This High Leverage Allows A Trader To Potentially Make Substantial Profits From Minor Market Fluctuations.

For, Indices And Commodities, VIG Investment Offers Leverage Of Up To 1:200. This Allows A Trader To Open Positions In These Markets Up To 200 Times Their Initial Deposit. For Example, If A Trader Has $1,000 In Their Account, A Trader Can Hold A Position Of Up To $200,000 In Indices Or Commodities. This Level Of Leverage Can Provide Traders With The Opportunity To Take Advantage Of Smaller Price Fluctuations In These Markets. However, It Is Also Important To Note That High Leverage Can Lead To Significant Losses If The Market Moves Against A Trader's Position.

Spreads And Commissions

It Seems As If VIG Investment Claims To Offer Competitive Or "tight" Spreads, Which Could Be A Significant Advantage For Traders As It May Reduce Trading Costs. However, Without Specific Numbers Or Ranges, It Is Difficult To Assess The True Competitiveness Of Its Spreads.

Trading Platform

VIG Investment Offers Its Clients A Trading Platform, MT5, Which Is Globally Recognized As A Highly Versatile Trading Platform For Forex, Futures And CFDs Trading. MT5 Offers Advanced Technical Analysis, Flexible Trading Systems And Algorithmic Trading Tools. One Of The Distinguishing Features Of MT5 Is Its Multi-platform Support, Which Allows Traders To Access Their Accounts And Trade Through A Variety Of Devices. This Includes Compatibility With IPhone And IPad Devices Running On IOS, Android Smartphones And Tablets, Windows-based Computers, As Well As Web Browsers.

Deposits And Withdrawals

VIG Investment Offers Customers Two Methods Of Depositing Funds Into Their Trading Accounts: Telegraphic Transfer And CoinPayments, In Particular Tether USD (USDT, ERC20). This, The Minimum Deposit Amount Is $100.

This Is Beneficial For Clients VIG Investment Does Not Charge Deposit/withdrawal Fees. Deposit And Withdrawal Time Is 3-4 Business Days. However, Traders Should Note That While The Company Itself Does Not Charge Fees, There May Still Be Transaction Costs Involved When Sending Funds Via Telegraphic Transfer Or Blockchain Transactions, As These Fees Are Usually Charged By The Sending Agency Or Blockchain Network, Not By The Sending Agency. Recipient.

Client Server

VIG Investment Seems To Prioritize Client Server's 24-hour Online Messaging Support On Weekdays. This Round-the-clock Service Is Crucial In The Trading World, As The Market Continues To Operate And Timely Assistance Can Determine Profits And Losses.

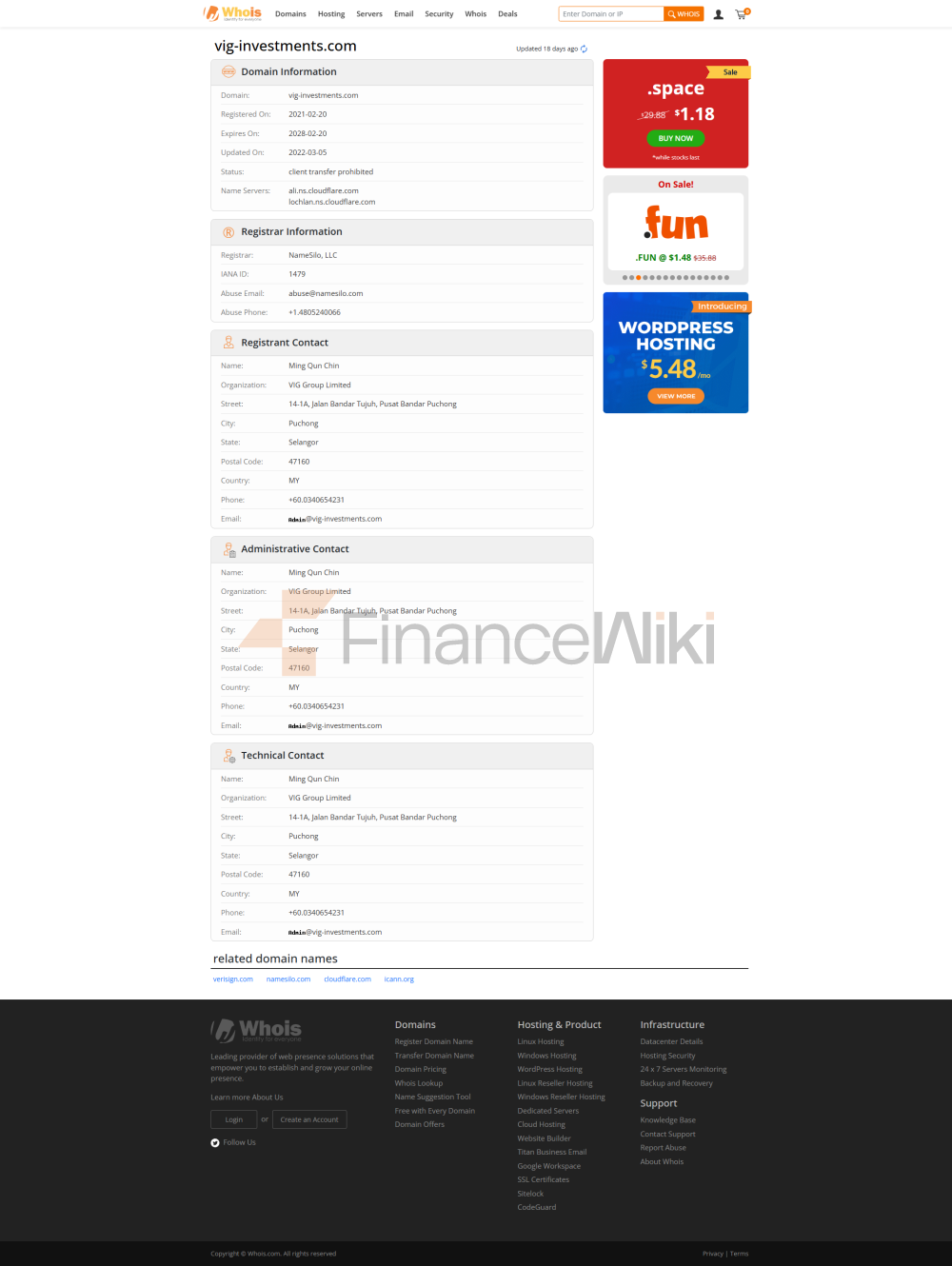

Headquarters Address: Room 511, 5th Floor, Ming Sang Industrial Building, 19-21 Hing Yip Street, Kwun Tong, Kowloon, Hong Kong.

Office Address: 14-1A, JALAN BANDAR YUJUH, PUSAT BANDAR PUCHONG, 47160 PUCHONG, SELANGOR, MALAYSIA.

The Company Also Offers, Send Email Support By Address Admin@vig-investments.com. Email Support Can Conveniently Address Issues Or Enquiries That Do Not Require Immediate Attention. This Method Also Allows For Detailed Communication, Can Explain Issues Broadly, And Can Refer To Responses Later. However, Response Times Can Vary, So It May Not Be The Best Way To Address Urgent Issues.

Also, VIG Investment Offers, Phone Support. The Phone Number Provided, + 60340654231, Indicates That The Client Server Center May Be Located In Malaysia (as 60 Is The Country Code For Malaysia). Phone Support Is Usually The Fastest Way To Resolve Issues And Get An Immediate Response. However, Time Zone Differences That May Exist Depending On The Trader's Location Must Be Considered.