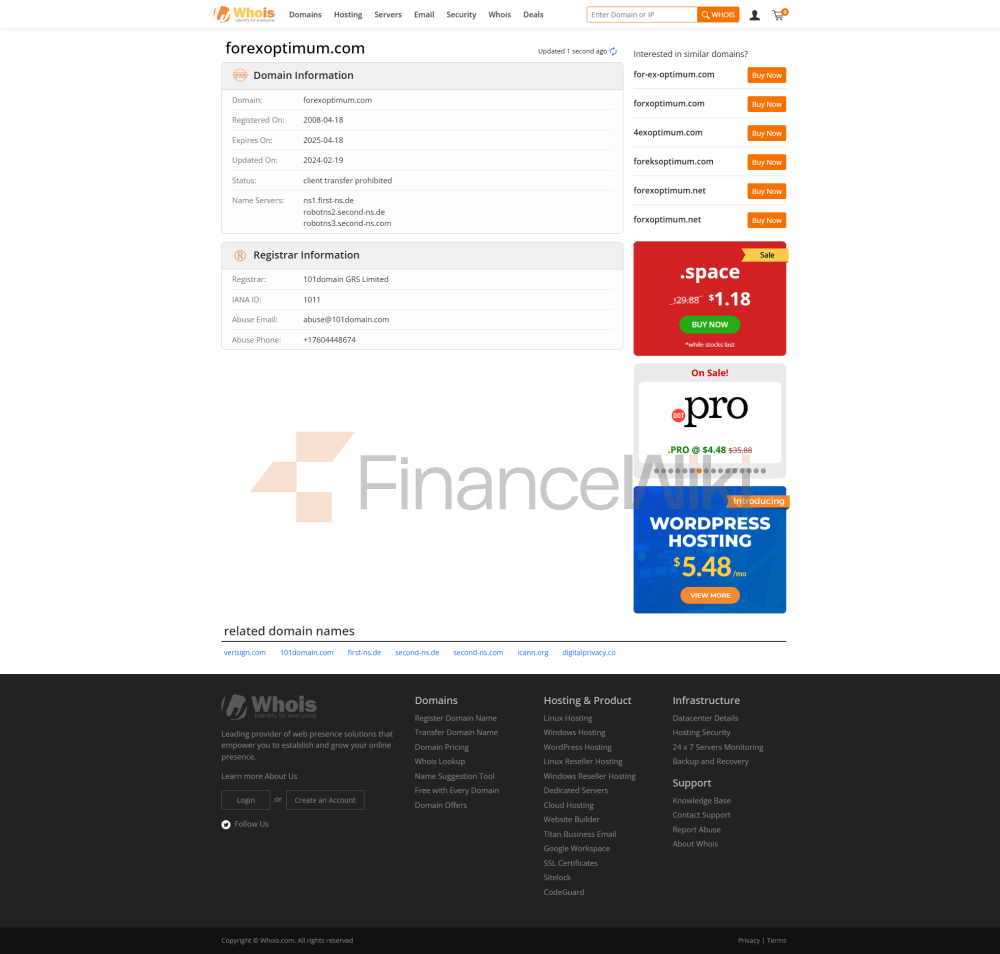

Founded In 2009, Forex Optimization Is A Trading Platform Owned By Forex Optimum Group Limited, An Offshore Company Registered In St. Louis. Saint Vincent And The Grenadines. The Region Is Known To Have The Lowest Regulatory Requirements And Forex Optimum (FOG) Operates Without Regulation, Raising Concerns About Transparency And Oversight.

Nonetheless, Forex Optimum Offers A Diverse Range Of Trading Assets That Appeal To Traders Employing Different Strategies. These Assets Include Forex, Metals CFDs, Indices, Commodities And Individual Stocks, Offering A Wide Range Of Trading Opportunities.

Is FOG Legal Or A Scam?

FOG Is Not Regulated By Any Regulator, A Factor That May Raise Concerns About Transparency And Regulation Of Exchanges. Unregulated Exchanges Operate Without The Oversight And Legal Safeguards Provided By Regulators, Thus Increasing The Latent Risk Of Fraud, Market Manipulation And Security Bugs. Without Proper Regulation, Users May Experience Difficulties In Seeking Remedies Or Resolving Disputes. In Addition, Lack Of Regulation May Result In A Less Transparent Trading Environment, Making It Difficult For Users To Determine The Legitimacy And Credibility Of An Exchange.

Advantages Of Forex Optimum:

Diversification Of Trading Assets: Forex Optimum Offers A Variety Of Trading Tools, Including Forex Pairs, Metals, Stock Market Indices, Commodities, And Individual Stocks, Providing Traders With Ample Diversification Options.

Low Minimum Deposit: Forex Optimum Has A Minimum Deposit Requirement Of Only $10, Allowing Traders Of All Capital Levels (including Beginners) To Trade.

Competitive Spreads: The Platform Offers Competitive Spreads Starting From 0 Pips For Both Standard And Cent Accounts, Helping Traders Keep Their Trading Costs Low.

High Leverage: Forex Optimum Offers High Leverage Of Up To 1:1000, Making It Possible For Traders To Expand Their Trading Positions.

Multiple Payment Methods: The Broker Supports Multiple Payment Methods, Including E-wallets Such As FasaPay And Neteller, Making It Convenient For Traders To Fund Their Accounts.

Disadvantages Of Forex Optimum:

Lack Of Regulation: Forex Optimum Is Not Regulated By Any Financial Institution Group, Which Raises Concerns About Transparency And Regulation.

Limited Educational Resources: Brokers Seem To Have Limited Educational Resources, Which Can Be A Drawback For Traders Seeking Comprehensive Learning Materials And Market Insights To Improve Their Trading Skills.

Market Tools

Forex Optimum Offers A Variety Of Trading Assets That Cater To Traders' Preferences And Strategies. Available Trading Assets Include:

Forex: Forex Optimum Offers Access To The Forex Market, Allowing Traders To Buy And Sell Currency Pairs. The Market Includes Major, Minor And Exotic Currency Pairs, Offering A Wide Range Of Trading Opportunities.

Metal Contracts For Difference: Traders Can Participate In Contracts For Difference (CFDs) On Various Metals, Such As Gold, Silver, Platinum, And Palladium. Metal Contracts For Difference (CFDs) Allow You To Understand The Price Movements Of These Valuable Commodities Without Physical Ownership.

Index Contracts For Difference (CFDs): Forex Optimum Offers CFDs On Global Stock Market Indices. This Allows Traders To Speculate On The Performance Of Major Stock Indices Such As The S & P 500, FTSE 100, And DAX 30.

Commodity Contracts For Difference (CFDs): This Platform Allows Traders To Trade CFDs On A Range Of Commodities, Including Oil, Gas, Agricultural Commodities, And More. Commodity CFDs Offer The Flexibility To Trade These Physical Commodities Without Direct Ownership.

Stock CFDs: Forex Optimum Also Offers Individual Stock CFDs, Giving You The Ability To Understand The Share Prices Of Various Global Companies. This Allows Traders To Diversify Their Portfolios And Take Advantage Of Share Price Fluctuations.

These Trading Assets Provide Traders With A Wide Range Of Market Options, Allowing Them To Diversify Their Portfolios And Implement Various Trading Strategies Based On Their Risk Tolerance And Market Outlook.

Account Types

Forex Optimum Offers Two Account Types: Standard And Cent. Both Account Types Offer Leverage Of 1:1000, With Great Trading Potential. The Minimum Deposit Requirement For Both Accounts Is Only $10, Ensuring That It Is Available To Traders Of All Levels.

Minimum Spreads Start From 1 Pip For Standard Accounts, While 0 Pips For Cent Accounts, Providing A Potentially More Competitive Advantage. In Terms Of Commissions, Standard Accounts Charge A Fee Of 0.010% Of Nominal Trading Volume, While Cent Accounts Have A Slightly Higher Commission Rate Of 0.011% Of Nominal Trading Volume. Traders Can Choose An Account Type That Matches Their Trading Preferences And Goals.

Trading Platform

Forex Optimum Offers Traders The MetaTrader 4 (MT4) Trading Platform, A Mature And Widely Used Platform In The Financial Industry. MT4 Is Known For Its Reliability, User-friendly Interface And Comprehensive Trading Tools, Making It A Popular Choice For Traders Worldwide.

With MT4, Forex Optimum Users Have Access To Real-time Price Charts, Technical Analysis Indicators And Multiple Order Types, Enabling Flexible Trading Strategies. The Platform Also Supports Automated Trading Through Expert Advisors (EAs), Enabling Traders To Automatically Make Trading Decisions. Here Are The Main Features Of MT4:

User-friendly Interface: MT4's Intuitive Interface Is Suitable For Traders Of All Experience Levels And Is Easy To Use And Navigate.

Live Price Charts: Traders Can Access Dynamic And Customizable Price Charts, Allowing For In-depth Technical Analysis.

Technical Indicators: MT4 Provides A Large Number Of Built-in Technical Indicators To Assist With Market Analysis And Decision-making.

Automated Trading: The Platform Supports Algorithmic Trading Through Expert Advisors (EAs), Allowing For Automated Execution Of Trades Based On Predefined Strategies.

Multiple Time Ranges: MT4 Offers Multiple Time Range Options To Help Traders View Price Data At Different Time Intervals.

Mobile Trading: The Platform Can Be Used On Mobile Devices, Enabling Traders To Monitor And Execute Trades Anytime, Anywhere.

One-Click Trading: It Offers A One-click Trading Function To Quickly Execute Orders.

Deposit And Withdrawal

Forex Optimum Offers Multiple Payment Methods To Meet The Needs Of Traders. These Methods Include:

FasaPay: FasaPay Is An Electronic Payment System That Enables Fast, Secure Online Transactions. It Is A Popular Choice For Traders In Certain Regions.

Neteller: Neteller Is A Widely Used E-wallet Service That Provides A Convenient Way To Deposit And Withdraw Funds From Trading Accounts.

WebMoney: WebMoney Is An E-wallet And Online Payment System Accepted By Forex Optimum That Provides Traders With Additional Payment Options.

Accentpay: Accentpay Is A Payment Aggregation Service That Facilitates Payments Through A Number Of Means, Including Credit/debit Cards, Bank Transfers, And E-wallets.

Qiwi: Qiwi Is A Russia-based Payment Service That Enables Traders To Fund Their Accounts Using Qiwi Wallet Or Other Related Payment Options.

Local Exchange Offices: Forex Optimum Also Allows Traders To Deposit Funds Through Local Exchange Offices, Which Can Provide Additional Convenience In Certain Regions.

The Minimum Deposit Required To Open An Account With Forex Optimum Is $10. This Lower Minimum Deposit Makes It Accessible To A Wide Range Of Traders, Including Those New To Forex And CFD Trading.

Processing Times For Deposits May Vary Depending On The Payment Method Chosen. In General, Electronic Payment Methods Such As FasaPay, Neteller, WebMoney And Qiwi Offer Near-instant Deposits, Allowing Traders To Quickly Fund Their Accounts.

CUSTOMER SUPPORT

Forex Optimum Offers A Comprehensive Customer Support Service To Meet The Diverse Needs Of Its Clients. For English Speaking Clients, There Is A Dedicated Contact Number + 442080682796. Indonesian Speaking Clients Can Be Contacted At + 628154633706, While Malay Speaking Clients Can Call + 60 367321123 For Customer Support.

Additionally, For Inquiries Or For Assistance, Clients Can Use The Email Addresses Provided: Info@forexoptimum.com And Cs@forexoptimum.com. These Multiple Contact Details Ensure That Traders From Different Regions Can Easily Get In Touch With Forex Optimum's Support Team To Provide Timely, Efficient Assistance With Their Trading Queries And Concerns.

CONCLUSION

Forex Optimum Offers A Wide Range Of Trading Assets, Including Forex, Metals, Indices, Commodities, And Stocks. This Diversity Can Appeal To Traders Who Employ Different Strategies.

However, Lack Of Regulation Raises Transparency Issues That May Affect The Safety Of Funds And Trader Protection. While Lower Minimum Deposits And Competitive Spreads May Attract Traders, High Leverage Carries Significant Risks, Especially For Inexperienced Traders. In Addition, Limited Educational Resources May Hinder Traders' Ability To Improve Their Skills. Prospective Traders Should Carefully Weigh These Factors Before Choosing Forex Optimum As A Trading Platform.