General Information

AvaTrade (Ava Trade Markets Ltd.) Was Established In 2006 By Negev Shekel Nosatzki, A Well-known Foreign Exchange Brokerage In Ireland. It Has 9 Financial Regulations On 6 Continents. As A Global Multinational Company, AvaTrade Has Offices And Branches In Paris, Chile, Abu Dhabi, South Africa, Milan, Tokyo And Sydney, Malaysia.

AvaTrade Mainly Provides 1250 Financial Products Including Foreign Exchange/commodities/stock Indices/ETFs/options To Global Customers. Leading Technology Trading Platform And Competitive Trading Conditions Have Attracted A Large Number Of Investors. And Provide A Variety Of Free Educational Resources To Assist Every Investor To Successfully Embark On The Road Of Trading. In Addition To Direct Customers, AvaTrade Also Has Online And Offline Agent Programs.

Corporate Background

AvaTrade Is A Broker That Provides Trading Services. The Company's Registered Entity Is Ava Trade Markets Ltd, Headquartered In Dublin, Ireland. The Broker Supports Multiple Languages, Including English, French, Italian, Japanese, Thai, Mongolian, Indonesian, Chinese And Other Regional Languages. The Company Was Established On March 3, 2006. According To The Information Found By Whois, The Domain Name Of AvaTrade's Official Website Was Registered On April 20, 2008.

Regulatory Information

AvaTrade Is A Global Multinational Company Regulated By Several Regional Regulators:

- AVA Trade EU Ltd Is Regulated By The Central Bank Of Ireland. (No. C53877)

- Ava Trade Markets Ltd. Is Regulated By The BV Financial Services Commission.

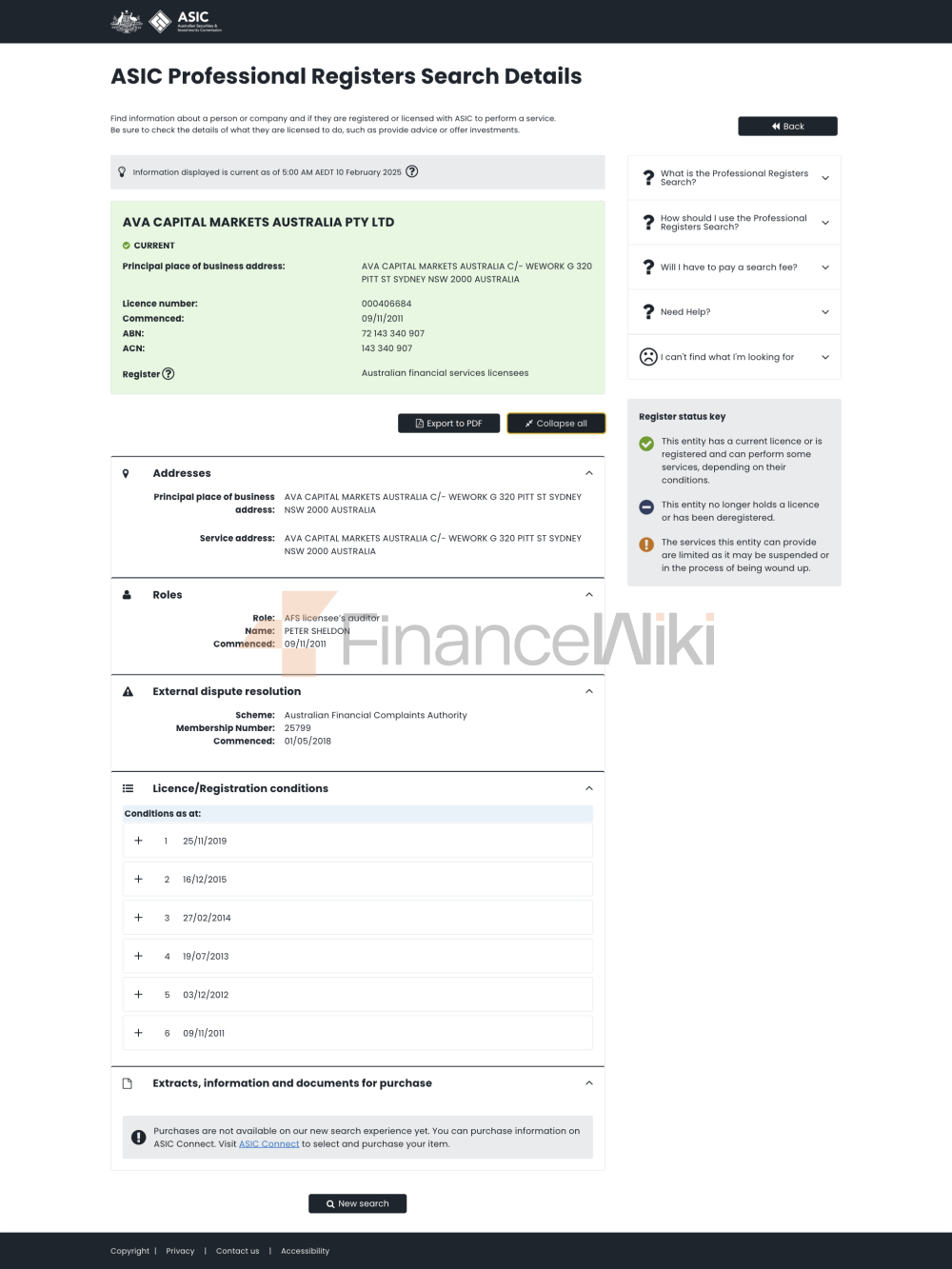

- Ava Capital Markets Australia Pty Ltd Is Regulated By ASIC No. 406684.

- Ava Capital Markets Pty Is Regulated By The Financial Sector Conduct Authority Of South Africa (FSCA No. 45984).

- Ava Trade Japan K.K. Is Licensed And Regulated In Japan By The Financial Services Agency Of Japan (license Number: 1662), The Financial Futures Association Of Japan (license Number: 1574).

- Ava Trade Middle East Ltd Is Regulated By The Financial Regulatory Services Authority (FRSA) (No. 190018) Of Abu Dhabi Global Market (ADGM).

- DT Direct Investment Hub Ltd. Is Regulated By The Cyprus Securities And Exchange Commission (No. 347/17).

- ATrade Ltd Is Regulated In Israel By The Israel Securities Authority (No. 514666577).

Trading Products

Avatrade Offers A Variety Of Market Instruments Covering Various Markets Such As Forex, Contracts For Difference, Stocks, Commodities, Indices, Futures, Cryptocurrencies And Options.

Forex: Avatrade Offers More Than 50 Currency Pairs, Including Major Currency Pairs, Minor Currency Pairs And Exotic Currency Pairs.

Stocks: Traders Can Trade Stocks From Major Global Exchanges Such As Nasdaq, NYSE, LSE And Others.

Commodities: Avatrade Offers Trading In Precious Metals Such As Gold And Silver, Energy Commodities Such As Oil And Gas, And Agricultural Commodities Such As Wheat And Coffee.

Cryptocurrencies: The Broker Offers Popular Cryptocurrencies Such As Bitcoin, Ether, Ripple And Litecoin, As Well As Lesser-known Currencies Such As Dash, Monero And NEO.

Indices: Avatrade Offers Trading In Major Indices Including The S & P 500, NASDAQ, FTSE 100 And More.

Options Allow Traders To Take Advantage Of Currency Fluctuations To Limit Risk. With Forex Options, A Trader Can Set A Specific Strike Price, And The Option Will Only Be Exercised When The Market Reaches That Price. This Allows The Trader To Potentially Profit From Market Fluctuations While Limiting Potential Losses.

Account Types

In Terms Of Account Types, Avatrade Only Offers Standard Accounts. This Means That All Clients Have Access To The Same Features And Trading Conditions Regardless Of The Deposit Amount.

Standard Accounts Have Access To All Of Avatrade's Trading Tools, Including Forex, Stocks, Commodities And Cryptocurrencies. This Means That Traders Can Diversify Their Assets Within The Same Account And Take Advantage Of Different Market Conditions.

Avatrade Has A Minimum Deposit Requirement Of $100, Which Is Relatively Low Compared To Other Brokers Within The Industry. However, There Are Other Brokers That Have Lower Minimum Deposit Requirements Than Avatrade. For Example, Pepperstone And XM Have Minimum Deposit Requirements Of $0 And $5, Respectively.

Demo Account

Avatrade Offers Demo Accounts For Traders Who Wish To Practice Their Trading Skills Or Test Their Trading Platform Without Risking Real Money. Demo Accounts Allow Traders To Access The Full Suite Of Trading Tools And Features On The Avatrade Platform Using Virtual Funds. A Useful Tool For Novice Traders Who Are Familiar With The Platform, And For Experienced Traders To Test New Strategies Prior To Live Trading. Demo Accounts Are Available For 21 Days And Can Be Renewed Upon Request.

Leverage

Avatrade Offers Maximum Leverage Of 1:400 For Forex Trading And 1:200 For Other Instruments Such As Commodities And Indices. This Means Traders Can Control Larger Positions With Less Capital. However, It Is Important To Keep In Mind That Leverage Can Amplify Profits And Losses And Traders Should Use It Responsibly And With Caution.

Avatrade Also Offers A Range Of Leverage Options For Different Account Types, Including 1:30 For ESMA-compliant Retail Clients And 1:400 For Professional Clients. It Is Important To Note That Professional Clients Must Meet Certain Conditions In Order To Receive Higher Leverage.

Spreads And Commissions (Trading Fees)

Avatrade Offers Competitive Spreads On Its Platform And Does Not Charge Trading Commissions. The Spreads Offered By Avatrade Vary Depending On The Trading Instrument And Market Conditions. For Example, The Typical Spread For EUR/USD Is 0.9 Pips, While The Spread For GBP/USD Is 1.5 Pips. Spreads Also Vary For Other Instruments Such As Indices And Commodities.

However, It Is Important To Note That Spreads May Vary Depending On Market Conditions And Volatility. Additionally, Avatrade Charges Commissions On Certain Trading Instruments, Such As CFDs, Which May Affect The Total Cost Of Trading.

Non-trading Fees

Non-trading Fees Are Fees Charged By Brokers For Activities Other Than Trading. These Fees Can Have A Significant Impact On A Trader's Profitability, So Be Aware Of These Fees When Choosing A Broker. Avatrade Charges Inactivity Fees And Management Fees.

Trading Software

AvaTrade Provides Investors With The Following Trading Software:

- MetaTrader 4: Widely Used Around The World, Powerful Trading Platform. Supports A Variety Of End Points And Operating Systems, Whether It Is A Computer Or A Mobile End Application, Bringing You A Convenient Trading Experience.

- MetaTrader 5: Meets All The Needs Of Users In Today's Market For Professional Stock Traders, User-friendly Interface, Automated Trading Technology, Etc.

- WebTrader: An Innovative Online Trading Platform Specially Designed For Novice Traders. You Don't Need To Download Or Install Anything, And You Can Trade From Anywhere In The World.

- AVA Options: The Use Process Is Straightforward And Smooth. You Don't Need To Install And Download. You Can Log In Online To Trade. A Variety Of Trading Combination Operations Provide Investors With Easier And More Flexible Operations.

- AvaTrade GO: Observe Market Fluctuations In Real Time. Investors Can Trade The World's Most Popular Currencies, Commodities, Stocks And Other Products. Professional Operation Interface And Unique Functions Provide Investors With Smoother Trading Operations.

- Automated Trading Tools: Contains MAM Multi-Account Management System, MQL5 Signal Service, Zulu Trade, DupliTrade.

Customer Support

This Broker Offers Support In More Than 30 Languages And Supports Providing Services Through Multiple Channels, Including Telephone Support And Live Chat. Traders Can Contact The Customer Support Team At Phone Number + 1 212-941-9609 For Direct And Immediate Assistance. Investing This Is Also Available On The AvaTrade Website. The Live Chat Feature Allows For Quick Communication With This Broker.

Summary

AvaTrade Is Registered In Dublin, Ireland And Is Regulated By Multiple Regulators Around The World To Ensure The Safety And Compliance Of Transactions. AvaTrade Provides A Variety Of Trading Products Including Commodities, Stocks, Indices, Etc., And Supports Multi-language Services. The Broker Provides Investors With Multiple Trading Platforms Including MT4, MT5, Etc., Providing Traders With A Convenient And Diverse Trading Experience.